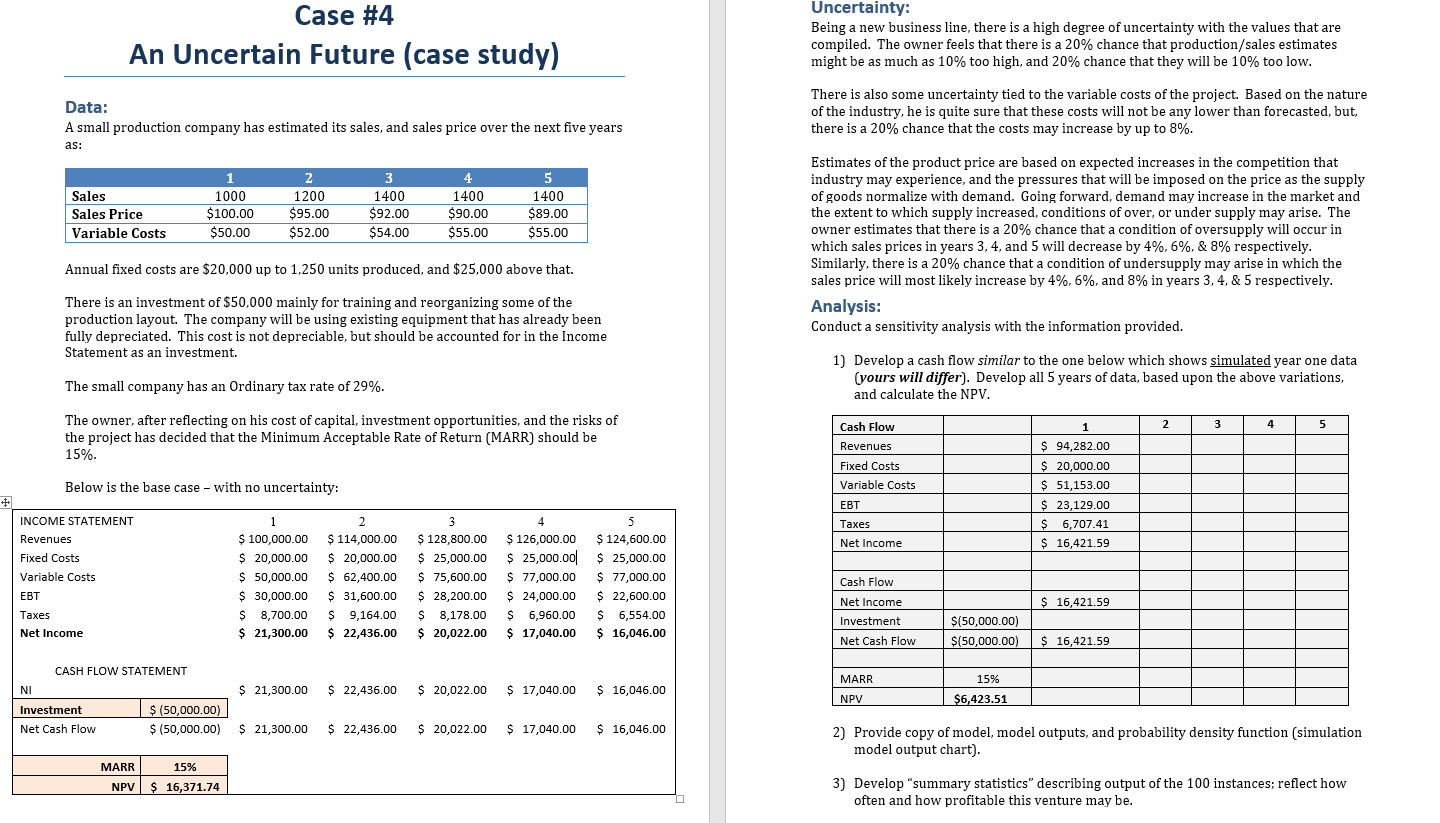

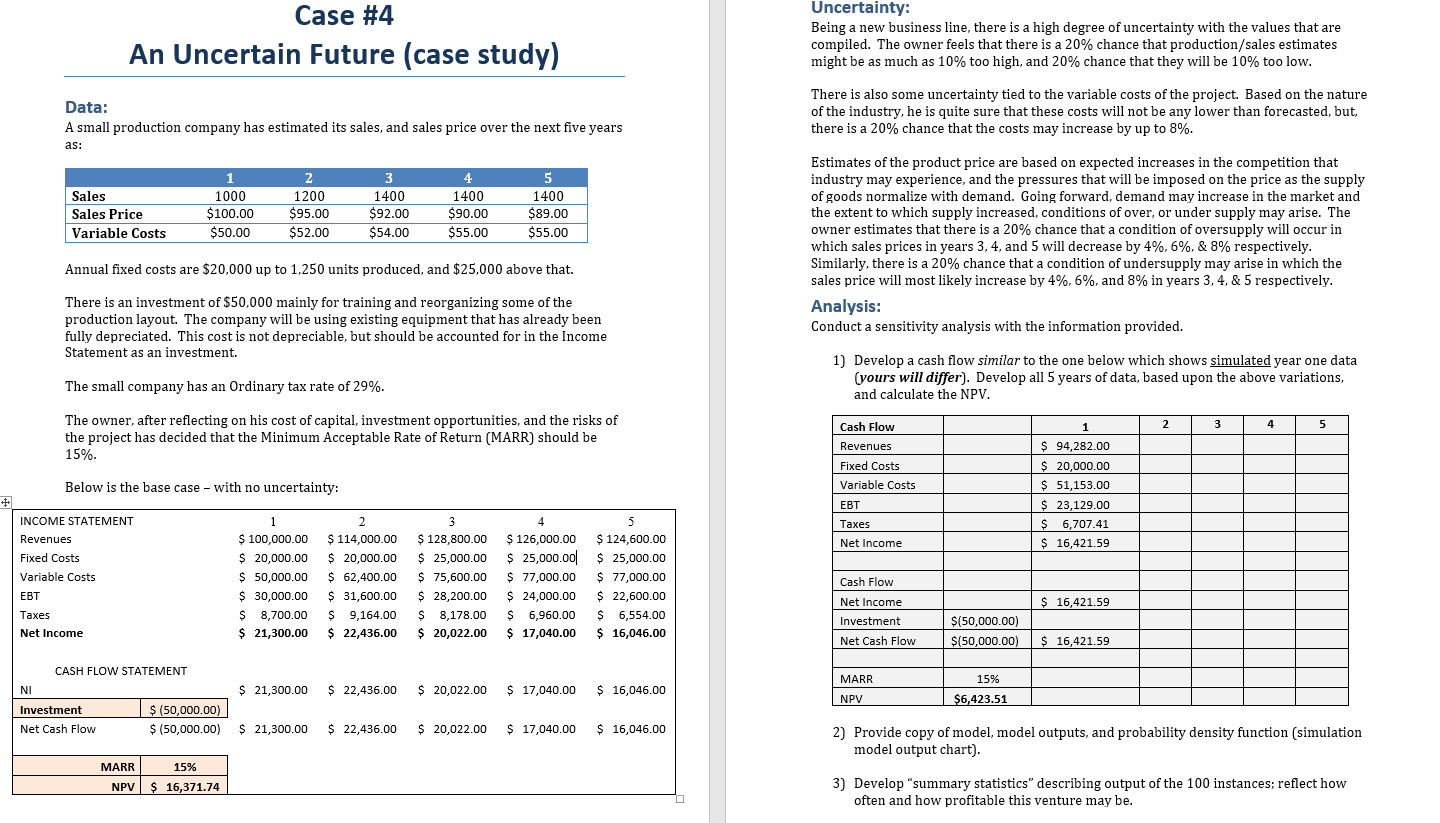

Case #4 An Uncertain Future (case study) Uncertainty: Being a new business line, there is a high degree of uncertainty with the values that are compiled. The owner feels that there is a 20% chance that production/sales estimates might be as much as 10% too high, and 20% chance that they will be 10% too low. Data: A small production company has estimated its sales, and sales price over the next five years as: There is also some uncertainty tied to the variable costs of the project. Based on the nature of the industry, he is quite sure that these costs will not be any lower than forecasted, but, there is a 20% chance that the costs may increase by up to 8%. Sales Sales Price Variable Costs 1 1000 $100.00 $50.00 2 1200 $95.00 $52.00 3 1400 $92.00 $54.00 4 1400 $90.00 $55.00 5 1400 $89.00 $55.00 Annual fixed costs are $20,000 up to 1,250 units produced, and $25,000 above that. Estimates of the product price are based on expected increases in the competition that industry may experience, and the pressures that will be imposed on the price as the supply of goods normalize with demand. Going forward, demand may increase in the market and the extent to which supply increased, conditions of over, or under supply may arise. The owner estimates that there is a 20% chance that a condition of oversupply will occur in which sales prices in years 3, 4, and 5 will decrease by 4%, 6%, & 8% respectively. Similarly, there is a 20% chance that a condition of undersupply may arise in which the sales price will most likely increase by 4%, 6%, and 8% in years 3, 4, & 5 respectively. Analysis: Conduct a sensitivity analysis with the information provided. 