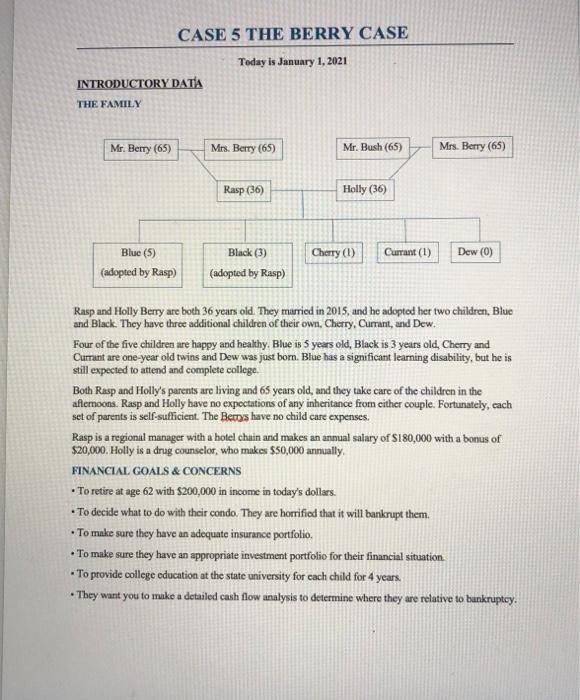

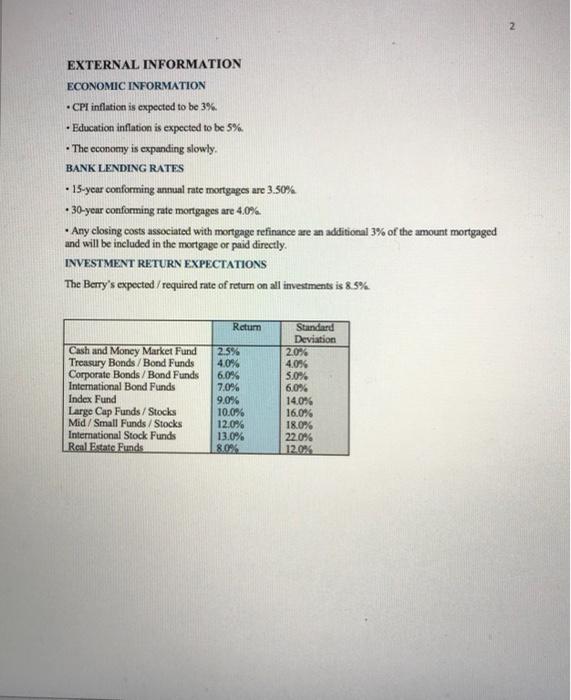

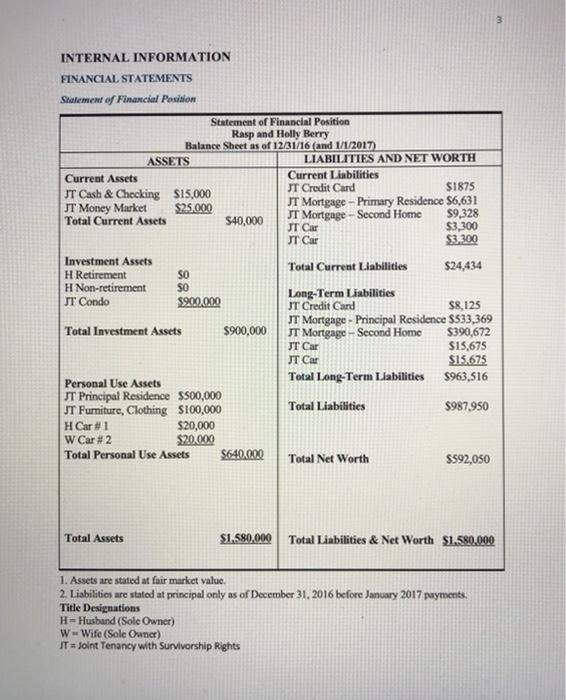

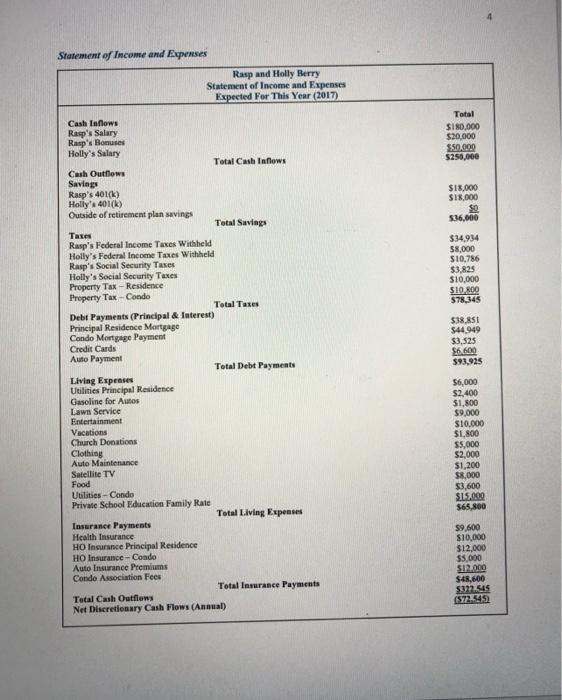

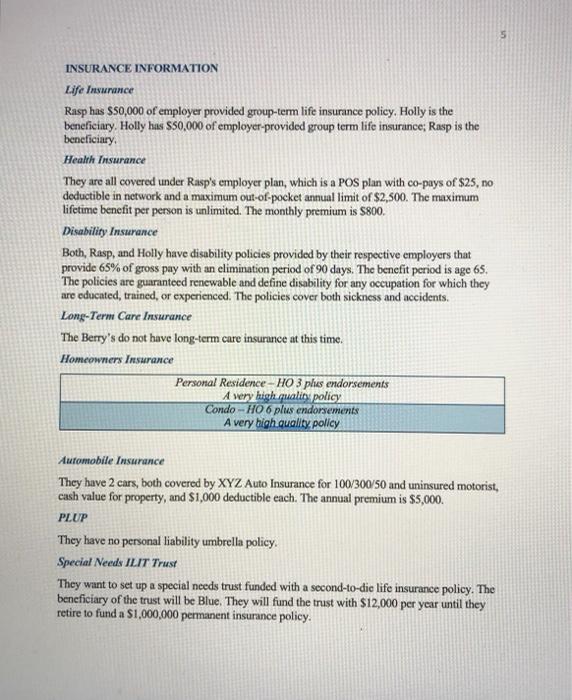

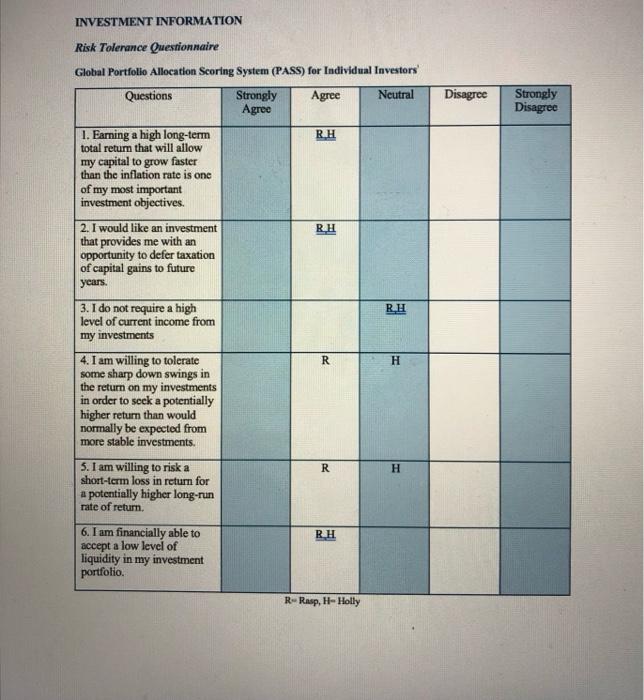

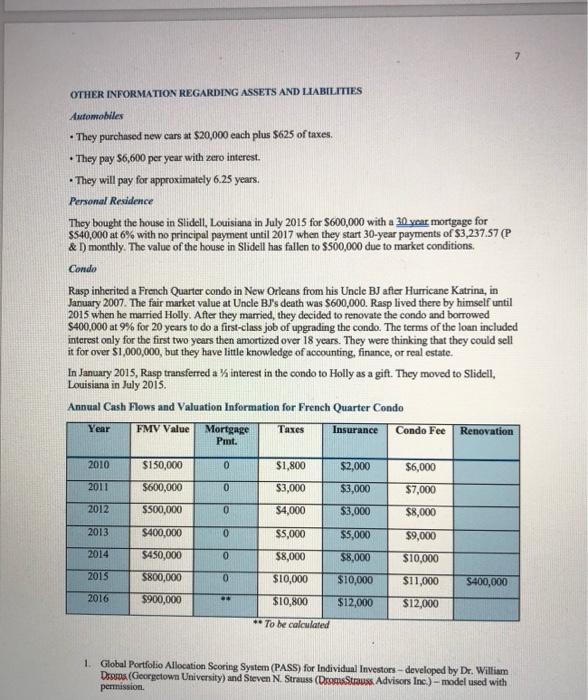

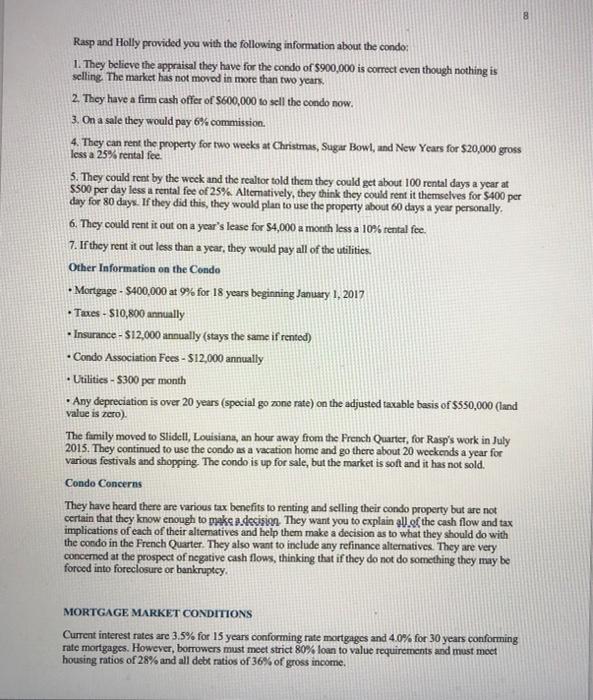

CASE 5 THE BERRY CASE Today is January 1, 2021 INTRODUCTORY DATA THE FAMILY Mr. Berry (65) Mrs. Berry (65) Mr. Bush (65) Mrs. Berry (65) Rasp (36) Holly (36) Blue (5) Cherry (1) Currant (1) Dew (0) Black (3) (adopted by Rasp) (adopted by Rasp) Rasp and Holly Berry are both 36 years old. They married in 2015, and he adopted her two children, Blue and Black. They have three additional children of their own, Cherry, Currant, and Dew. Four of the five children are happy and healthy. Blue is 5 years old, Black is 3 years old, Cherry and Currant are one-year old twins and Dew was just born. Blue has a significant learning disability, but he is still expected to attend and complete college. Both Rasp and Holly's parents are living and 65 years old, and they take care of the children in the aftemoons. Rasp and Holly have no expectations of any inheritance from cither couple. Fortunately, cach set of parents is self-sufficient. The Betors have no child care expenses. Rasp is a regional manager with a hotel chain and makes an annual salary of S180,000 with a bonus of $20,000, Holly is a drug counselor, who makes $50,000 annually. FINANCIAL GOALS & CONCERNS To retire at age 62 with $200,000 in income in today's dollars. To decide what to do with their condo. They are borrified that it will bankrupt them. To make sure they have an adequate insurance portfolio To make sure they have an appropriate investment portfolio for their financial situation To provide college education at the state university for each child for 4 years. They want you to make a detailed cash flow analysis to determine where they are relative to bunkruptcy. . 2 EXTERNAL INFORMATION ECONOMIC INFORMATION . CPI inflation is expected to be 3%. Education inflation is expected to be 5% The economy is expanding slowly BANK LENDING RATES - 15-year conforming annual rate mortgages arc 3.50% 30-year conforming rate mortgages are 4.0%. Any closing costs associated with mortgage refinance are an additional 3% of the amount mortgaged and will be included in the mortgage or paid directly INVESTMENT RETURN EXPECTATIONS The Berry's expected / required rate of return on all investments is 8.5% . Return Cash and Money Market Fund Treasury Bonds /Bond Funds Corporate Bonds /Bond Funds International Bond Funds Index Fund Large Cap Funds/Stocks Mid / Small Funds/Stocks International Stock Funds Real Estate Funds 2.5% 4,0% 6.0% 7.0% 9.0% 10.0% 12.0% 13.0% 8.0% Standard Deviation 20% 40% 5.0% 6.0% 14.0% 16.0% 18.0% 22.0% 120% 3 INTERNAL INFORMATION FINANCIAL STATEMENTS Statement of Financial Position Statement of Financial Position Rasp and Holly Berry Balance Sheet as of 12/31/16 (and 1/1/2017) ASSETS LIABILITIES AND NET WORTH Current Assets Current Liabilities JT Credit Card $1875 JT Cash & Checking $15,000 JT Money Market $25,000 JT Mortgage - Primary Residence $6,631 Total Current Assets $9,328 $40,000 JT Mortgage - Second Home JT Car $3,300 JT Car $3.300 Investment Assets H Retirement Total Current Liabilities $24,434 SO H Non-retirement SO JT Condo Long-Term Liabilities $900.000 JT Credit Card $8,125 JT Mortgage - Principal Residence $533,369 Total Investment Assets $900,000 JT Mortgage - Second Home $390,672 JT Car $15,675 JT Car SI5.675 Personal Use Assets Total Long-Term Liabilities $963,516 JT Principal Residence $500,000 JT Furniture, Clothing $100,000 Total Liabilities $987,950 H Car #1 $20,000 W Car #2 $20.000 Total Personal Use Assets $640.000 Total Net Worth $592,050 Total Assets $1,580.000 Total Liabilities & Net Worth $1.580,000 1. Assets are stated at fair market value. 