Case Analysis :Eastman Kodak

Use the following questions to guide your write-up.You don't have to answer them one-by-one in the submission.Rather, use them to guide your thought.For the submission follow the generic case analysis template:

1) Problem Identification

2) Discussion of context & Identify alternatives

3) Evaluate alternatives using concrete marketing concepts from class

4) Provide recommendation

Use the following questions as guidance for recommendation.You don't have to answer them one by one for your submission - rather, use them as guideposts for your analysis and discussion.

As part of the Kodak case, you are required to assess the product planning options that Kodak should pursue to overcome its market share loss problems. Underlying this launch is a segmentation plan based on the type of film user. You should be able to draw on our session on segmentation to integrate the concepts.

With the reorientation of Royal Gold and the potential launch of Funtime, Kodak is trying to form a vertical product line extension - i.e., offerings vary on price/quality tradeoff.

1) Is Kodak headed in the right direction with product proliferation?

2) What will Fuji's reaction be to such a launch?

3) What will be the impact on Kodak if the plan were to be implemented?

4) If a price cut on the flagship brand is an alternative, try to assess the impact of such a cut on Kodak's margins and subsequent bump in sales needed to offset this.

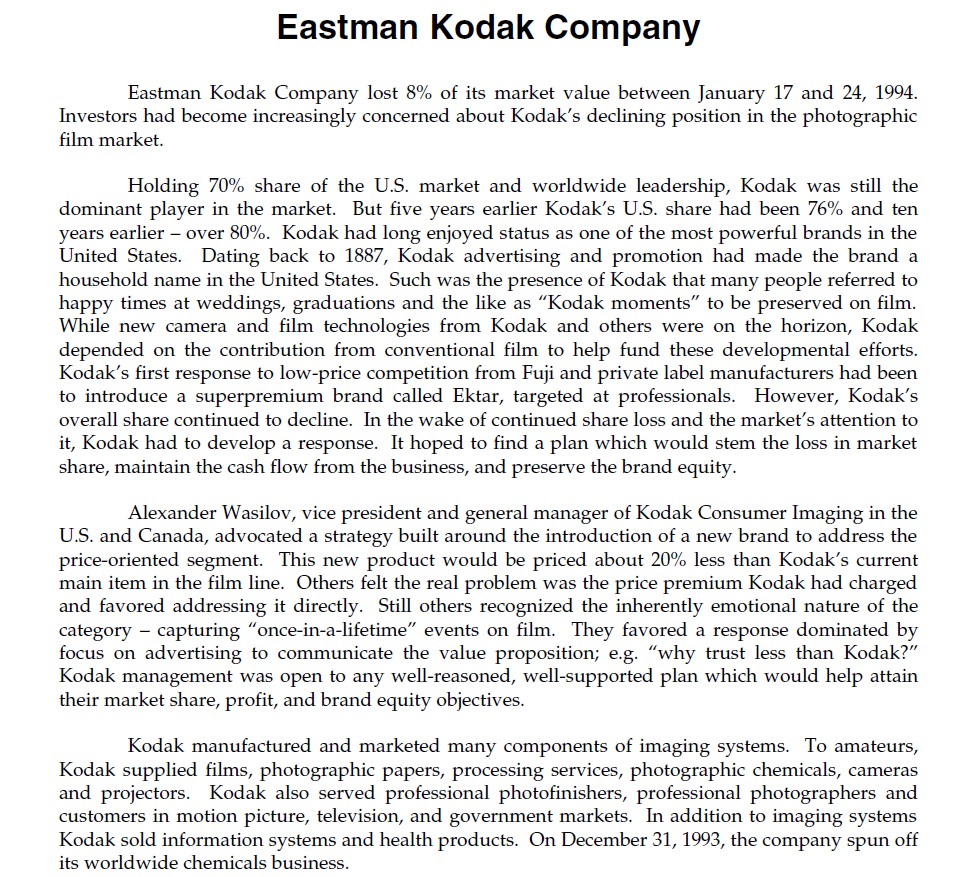

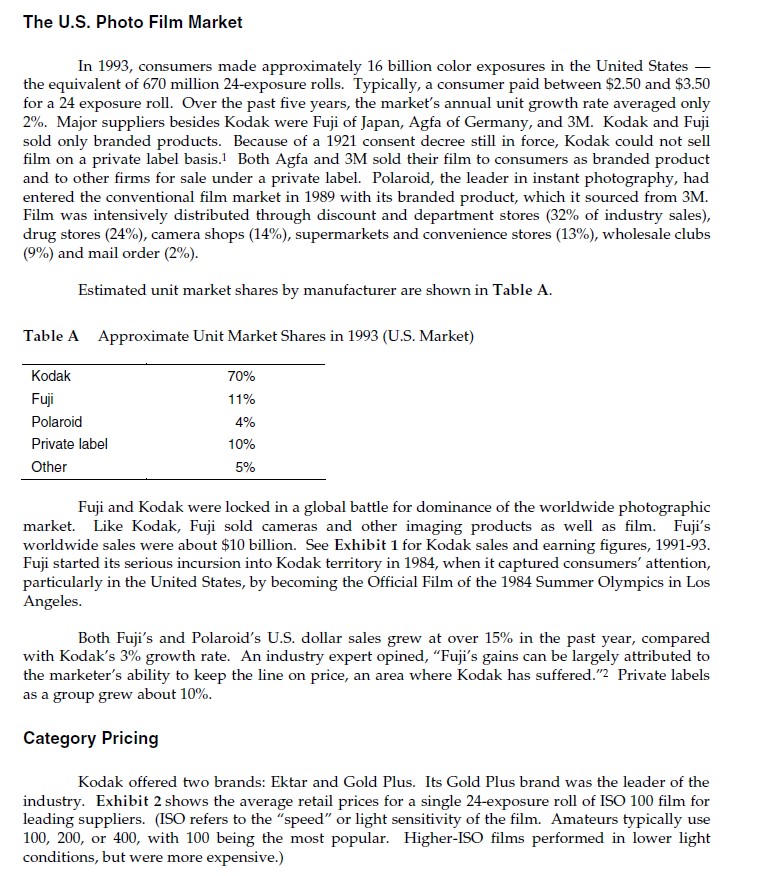

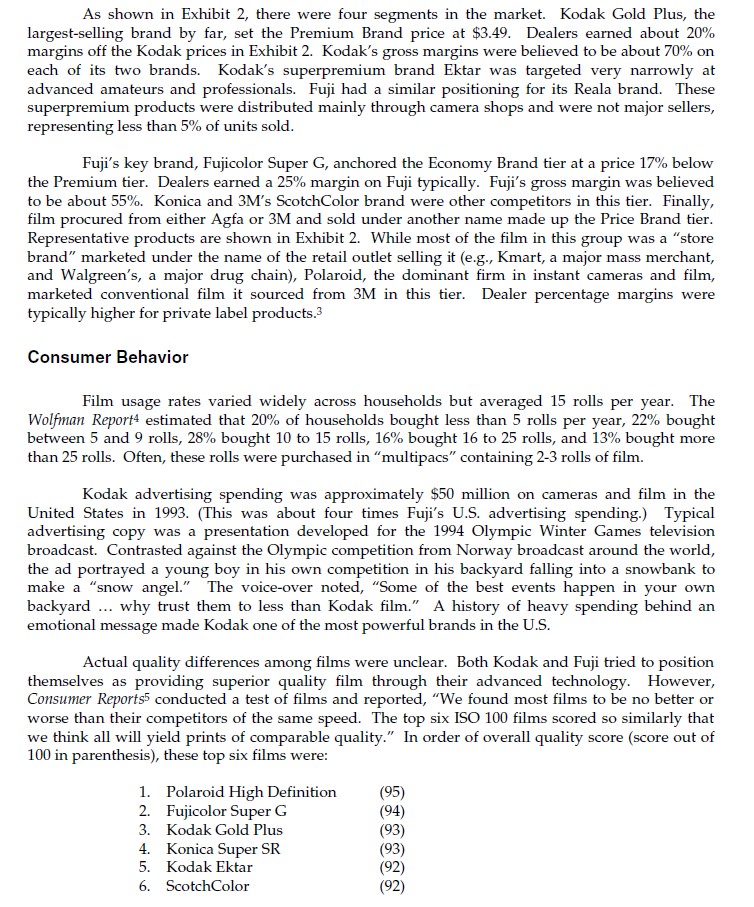

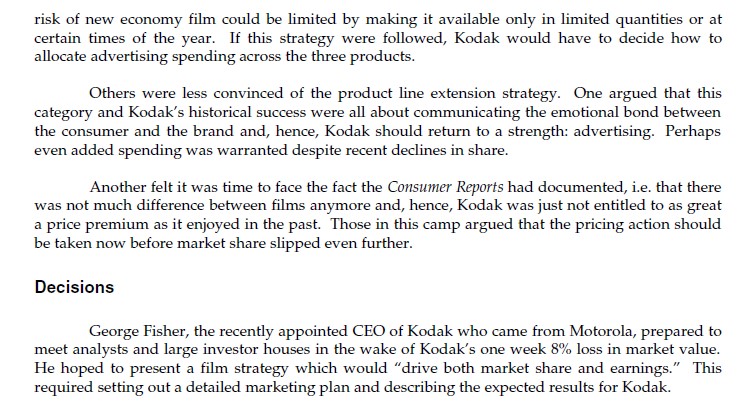

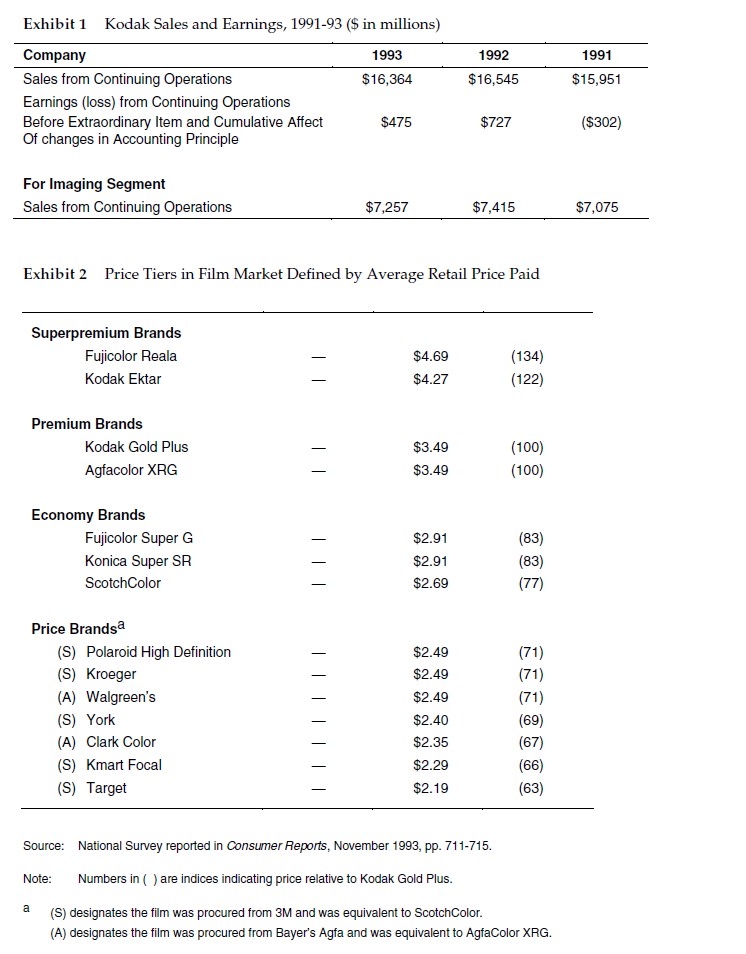

Eastman Kodak Company Eastman Kodak Company lost 3% of its market value between January 17 and 24, 1994. Investors had become increasingly concerned about Kodak's declining position in the photographic lm market. Holding 70% share of the US. market and worldwide leadership, Kodak was still the dominant player in the market. But ve years earlier Kodak's U.S. share had been 76% and ten years earlier - over 80%. Kodak had long enjoyed status as one of the most powerful brands in the United States. Dating back to 1837, Kodak advertising and promotion had made the brand a household name in the United States. Such was the presence of Kodak that many people referred to happy times at weddings, graduations and the like as "Kodak moments\" to be preserved on lm. While new camera and lm technologies from Kodak and others were on the horizon, Kodak depended on the contribution from