1) Develop a cash flow similar to the one below which shows simulated year one data (yours will differ). Develop all 5 years of data, based upon the above variations, and calculate the NPV. There is an investment of $50,000 mainly for training and reorganizing some of the production layout. The company will be using existing equipment that has already been fully depreciated. This cost is not depreciable, but should be accounted for in the Income Statement as an investment. The small company has an Ordinary tax rate of 29%. 1 2 3 4 5 The owner, after reflecting on his cost of capital, investment opportunities, and the risks of the project has decided that the Minimum Acceptable Rate of Return (MARR) should be 15%. Cash Flow Revenues Fixed Costs Variable Costs Below is the base case - with no uncertainty: $ 94,282.00 $ 20,000.00 $ 51,153.00 $ 23,129.00 $ 6,707.41 $ 16,421.59 EBT Taxes Net Income INCOME STATEMENT Revenues Fixed Costs Variable Costs EBT Taxes Net Income 1 $ 100,000.00 $ 20,000.00 $ 50,000.00 $ 30,000.00 S 8,700.00 $ 21,300.00 2 $ 114,000.00 $ 20,000.00 $ 62,400.00 $ 31,600.00 S 9,164.00 $ 22,436.00 3 $ 128,800.00 $ 25,000.00 $ 75,600.00 $ 28,200.00 S 8,178.00 $ 20,022.00 4 $ 126,000.00 $ 25,000.00 $ 77,000.00 $ 24,000.00 S 6,960.00 $ 17,040.00 5 $ 124,600.00 $ 25,000.00 $ 77,000.00 $ 22,600.00 S 6,554.00 $ 16,046.00 $ 16,421.59 Cash Flow Net Income Investment Net Cash Flow $(50,000.00) $(50,000.00) $ 16,421.59 MARR $ 21,300.00 $ 22,436.00 $ 20,022.00 $ 17,040.00 $ 16,046.00 CASH FLOW STATEMENT NI Investment $ (50,000.00) Net Cash Flow $ (50,000.00) 15% $6,423.51 NPV $ 21,300.00 $ 22,436.00 $ 20,022.00 $ 17,040.00 $ 16,046.00 2) Provide copy of model, model outputs, and probability density function (simulation model output chart). MARR 15% NPV $ 16,371.74 3) Develop "summary statistics" describing output of the 100 instances; reflect how