2. Liabilities are stated at principal only as of December 31, 2016 before January 2017 payments. Title Designations H-Husband (Sole Owner) W Wife (Sole Owner) JT + Joint Tenancy with Survivorship Rights Statement of Income and Expenses Rasp and Holly Berry Statement of Income and Expenses Expected For This Year (2017) Total $180,000 520,000 $50.000 $250,000 $18,000 SI5,000 536,000 $34.934 $8.000 $10,786 53.825 $10,000 $10.800 $78,345 538.SI $44.949 $3.525 $5.600 $93.925 Cash Innows Rasp's Salary Rasp's Bonuses Holly's Salary Total Cash Inflows Cash Outflows Savings Rasp's 401(k) Holly's 401(k) Outside of retirement plan savings Total Savings Tai Rasp's Federal Income Taxes Withheld Holly's Federal Income Taxes Withheld Rasp's Social Security Takes Holly's Social Security Taxes Property Tax - Residence Property Tax-Condo Total Taxes Debt Payments (Principal & Interest) Principal Residence Mortgage Condo Mortgage Payment Credit Cards Auto Payment Total Debt Payments Living Expenses Utilities Principal Residence Gasoline for Autos Lawn Service Entertainment Vacations Church Donations Clothing Auto Maintenance Satellite TV Food Utilities - Condo Private School Education Family Rate Total Living Expenses Insurance Payments Health Insurance HO Insurance Principal Residence HO Insurance - Condo Auto Insurance Premiums Condo Association Fees Total Insurance Payments Total Cash Outflows Net Discretionary Cash Flows (Annual) 56,000 $2,400 $1,800 $9.000 $10,000 $1,800 $5,000 $2.000 $1,200 $8,000 $3,600 $15.000 565,800 59,600 S10,000 $12,000 55.000 517.000 $48.600 3012345 1572.545 5 INSURANCE INFORMATION Life Insurance Rasp has $50,000 of employer provided group-term life insurance policy. Holly is the beneficiary. Holly has $50,000 of employer-provided group term life insurance; Rasp is the beneficiary, Health Insurance They are all covered under Rasp's employer plan, which is a POS plan with co-pays of $25, no deductible in network and a maximum out-of-pocket annual limit of $2,500. The maximum lifetime benefit per person is unlimited. The monthly premium is $800. s Disability Insurance Both, Rasp, and Holly have disability policies provided by their respective employers that provide 65% of gross pay with an elimination period of 90 days. The benefit period is age 65. The policies are guaranteed renewable and define disability for any occupation for which they are educated, trained, or experienced. The policies cover both sickness and accidents Long-Term Care Insurance The Berry's do not have long-term care insurance at this time. Homeowners Insurance Personal Residence- HO 3 phas endorsements A very high quality policy Condo - HO 6 plus endorsements A very high quality policy Automobile Insurance They have 2 cars, both covered by XYZ Auto Insurance for 100/300/50 and uninsured motorist, cash value for property, and $1,000 deductible each. The annual premium is $5,000. PLUP They have no personal liability umbrella policy Special Needs ILIT Trust They want to set up a special needs trust funded with a second-to-dic life insurance policy. The beneficiary of the trust will be Blue. They will find the trust with $12,000 per year until they retire to fund a $1,000,000 permanent insurance policy. INVESTMENT INFORMATION Risk Tolerance Questionnaire Global Portfolio Allocation Scoring System (PASS) for Individual Investors Questions Strongly Agree Neutral Agree Disagree Strongly Disagree RH RH 1. Earning a high long-term total return that will allow my capital to grow faster than the inflation rate is one of my most important investment objectives. 