conventional film to help fund these developmental efforts. Kodak's rst response to low-price competition from Fuji and private label manufacturers had been to introduce a superpremium brand called Ektar, targeted at professionals. However, Kodak's overall share continued to decline. In the wake of continued share loss and the market's attention to it, Kodak had to develop a response. It hoped to find a plan which would stem the loss in market share, maintain the cash ow from the business, and preserve the brand equity. Alexander Wasilov, vice president and general manager of Kodak Consumer Imaging in the US. and Canada, advocated a strategy built around the introduction of a new brand to address the price-oriented segment. This new product would be priced about 20% less than Kodak's current main item in the film line. Others felt the real problem was the price premium Kodak had charged and favored addressing it directly. Still others recognized the inherently emotional nature of the category capturing \"once-in-a-lifetime\" events on lm. They favored a response dominated by focus on advertising to communicate the value proposition; e.g. "why trust less than Kodak?" Kodak management was open to any well-reasoned, well-supported plan which would help attain their market share, prot, and brand equity objectives. Kodak manufactured and marketed many components of imaging systems. To amateurs, Kodak supplied lms, photographic papers, processing services, photographic chemicals, cameras and projectors. Kodak also served professional photonishers, professional photographers and customers in motion picture, television, and government markets. In addition to imaging systems Kodak sold information systems and health products. On December 31, 1993, the company spun off its worldwide chemicals business. The U.S. Photo Film Market In 1993, consumers made approximately 16 billion color exposures in the United States the equivalent of 670 million 24-exposure rolls. Typically, a consumer paid between $2.50 and $3.50 for a 24 exposure roll. Over the past five years, the market's annual unit growth rate averaged only 2%. Major suppliers besides Kodak were Fuji of Japan, Agfa of Germany, and 3M. Kodak and Fuji sold only branded products. Because of a 1921 consent decree still in force, Kodak could not sell film on a private label basis. Both Agfa and 3M sold their film to consumers as branded product and to other firms for sale under a private label. Polaroid, the leader in instant photography, had entered the conventional film