Answered step by step

Verified Expert Solution

Question

1 Approved Answer

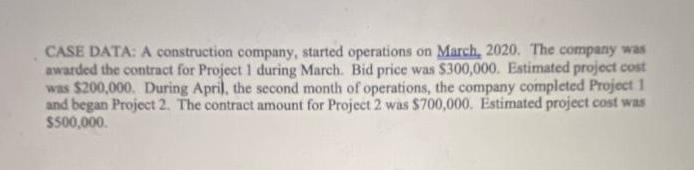

CASE DATA: A construction company, started operations on March, 2020. The company was awarded the contract for Project 1 during March. Bid price was

![]()

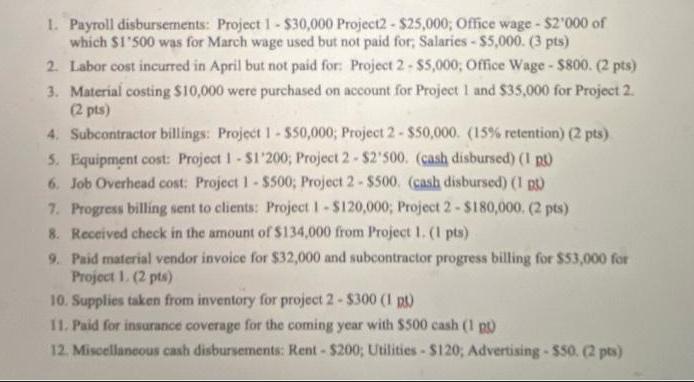

CASE DATA: A construction company, started operations on March, 2020. The company was awarded the contract for Project 1 during March. Bid price was $300,000. Estimated project cost was $200,000. During April, the second month of operations, the company completed Project 1 and began Project 2. The contract amount for Project 2 was $700,000. Estimated project cost was $500,000. Journalize the given transactions that occur in APRIL 1. Payroll disbursements: Project 1 - $30,000 Project2- $25,000; Office wage - $2'000 of which $1'500 was for March wage used but not paid for, Salaries - $5,000. (3 pts) 2. Labor cost incurred in April but not paid for: Project 2-$5,000; Office Wage - $800. (2 pts) 3. Material costing $10,000 were purchased on account for Project 1 and $35,000 for Project 2. (2 pts) 4. Subcontractor billings: Project 1 - $50,000; Project 2 - $50,000. (15% retention) (2 pts) 5. Equipment cost: Project 1 - $1'200; Project 2-$2'500. (cash disbursed) (1 pt) 6. Job Overhead cost: Project 1-$500; Project 2- $500. (cash disbursed) (1 pt) 7. Progress billing sent to clients: Project 1-$120,000; Project 2-$180,000. (2 pts) 8. Received check in the amount of $134,000 from Project 1. (1 pts) 9. Paid material vendor invoice for $32,000 and subcontractor progress billing for $53,000 for Project 1. (2 pts) 10. Supplies taken from inventory for project 2-$300 (1 pt) 11. Paid for insurance coverage for the coming year with $500 cash (1 pt) 12. Miscellaneous cash disbursements: Rent - $200; Utilities - $120; Advertising - $50. (2 pts)

Step by Step Solution

★★★★★

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

1 Payroll disbursements Debit Project 1 Expense 30000 Debit Project 2 Expense 25000 Debit Office Wage Expense 2000 Credit Accounts Payable 30000 25000 2000 57000 Date Account Debit Credit Project 1 Ex...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started