2. I would like an investment that provides me with an opportunity to defer taxation of capital gains to future years. 3. I do not require a high level of current income from my investments RH R H 4. I am willing to tolerate some sharp down swings in the return on my investments in order to seek a potentially higher return than would normally be expected from more stable investments. 5. I am willing to risk a short-term loss in return for a potentially higher long-run rate of return 6. I am financially able to accept a low level of liquidity in my investment portfolio R H RH R-Rap, H-Holly 7 OTHER INFORMATION REGARDING ASSETS AND LIABILITIES Automobiles They purchased new cars at $20,000 each plus $625 of taxes, They pay $6,600 per year with zero interest. They will pay for approximately 6.25 years. Personal Residence They bought the house in Slidell, Louisiana in July 2015 for $600,000 with a 30 year mortgage for $540,000 at 6% with no principal payment until 2017 when they start 30-year payments of $3,237.57 (P & 1) monthly. The value of the house in Slidell has fallen to SS60,000 due to market conditions Condo Rasp inherited a French Quarter condo in New Orleans from his Uncle BJ after Hurricane Katrina, in January 2007. The fair market value at Uncle BJ's death was $600,000. Rasp lived there by himself until 2015 when he married Holly. After they married, they decided to renovate the condo and borrowed $400,000 at 9% for 20 years to do a first-class job of upgrading the condo. The terms of the loan included interest only for the first two years then amortized over 18 years. They were thinking that they could sell it for over $1,000,000, but they have little knowledge of accounting, finance, or real estate In January 2015, Rasp transferred a % interest in the condo to Holly as a gift. They moved to Slidell, Louisiana in July 2015 Annual Cash Flows and Valuation Information for French Quarter Condo FMV Value Mortgage Insurance Condo Fee Renovation Year Taxes Pmt. 2010 $150,000 0 $6,000 $1,800 $3,000 $2,000 $3,000 2011 $600,000 0 $7,000 2012 S500,000 0 $4,000 $3,000 $8,000 2013 $400,000 0 $5,000 $5,000 $9,000 $10,000 2014 $450,000 0 $8,000 $8,000 2015 $800,000 0 $10,000 $10,000 $11,000 $400,000 2016 $900,000 $10,800 $12,000 $12,000 ** To be calculated 1. Global Portfolio Allocation Scoring System (PASS) for Individual Investors - developed by Dr. William Dotas (Georgetown University) and Steven N Strauss (Dross Strauss Advisors Inc.) - model used with permission 8 Rasp and Holly provided you with the following information about the condo: 1. They believe the appraisal they have for the condo of $900,000 is correct even though nothing is selling. The market has not moved in more than two years 2. They have a firm cash offer of $600,000 to sell the condo now. 3. On a sale they would pay 6% commission 4. They can rent the property for two weeks at Christmas, Sugar Bowl, and New Years for $20,000 gross less a 25% rental fee. 5. They could rent by the week and the realtor told them they could get about 100 rental days a year at $500 per day less a rental fee of 25%. Alternatively, they think they could rent it themselves for S400 per day for 80 days. If they did this, they would plan to use the property about 60 days a year personally. 