Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CASE 38 Upper Canada Wood Stoves This is your first assignment as a consultant with the prestigious McHenry Consulting firm. You want to do well.

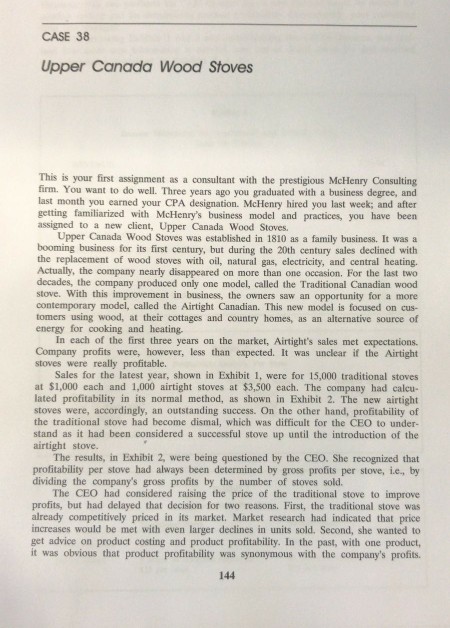

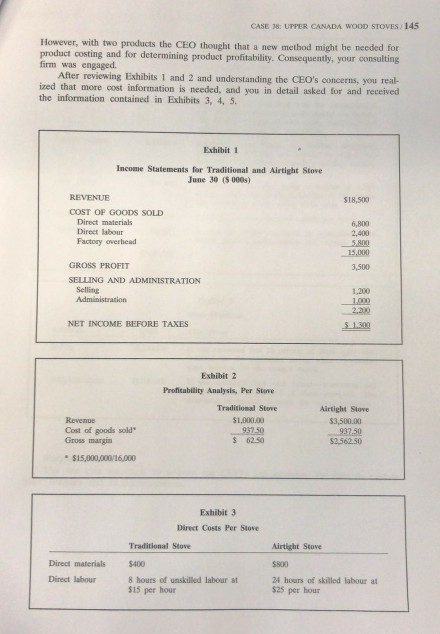

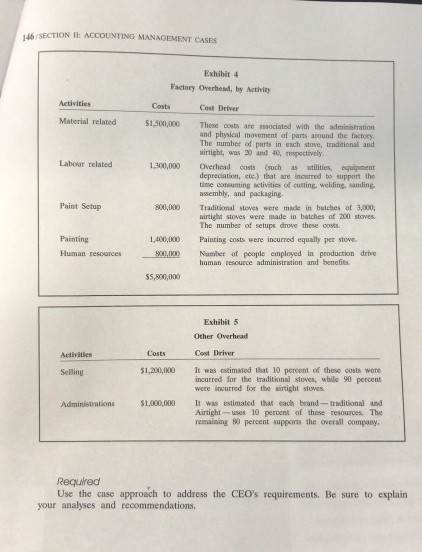

CASE 38 Upper Canada Wood Stoves This is your first assignment as a consultant with the prestigious McHenry Consulting firm. You want to do well. Three years ago you graduated with a business degree, and last month you earned your CPA designation. McHenry hired you last week; and after getting familiarized with McHenry's business model and practices, you have been assigned to a new client, Upper Canada Wood Stoves. Upper Canada Wood Stoves was established in 1810 as a family business. It was a booming business for its first century, but during the 20th century sales declined with the replacement of wood stoves with oil, natural gas, electricity, and central heating. Actually, the company nearly disappeared on more than one occasion. For the last two decades, the company produced only one model, called the Traditional Canadian wood stove. With this improvement in business, the owners saw an opportunity for a more contemporary model, called the Airtight Canadian. This new model is focused on cus- tomers using wood, at their cottages and country homes, as an alternative source of energy for cooking and heating. In each of the first three years on the market, Airtight's sales met expectations. Company profits were, however, less than expected. It was unclear if the Airtight stoves were really profitable. Sales for the latest year, shown in Exhibit 1, were for 15,000 traditional stoves at $1,000 each and 1,000 airtight stoves at $3,500 each. The company had calcu- lated profitability in its normal method, as shown in Exhibit 2. The new airtight stoves were, accordingly, an outstanding success. On the other hand, profitability of the traditional stove had become dismal, which was difficult for the CEO to under- stand as it had been considered a successful stove up until the introduction of the airtight stove. The results, in Exhibit 2, were being questioned by the CEO. She recognized that profitability per stove had always been determined by gross profits per stove, i.e., by dividing the company's gross profits by the number of stoves sold. The CEO had considered raising the price of the traditional stove to improve profits, but had delayed that decision for two reasons. First, the traditional stove was already competitively priced in its market. Market research had indicated that price increases would be met with even larger declines in units sold. Second, she wanted to get advice on product costing and product profitability. In the past, with one product, it was obvious that product profitability was synonymous with the company's profits. 144

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started