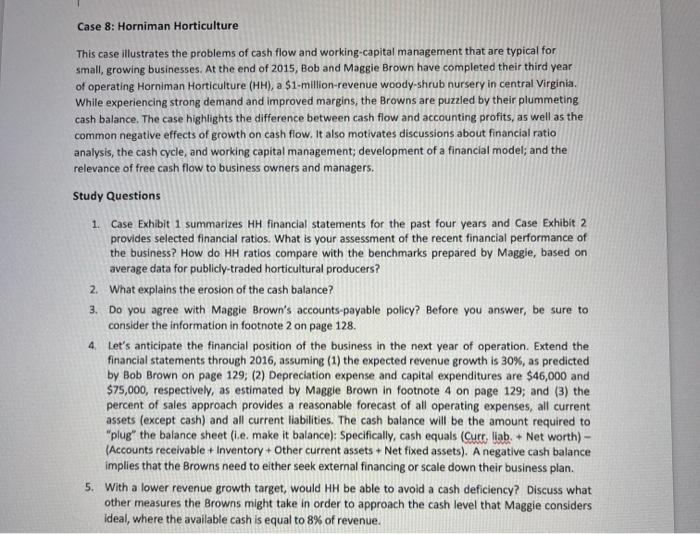

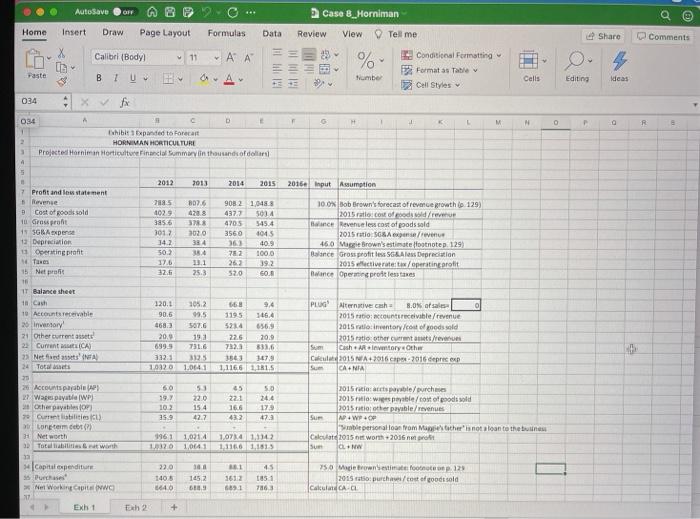

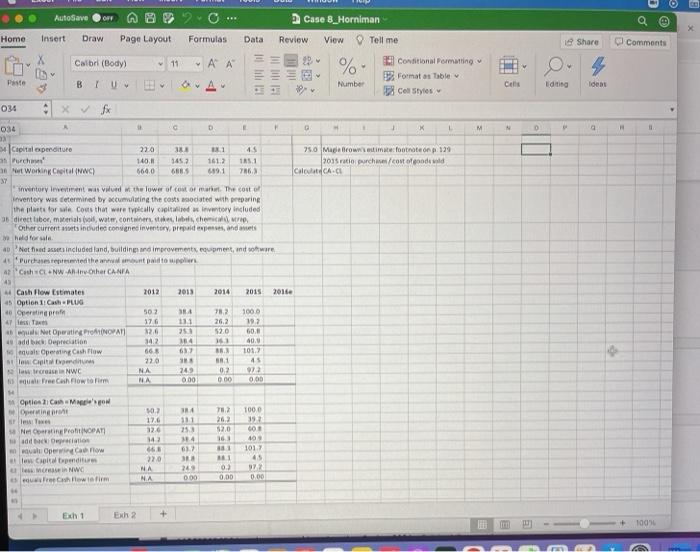

Case 8: Horniman Horticulture This case illustrates the problems of cash flow and working-capital management that are typical for small, growing businesses. At the end of 2015, Bob and Maggie Brown have completed their third year of operating Horniman Horticulture (HH), a $1-million-revenue woody-shrub nursery in central Virginia. While experiencing strong demand and improved margins, the Browns are puzzled by their plummeting cash balance. The case highlights the difference between cash flow and accounting profits, as well as the common negative effects of growth on cash flow. It also motivates discussions about financial ratio analysis, the cash cycle, and working capital management; development of a financial model; and the relevance of free cash flow to business owners and managers. Study Questions 1. Case Exhibit 1 summarizes HH financial statements for the past four years and Case Exhibit 2 provides selected financial ratios. What is your assessment of the recent financial performance of the business? How do HH ratios compare with the benchmarks prepared by Maggie, based on average data for publicly-traded horticultural producers? 2. What explains the erosion of the cash balance? 3. Do you agree with Maggie Brown's accounts payable policy? Before you answer, be sure to consider the information in footnote 2 on page 128. 4. Let's anticipate the financial position of the business in the next year of operation. Extend the financial statements through 2016, assuming (1) the expected revenue growth is 30%, as predicted by Bob Brown on page 129, (2) Depreciation expense and capital expenditures are $46,000 and $75,000, respectively, as estimated by Maggie Brown in footnote 4 on page 129; and (3) the percent of sales approach provides a reasonable forecast of all operating expenses, all current assets (except cash) and all current liabilities. The cash balance will be the amount required to "plug" the balance sheet (e. make it balance): Specifically, cash equals (cut liab. + Net worth) - (Accounts receivable + Inventory + Other current assets. Net fixed assets). A negative cash balance implies that the Browns need to either seek external financing or scale down their business plan. 5. With a lower revenue growth target, would HH be able to avoid a cash deficiency? Discuss what other measures the Browns might take in order to approach the cash level that Maggie considers ideal, where the available cash is equal to 8% of revenue. Autosave OFF Case 8. Horniman Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments Calibrl (Body 11 23 0 Conditional Formatting Formatas Tativ Call Styles 4 Paste B 1 U A Number Cells Editing deas 034 1 M M R 034 Dhibit 1 Expanded to Forecast HORNIMAN HORTICULTURE Projected Marian Horticulture Final Summary in thousands of dollar 4 2012 2013 2014 2015 2016 Input Assumption 302.6 7 Profit and low statement Reverse 3 Cost of goods sold 10 Grouprot 11 SGBA pense 12 Depreciation Operating profit Tan Net profit 28.5 102.9 3856 3017 142 50.2 373 3020 334 14 201 25.3 908 2 1,0483 4377 5014 4705 545.4 3560 1045 361 409 782 1000 262 392 520 60. 