6. They could rent it out on a year's lease for $4,000 a month less a 10% rental fee. 7. If they rent it out less than a year, they would pay all of the utilities Other Information on the Condo Mortgage - $400,000 at 9% for 18 years beginning January 1, 2017 Tues - $10,800 annually Insurance - $12,000 annually (stays the same if rented) Condo Association Fees - $12,000 annually Utilities - 5300 per month Any depreciation is over 20 years (special go zone rate) on the adjusted taxable basis of $550,000 (land value is zero) The family moved to Slidell, Louisiana, an hour away from the French Quarter, for Rasp's work in July 2015. They continued to use the condo as a vacation home and go there about 20 weekends a year for various festivals and shopping. The condo is up for sale, but the market is soft and it has not sold. Condo Concerns They have heard there are various tax benefits to renting and selling their condo property but are not certain that they know enough to make a decision. They want you to explain a. the cash flow and tax implications of each of their alternatives and help them make a decision as to what they should do with the condo in the French Quarter. They also want to include any refinance alternatives. They are very concerned at the prospect of negative cash flows, thinking that if they do not do something they may be forced into foreclosure or bankruptcy. MORTGAGE MARKET CONDITIONS Current interest rates are 3.5% for 15 years conforming rate mortgages and 4.0% for 30 years conforming rate mortgages. However, borrowers must meet strict 80% loan to value requirements and must meet housing ratios of 28% and all debt ratios of 36% of gross income. EDUCATION The cost of in state college education is $17,000 per year in today's dollars. The Berry's have the five- year old and the three-year old in private school and pay $15,000 per year for the family rate no matter how many children in excess of 2 go to school. Therefore they expect this cost to be with them for the next 17 - 18 years. The Berry's want you to include Blue in any post-secondary or college education analysis because he may use resources equal to or even greater than the other children for his education. RETIREMENT INFORMATION They would like to retire at age 62 with annual income of $200,000 in today's dollars. Their life expectancy is assumed to be to age 95. They expect to earn 8.5% on investments and they expect $50,000 (total for both of them) in today's dollars for Social Security at normal retirement age at age 67. While they have made no contributions to date, they each expect to contribute $18,000 in this next year to their respective 401(k) plans. He has no employer match but her employer match is 4%. INCOME TAX INFORMATION Any small refund ($2,000 - $3,000) will be spent and any small liability ($2,000 - $3,000) will be paid out of cash and cash equivalents. ESTATE INFORMATION The Berry's have no estate plan and no estate documents. 1. Use the attached Berry case as the basis for this comprehensive case. 2. Life Coverage: Based on the capital needs approach, evaluate the adequacy of Rasp's life insurance coverage amount if he were to die today. Make sure to convert the amount of capital needed today to provide the future stream of income to an equivalent present value amount. Is Rasp adequately covered? If not, what are your insurance recommendations? 3. Disability Coverage: A short term or long-term disability due to illness or injury can devastate your financial plans. At a time when you can no longer work for a living, your expenses may actually increase while your income decreases, forcing you to deplete funds that were accumulating for your financial independence in your retirement years. Thus, careful planning should be made to assure that you have adequate coverage in the event of disability. a. Calculate the income needed and the income available when the following two situations occur: (a) if Rasp becomes disabled and (b) if Holly becomes disabled. b. Answer this question: Is there a shortage in their disability coverage? 