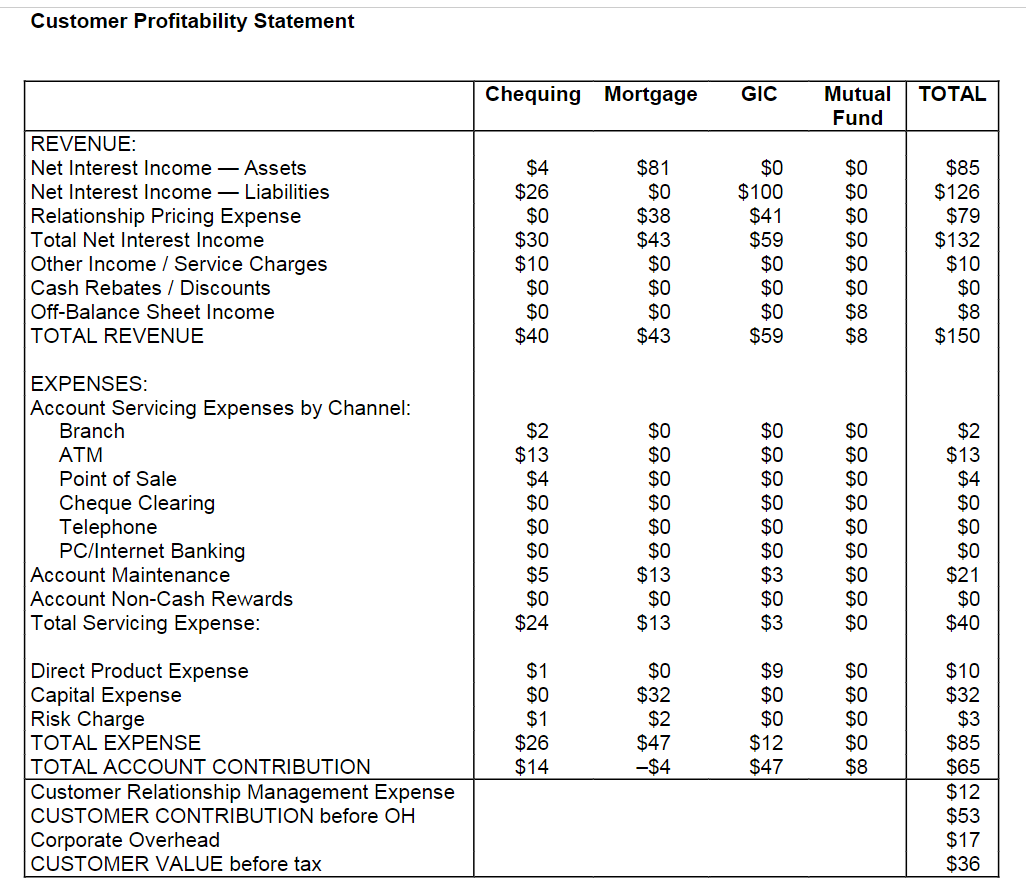

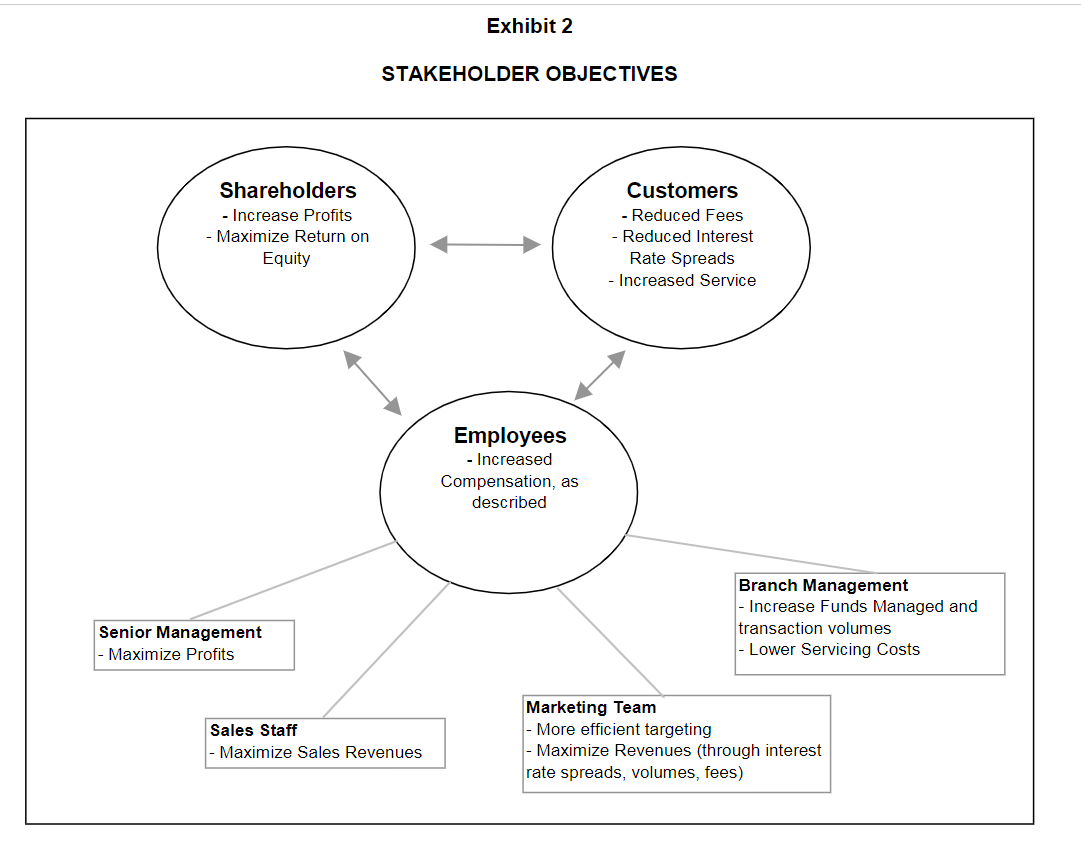

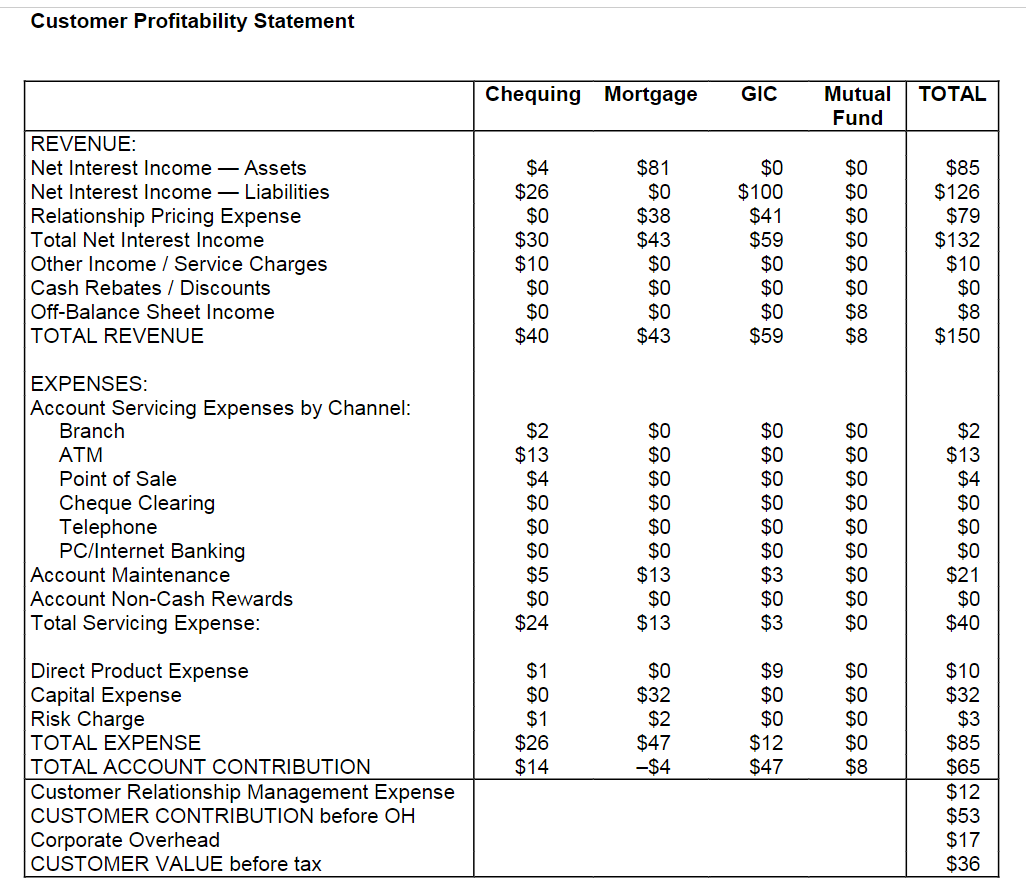

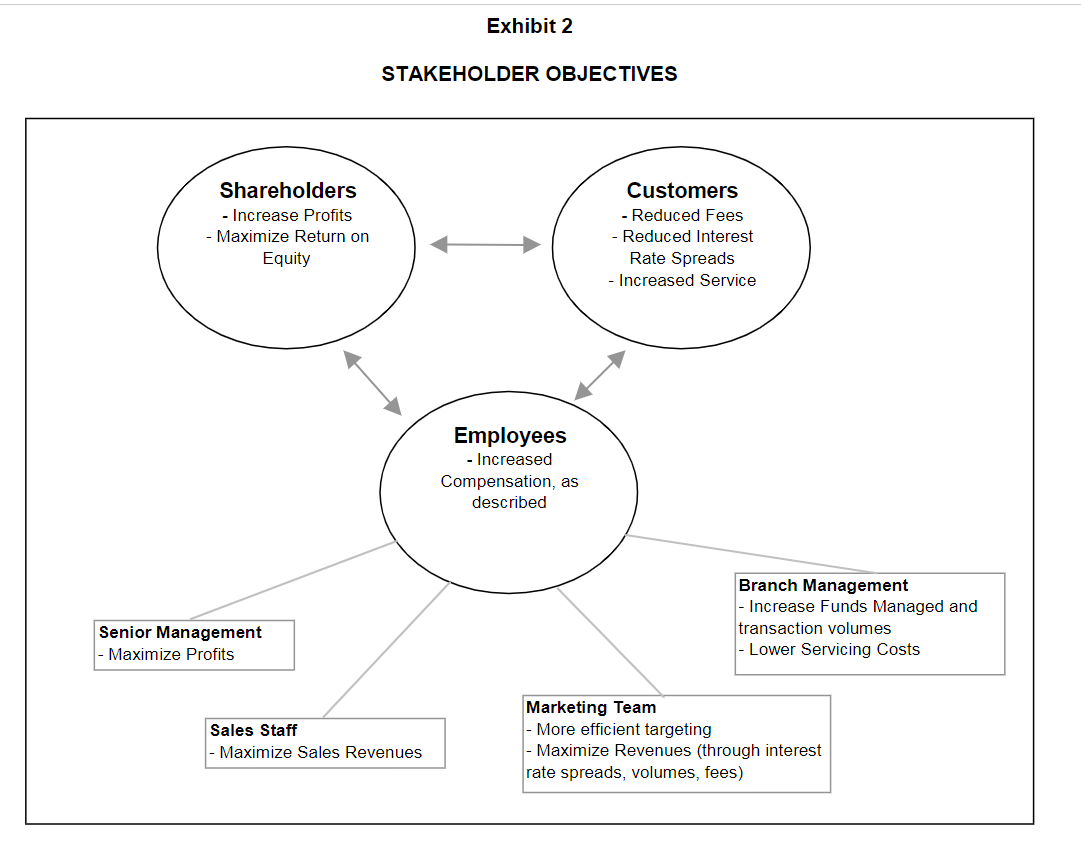

CASE CIBC (B) ASSIGNMENT QUESTIONS 1. Given that not all of CIBC's seven million customers are profitable, what should be done with the non-profitable ones? 2. How could their profitability be improved? 3. Should detailed customer profitability information for each customer be shared with employees of the bank? 4. What would be the pros for and cons against? 5. How can CIBC use the customer profitability data to gain a competitive advantage over their competition? 6. What concerns, if any, do you have with the customer income statement (case (8) Exhibit 1) generated by the new system? Customer Profitability Statement Chequing Mortgage GIC TOTAL Mutual Fund REVENUE: Net Interest Income Assets Net Interest Income Liabilities Relationship Pricing Expense Total Net Interest Income Other Income / Service Charges Cash Rebates / Discounts Off-Balance Sheet Income TOTAL REVENUE $4 $26 $0 $30 $10 $0 $0 $40 $81 $0 $38 $43 $0 $0 $0 $43 $0 $100 $41 $59 $0 $0 $0 $0 $0 $0 $0 $0 $0 $8 $8 $85 $126 $79 $132 $10 $0 $8 $59 $150 EXPENSES: Account Servicing Expenses by Channel: Branch ATM Point of Sale Cheque Clearing Telephone PC/Internet Banking Account Maintenance Account Non-Cash Rewards Total Servicing Expense: $2 $13 $4 $0 $0 $0 $5 $0 $24 $0 $0 $0 $0 $0 $0 $13 $0 $13 $0 $0 $0 $0 $0 $0 $3 $0 $3 $0 $0 $0 $0 $0 $0 $0 $0 $0 $2 $13 $4 $0 $0 $0 $21 $0 $40 Direct Product Expense Capital Expense Risk Charge TOTAL EXPENSE TOTAL ACCOUNT CONTRIBUTION Customer Relationship Management Expense CUSTOMER CONTRIBUTION before OH Corporate Overhead CUSTOMER VALUE before tax $1 $0 $1 $26 $14 $0 $32 $2 $47 -$4 $9 $0 $0 $12 $47 $0 $0 $0 $0 $8 $10 $32 $3 $85 $65 $12 $53 $17 $36 Exhibit 2 STAKEHOLDER OBJECTIVES Shareholders - Increase Profits - Maximize Return on Equity Customers - Reduced Fees - Reduced Interest Rate Spreads - Increased Service Employees - Increased Compensation, as described Branch Management Increase Funds Managed and transaction volumes Lower Servicing Costs Senior Management - Maximize Profits Sales Staff Maximize Sales Revenues Marketing Team More