market in 1989 with its branded product, which it sourced from 3M. Film was intensively distributed through discount and department stores (32% of industry sales), drug stores (24%), camera shops (14%), supermarkets and convenience stores (13%), wholesale clubs (9%) and mail order (2%). Estimated unit market shares by manufacturer are shown in Table A. Table A Approximate Unit Market Shares in 1993 (U.S. Market) Kodak 70% Fuji 11% Polaroid 4% Private label 10% Other 5% Fuji and Kodak were locked in a global battle for dominance of the worldwide photographic market. Like Kodak, Fuji sold cameras and other imaging products as well as film. Fuji's worldwide sales were about $10 billion. See Exhibit 1 for Kodak sales and earning figures, 1991-93. Fuji started its serious incursion into Kodak territory in 1984, when it captured consumers' attention, particularly in the United States, by becoming the Official Film of the 1984 Summer Olympics in Los Angeles. Both Fuji's and Polaroid's U.S. dollar sales grew at over 15% in the past year, compared with Kodak's 3% growth rate. An industry expert opined, "Fuji's gains can be largely attributed to the marketer's ability to keep the line on price, an area where Kodak has suffered."2 Private labels as a group grew about 10%. Category Pricing Kodak offered two brands: Ektar and Gold Plus. Its Gold Plus brand was the leader of the industry. Exhibit 2 shows the average retail prices for a single 24-exposure roll of ISO 100 film for leading suppliers. (ISO refers to the "speed" or light sensitivity of the film. Amateurs typically use 100, 200, or 400, with 100 being the most popular. Higher-ISO films performed in lower light conditions, but were more expensive.)As shown in Exhibit 2, there were four segments in the market. Kodak Gold Plus, the largest-selling brand by far, set the Premium Brand price at $3.49. Dealers earned about 20% margins off the Kodak prices in Exhibit 2. Kodak's gross margins were believed to be about 70% on each of its two brands. Kodak's superpremium brand Ektar was targeted very narrowly at advanced amateurs and professionals. Fuji had a similar positioning for its Reala brand. These superpremium products were distributed mainly through camera shops and were not major sellers, representing less than 5% of units sold. Fuji's key brand, Fujicolor Super G, anchored the Economy Brand tier at a price 17% below the Premium tier. Dealers earned a 25% margin on Fuji typically. Fuji's gross margin was believed to be about 55%. Konica and 3M's ScotchColor brand were other