Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case B . On June 1 , 2 0 2 0 , Cappa Apparel sold merchandise to a customer, Frank Levens and received a $

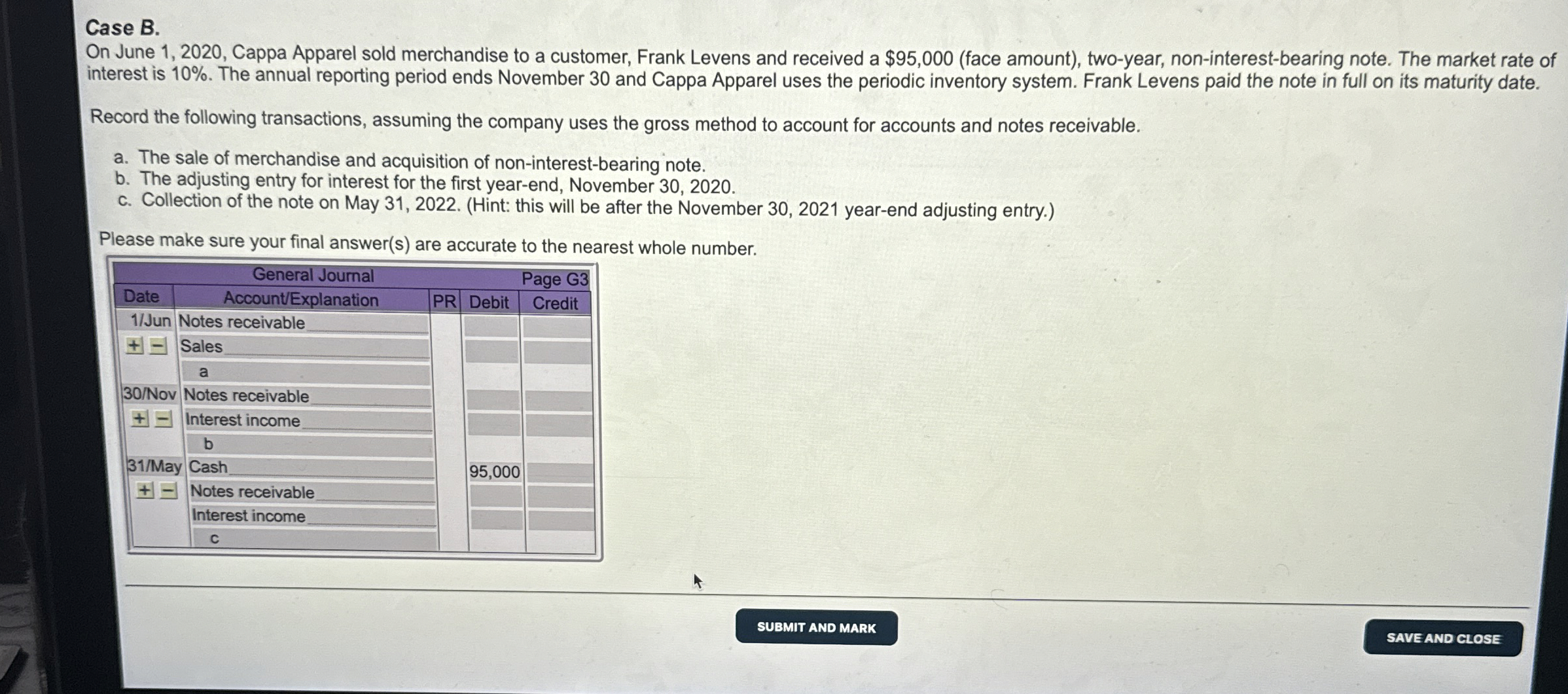

Case B

On June Cappa Apparel sold merchandise to a customer, Frank Levens and received a $face amount twoyear, noninterestbearing note. The market rate of

interest is The annual reporting period ends November and Cappa Apparel uses the periodic inventory system. Frank Levens paid the note in full on its maturity date.

Record the following transactions, assuming the company uses the gross method to account for accounts and notes receivable.

a The sale of merchandise and acquisition of noninterestbearing note.

b The adjusting entry for interest for the first yearend, November

c Collection of the note on May Hint: this will be after the November yearend adjusting entry.

Please make sure your final answers are accurate to the nearest whole number.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started