4. Long-term Care: Calculate the total potential long-term care costs in today's dollars for the Berrys. Factors you should consider in this long-term care analysis include: a. estimation of monthly care cost, b. number of months of care needed, c assumed inflation rate, d. years until long-term care starts, etc. CASE 5 THE BERRY CASE Today is January 1, 2021 INTRODUCTORY DATA THE FAMILY Mr. Berry (65) Mrs. Berry (65) Mr. Bush (65) Mrs. Berry (65) Rasp (36) Holly (36) Blue (5) Cherry (1) Currant (1) Dew (0) Black (3) (adopted by Rasp) (adopted by Rasp) Rasp and Holly Berry are both 36 years old. They married in 2015, and he adopted her two children, Blue and Black. They have three additional children of their own, Cherry, Currant, and Dew. Four of the five children are happy and healthy. Blue is 5 years old, Black is 3 years old, Cherry and Currant are one-year old twins and Dew was just born. Blue has a significant learning disability, but he is still expected to attend and complete college. Both Rasp and Holly's parents are living and 65 years old, and they take care of the children in the aftemoons. Rasp and Holly have no expectations of any inheritance from cither couple. Fortunately, cach set of parents is self-sufficient. The Betors have no child care expenses. Rasp is a regional manager with a hotel chain and makes an annual salary of S180,000 with a bonus of $20,000, Holly is a drug counselor, who makes $50,000 annually. FINANCIAL GOALS & CONCERNS To retire at age 62 with $200,000 in income in today's dollars. To decide what to do with their condo. They are borrified that it will bankrupt them. To make sure they have an adequate insurance portfolio To make sure they have an appropriate investment portfolio for their financial situation To provide college education at the state university for each child for 4 years. They want you to make a detailed cash flow analysis to determine where they are relative to bunkruptcy. . 2 EXTERNAL INFORMATION ECONOMIC INFORMATION . CPI inflation is expected to be 3%. Education inflation is expected to be 5% The economy is expanding slowly BANK LENDING RATES - 15-year conforming annual rate mortgages arc 3.50% 30-year conforming rate mortgages are 4.0%. Any closing costs associated with mortgage refinance are an additional 3% of the amount mortgaged and will be included in the mortgage or paid directly INVESTMENT RETURN EXPECTATIONS The Berry's expected / required rate of return on all investments is 8.5% . Return Cash and Money Market Fund Treasury Bonds /Bond Funds Corporate Bonds /Bond Funds International Bond Funds Index Fund Large Cap Funds/Stocks Mid / Small Funds/Stocks International Stock Funds Real Estate Funds 2.5% 4,0% 6.0% 7.0% 9.0% 10.0% 12.0% 13.0% 8.0% Standard Deviation 20% 40% 5.0% 6.0% 14.0% 16.0% 18.0% 22.0% 120% 3 INTERNAL INFORMATION FINANCIAL STATEMENTS Statement of Financial Position Statement of Financial Position Rasp and Holly Berry Balance Sheet as of 12/31/16 (and 1/1/2017) ASSETS LIABILITIES AND NET WORTH Current Assets Current Liabilities JT Credit Card $1875 JT Cash & Checking $15,000 JT Money Market $25,000 JT Mortgage - Primary Residence $6,631 Total Current Assets $9,328 $40,000 JT Mortgage - Second Home JT Car $3,300 JT Car $3.300 Investment Assets H Retirement Total Current Liabilities $24,434 SO H Non-retirement SO JT Condo Long-Term Liabilities $900.000 JT Credit Card $8,125 JT Mortgage - Principal Residence $533,369 Total Investment Assets $900,000 JT Mortgage - Second Home $390,672 JT Car $15,675 JT Car SI5.675 Personal Use Assets Total Long-Term Liabilities $963,516 JT Principal Residence $500,000 JT Furniture, Clothing $100,000 Total Liabilities $987,950 H Car #1 $20,000 W Car #2 $20.000 Total Personal Use Assets $640.000 Total Net Worth $592,050 Total Assets $1,580.000 Total Liabilities & Net Worth $1.580,000 1. Assets are stated at fair market value. 