Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case: Amtrak has following financing options: Here are the exhibits mentioned in the above case: Question: a) What are the pros and cons of each

Case:

Amtrak has following financing options:

Here are the exhibits mentioned in the above case:

Question:

a) What are the pros and cons of each of the three financing alternatives given in the case?

b) Which alternative did you choose? Why? Provide qualitative support for your answer.

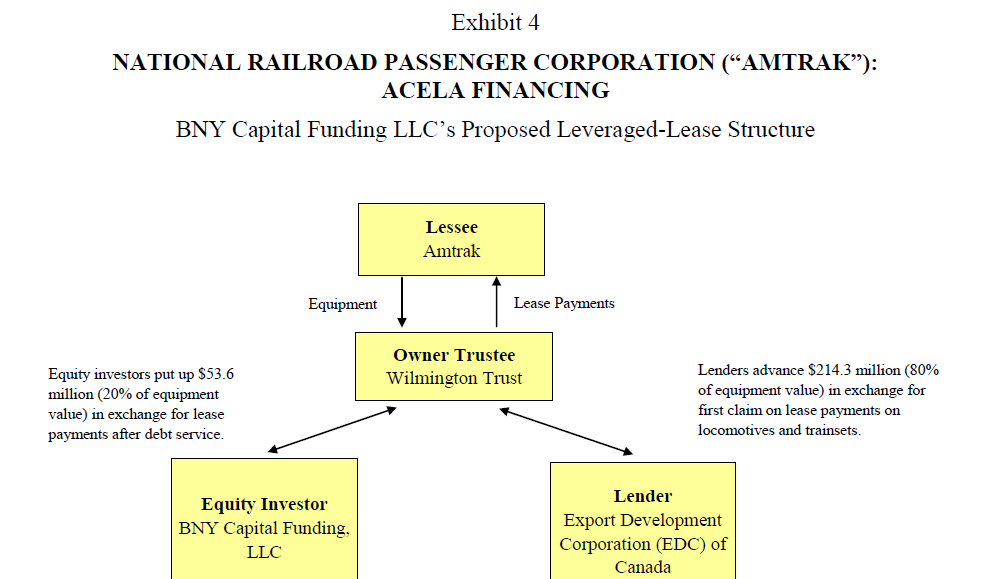

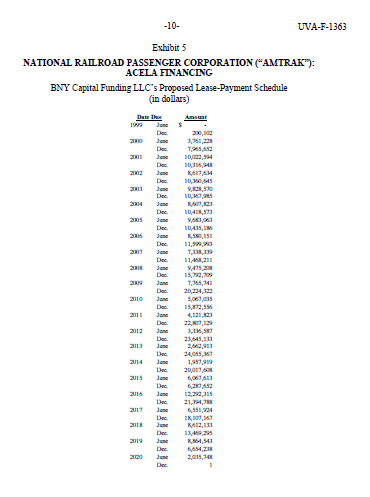

Financing Options Three options were available for Amtrak to gain use of the equipment: (1) borrow money to fund the purchase, (2) lease the equipment from a financial institution such as BNYCF, or (3) rely on federal sources for funding. Borrow and buy A major bank had offered to underwrite a bond issuance for Amtrak with a 20-year term at 6.75% per annum. This arrangement would call for Amtrak to make semiannual payments of $12.303 million, beginning in December 1999. The locomotives and train sets would serve as collateral for the loan. A member of the Treasury staff suggested that one drawback to this alternative was that Amtrak had recently issued debtas such, the public market might already be saturated with Amtrak paper. Lease BNYCF had proposed a leveraged-lease structure for the transaction (Exhibit 4). BNY Capital Funding LLC, a wholly owned subsidiary of the Bank of New York, would act as lessor. It would provide the equity funds needed to finance the purchase. The Export Development Corporation (EDC) of Canada would be the sole lender and debt provider, agreeing to provide 80% of the required funds. The equity investor, BNYCF, would provide the remaining 20% and would receive lease payments only after the debtor had been paid. The equity and debt funds on closing would flow through Wilmington Trust, an independent third party to the transaction that acted as owner-trustee. The rental payments would also flow through Wilmington Trust, which would distribute the payments to either EDC or BNYCF. Under the lease proposal, Amtrak would have to make semiannual payments according to the schedule provided in Exhibit 5. At the end of the lease term, Amtrak could buy the equipment from BNYCF at the higher of terminal or fair market value.10 Amtrak also had an early-buyout option, whereby it could acquire the equipment from BNYCF in 2017 for $126.6 million. Rely on federal sources Theoretically, Amtrak could use federal monies to fund the Acela equipment purchases. Although Congress had mandated that Amtrak could not use federal subsidies for operating expenses, it had agreed to continue funding Amtrak for capital appropriations. Purchase of the Acela equipment would be considered a capital-asset acquisition and, as such, federal grant monies could be used. But Friner and her staff considered federal grants to be a premium and precious commodity; thus, Amtrak preferred to use the grant money to fund capital projects that could not be easily and cost-effectively financed, such as safety, right-of-way and infrastructure- related projects, and major overhauls. Acela train sets and other rolling stock, however, could be very efficiently financed through the capital markets. Exhibit 4 NATIONAL RAILROAD PASSENGER CORPORATION (AMTRAK): ACELA FINANCING BNY Capital Funding LLC's Proposed Leveraged-Lease Structure Lessee Amtrak Equipment Lease Payments Owner Trustee Wilmington Trust Equity investors put up $53.6 million (20% of equipment value) in exchange for lease payments after debt service. Lenders advance $214.3 million (80% of equipment value) in exchange for first claim on lease payments on locomotives and trainsets. Equity Investor BNY Capital Funding, LLC Lender Export Development Corporation (EDC) of Canada -10- UVA-F-1363 Exhibits NATIONAL RAILROAD PASSENGER CORPORATION ("AMTRAK"): ACELA FINANCING BNY Capital Funding LLC's Proposed Lease-Payment Schedule in dollars) Amunt 20 10 10. 7. her Dec. RA June 417 Dec. we 10.45 Dec 9,108,50 JR. 10418,90 an SARIO 10,485, IM 2014 205 26 2009 2005 2013 11,999,90 1. 1146.211 9,439,20 7,365,341 Dec 20,224,22 her Dec. Seans . Dec 3,036,50 Dec. 25,845,11 June 2009 1,999 Dec 2017 Je 6,00 Dec 12,280,35 21.7. 6.551,304 1,100,160 412,13 Dec 14,543 1,23 2,045,745 Dec 2014 2015 SA 2016 2017 2018 13.10.20 2019Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started