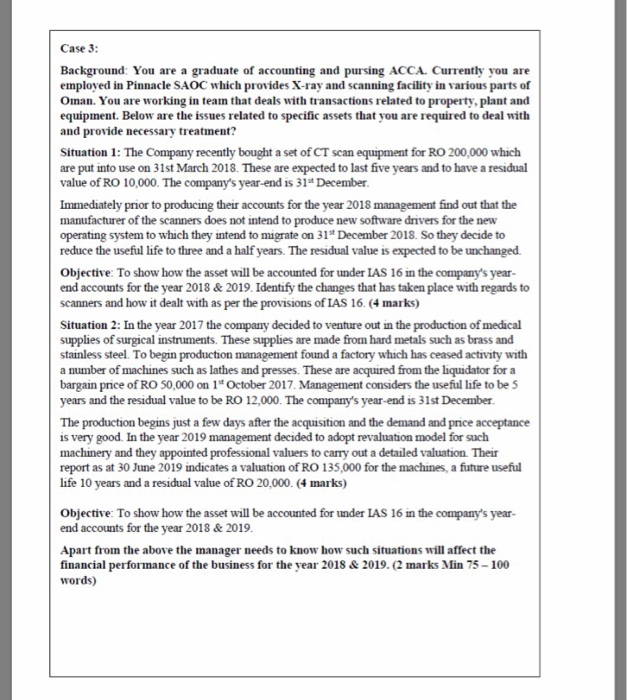

Case 3: Background: You are a graduate of accounting and pursing ACCA. Currently you are employed in Pinnacle SAOC which provides X-ray and scanning facility in various parts of Oman. You are working in team that deals with transactions related to property, plant and equipment. Below are the issues related to specific assets that you are required to deal with and provide necessary treatment? Situation 1: The Company recently bought a set of CT scan equipment for RO 200,000 which are put into use on 31st March 2018. These are expected to last five years and to have a residual value of RO 10,000. The company's year-end is 31* December Immediately prior to producing their accounts for the year 2018 management find out that the manufacturer of the scanners does not intend to produce new software drivers for the new operating system to which they intend to migrate on 31" December 2018. So they decide to reduce the useful life to three and a half years. The residual value is expected to be unchanged. Objective: To show how the asset will be accounted for under IAS 16 in the company's year- end accounts for the year 2018 & 2019. Identify the changes that has taken place with regards to scanners and how it dealt with as per the provisions of IAS 16. (4 marks) Situation 2: In the year 2017 the company decided to venture out in the production of medical supplies of surgical instruments. These supplies are made from hard metals such as brass and stainless steel. To begin production management found a factory which has ceased activity with a number of machines such as lathes and presses. These are acquired from the liquidator for a bargain price of RO 50,000 on 1* October 2017 Management considers the useful life to be 5 years and the residual value to be RO 12,000. The company's year-end is 31st December The production begins just a few days after the acquisition and the demand and price acceptance is very good. In the year 2019 management decided to adopt revaluation model for such machinery and they appointed professional valuers to carry out a detailed valuation. Their report as at 30 June 2019 indicates a valuation of RO 135,000 for the machines, a future useful life 10 years and a residual value of RO 20,000. (4 marks) Objective: To show how the asset will be accounted for under IAS 16 in the company's year- end accounts for the year 2018 & 2019. Apart from the above the manager needs to know how such situations will affect the financial performance of the business for the year 2018 & 2019. (2 marks Min 75-100 words)