competitors in this tier. Finally, film procured from either Agfa or 3M and sold under another name made up the Price Brand tier. Representative products are shown in Exhibit 2. While most of the film in this group was a "store brand" marketed under the name of the retail outlet selling it (e.g., Kmart, a major mass merchant, and Walgreen's, a major drug chain), Polaroid, the dominant firm in instant cameras and film, marketed conventional film it sourced from 3M in this tier. Dealer percentage margins were typically higher for private label products.3 Consumer Behavior Film usage rates varied widely across households but averaged 15 rolls per year. The Wolfman Report estimated that 20% of households bought less than 5 rolls per year, 22% bought between 5 and 9 rolls, 28% bought 10 to 15 rolls, 16% bought 16 to 25 rolls, and 13% bought more than 25 rolls. Often, these rolls were purchased in "multipacs" containing 2-3 rolls of film. Kodak advertising spending was approximately $50 million on cameras and film in the United States in 1993. (This was about four times Fuji's U.S. advertising spending.) Typical advertising copy was a presentation developed for the 1994 Olympic Winter Games television broadcast. Contrasted against the Olympic competition from Norway broadcast around the world, the ad portrayed a young boy in his own competition in his backyard falling into a snowbank to make a "snow angel." The voice-over noted, "Some of the best events happen in your own backyard ... why trust them to less than Kodak film." A history of heavy spending behind an emotional message made Kodak one of the most powerful brands in the U.S. Actual quality differences among films were unclear. Both Kodak and Fuji tried to position themselves as providing superior quality film through their advanced technology. However, Consumer Reports conducted a test of films and reported, "We found most films to be no better or worse than their competitors of the same speed. The top six ISO 100 films scored so similarly that we think all will yield prints of comparable quality." In order of overall quality score (score out of 100 in parenthesis), these top six films were: 1. Polaroid High Definition (95) 2. Fujicolor Super G (94) 3. Kodak Gold Plus (93) 4. (93) 5 . Konica Super SR Kodak Ektar (92) 6. ScotchColor (92)ScotchColor was also sold as private label from Kmart, Kroeger, Target, and York, among others as shown in Exhibit 2. Fuji Superpremium brand Reala had a score of 90, and Agfaoolor KEG scored 88. Consumer Reports regarded score differenoes of less than 5 points as "not signicant." According to a 1991 survey cited in Dismunt Merchandiser, more than half of the picture takers in the United States claim to know "little or nothing about photography.