Answered step by step

Verified Expert Solution

Question

1 Approved Answer

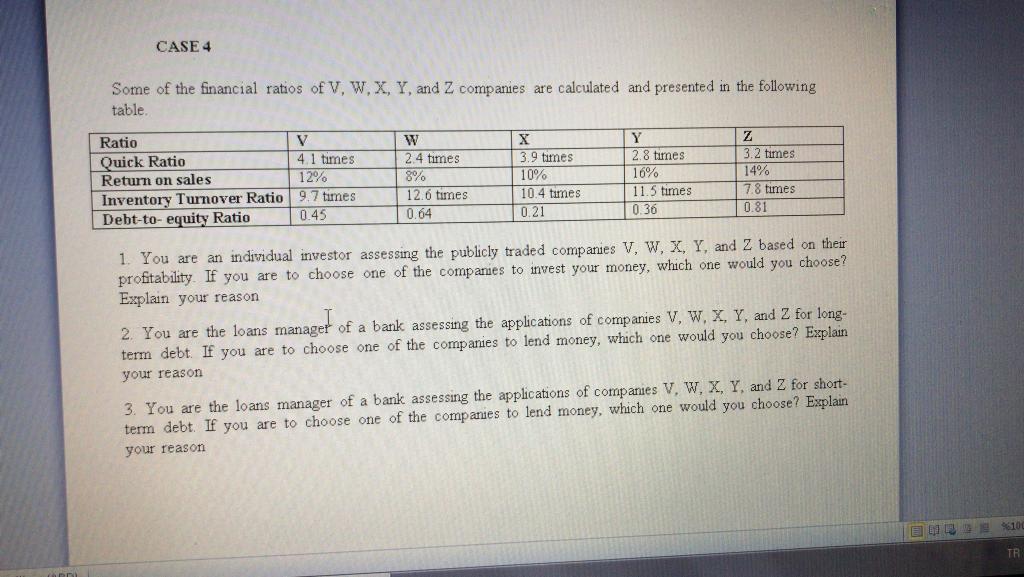

ARDI CASE 4 Some of the financial ratios of V, W, X, Y, and Z companies are calculated and presented in the following table.

ARDI CASE 4 Some of the financial ratios of V, W, X, Y, and Z companies are calculated and presented in the following table. Ratio Quick Ratio Return on sales Inventory Turnover Ratio Debt-to-equity Ratio V 4.1 times. 12% 9.7 times 0.45 W 2.4 times. 8% 12.6 times. 0.64 X 3.9 times 10% 10.4 times 0.21 Y 2.8 times: 16% 11.5 times. 0.36 Z 3.2 times. 14% 7.8 times 0.81 1. You are an individual investor assessing the publicly traded companies V, W, X, Y, and Z based on their profitability. If you are to choose one of the companies to invest your money, which one would you choose? Explain your reason 2. You are the loans manager of a bank assessing the applications of companies V, W, X, Y, and Z for long- term debt. If you are to choose one of the companies to lend money, which one would you choose? Explain your reason. 3. You are the loans manager of a bank assessing the applications of companies V, W, X, Y, and Z for short- term debt. If you are to choose one of the companies to lend money, which one would you choose? Explain your reason %100 TR

Step by Step Solution

★★★★★

3.53 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

1 If I were an individual investor assessing the publicly traded companies V W X Y and Z based on th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started