2. Liabilities are stated at principal only as of December 31, 2016 before January 2017 payments. Title Designations H-Husband (Sole Owner) W Wife (Sole Owner) JT + Joint Tenancy with Survivorship Rights Statement of Income and Expenses Rasp and Holly Berry Statement of Income and Expenses Expected For This Year (2017) Total $180,000 520,000 $50.000 $250,000 $18,000 SI5,000 536,000 $34.934 $8.000 $10,786 53.825 $10,000 $10.800 $78,345 538.SI $44.949 $3.525 $5.600 $93.925 Cash Innows Rasp's Salary Rasp's Bonuses Holly's Salary Total Cash Inflows Cash Outflows Savings Rasp's 401(k) Holly's 401(k) Outside of retirement plan savings Total Savings Tai Rasp's Federal Income Taxes Withheld Holly's Federal Income Taxes Withheld Rasp's Social Security Takes Holly's Social Security Taxes Property Tax - Residence Property Tax-Condo Total Taxes Debt Payments (Principal & Interest) Principal Residence Mortgage Condo Mortgage Payment Credit Cards Auto Payment Total Debt Payments Living Expenses Utilities Principal Residence Gasoline for Autos Lawn Service Entertainment Vacations Church Donations Clothing Auto Maintenance Satellite TV Food Utilities - Condo Private School Education Family Rate Total Living Expenses Insurance Payments Health Insurance HO Insurance Principal Residence HO Insurance - Condo Auto Insurance Premiums Condo Association Fees Total Insurance Payments Total Cash Outflows Net Discretionary Cash Flows (Annual) 56,000 $2,400 $1,800 $9.000 $10,000 $1,800 $5,000 $2.000 $1,200 $8,000 $3,600 $15.000 565,800 59,600 S10,000 $12,000 55.000 517.000 $48.600 3012345 1572.545 5 INSURANCE INFORMATION Life Insurance Rasp has $50,000 of employer provided group-term life insurance policy. Holly is the beneficiary. Holly has $50,000 of employer-provided group term life insurance; Rasp is the beneficiary, Health Insurance They are all covered under Rasp's employer plan, which is a POS plan with co-pays of $25, no deductible in network and a maximum out-of-pocket annual limit of $2,500. The maximum lifetime benefit per person is unlimited. The monthly premium is $800. s Disability Insurance Both, Rasp, and Holly have disability policies provided by their respective employers that provide 65% of gross pay with an elimination period of 90 days. The benefit period is age 65. The policies are guaranteed renewable and define disability for any occupation for which they are educated, trained, or experienced. The policies cover both sickness and accidents Long-Term Care Insurance The Berry's do not have long-term care insurance at this time. Homeowners Insurance Personal Residence- HO 3 phas endorsements A very high quality policy Condo - HO 6 plus endorsements A very high quality policy Automobile Insurance They have 2 cars, both covered by XYZ Auto Insurance for 100/300/50 and uninsured motorist, cash value for property, and $1,000 deductible each. The annual premium is $5,000. PLUP They have no personal liability umbrella policy Special Needs ILIT Trust They want to set up a special needs trust funded with a second-to-dic life insurance policy. The beneficiary of the trust will be Blue. They will find the trust with $12,000 per year until they retire to fund a $1,000,000 permanent insurance policy. INVESTMENT INFORMATION Risk Tolerance Questionnaire Global Portfolio Allocation Scoring System (PASS) for Individual Investors Questions Strongly Agree Neutral Agree Disagree Strongly Disagree RH RH 1. Earning a high long-term total return that will allow my capital to grow faster than the inflation rate is one of my most important investment objectives. 2. I would like an investment that provides me with an opportunity to defer taxation of capital gains to future years. 