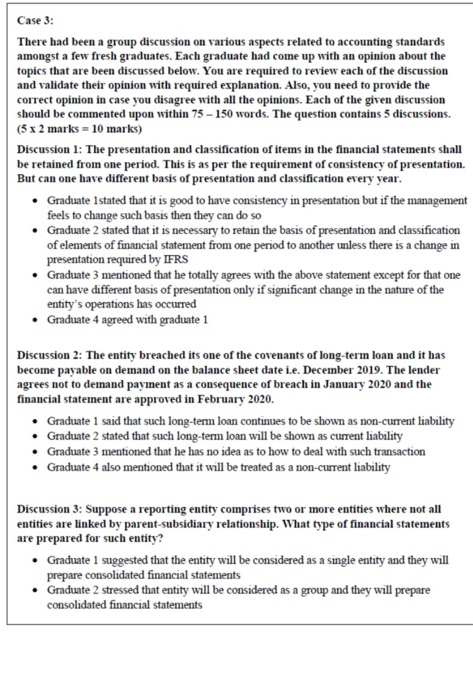

Case 3: There had been a group discussion on various aspects related to accounting standards amongst a few fresh graduates. Each graduate had come up with an opinion about the topics that are been discussed below. You are required to review each of the discussion and validate their opinion with required explanation. Also, you need to provide the correct opinion in case you disagree with all the opinions. Each of the given discussion should be commented upon within 75 - 150 words. The question contains 5 discussions. (5 x 2 marks = 10 marks) Discussion 1: The presentation and classification of items in the financial statements shall be retained from one period. This is as per the requirement of consistency of presentation. But can one have different basis of presentation and classification every year. Graduate Istated that it is good to have consistency in presentation but if the management feels to change such basis then they can do so Graduate 2 stated that it is necessary to retain the basis of presentation and classification of elements of financial statement from one period to another unless there is a change in presentation required by IFRS Graduate 3 mentioned that he totally agrees with the above statement except for that one can have different basis of presentation only if significant change in the nature of the entity's operations has occurred Graduate 4 agreed with graduate 1 Discussion 2: The entity breached its one of the covenants of long-term loan and it has become payable on demand on the balance sheet date i.e. December 2019. The lender agrees not to demand payment as a consequence of breach in January 2020 and the financial statement are approved in February 2020. Graduate 1 said that such long-term loan continues to be shown as non-current liability Graduate 2 stated that such long-term loan will be shown as current liability Graduate 3 mentioned that he has no idea as to how to deal with such transaction Graduate 4 also mentioned that it will be treated as a non-current liability Discussion 3: Suppose a reporting entity comprises two or more entities where not all entities are linked by parent-subsidiary relationship. What type of financial statements are prepared for such entity? Graduate 1 suggested that the entity will be considered as a single entity and they will prepare consolidated financial statements Graduate 2 stressed that entity will be considered as a group and they will prepare consolidated financial statements