\"6 As a result the article claimed, "Consumers tend to view lm as a commodity, often buying on price alone."r Neither top player accepted the judgment that price was key however. A Fuji spokesperson noted that if price were the deciding factor, private label would be a stronger seller. ]irn Van Senus, Kodak's Inanager of general merchandise lnarketing said: "The importance of brand name in consumer decision making is still strong. On the other hand, there is a growing body of price' sensitive consumers there. We are seeing growth in private label lm activity." Kodak research had shown that 50% of buyers were "Kodakloyal," 40% were "samplers" switching between brands but relying heavily on Kodak, and 10% shopped on price. Strategic Alternatives One proposal was for a major repositioning of Kodak's lm product line, expanding the number of offerings to three: 1. Gold Pluswould renlain the agship brand at a price unchanged from 1993 levels. 2. Royal Goldthe Ektar product would be renamed Royal Gold, in the Superpremium segment. Whereas Ektar had been targeted to professionals and serious amateurs, Royal Gold would be targeted to a consumer audience for "very special\" occasions. Offering richer color saturation and sharper pictures than Gold Plus, it would be positioned as especially appropriate for those occasions when the consumer may wish to make enlargements. It would be priced lower than Ektar had been, selling to the trade at only a 9% premium over Gold Plus. Cooperative advertising allowances were to be offered to the trade to provide the incentive to maintain Royal Gold remit prices at 2W9 above Gold Plus, thereby offering superior trade Jnargjns? 3. A new brand would be introduced to give Kodak a presenoe in the Economy Brand Tier, at a price approximately 20% below Gold Plus on a per roll basis. One proposal was to call the new brand \"Funtime\" and position it as being "For Casual Picture Taking.\" The Inanufacturing cost for this product would be about the same as for the current Gold Plus product. Alexander WEISDV advocated this strategy as: "intelligent risk taking that will drive both our market share and earnings.\" He described it as a way to target customer segments more precisely, with Royal Gold for \"very special moments\" and Gold for "those unexpected ntoments the baby smiling, the father and son playing catch.