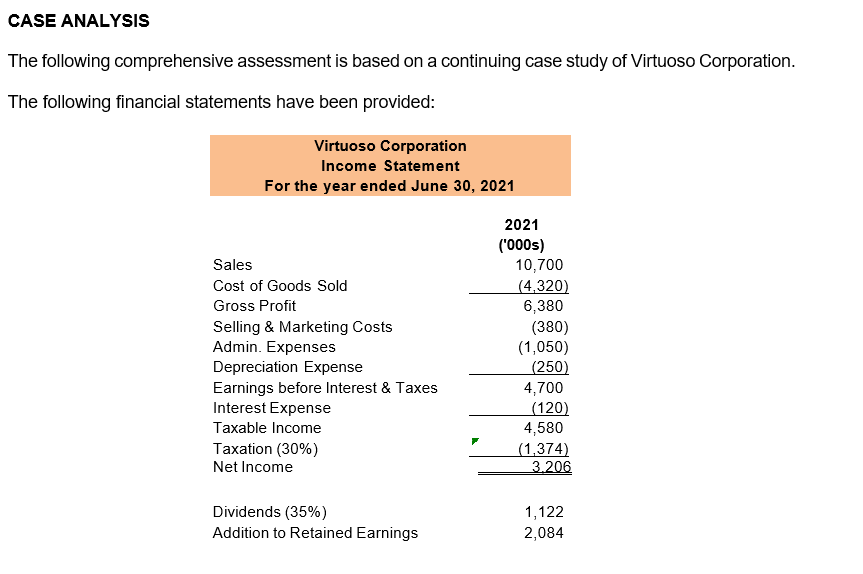

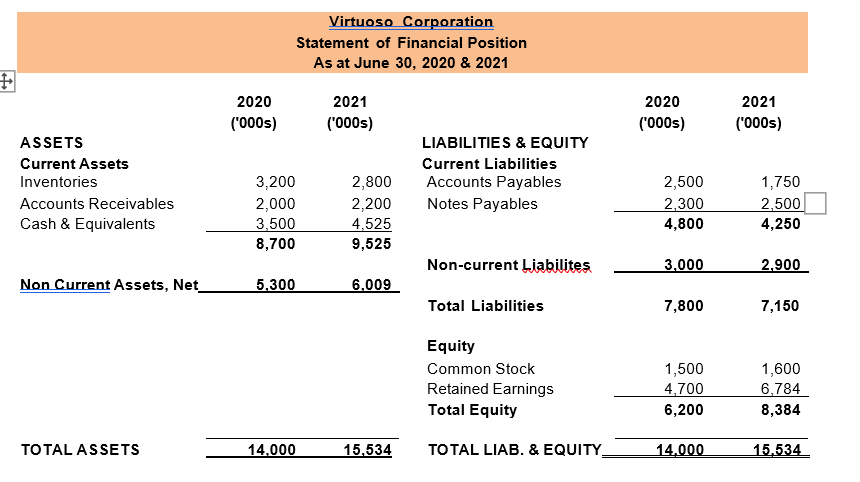

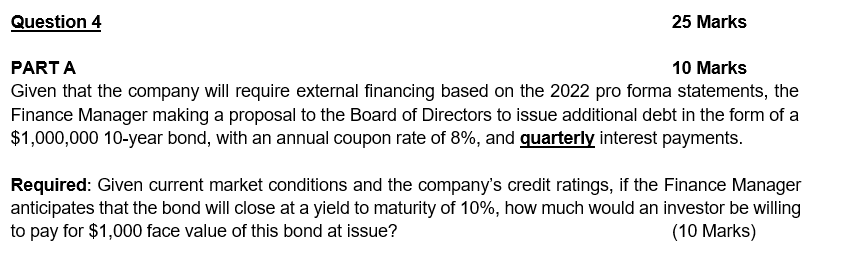

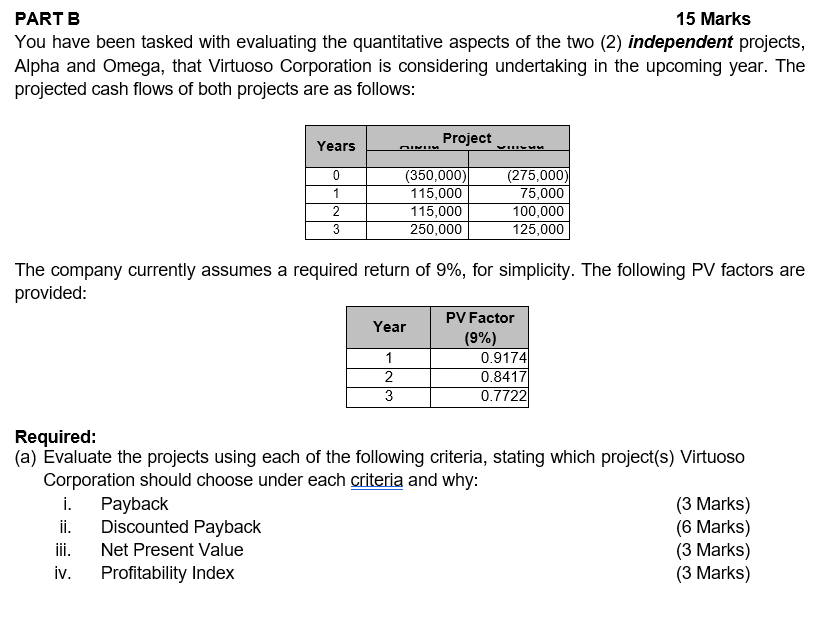

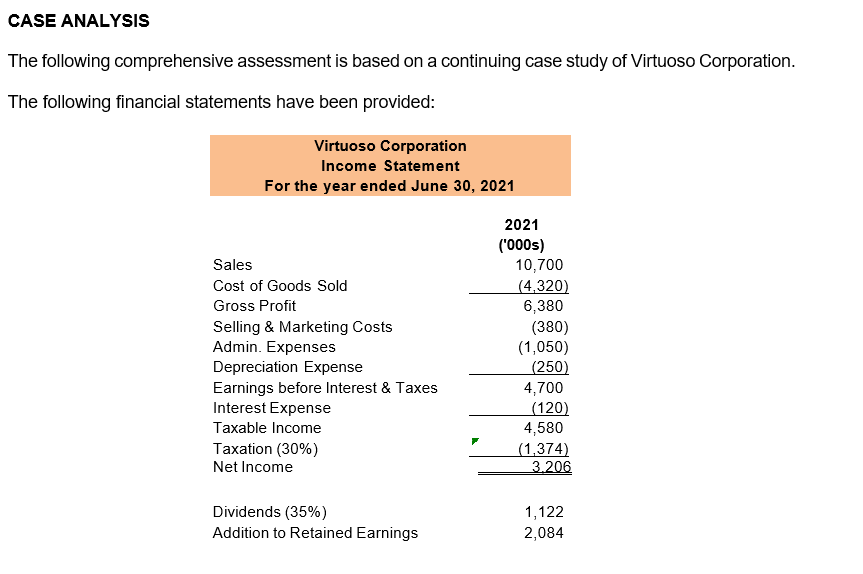

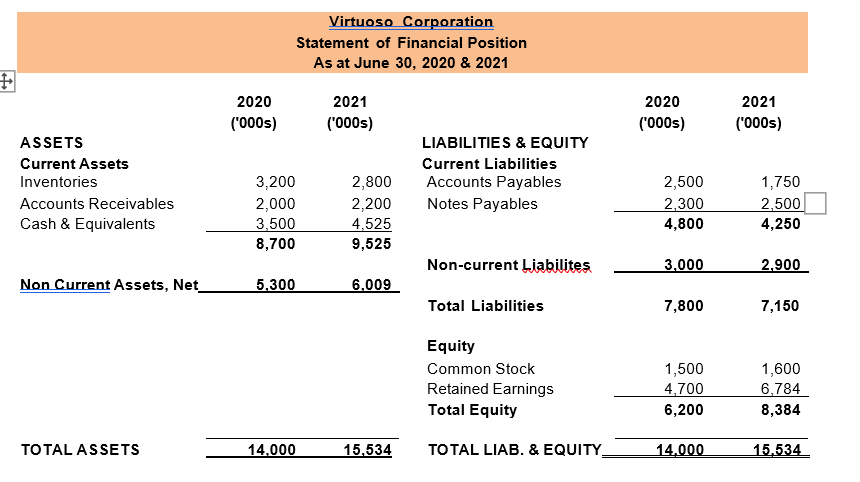

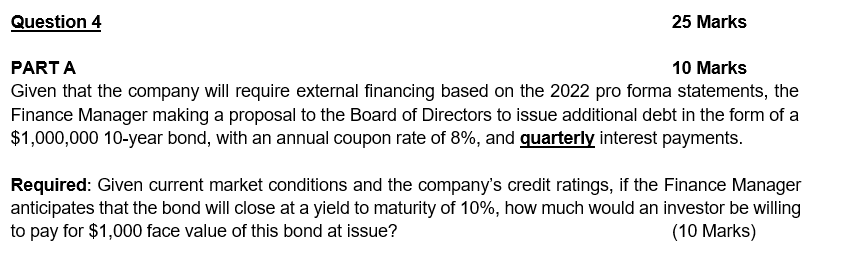

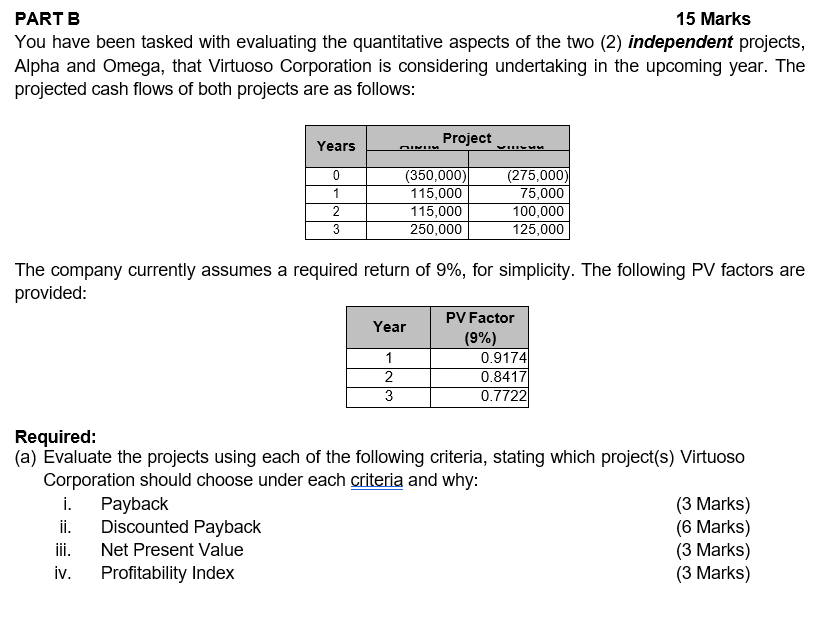

CASE ANALYSIS The following comprehensive assessment is based on a continuing case study of Virtuoso Corporation. The following financial statements have been provided: Virtuoso Corporation Income Statement For the year ended June 30, 2021 Sales Cost of Goods Sold Gross Profit Selling & Marketing Costs Admin. Expenses Depreciation Expense Earnings before Interest & Taxes Interest Expense Taxable Income Taxation (30%) Net Income 2021 ('000s) 10,700 (4,320) 6,380 (380) (1,050) (250) 4,700 (120) 4,580 (1,374) 3.206 Dividends (35%) Addition to Retained Earnings 1,122 2,084 Virtuoso Corporation Statement of Financial Position As at June 30, 2020 & 2021 + 2020 ('000s) 2021 ('000s) 2020 ('000s) 2021 ('000s) ASSETS Current Assets Inventories Accounts Receivables Cash & Equivalents LIABILITIES & EQUITY Current Liabilities Accounts Payables Notes Payables 3,200 2,000 3,500 8,700 2,800 2,200 4.525 9,525 2,500 2.300 4,800 1,750 2,500 4,250 Non-current Liabilites 3,000 2.900 Non Current Assets, Net 5.300 6.009 Total Liabilities 7,800 7,150 