Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case 5: Mr. Ali is the Leader of Audit team of EX auditing firm. He is working with 3 auditors: Abdulah, Samina, Ahmed. Their team

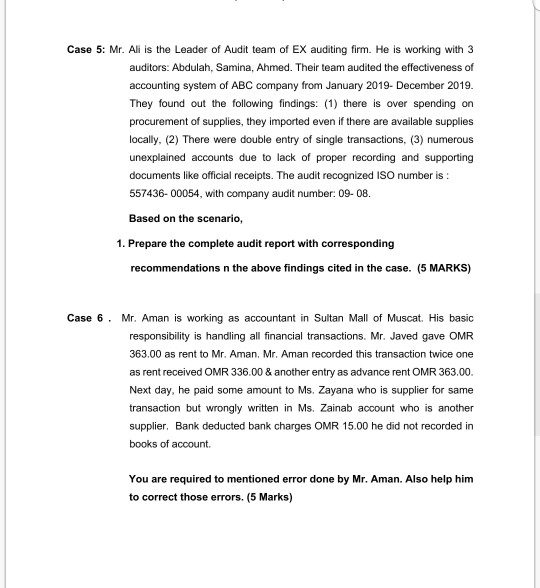

Case 5: Mr. Ali is the Leader of Audit team of EX auditing firm. He is working with 3 auditors: Abdulah, Samina, Ahmed. Their team audited the effectiveness of accounting system of ABC company from January 2019- December 2019. They found out the following findings: (1) there is over spending on procurement of supplies, they imported even if there are available supplies locally, (2) There were double entry of single transactions, (3) numerous unexplained accounts due to lack of proper recording and supporting documents like official receipts. The audit recognized ISO number is : 557436-00054, with company audit number: 09-08. Based on the scenario, 1. Prepare the complete audit report with corresponding recommendations n the above findings cited in the case. (5 MARKS) Case 6 Mr. Aman is working as accountant in Sultan Mall of Muscat. His basic responsibility is handling all financial transactions. Mr. Javed gave OMR 363.00 as rent to Mr. Aman. Mr. Aman recorded this transaction twice one as rent received OMR 336.00 & another entry as advance rent OMR 363.00. Next day, he paid some amount to Ms. Zayana who is supplier for same transaction but wrongly written in Ms. Zainab account who is another supplier. Bank deducted bank charges OMR 15.00 he did not recorded in books of account You are required to mentioned error done by Mr. Aman. Also help him to correct those errors. (5 Marks) Case 5: Mr. Ali is the Leader of Audit team of EX auditing firm. He is working with 3 auditors: Abdulah, Samina, Ahmed. Their team audited the effectiveness of accounting system of ABC company from January 2019- December 2019. They found out the following findings: (1) there is over spending on procurement of supplies, they imported even if there are available supplies locally, (2) There were double entry of single transactions, (3) numerous unexplained accounts due to lack of proper recording and supporting documents like official receipts. The audit recognized ISO number is : 557436-00054, with company audit number: 09-08. Based on the scenario, 1. Prepare the complete audit report with corresponding recommendations n the above findings cited in the case. (5 MARKS) Case 6 Mr. Aman is working as accountant in Sultan Mall of Muscat. His basic responsibility is handling all financial transactions. Mr. Javed gave OMR 363.00 as rent to Mr. Aman. Mr. Aman recorded this transaction twice one as rent received OMR 336.00 & another entry as advance rent OMR 363.00. Next day, he paid some amount to Ms. Zayana who is supplier for same transaction but wrongly written in Ms. Zainab account who is another supplier. Bank deducted bank charges OMR 15.00 he did not recorded in books of account You are required to mentioned error done by Mr. Aman. Also help him to correct those errors

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started