10.0Bob Brown's forecast ofrece growth to 129) 2015 ratio cost of rood side Blanc Revenue les cost of goods sold 2015 ratios/venue 46 0 Marie Brown's estimate footnotep. 129) Balance Gross profit des SG&AlessDepreciation 2015 activer/operating oroit Balance Operating process takes 32. IT Balance sheet in Cash 10 Accounts receivable 20 Ingry! 21 Other current assets 2 Current ICA 2) Netfand AFA 24 Total 25 20 Accounts payabi 27 Wapayatlap Other parties 70 Curretti contece Net worth 3 Totalitas tinh 120.1 90.6 4683 20,9 699.5 3321 1932 305.2 99.5 507.6 190 731.6 668 9.4 1195 46.4 5214 22.6 20.9 7323 8336 3.79 1,11651,115 PLUGS Alternative cash NON of sale 2015 rationcounterecevable/revenue 2015 al ventory/cotofoods sold 2015 ratio other currentes revenue Sem Cash Atory Other C3015A+2016 2015 derece CANIA 1.0641 65 60 19. 102 35.9 51 22.0 15 4 42.7 50 244 179 47.3 166 432 2015 ratio acable/ourche 2015 winple/cost of goods sold 2015 ratio other payable revenues Sum N.W.OP personal loan from Mother is not loan to the business Calculate 2015 won 2036 Isum OL NW 1961 112 1,021.4 1,0641 1.071,114 1.1166 1.151 BE 45 capital expenditur Purchase Net Working CHIENWO 27 Exht 22.0 1405 640 10 1452 250 Merweimfoon 128 2015 to purcha/cost of goods sold Calculate CA- 61 7863 Exh2 + AutoSave ORT Case 8_Horniman Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments Calbr (Body) 11 - A A % v Conditional Formatting Format : Table Con Styles Piste OA Number Cels Editing Ideas 034 Xfx 034 G D X M D a 25.0 Mga Browntimate footnoten p. 129 2015 ratio purchase/costofcoded CaoCA. Capital penditure 220 33 11 4.5 Purch 140, 3452 161.2 ut Working Crital (WC) 560.0 6885 6891 7863 inventory invent wanted the lower of cont of met The cost of inventory was determined by accumulating the costs asociated with preparing the parts for sale costs that were typically cold wintry included 35 direct labor, mens water containerste beschermi Other current includes consigned inventory, prepaid expensesinde hefort Net fredats included land, building and improvements, equipment, and we Purchase repented the amount paid to po Cash CL NW An in Other CANTA 4 2012 2013 2014 2015 2016 Cash Flow Estimates 5 Option 1 Cash-PLUG Operating A les Net Operating NOWATI 18 depreciation qual Operating Cash Flow to Capit worse NWC Free Cash Flow to 782 26,2 52.0 11 502 176 12.6 342 665 220 NA NA 34 111 251 14 67 SH 249 000 1000 192 60. 