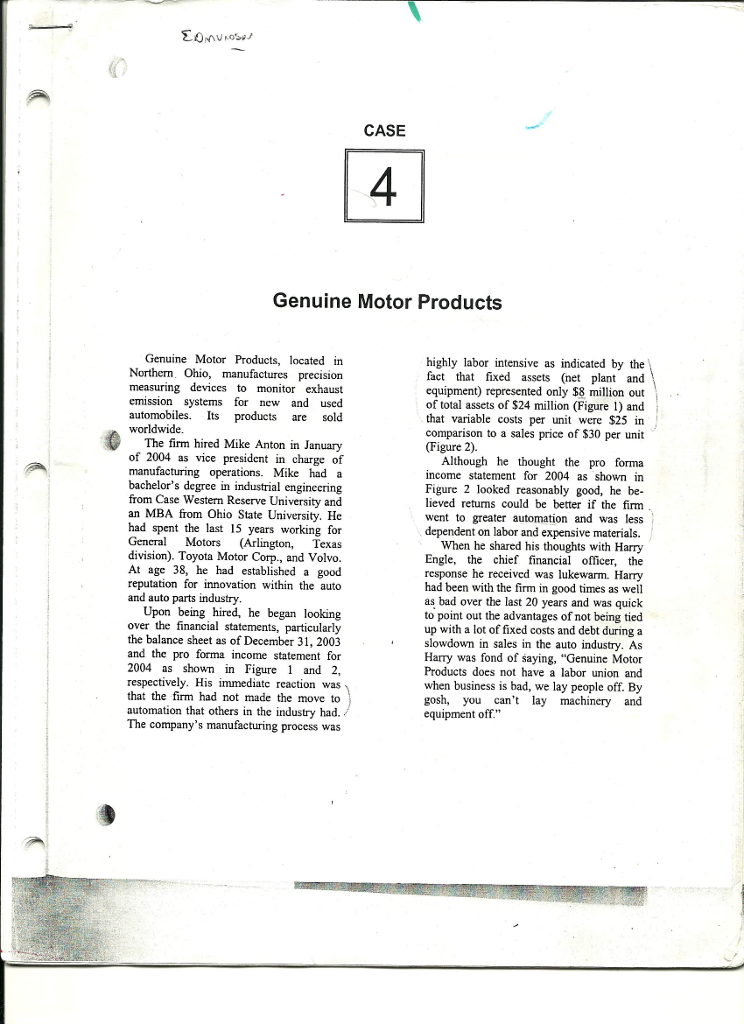

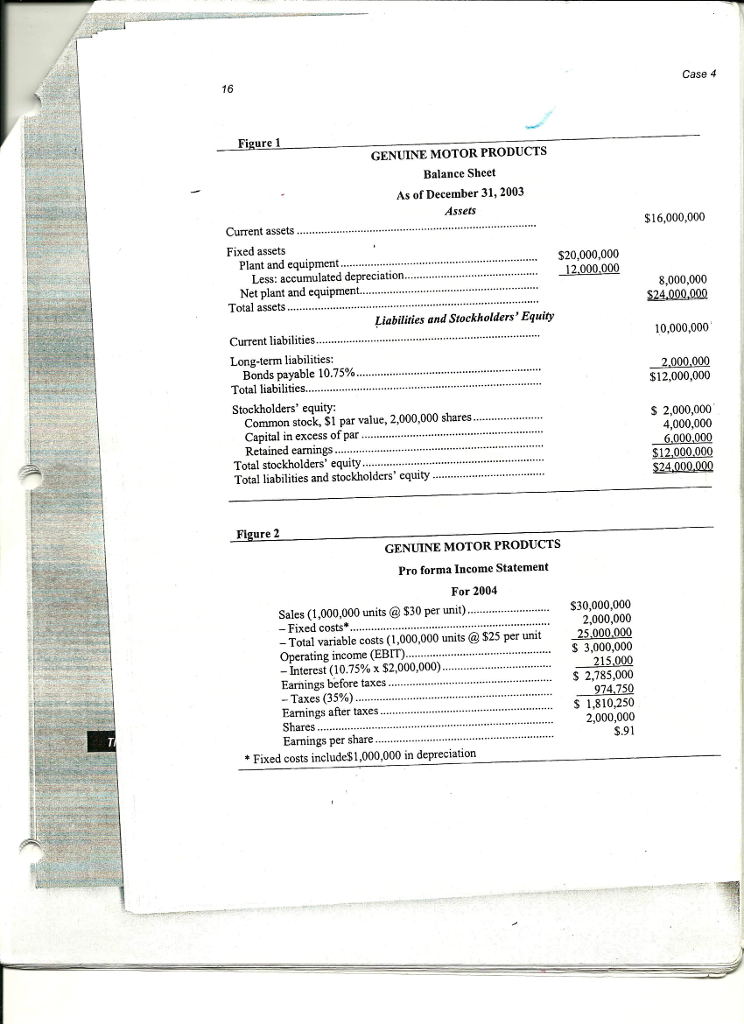

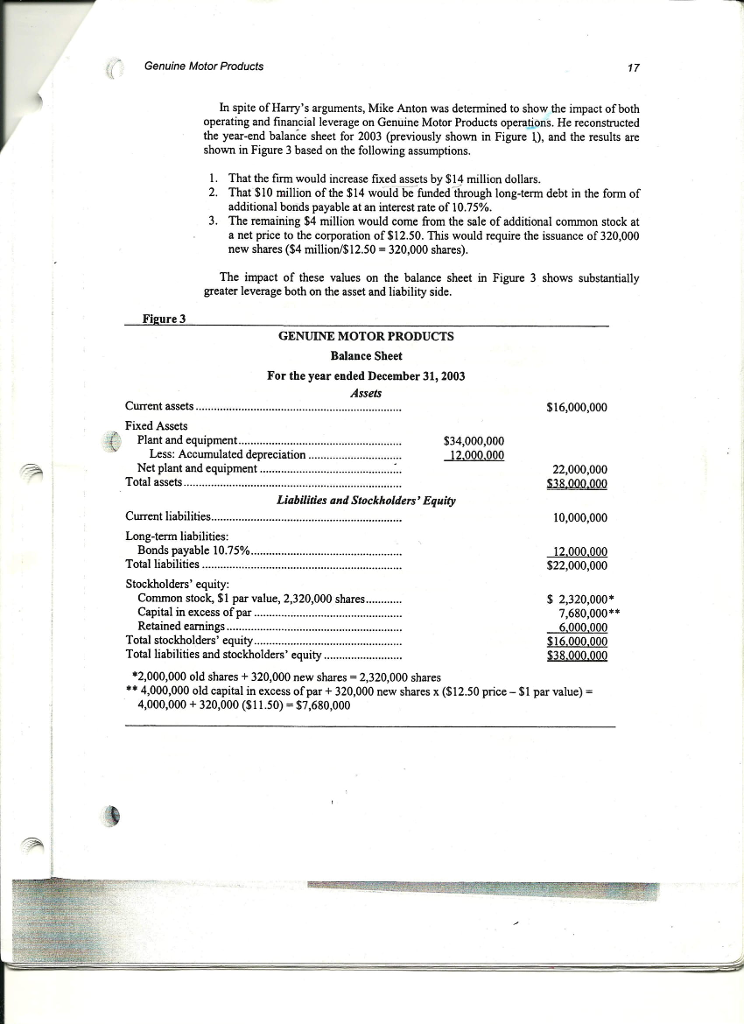

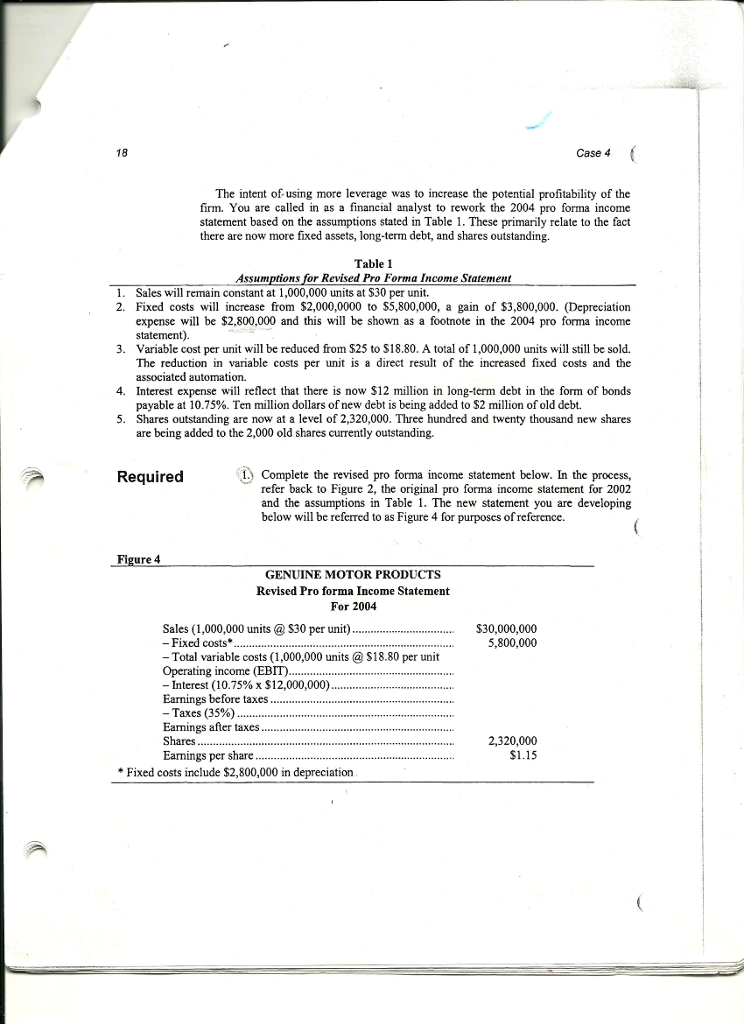

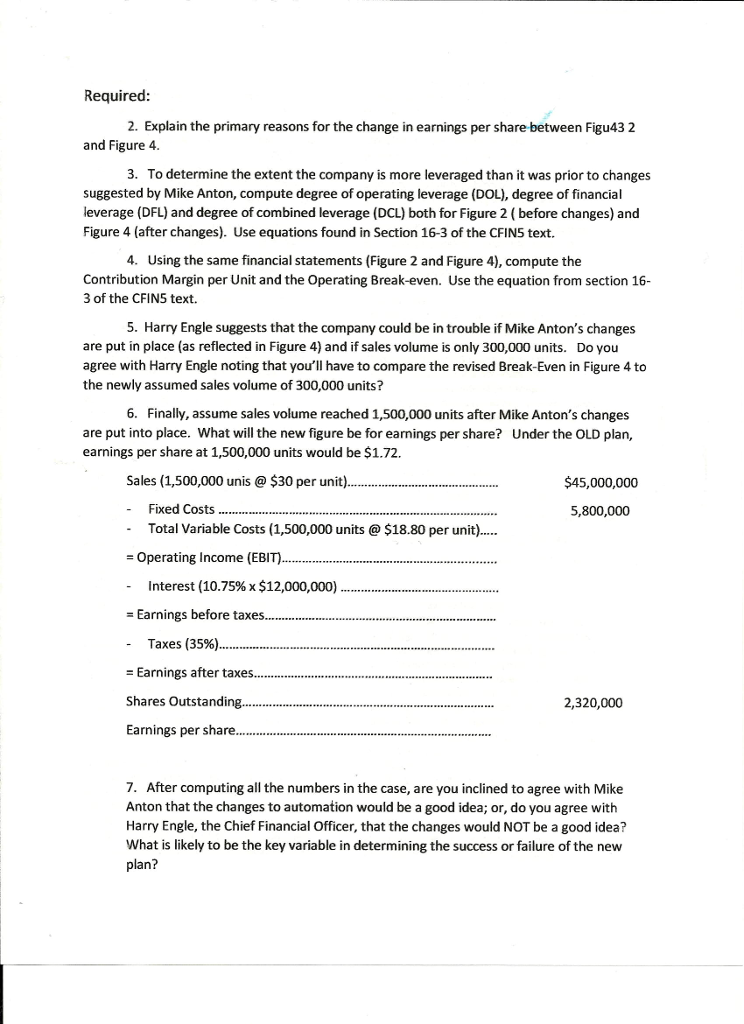

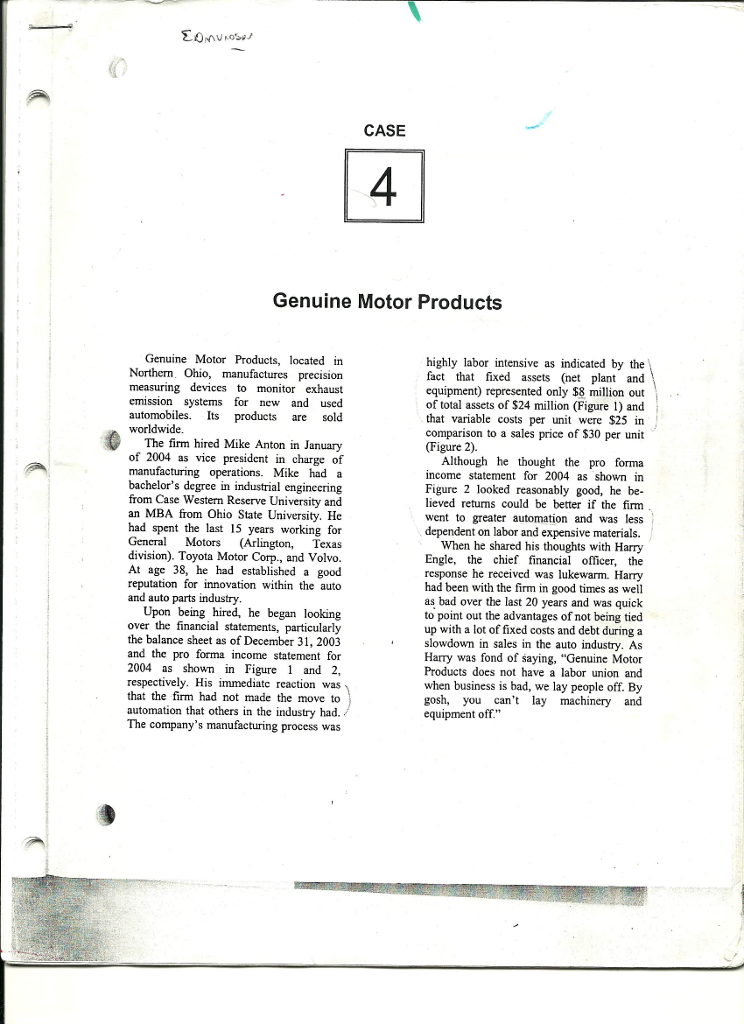

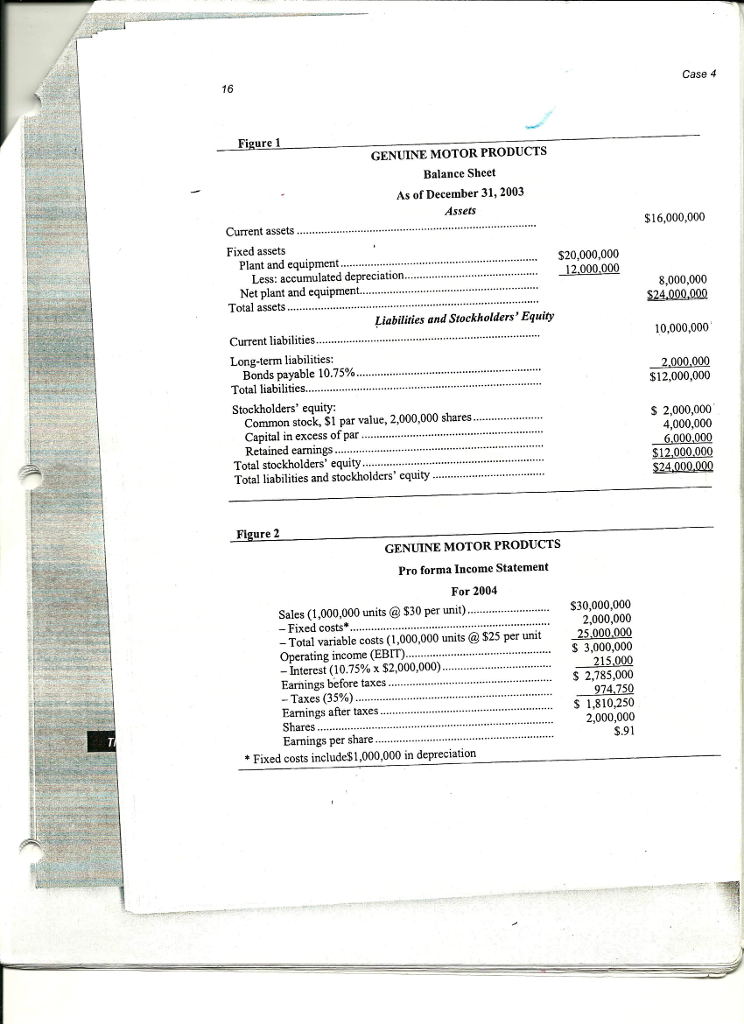

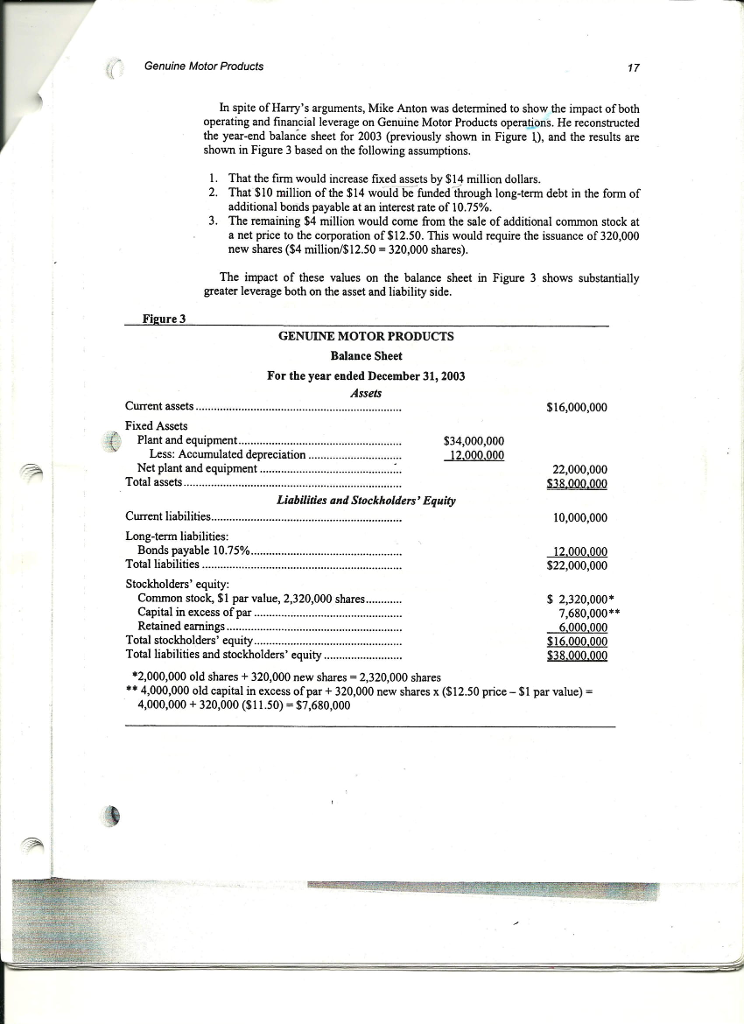

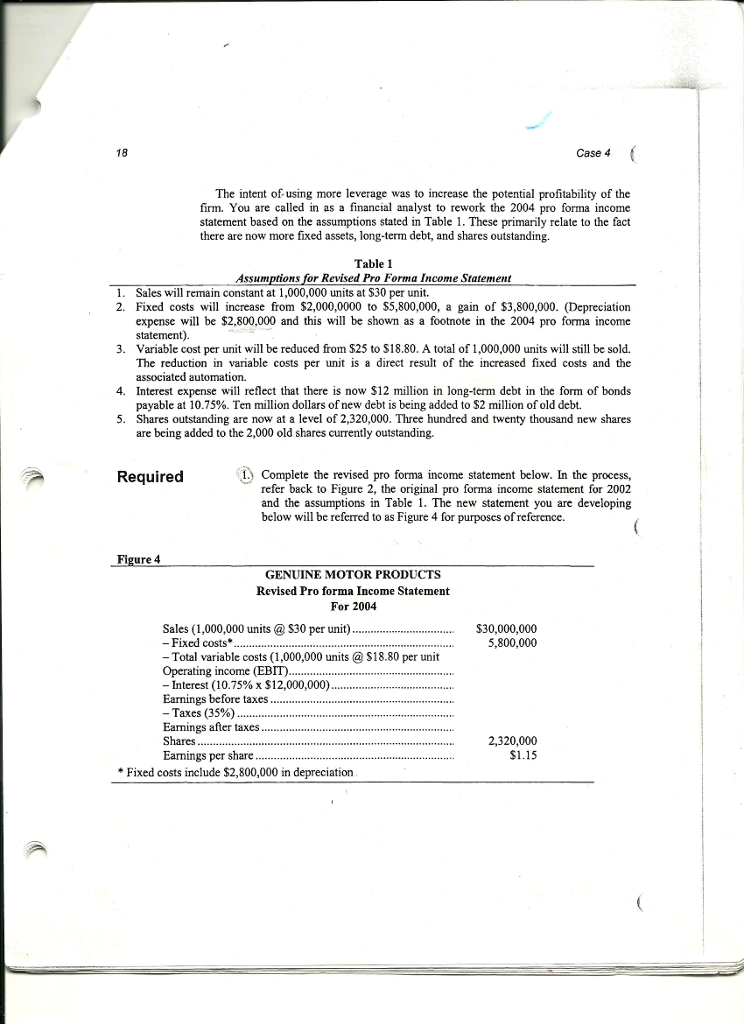

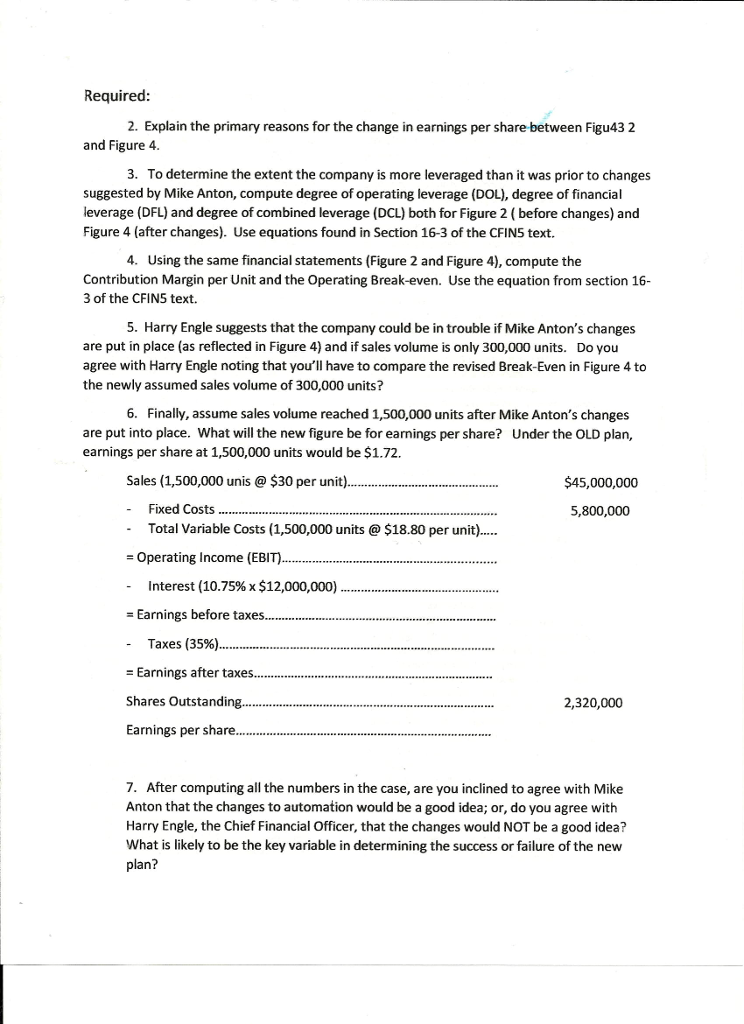

CASE 4 Genuine Motor Products Genuine Motor Products, located in Northern. Ohio, manufactures precision measuring devices to monitor exhaust emission systems for new and used automobiles. Its products are sold highly