3. I do not require a high level of current income from my investments RH R H 4. I am willing to tolerate some sharp down swings in the return on my investments in order to seek a potentially higher return than would normally be expected from more stable investments. 5. I am willing to risk a short-term loss in return for a potentially higher long-run rate of return 6. I am financially able to accept a low level of liquidity in my investment portfolio R H RH R-Rap, H-Holly 7 OTHER INFORMATION REGARDING ASSETS AND LIABILITIES Automobiles They purchased new cars at $20,000 each plus $625 of taxes, They pay $6,600 per year with zero interest. They will pay for approximately 6.25 years. Personal Residence They bought the house in Slidell, Louisiana in July 2015 for $600,000 with a 30 year mortgage for $540,000 at 6% with no principal payment until 2017 when they start 30-year payments of $3,237.57 (P & 1) monthly. The value of the house in Slidell has fallen to SS60,000 due to market conditions Condo Rasp inherited a French Quarter condo in New Orleans from his Uncle BJ after Hurricane Katrina, in January 2007. The fair market value at Uncle BJ's death was $600,000. Rasp lived there by himself until 2015 when he married Holly. After they married, they decided to renovate the condo and borrowed $400,000 at 9% for 20 years to do a first-class job of upgrading the condo. The terms of the loan included interest only for the first two years then amortized over 18 years. They were thinking that they could sell it for over $1,000,000, but they have little knowledge of accounting, finance, or real estate In January 2015, Rasp transferred a % interest in the condo to Holly as a gift. They moved to Slidell, Louisiana in July 2015 Annual Cash Flows and Valuation Information for French Quarter Condo FMV Value Mortgage Insurance Condo Fee Renovation Year Taxes Pmt. 2010 $150,000 0 $6,000 $1,800 $3,000 $2,000 $3,000 2011 $600,000 0 $7,000 2012 S500,000 0 $4,000 $3,000 $8,000 2013 $400,000 0 $5,000 $5,000 $9,000 $10,000 2014 $450,000 0 $8,000 $8,000 2015 $800,000 0 $10,000 $10,000 $11,000 $400,000 2016 $900,000 $10,800 $12,000 $12,000 ** To be calculated 1. Global Portfolio Allocation Scoring System (PASS) for Individual Investors - developed by Dr. William Dotas (Georgetown University) and Steven N Strauss (Dross Strauss Advisors Inc.) - model used with permission 8 Rasp and Holly provided you with the following information about the condo: 1. They believe the appraisal they have for the condo of $900,000 is correct even though nothing is selling. The market has not moved in more than two years 2. They have a firm cash offer of $600,000 to sell the condo now. 3. On a sale they would pay 6% commission 4. They can rent the property for two weeks at Christmas, Sugar Bowl, and New Years for $20,000 gross less a 25% rental fee. 5. They could rent by the week and the realtor told them they could get about 100 rental days a year at $500 per day less a rental fee of 25%. Alternatively, they think they could rent it themselves for S400 per day for 80 days. If they did this, they would plan to use the property about 60 days a year personally. 6. They could rent it out on a year's lease for $4,000 a month less a 10% rental fee. 7. If they rent it out less than a year, they would pay all of the utilities Other Information on the Condo Mortgage - $400,000 at 9% for 18 years beginning January 1, 2017 Tues - $10,800 annually Insurance - $12,000 annually (stays the same if rented) Condo Association Fees - $12,000 annually Utilities - 5300 per month Any depreciation is over 20 years (special go zone rate) on the adjusted taxable basis of $550,000 (land value is zero) The family moved to Slidell, Louisiana, an hour away from the French Quarter, for Rasp's work in July 2015. They