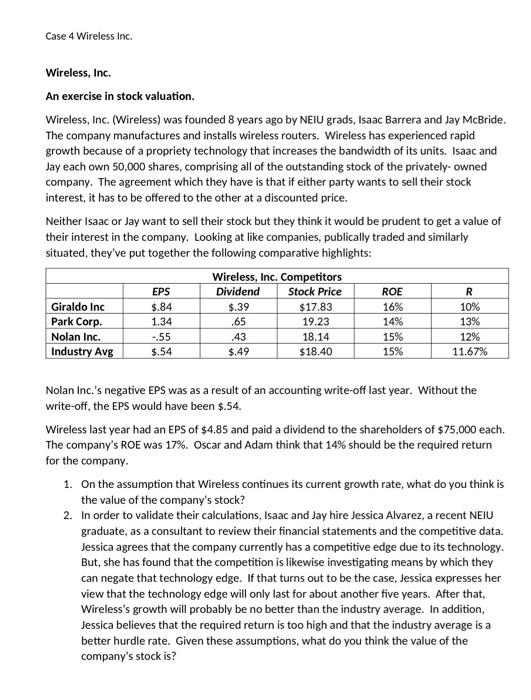

Case 4 Wireless Inc. Wireless, Inc. An exercise in stock valuation. Wireless, Inc. (Wireless) was founded 8 years ago by NEIU grads, Isaac Barrera and Jay McBride. The company manufactures and installs wireless routers. Wireless has experienced rapid growth because of a propriety technology that increases the bandwidth of its units. Isaac and Jay each own 50,000 shares, comprising all of the outstanding stock of the privately-owned company. The agreement which they have is that if either party wants to sell their stock interest, it has to be offered to the other at a discounted price. Neither Isaac or Jay want to sell their stock but they think it would be prudent to get a value of their interest in the company. Looking at like companies, publically traded and similarly situated, they've put together the following comparative highlights: Nolan Inc.'s negative EPS was as a result of an accounting write-off last year. Without the write-off, the EPS would have been $.54. Wireless last year had an EPS of $4.85 and paid a dividend to the shareholders of $75,000 each. The company's ROE was 17%. Oscar and Adam think that 14% should be the required return for the company. 1. On the assumption that Wireless continues its current growth rate, what do you think is the value of the company's stock? 2. In order to validate their calculations, Isaac and Jay hire Jessica Alvarez, a recent NEIU graduate, as a consultant to review their financial statements and the competitive data. Jessica agrees that the company currently has a competitive edge due to its technology. But, she has found that the competition is likewise investigating means by which they can negate that technology edge. If that turns out to be the case, Jessica expresses her view that the technology edge will only last for about another five years. After that, Wireless's growth will probably be no better than the industry average. In addition, Jessica believes that the required return is too high and that the industry average is a better hurdle rate. Given these assumptions, what do you think the value of the company's stock is