Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case 7 : IAS 8 - Accounting Policies, Changes in Accounting Estimates, and Errors Scenario: RetailHub Ltd . has been using the straight - line

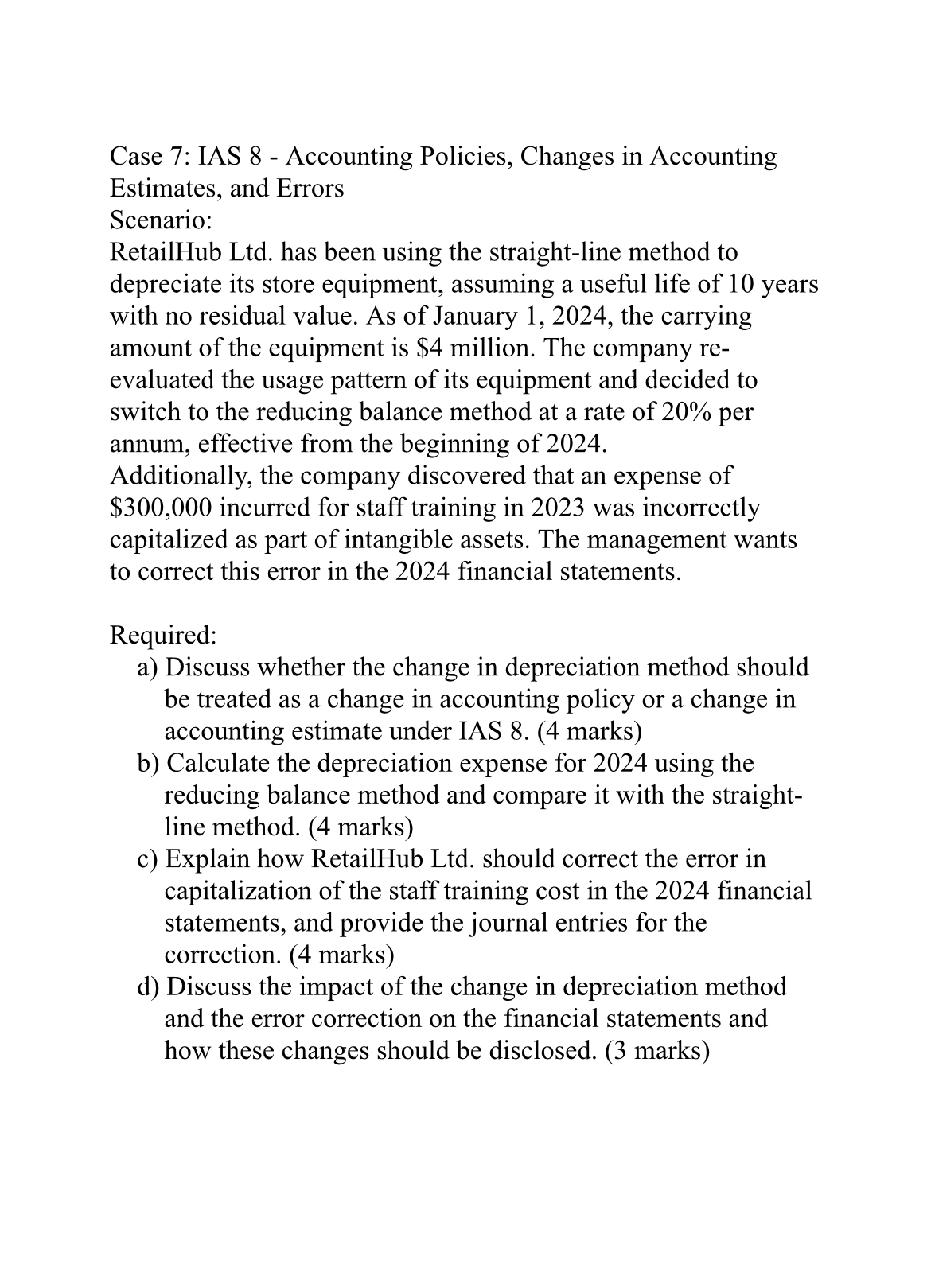

Case : IAS Accounting Policies, Changes in Accounting

Estimates, and Errors

Scenario:

RetailHub Ltd has been using the straightline method to

depreciate its store equipment, assuming a useful life of years

with no residual value. As of January the carrying

amount of the equipment is $ million. The company re

evaluated the usage pattern of its equipment and decided to

switch to the reducing balance method at a rate of per

annum, effective from the beginning of

Additionally, the company discovered that an expense of

$ incurred for staff training in was incorrectly

capitalized as part of intangible assets. The management wants

to correct this error in the financial statements.

Required:

a Discuss whether the change in depreciation method should

be treated as a change in accounting policy or a change in

accounting estimate under IAS marks

b Calculate the depreciation expense for using the

reducing balance method and compare it with the straight

line method. marks

c Explain how RetailHub Ltd should correct the error in

capitalization of the staff training cost in the financial

statements, and provide the journal entries for the

correction. marks

d Discuss the impact of the change in depreciation method

and the error correction on the financial statements and

how these changes should be disclosed. marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started