labor intensive as indicated by the fact that fixed assets (net plant and out of total assets of $24 million (Figure 1) and that variable costs per unit were $25 in comparison to a sales price of $30 per unit equipment) represented only $8 million The firm hired Mike At anuary of 2004 as vice president in charge of manufacturing operations. Mike had a bachelor's degree in industrial enginecring from Case Western Reserve University and an MBA from Ohio State University. He had spent the last 15 years working for Genera Motors (Arlington, Texas ivision). Toyota Motor Corp., and Volvo. At age 38, he had established a good reputation for innovation within the auto (Figure 2). Although he thought the pro forma income statement for 2004 as shown in Figure 2 looked reasonably good, he be lieved retums could be better if the firm went to greater automation and was less dependent on labor and expensive materials. When he shared his thoughts with Harry Engle, the chief financial officer, the response he received was lukewarm. Harry had been with the firm in good times as well as bad over the last 20 years and was quick to point out the advantages of not being tied up with a lot of fixed costs and debt duringa slowdown in sales in the auto industry. As Harry was fond of saying, "Genuine Motor Products does not have a labor union and when business is bad, we lay people off. By gosh, you can't lay machinery and and auto parts industry Upon being hired, he began looking over the financial statements, particularly the balance sheet as of December 31, 2003 and the pro forma income statement for 2004 as shown in Figure 1 and 2, eaction was that the firm had not made the move to automation that others in the industry had. The company's manufacturing process was respectively. His immediate r CASE 4 Genuine Motor Products Genuine Motor Products, located in Northern. Ohio, manufactures precision