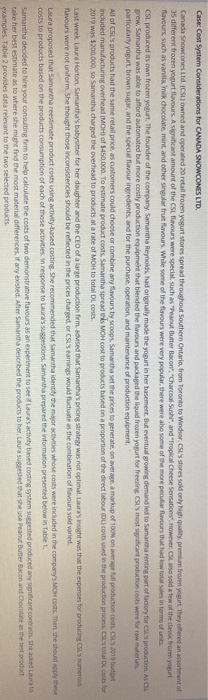

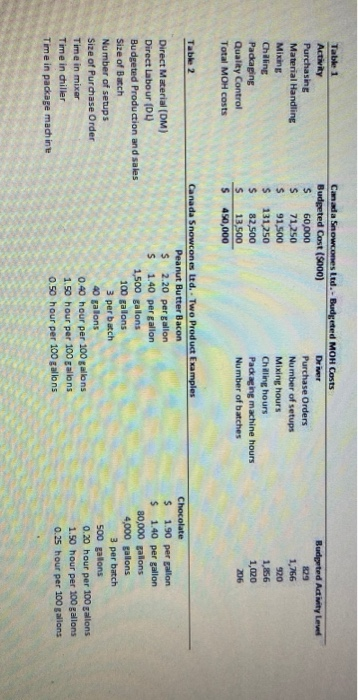

Case: Cost System Considerations for CANADA SNOWCONES LTD, Canada Snowcones Ltd. (CSL) owned and operated 20 retail frozen yogurt stores spread throughout Southern Ontario, from Toronto to Windsor. CSL's stores sold only high quality premium froen yogurt. They offered an assortment of 35 different frozen your favours. A significant amount of the CSL flavours were special such as Peanut Butter Bacon", "Charcoal Sus", and "Tropical Cheese Sensations. However, CSL sold a few of the classic from yogurt flavours, such as vantamik chocolate, mint and other singular fruit flavours. While some of the flavours were very popular, there were also some of the more peculiar favours that had low total sales in terms of units. CSL produced its own frozen yogurt. The founder of the company, Samantha Reynolds, had originally made the yogurt in her basement. But eventual growing demand led to Samantha renting part of tactory for sus production. As CSL grew, Samantha was able to afford automated but more costly production equipment that blended the flavours and packaged the liquid frozen yogurt for freezing CSL's most significant production costs were for raw materials particularly yogurt, brown sugar and the special favour ingredients, and for the purchase operation and maintenance of production equipment All of CSL's products had the same retail price, as customers could choose or combine any flavours by scoops. Samantha set the prices to generate on average a markup of 100% on average full production costs. CSUS 2019 budou included manufacturing overhead (MH) of 5450.000. To estimate product costs. Samantha spreads MOH cost to products based on a proportion of the direct labour (Du) costs used in the production process. C's total costs for 2019 was $200.000, so Samantha charged the overhead to products at a rate of MOH to total costs Last week. Laura Horton Samantha's babysitter for her daughter and the CEO of a large production form avised that Samantha's pricing strategy was not optimal. Laura's insight was that the expenses for producing met flavours were not uniform. She thought those inconsistencies should be reflected in the prices charged or Clearings would fluctuate as the combination of flavours sold varied. Laura proposed that Samantha reestimate product costs using activity-based costing She recommended that Samantha identify the major activities whose costs were included in the company's costs. Then the should by these costs to products based on the products consumption of each of those activities. In response to Laura's suggestions, Samantha prepared the information presented below in Table 1 Samantha decided to hire your consulting firm to help calculate the costs of two demonstrative flavours as an experiment to see iflas activity based costing system suggested produced any significant contrasts. She asked Laura to take her best estimate as to where she might find the most material differences. If any existed. After Samantha described the products to her, Laura Sugested that the use Peanut Butter Bacon and Chocolate as the test product examples. Table 2 provides data relevant to the two selected products Table 1 Activity Purchasing Material Handling Mixing Chaling Packaging Quality Control Total MOH costs Canada Snowcones Ltd. - Budgeted MOH Costs Budgeted Cost (5000) Driver s 60,000 Purchase Orders $ 71,250 Number of setups $ 91,500 Mixing hours s 131,250 Chilling hours s 82,500 Packaging machine hours $ 13,500 Number of batches s 450,000 Bulgated Activity Level 399 1,756 920 1,856 1,020 206 Table 2 Canada Snowcones Ltd. - Two Product Examples Peanut Butter Bacon Direct Material (DM) $ 2.20 per gallon Direct Labour (0) S 1.40 per gallon Budgeted Production and sales 1,500 gallons Size of Batch 100 gallons Number of setups 3 per batch Size of Purchase Order 40 galons Time in mixer 0.40 hour per 100 gallons Time in chiller 1.50 hour per 100 gallons Time in package machine 0.50 hour per 100 gallons Chocolate $ 1.90 per gallon s 1.40 per gallon 80,000 gallons 4,000 gallons 3 per batch 500 galons 0.20 hour per 100 gallons 1.50 hour per 100 gallons 0.25 hour per 100 gallons Time in pace machine Show per 100 O hour 100g Case Questions Utilizing the information above. Calculate the full product cost (on a per gallon basis of the Peanut Butter Bacon and Chocolate flavours utilizing: Samantha's more traditional costing system. b. Laura's suggestion to use activity based costing, 2 a. What are the impacts. If there is any at all, of switching Sus costing method in particular, are the any significant contrasts between traditional costing and activity based costing in terms Their impact on costs for independent products Their effect on CSL's total firm income (assuming everything else remains the same, such as production and sales prices) if there are significant contrasts, why are they present if there are no significant contrasts, why are they not present? What would you recommend to be Samantha's next step, based on this analysis? Explain. b. 3 Evaluation Case Analysis 2 will be marked in its entirety out of 100. The following rubric indicates the criteria students are to adhere to, and their relative weights to the assignment overall