continued to use the condo as a vacation home and go there about 20 weekends a year for various festivals and shopping. The condo is up for sale, but the market is soft and it has not sold. Condo Concerns They have heard there are various tax benefits to renting and selling their condo property but are not certain that they know enough to make a decision. They want you to explain a. the cash flow and tax implications of each of their alternatives and help them make a decision as to what they should do with the condo in the French Quarter. They also want to include any refinance alternatives. They are very concerned at the prospect of negative cash flows, thinking that if they do not do something they may be forced into foreclosure or bankruptcy. MORTGAGE MARKET CONDITIONS Current interest rates are 3.5% for 15 years conforming rate mortgages and 4.0% for 30 years conforming rate mortgages. However, borrowers must meet strict 80% loan to value requirements and must meet housing ratios of 28% and all debt ratios of 36% of gross income. EDUCATION The cost of in state college education is $17,000 per year in today's dollars. The Berry's have the five- year old and the three-year old in private school and pay $15,000 per year for the family rate no matter how many children in excess of 2 go to school. Therefore they expect this cost to be with them for the next 17 - 18 years. The Berry's want you to include Blue in any post-secondary or college education analysis because he may use resources equal to or even greater than the other children for his education. RETIREMENT INFORMATION They would like to retire at age 62 with annual income of $200,000 in today's dollars. Their life expectancy is assumed to be to age 95. They expect to earn 8.5% on investments and they expect $50,000 (total for both of them) in today's dollars for Social Security at normal retirement age at age 67. While they have made no contributions to date, they each expect to contribute $18,000 in this next year to their respective 401(k) plans. He has no employer match but her employer match is 4%. INCOME TAX INFORMATION Any small refund ($2,000 - $3,000) will be spent and any small liability ($2,000 - $3,000) will be paid out of cash and cash equivalents. ESTATE INFORMATION The Berry's have no estate plan and no estate documents. 1. Use the attached Berry case as the basis for this comprehensive case. 2. Life Coverage: Based on the capital needs approach, evaluate the adequacy of Rasp's life insurance coverage amount if he were to die today. Make sure to convert the amount of capital needed today to provide the future stream of income to an equivalent present value amount. Is Rasp adequately covered? If not, what are your insurance recommendations? 3. Disability Coverage: A short term or long-term disability due to illness or injury can devastate your financial plans. At a time when you can no longer work for a living, your expenses may actually increase while your income decreases, forcing you to deplete funds that were accumulating for your financial independence in your retirement years. Thus, careful planning should be made to assure that you have adequate coverage in the event of disability. a. Calculate the income needed and the income available when the following two situations occur: (a) if Rasp becomes disabled and (b) if Holly becomes disabled. b. Answer this question: Is there a shortage in their disability coverage? 4. Long-term Care: Calculate the total potential long-term care costs in today's dollars for the Berrys. Factors you should consider in this long-term care analysis include: a. estimation of monthly care cost, b. number of months of care needed, c assumed inflation rate, d. years until long-term care starts, etc