Equity Common Stock Retained Earnings Total Equity 1,500 4,700 6,200 1,600 6,784 8,384 TOTAL ASSETS 14.000 15,534 TOTAL LIAB. & EQUITY_ 14.000 15.534 Question 4 25 Marks PARTA 10 Marks Given that the company will require external financing based on the 2022 pro forma statements, the Finance Manager making a proposal to the Board of Directors to issue additional debt in the form of a $1,000,000 10-year bond, with an annual coupon rate of 8%, and quarterly interest payments. Required: Given current market conditions and the company's credit ratings, if the Finance Manager anticipates that the bond will close at a yield to maturity of 10%, how much would an investor be willing to pay for $1,000 face value of this bond at issue? (10 Marks) PART B 15 Marks You have been tasked with evaluating the quantitative aspects of the two (2) independent projects, Alpha and Omega, that Virtuoso Corporation is considering undertaking in the upcoming year. The projected cash flows of both projects are as follows: Years Project DINU 0 1 2 (350,000) 115,000 115,000 250,000 (275,000) 75,000 100,000 125,000 3 The company currently assumes a required return of 9%, for simplicity. The following PV factors are provided: Year PV Factor (9%) 1 0.9174 2 0.8417 3 0.7722 Required: (a) Evaluate the projects using each of the following criteria, stating which project(s) Virtuoso Corporation