often and how profitable this venture may be. Case #4 An Uncertain Future (case study) Uncertainty: Being a new business line, there is a high degree of uncertainty with the values that are compiled. The owner feels that there is a 20% chance that production/sales estimates might be as much as 10% too high, and 20% chance that they will be 10% too low. Data: A small production company has estimated its sales, and sales price over the next five years as: There is also some uncertainty tied to the variable costs of the project. Based on the nature of the industry, he is quite sure that these costs will not be any lower than forecasted, but, there is a 20% chance that the costs may increase by up to 8%. Sales Sales Price Variable Costs 1 1000 $100.00 $50.00 2 1200 $95.00 $52.00 3 1400 $92.00 $54.00 4 1400 $90.00 $55.00 5 1400 $89.00 $55.00 Annual fixed costs are $20,000 up to 1,250 units produced, and $25,000 above that. Estimates of the product price are based on expected increases in the competition that industry may experience, and the pressures that will be imposed on the price as the supply of goods normalize with demand. Going forward, demand may increase in the market and the extent to which supply increased, conditions of over, or under supply may arise. The owner estimates that there is a 20% chance that a condition of oversupply will occur in which sales prices in years 3, 4, and 5 will decrease by 4%, 6%, & 8% respectively. Similarly, there is a 20% chance that a condition of undersupply may arise in which the sales price will most likely increase by 4%, 6%, and 8% in years 3, 4, & 5 respectively. Analysis: Conduct a sensitivity analysis with the information provided. 