Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CASE 50: Capital Planning Consultants Capital budgeting including mutually exclusive alternatives. Includes uncertainties in first cost, annual benefit, and lives. ?What are your Assumptions and

CASE 50: Capital Planning Consultants Capital budgeting including mutually exclusive alternatives. Includes uncertainties in first cost, annual benefit, and lives.

?What are your Assumptions and Recommendations... Explain in Detail?

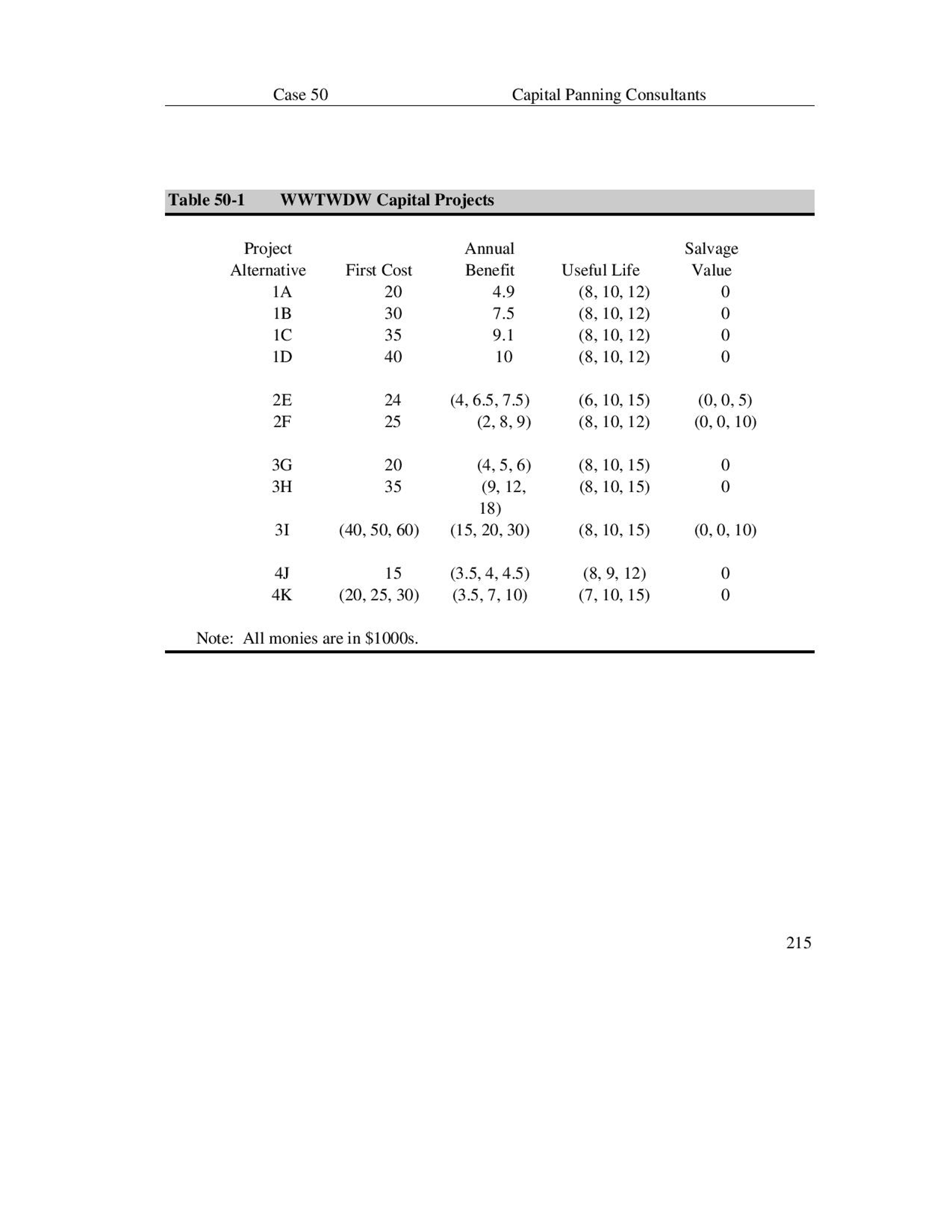

Case 50 Capital Planning Consultants Your consulting firm has been hired to assist WWTWDW (We Wish This Were a Deterministic World) with their capital budgeting. You are to write a brief "technical report" giving the recommended projects, and describing your principal assumptions. What is your evaluation criterion, and why did you make this choice? As some estimates may change before project selection is actually made, discuss which circumstances would force changes in the recommended list and what those changes would be. The analysis used in developing the recommendations should be an appendix to your technical report. 1. The four numbered projects (Table 50-1) may all be done, but the lettered alternatives within each project are mutually exclusive. 2. The minimum attractive rate of return is 15%, but the firm averages a 20% return on its investments. 3. The capital budget, excluding borrowing, is $100,000, and the company may borrow on short notice $10,000 at 18% from an interested venture capitalist. The borrowing rate includes an increase that reflects the Board of Directors' estimate of the cost of increases in bookkeeping expenses and managerial time used.) 4. You may assume that pessimistic estimates have a probability of .25 and that optimistic estimates have a probability of .1 214Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started