should choose under each criteria and why: i. Payback (3 Marks) ii. Discounted Payback (6 Marks) iii. Net Present Value (3 Marks) Profitability Index (3 Marks) iv. CASE ANALYSIS The following comprehensive assessment is based on a continuing case study of Virtuoso Corporation. The following financial statements have been provided: Virtuoso Corporation Income Statement For the year ended June 30, 2021 Sales Cost of Goods Sold Gross Profit Selling & Marketing Costs Admin. Expenses Depreciation Expense Earnings before Interest & Taxes Interest Expense Taxable Income Taxation (30%) Net Income 2021 ('000s) 10,700 (4,320) 6,380 (380) (1,050) (250) 4,700 (120) 4,580 (1,374) 3.206 Dividends (35%) Addition to Retained Earnings 1,122 2,084 Virtuoso Corporation Statement of Financial Position As at June 30, 2020 & 2021 + 2020 ('000s) 2021 ('000s) 2020 ('000s) 2021 ('000s) ASSETS Current Assets Inventories Accounts Receivables Cash & Equivalents LIABILITIES & EQUITY Current Liabilities Accounts Payables Notes Payables 3,200 2,000 3,500 8,700 2,800 2,200 4.525 9,525 2,500 2.300 4,800 1,750 2,500 4,250 Non-current Liabilites 3,000 2.900 Non Current Assets, Net 5.300 6.009 Total Liabilities 7,800 7,150 Equity Common Stock Retained Earnings Total Equity 1,500 4,700 6,200 1,600 6,784 8,384 TOTAL ASSETS 14.000 15,534 TOTAL LIAB. & EQUITY_ 14.000 15.534 Question 4 25 Marks PARTA 10 Marks Given that the company will require external financing based on the 2022 pro forma statements, the Finance Manager making a proposal to the Board of Directors to issue additional debt in the form of a $1,000,000 10-year bond, with an annual coupon rate of 8%, and quarterly interest payments. Required: Given current market conditions and the company's credit ratings, if the Finance Manager anticipates that the bond will close at a yield to maturity of 10%, how much would an investor be willing to pay for $1,000 face value of this bond at issue? (10 Marks) PART B 15 Marks You have been tasked with evaluating the quantitative aspects of the two (2) independent projects, Alpha and Omega, that Virtuoso Corporation is considering undertaking in the upcoming year. The projected cash flows of both projects are as follows: Years Project DINU 0 1 2 (350,000) 115,000 115,000 250,000 (275,000) 75,000 100,000 125,000 3 The company currently assumes a required return of 9%, for simplicity. The following PV factors are provided: Year PV Factor (9%) 1 0.9174 2 0.8417 3 0.7722 Required: (a) Evaluate the projects using each of the following criteria, stating which project(s) Virtuoso Corporation should choose under each criteria and why: i. Payback (3 Marks) ii. Discounted Payback (6 Marks) iii. Net Present Value (3 Marks) Profitability Index (3 Marks) iv