Answered step by step

Verified Expert Solution

Question

1 Approved Answer

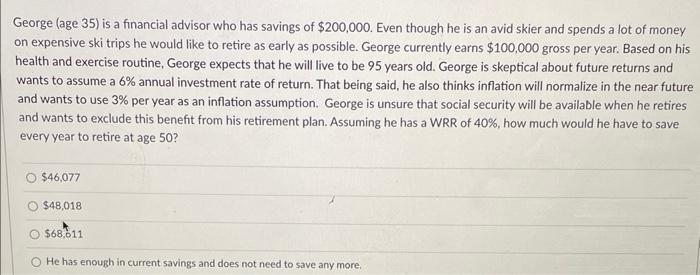

George (age 35) is a financial advisor who has savings of $200,000. Even though he is an avid skier and spends a lot of

George (age 35) is a financial advisor who has savings of $200,000. Even though he is an avid skier and spends a lot of money on expensive ski trips he would like to retire as early as possible. George currently earns $100,000 gross per year. Based on his health and exercise routine, George expects that he will live to be 95 years old. George is skeptical about future returns and wants to assume a 6% annual investment rate of return. That being said, he also thinks inflation will normalize in the near future and wants to use 3% per year as an inflation assumption. George is unsure that social security will be available when he retires and wants to exclude this benefit from his retirement plan. Assuming he has a WRR of 40%, how much would he have to save every year to retire at age 50? $46,077 $48,018 $68,011 He has enough in current savings and does not need to save any more.

Step by Step Solution

★★★★★

3.25 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started