Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case A - You have decided to start planning for your retirement. You already have $11,000 in your investment account. You plan to put

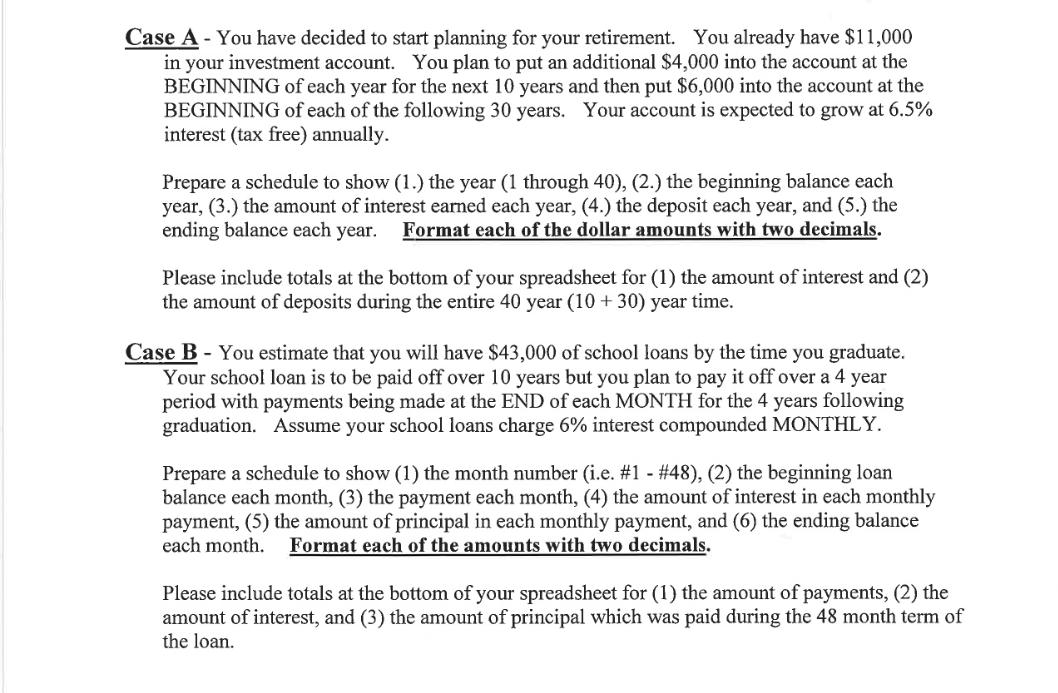

Case A - You have decided to start planning for your retirement. You already have $11,000 in your investment account. You plan to put an additional $4,000 into the account at the BEGINNING of each year for the next 10 years and then put $6,000 into the account at the BEGINNING of each of the following 30 years. Your account is expected to grow at 6.5% interest (tax free) annually. Prepare a schedule to show (1.) the year (1 through 40), (2.) the beginning balance each year, (3.) the amount of interest earned each year, (4.) the deposit each year, and (5.) the ending balance each year. Format each of the dollar amounts with two decimals. Please include totals at the bottom of your spreadsheet for (1) the amount of interest and (2) the amount of deposits during the entire 40 year (10 + 30) year time. Case B-You estimate that you will have $43,000 of school loans by the time you graduate. Your school loan is to be paid off over 10 years but you plan to pay it off over a 4 year period with payments being made at the END of each MONTH for the 4 years following graduation. Assume your school loans charge 6% interest compounded MONTHLY. Prepare a schedule to show (1) the month number (i.e. #1 - #48), (2) the beginning loan balance each month, (3) the payment each month, (4) the amount of interest in each monthly payment, (5) the amount of principal in each monthly payment, and (6) the ending balance each month. Format each of the amounts with two decimals. Please include totals at the bottom of your spreadsheet for (1) the amount of payments, (2) the amount of interest, and (3) the amount of principal which was paid during the 48 month term of the loan.

Step by Step Solution

★★★★★

3.42 Rating (174 Votes )

There are 3 Steps involved in it

Step: 1

CASEA Here I have considered interest is reinvested in such account Please go through the table below SL NO YEAR Opening balance AMOUNT INTEREST 65 TOTAL 1 1 1100000 400000 97500 1597500 2 2 1597500 4...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started