measuring devices to monitor exhaust emission systems for new and used automobiles. Its products are sold highly labor intensive as indicated by the fact that fixed assets (net plant and out of total assets of $24 million (Figure 1) and that variable costs per unit were $25 in comparison to a sales price of $30 per unit equipment) represented only $8 million The firm hired Mike At anuary of 2004 as vice president in charge of manufacturing operations. Mike had a bachelor's degree in industrial enginecring from Case Western Reserve University and an MBA from Ohio State University. He had spent the last 15 years working for Genera Motors (Arlington, Texas ivision). Toyota Motor Corp., and Volvo. At age 38, he had established a good reputation for innovation within the auto (Figure 2). Although he thought the pro forma income statement for 2004 as shown in Figure 2 looked reasonably good, he be lieved retums could be better if the firm went to greater automation and was less dependent on labor and expensive materials. When he shared his thoughts with Harry Engle, the chief financial officer, the response he received was lukewarm. Harry had been with the firm in good times as well as bad over the last 20 years and was quick to point out the advantages of not being tied up with a lot of fixed costs and debt duringa slowdown in sales in the auto industry. As Harry was fond of saying, "Genuine Motor Products does not have a labor union and when business is bad, we lay people off. By gosh, you can't lay machinery and and auto parts industry Upon being hired, he began looking over the financial statements, particularly the balance sheet as of December 31, 2003 and the pro forma income statement for 2004 as shown in Figure 1 and 2, eaction was that the firm had not made the move to automation that others in the industry had. The company's manufacturing process was respectively. His immediate r