40.4 1017 45 1 02 0.00 000 Option CMO Operine 111 253 184 72 262 52.0 16 North ProPATI to add prition mul Opera w pendium le in NWO Chwefirm 02 17.6 120 142 668 220 NA NA 1000 39 CO3 40 101 45 972 0.00 3 11 03 0.00 000 Echt Exh 2 + 1005 Case 8: Horniman Horticulture This case illustrates the problems of cash flow and working-capital management that are typical for small, growing businesses. At the end of 2015, Bob and Maggie Brown have completed their third year of operating Horniman Horticulture (HH), a $1-million-revenue woody-shrub nursery in central Virginia. While experiencing strong demand and improved margins, the Browns are puzzled by their plummeting cash balance. The case highlights the difference between cash flow and accounting profits, as well as the common negative effects of growth on cash flow. It also motivates discussions about financial ratio analysis, the cash cycle, and working capital management; development of a financial model; and the relevance of free cash flow to business owners and managers. Study Questions 1. Case Exhibit 1 summarizes HH financial statements for the past four years and Case Exhibit 2 provides selected financial ratios. What is your assessment of the recent financial performance of the business? How do HH ratios compare with the benchmarks prepared by Maggie, based on average data for publicly-traded horticultural producers? 2. What explains the erosion of the cash balance? 3. Do you agree with Maggie Brown's accounts payable policy? Before you answer, be sure to consider the information in footnote 2 on page 128. 4. Let's anticipate the financial position of the business in the next year of operation. Extend the financial statements through 2016, assuming (1) the expected revenue growth is 30%, as predicted by Bob Brown on page 129, (2) Depreciation expense and capital expenditures are $46,000 and $75,000, respectively, as estimated by Maggie Brown in footnote 4 on page 129; and (3) the percent of sales approach provides a reasonable forecast of all operating expenses, all current assets (except cash) and all current liabilities. The cash balance will be the amount required to "plug" the balance sheet (e. make it balance): Specifically, cash equals (cut liab. + Net worth) - (Accounts receivable + Inventory + Other current assets. Net fixed assets). A negative cash balance implies that the Browns need to either seek external financing or scale down their business plan. 5. With a lower revenue growth target, would HH be able to avoid a cash deficiency? Discuss what other measures the Browns might take in order to approach the cash level that Maggie considers ideal, where the available cash is equal to 8% of revenue. Autosave OFF Case 8. Horniman Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments Calibrl (Body 11 23 0 Conditional Formatting Formatas Tativ Call Styles 4 Paste B 1 U A Number Cells Editing deas 034 1 M M R 034 Dhibit 1 Expanded to Forecast HORNIMAN HORTICULTURE Projected Marian Horticulture Final Summary in thousands of dollar 4 2012 2013 2014 2015 2016 Input Assumption 302.6 7 Profit and low statement Reverse 3 Cost of goods sold 10 Grouprot 11 SGBA pense 12 Depreciation Operating profit Tan Net profit 28.5 102.9 3856 3017 142 50.2 373 3020 334 14 201 25.3 908 2 1,0483 4377 5014 4705 545.4 3560 1045 361 409 782 1000 262 392 520 60. 