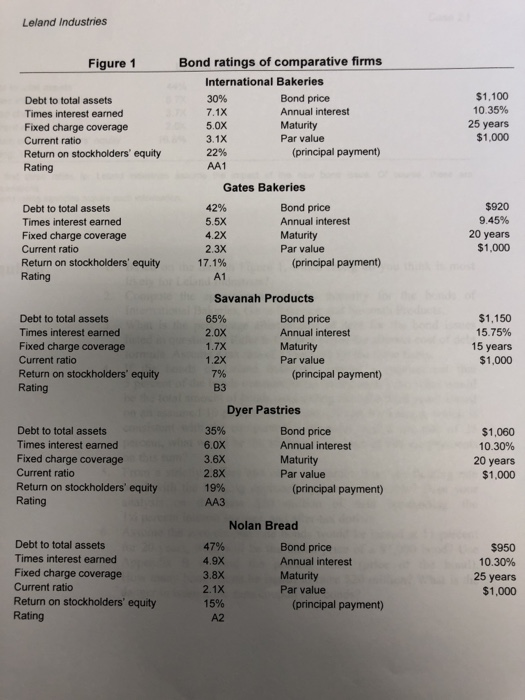

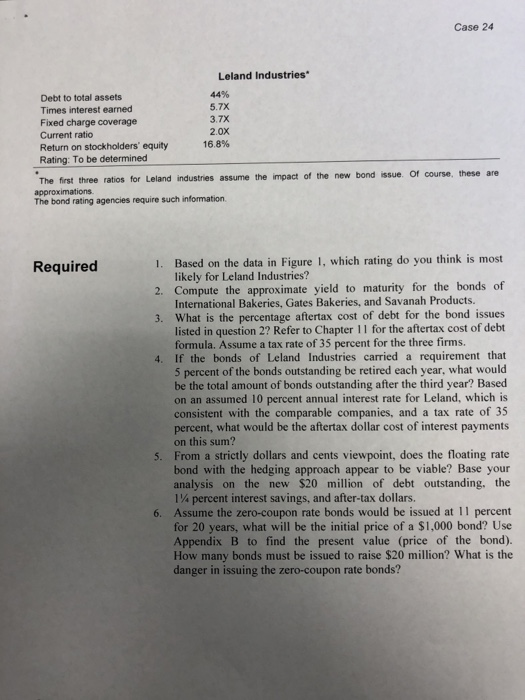

CASE 24 Leland Industries companies and pension funds, but A believed this was an appropriate time to approach the company's recent strong performance. Leland Industries is the nation's fifth largest producer of bakery and snack goods, with operations primarily located in the southeastern United States. Over the last 10 years, Leland had been one of the most efficient bakeries in the nation, with a 10-year average sales growth of 9.8 percent and an average return on equity of 16.8 percent. Management goals for the company include 10 percent earnings growth per year, and an average return of 16.8 percent on equity over time. Late in the year 2015, Leland reached an agreement with a major food chain to provide private label bakery service in ic He called his investment banker and was told that the rating that the firm received from Standard and Poor's and Moody's would be a key variable in determining the interest rate that would be intended to issue $20 million of new debt. A comparison of Leland Industries to other bakeries is shown in Figure 1. The other five firms all had issued debt publicly according to Ben Gilbert, who was Leland Industries' major contact at the investment banking firm of Gilbert, Rollins and Ross. to Krogers, Albertson's, and many other grocery stores. The new private label program had significant start-up costs, including new packaging techniques and As an altermative to a straight bond issue, Ben Gilbert suggested that the firm consider issuing floating rate or even zero- coupon rate bonds. He said the principal advantage to the floating rate bonds was that they could be issued at 14 percent below the going market rate for straight debt issues. Al Oliver was pleasantly surprised to hear this, and asked his investment banker what the catch was. A had heard too many times that "there is no such thing as a free lunch." His investment the addition of 250 sales routes. Al Oliver, the vice president of finance, believed in maintaining a balanced capital structure, and since a 1I million share stock issue totaling $25 million in value had been offered earlier in the year, he thought this was a good time to go to the debt market. Previously, the firm's debt issues had been privately placed with insurance