Answered step by step

Verified Expert Solution

Question

1 Approved Answer

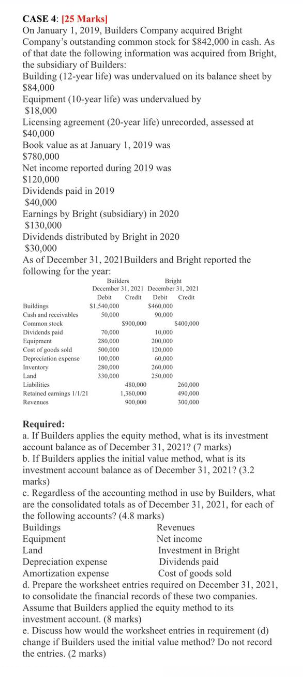

CASE 4: [25 Marks] On January 1, 2019, Builders Company acquired Bright Company's outstanding common stock for $842,000 in cash. As of that date the

CASE 4: [25 Marks] On January 1, 2019, Builders Company acquired Bright Company's outstanding common stock for $842,000 in cash. As of that date the following information was acquired from Bright, the subsidiary of Builders: Building (12-year life) was undervalued on its balance sheet by $84,000 Equipment (10-year life) was undervalued by $18,000 Licensing agreement (20-year life) untecorded, assessed at $40,000 Book value as at January 1, 2019 was $780,000 Net income reported during 2019 was $120,000 Dividends paid in 2019 $40,000 Earnings by Bright (subsidiary) in 2020 $130,000 Dividends distributed by Bright in 2020 $30,000 As of December 31,2021Builders and Bright reported the following for the year: Required: a. If Builders applies the equity method, what is its investment account balance as of December 31, 2021? (7 marks) b. If Builders applies the initial value method, what is its investment account balance as of December 31, 2021? (3.2 marks) c. Regardless of the accounting method in use by Builders, what are the consolidated totals as of December 31, 2021, for each of the following accounts? (4.8 marks) d. Prepare the worksheet entries required on December 31, 2021, to consolidate the financial records of these two companies. Assume that Builders applied the equity methox to its investment account. (8 marks) e. Discuss how would the worksheet entries in requirement (d) change if Builders used the initial value method? Do not record the entries. (2 marks)

CASE 4: [25 Marks] On January 1, 2019, Builders Company acquired Bright Company's outstanding common stock for $842,000 in cash. As of that date the following information was acquired from Bright, the subsidiary of Builders: Building (12-year life) was undervalued on its balance sheet by $84,000 Equipment (10-year life) was undervalued by $18,000 Licensing agreement (20-year life) untecorded, assessed at $40,000 Book value as at January 1, 2019 was $780,000 Net income reported during 2019 was $120,000 Dividends paid in 2019 $40,000 Earnings by Bright (subsidiary) in 2020 $130,000 Dividends distributed by Bright in 2020 $30,000 As of December 31,2021Builders and Bright reported the following for the year: Required: a. If Builders applies the equity method, what is its investment account balance as of December 31, 2021? (7 marks) b. If Builders applies the initial value method, what is its investment account balance as of December 31, 2021? (3.2 marks) c. Regardless of the accounting method in use by Builders, what are the consolidated totals as of December 31, 2021, for each of the following accounts? (4.8 marks) d. Prepare the worksheet entries required on December 31, 2021, to consolidate the financial records of these two companies. Assume that Builders applied the equity methox to its investment account. (8 marks) e. Discuss how would the worksheet entries in requirement (d) change if Builders used the initial value method? Do not record the entries. (2 marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started