Answered step by step

Verified Expert Solution

Question

1 Approved Answer

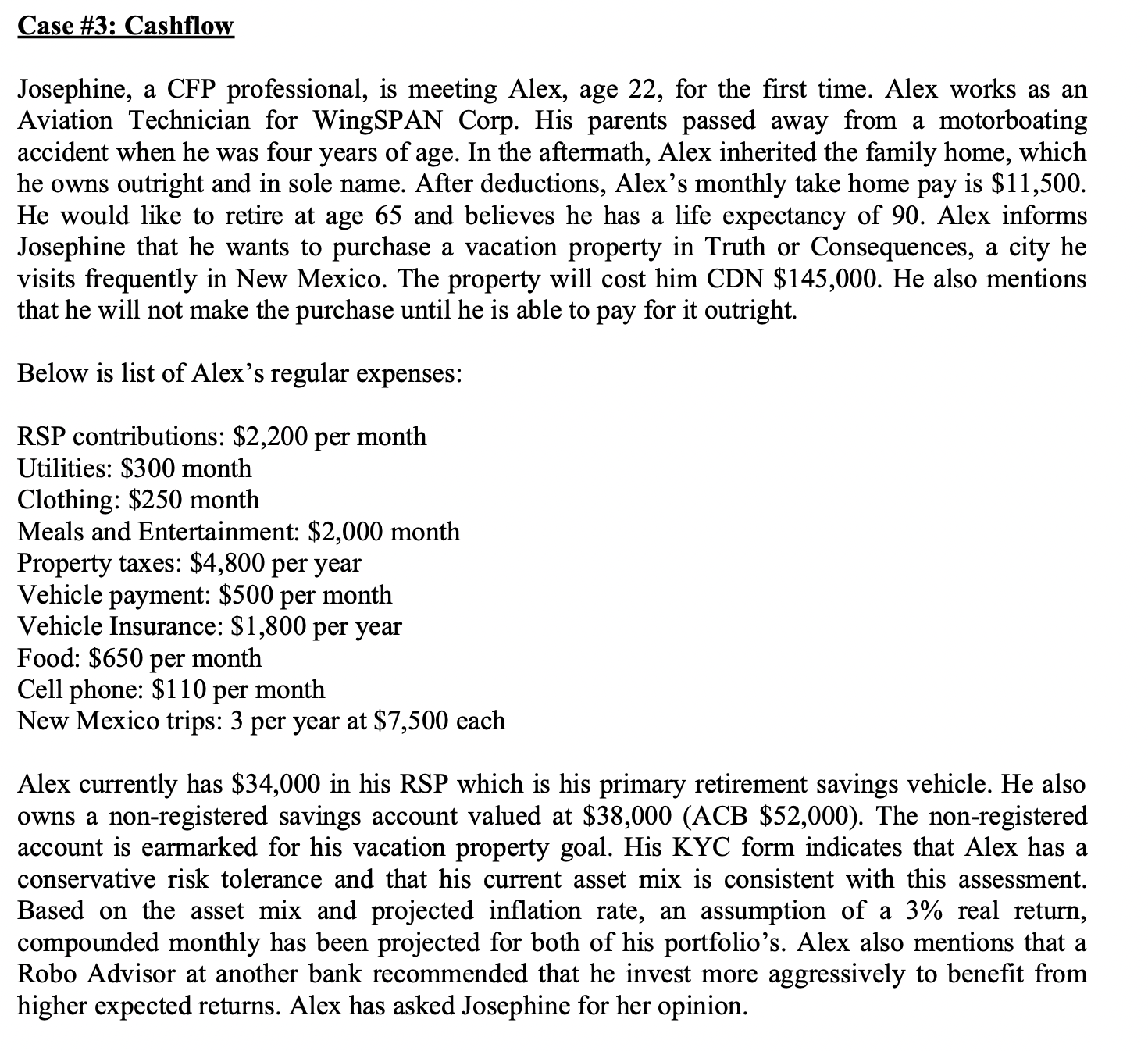

Case # 3 : Cashflow Josephine, a CFP professional, is meeting Alex, age 2 2 , for the first time. Alex works as an Aviation

Case #: Cashflow

Josephine, a CFP professional, is meeting Alex, age for the first time. Alex works as an

Aviation Technician for WingSPAN Corp. His parents passed away from a motorboating

accident when he was four years of age. In the aftermath, Alex inherited the family home, which

he owns outright and in sole name. After deductions, Alexs monthly take home pay is $

He would like to retire at age and believes he has a life expectancy of Alex informs

Josephine that he wants to purchase a vacation property in Truth or Consequences, a city he

visits frequently in New Mexico. The property will cost him CDN $ He also mentions

that he will not make the purchase until he is able to pay for it outright.

Below is list of Alexs regular expenses:

RSP contributions: $ per month

Utilities: $ month

Clothing: $ month

Meals and Entertainment: $ month

Property taxes: $ per year

Vehicle payment: $ per month

Vehicle Insurance: $ per year

Food: $ per month

Cell phone: $ per month

New Mexico trips: per year at $ each

Alex currently has $ in his RSP which is his primary retirement savings vehicle. He also

owns a nonregistered savings account valued at $ACB $ The nonregistered

account is earmarked for his vacation property goal. His KYC form indicates that Alex has a

conservative risk tolerance and that his current asset mix is consistent with this assessment.

Based on the asset mix and projected inflation rate, an assumption of a real return,

compounded monthly has been projected for both of his portfolios Alex also mentions that a

Robo Advisor at another bank recommended that he invest more aggressively to benefit from

higher expected returns. Alex has asked Josephine for her opinion.

By completing a cash flow statement, determine how much Alex is able to add to his non

registered savings at the end of each month. marks

Cash Flow Statement

Income Expense item Monthly Amount $

Monthly Savings $

Calculate the number of months before Alex is able to purchase the New Mexico

property, ignoring any tax implications. marks

Calculate the projected value of Alexs RSP account at retirement and the projected

monthly income available during retirement. Ignore RIF minimums marks

Account Value at Retirement:

Projected Monthly Income During Retirement:

Briefly explain two elements of Alexs circumstances that could indicate his suitability to

change to a more aggressive asset allocation in his retirement portfolio and two elements

of Alexs circumstances that could indicate that a more aggressive asset allocation is not

suitable. marks

Two factors suggesting more aggressive asset allocation IS suitable

Two factors suggesting more aggressive asset allocation is NOT suitable

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started