\" The risk of new economy lm could be limited by making it available only in limited quantities or at certain times of the year. If this strategy were followed, Kodak would have to decide how to allocate advertising spending across the three products. Others were less convinced of the product line extension strategy. One argued that this category and Kodak's historical success were all about communicating the emotional bond between the consumer and the brand and, hence, Kodak should return to a strength: advertising. Perhaps even added spending was warranted despite recent declines in share. Another felt it was time to face the fact the Cmmer Reports had documented, i.e. that there was not much difference between films anymore and, hence, Kodak was just not entitled to as great a price premium as it enjoyed in the past. Those in this camp argued that the pricing action should be taken now before market share slipped even further. Decisions George Fisher, the recently appointed CEO of Kodak who came from Motorola, prepared to meet analysts and large investor houses in the wake of Kodak's one week 3% loss in market value. He hoped to present a lm strategy which would "drive both market share and earnings.\"r This required setting out a detailed marketing plan and describing the expected results for Kodak. Exhibit 1 Kodak Sales and Earnings, 1991-93 ($ in millions) Company 199: 1992 1991 Sales from Continuing Operations $16,364 $16,545 $15,951 Earnings (loss) from Continuing Operations Before Extraordinary Item and Cumulative Affect $475 $727 ($302) Of changes in Accounting Principle For Imaging Segment Sales from Continuing Operations $7,257 $7,415 $7,075 Exhibit 2 Price Tiers in Film Market Defined by Average Retail Price Paid Superpremium Brands Fujicolor Reala Kodak Ektar 1 1 $4.69 (134) $4.27 (122) Premium Brands Kodak Gold Plus $3.49 (100) Agfacolor XRG $3.49 (100) Economy Brands Fujicolor Super G $2.91 (83) Konica Super SR $2.91 (83) ScotchColor $2.69 (77) Price Brandsa (S) Polaroid High Definition $2.49 (71) (S) Kroeger $2.49 (71) (A) Walgreen's $2.49 (71 ) (S) York $2.40 (69) (A) Clark Color $2.35 (67) (S) Kmart Focal $2.29 (66) (S) Target $2.19 (63) Source: National Survey reported in Consumer Reports, November 1993, pp. 711-715. Note: Numbers in ( ) are indices indicating price relative to Kodak Gold Plus. a (S) designates the film was procured from 3M and was equivalent to ScotchColor. (A) designates the film was procured from Bayer's Agfa and was equivalent to AgfaColor XRG