efficient targeting - Maximize Revenues (through interest rate spreads, volumes, fees) CASE CIBC (B) ASSIGNMENT QUESTIONS 1. Given that not all of CIBC's seven million customers are profitable, what should be done with the non-profitable ones? 2. How could their profitability be improved? 3. Should detailed customer profitability information for each customer be shared with employees of the bank? 4. What would be the pros for and cons against? 5. How can CIBC use the customer profitability data to gain a competitive advantage over their competition? 6. What concerns, if any, do you have with the customer income statement (case (8) Exhibit 1) generated by the new system? Customer Profitability Statement Chequing Mortgage GIC TOTAL Mutual Fund REVENUE: Net Interest Income Assets Net Interest Income Liabilities Relationship Pricing Expense Total Net Interest Income Other Income / Service Charges Cash Rebates / Discounts Off-Balance Sheet Income TOTAL REVENUE $4 $26 $0 $30 $10 $0 $0 $40 $81 $0 $38 $43 $0 $0 $0 $43 $0 $100 $41 $59 $0 $0 $0 $0 $0 $0 $0 $0 $0 $8 $8 $85 $126 $79 $132 $10 $0 $8 $59 $150 EXPENSES: Account Servicing Expenses by Channel: Branch ATM Point of Sale Cheque Clearing Telephone PC/Internet Banking Account Maintenance Account Non-Cash Rewards Total Servicing Expense: $2 $13 $4 $0 $0 $0 $5 $0 $24 $0 $0 $0 $0 $0 $0 $13 $0 $13 $0 $0 $0 $0 $0 $0 $3 $0 $3 $0 $0 $0 $0 $0 $0 $0 $0 $0 $2 $13 $4 $0 $0 $0 $21 $0 $40 Direct Product Expense Capital Expense Risk Charge TOTAL EXPENSE TOTAL ACCOUNT CONTRIBUTION Customer Relationship Management Expense CUSTOMER CONTRIBUTION before OH Corporate Overhead CUSTOMER VALUE before tax $1 $0 $1 $26 $14 $0 $32 $2 $47 -$4 $9 $0 $0 $12 $47 $0 $0 $0 $0 $8 $10 $32 $3 $85 $65 $12 $53 $17 $36 Exhibit 2 STAKEHOLDER OBJECTIVES Shareholders - Increase Profits - Maximize Return on Equity Customers - Reduced Fees - Reduced Interest Rate Spreads - Increased Service Employees - Increased Compensation, as described Branch Management Increase Funds Managed and transaction volumes Lower Servicing Costs Senior Management - Maximize Profits Sales Staff Maximize Sales Revenues Marketing Team More efficient targeting - Maximize Revenues (through interest rate spreads, volumes, fees)