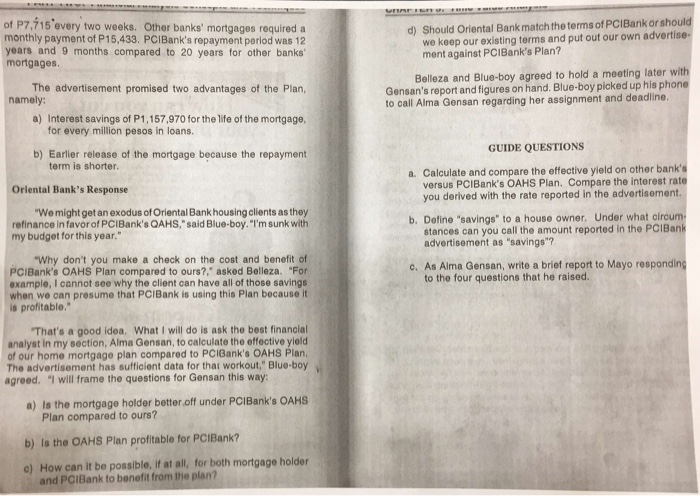

CASE 3 Exhibit 1 PCIBANK'S OWN A-HOME SPECIAL Terms of PCIBank's Offer PCIBANK'S OWN-A-HOME SPECIAL ManagerialFinance Concept Financing has a Cost Financial Analysis Technique: Estimating the true cost of financ ing home mortgages Bank would like to compare the true yipld of two financing schemes for housing loans How can you cut your interest payment by almost half? Decision Context : June ("Blue-boy) Mayo was visibly worried as he entered the roomof vice president Jess Belleza of Oriental Bank. "Blue-boy," as he was called at Oriental Bank, was head of Consumer Lending Section which also took care of housing loans, household (or consumption") alf of socal isterest charges o loans and auto loans The first and only ose of ine kind PCIBank came up with a direct hit on our current housing loans. They put out an ad today proposing to our clients to shift to PCIBank as the cheaper alternative! PCIBank is asking them to refinance our housing loans, Blue-boy exclaimed. "Calm down. Let me look at the terms of PCIBank. Then lets discuss it," Belleza answered. Well, five of our clients have called us so far to consider PCIBank's product. They are asking me why they should not do it," Blue-boy said. "But let me explain the details of PCIBank's plan." OWN A HOME SPECIAL Terms of PCI Bank's "Own-A-Home Special " Blue-boy showed Belleza a copy of the PCIBank advertisement on the "Own-A-Home Special (OAHS Plan), shown as Exhibit 1. In the advertisement, PCIBank offered to refinance existingmortgages under the same interest rate of 18 percent but with payment terms This cane was prepared by Dr. Cesar Q. Sakdea Pm.D,bs for class dscussion and CASE 3 Exhibit 1 PCIBANK'S OWN A-HOME SPECIAL Terms of PCIBank's Offer PCIBANK'S OWN-A-HOME SPECIAL ManagerialFinance Concept Financing has a Cost Financial Analysis Technique: Estimating the true cost of financ ing home mortgages Bank would like to compare the true yipld of two financing schemes for housing loans How can you cut your interest payment by almost half? Decision Context : June ("Blue-boy) Mayo was visibly worried as he entered the roomof vice president Jess Belleza of Oriental Bank. "Blue-boy," as he was called at Oriental Bank, was head of Consumer Lending Section which also took care of housing loans, household (or consumption") alf of socal isterest charges o loans and auto loans The first and only ose of ine kind PCIBank came up with a direct hit on our current housing loans. They put out an ad today proposing to our clients to shift to PCIBank as the cheaper alternative! PCIBank is asking them to refinance our housing loans, Blue-boy exclaimed. "Calm down. Let me look at the terms of PCIBank. Then lets discuss it," Belleza answered. Well, five of our clients have called us so far to consider PCIBank's product. They are asking me why they should not do it," Blue-boy said. "But let me explain the details of PCIBank's plan." OWN A HOME SPECIAL Terms of PCI Bank's "Own-A-Home Special " Blue-boy showed Belleza a copy of the PCIBank advertisement on the "Own-A-Home Special (OAHS Plan), shown as Exhibit 1. In the advertisement, PCIBank offered to refinance existingmortgages under the same interest rate of 18 percent but with payment terms This cane was prepared by Dr. Cesar Q. Sakdea Pm.D,bs for class dscussion and