1) Develop a cash flow similar to the one below which shows simulated year one data (yours will differ). Develop all 5 years of data, based upon the above variations, and calculate the NPV. There is an investment of $50,000 mainly for training and reorganizing some of the production layout. The company will be using existing equipment that has already been fully depreciated. This cost is not depreciable, but should be accounted for in the Income Statement as an investment. The small company has an Ordinary tax rate of 29%. 1 2 3 4 5 The owner, after reflecting on his cost of capital, investment opportunities, and the risks of the project has decided that the Minimum Acceptable Rate of Return (MARR) should be 15%. Cash Flow Revenues Fixed Costs Variable Costs Below is the base case - with no uncertainty: $ 94,282.00 $ 20,000.00 $ 51,153.00 $ 23,129.00 $ 6,707.41 $ 16,421.59 EBT Taxes Net Income INCOME STATEMENT Revenues Fixed Costs Variable Costs EBT Taxes Net Income 1 $ 100,000.00 $ 20,000.00 $ 50,000.00 $ 30,000.00 S 8,700.00 $ 21,300.00 2 $ 114,000.00 $ 20,000.00 $ 62,400.00 $ 31,600.00 S 9,164.00 $ 22,436.00 3 $ 128,800.00 $ 25,000.00 $ 75,600.00 $ 28,200.00 S 8,178.00 $ 20,022.00 4 $ 126,000.00 $ 25,000.00 $ 77,000.00 $ 24,000.00 S 6,960.00 $ 17,040.00 5 $ 124,600.00 $ 25,000.00 $ 77,000.00 $ 22,600.00 S 6,554.00 $ 16,046.00 $ 16,421.59 Cash Flow Net Income Investment Net Cash Flow $(50,000.00) $(50,000.00) $ 16,421.59 MARR $ 21,300.00 $ 22,436.00 $ 20,022.00 $ 17,040.00 $ 16,046.00 CASH FLOW STATEMENT NI Investment $ (50,000.00) Net Cash Flow $ (50,000.00) 15% $6,423.51 NPV $ 21,300.00 $ 22,436.00 $ 20,022.00 $ 17,040.00 $ 16,046.00 2) Provide copy of model, model outputs, and probability density function (simulation model output chart). MARR 15% NPV $ 16,371.74 3) Develop "summary statistics" describing output of the 100 instances; reflect how often and how profitable this venture may be