10.0Bob Brown's forecast ofrece growth to 129) 2015 ratio cost of rood side Blanc Revenue les cost of goods sold 2015 ratios/venue 46 0 Marie Brown's estimate footnotep. 129) Balance Gross profit des SG&AlessDepreciation 2015 activer/operating oroit Balance Operating process takes 32. IT Balance sheet in Cash 10 Accounts receivable 20 Ingry! 21 Other current assets 2 Current ICA 2) Netfand AFA 24 Total 25 20 Accounts payabi 27 Wapayatlap Other parties 70 Curretti contece Net worth 3 Totalitas tinh 120.1 90.6 4683 20,9 699.5 3321 1932 305.2 99.5 507.6 190 731.6 668 9.4 1195 46.4 5214 22.6 20.9 7323 8336 3.79 1,11651,115 PLUGS Alternative cash NON of sale 2015 rationcounterecevable/revenue 2015 al ventory/cotofoods sold 2015 ratio other currentes revenue Sem Cash Atory Other C3015A+2016 2015 derece CANIA 1.0641 65 60 19. 102 35.9 51 22.0 15 4 42.7 50 244 179 47.3 166 432 2015 ratio acable/ourche 2015 winple/cost of goods sold 2015 ratio other payable revenues Sum N.W.OP personal loan from Mother is not loan to the business Calculate 2015 won 2036 Isum OL NW 1961 112 1,021.4 1,0641 1.071,114 1.1166 1.151 BE 45 capital expenditur Purchase Net Working CHIENWO 27 Exht 22.0 1405 640 10 1452 250 Merweimfoon 128 2015 to purcha/cost of goods sold Calculate CA- 61 7863 Exh2 + AutoSave ORT Case 8_Horniman Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments Calbr (Body) 11 - A A % v Conditional Formatting Format : Table Con Styles Piste OA Number Cels Editing Ideas 034 Xfx 034 G D X M D a 25.0 Mga Browntimate footnoten p. 129 2015 ratio purchase/costofcoded CaoCA. Capital penditure 220 33 11 4.5 Purch 140, 3452 161.2 ut Working Crital (WC) 560.0 6885 6891 7863 inventory invent wanted the lower of cont of met The cost of inventory was determined by accumulating the costs asociated with preparing the parts for sale costs that were typically cold wintry included 35 direct labor, mens water containerste beschermi Other current includes consigned inventory, prepaid expensesinde hefort Net fredats included land, building and improvements, equipment, and we Purchase repented the amount paid to po Cash CL NW An in Other CANTA 4 2012 2013 2014 2015 2016 Cash Flow Estimates 5 Option 1 Cash-PLUG Operating A les Net Operating NOWATI 18 depreciation qual Operating Cash Flow to Capit worse NWC Free Cash Flow to 782 26,2 52.0 11 502 176 12.6 342 665 220 NA NA 34 111 251 14 67 SH 249 000 1000 192 60. 40.4 1017 45 1 02 0.00 000 Option CMO Operine 111 253 184 72 262 52.0 16 North ProPATI to add prition mul Opera w pendium le in NWO Chwefirm 02 17.6 120 142 668 220 NA NA 1000 39 CO3 40 101 45 972 0.00 3 11 03 0.00 000 Echt Exh 2 + 1005