Question

Case Description: In July 2020, Eastman Kodak Company (Kodak) received a US$765 million loan from the US federal government for drug component manufacturing. Kodak's chief

Case Description:

In July 2020, Eastman Kodak Company (Kodak) received a US$765 million loan from the US federal government for drug component manufacturing. Kodak's chief executive officer (CEO) was confident about the company's ability to excel in the pharmaceutical industry. However, critics cited several concerns, such as workforce availability and Kodak's lack of experience in the pharma business. The CEO believed that Kodak's expertise in advanced chemicals and manufacturing could drive the firm's success in the pharma business. Would Kodak be able to establish its mark in the US pharma industry? What challenges was Kodak likely to face?

Case Assignment Questions:

- Critically analyze whether Kodak should diversify into the pharmaceutical industry. Will Kodak be able to deliver performance in the generic drug industry? Why or why not?

- How can Kodak ensure successful diversification in the pharma industry, especially in generic industry? What diversification strategies should Kodak pursue if your analysis supports Kodak's diversification effort.

- Given that Kodak needed to follow a low-cost strategy, was it justified in issuing stock options to Continenza? Explain your answers.

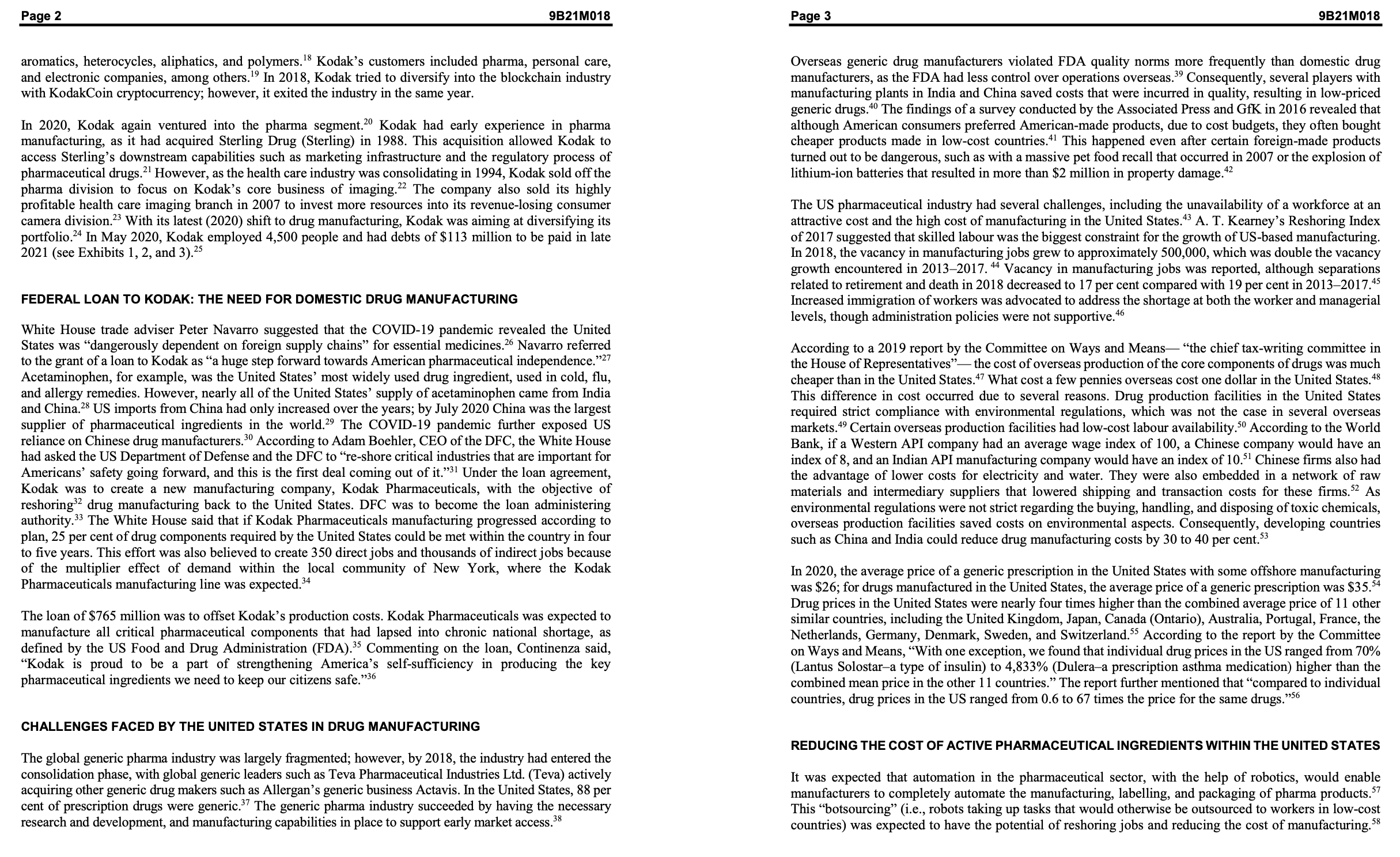

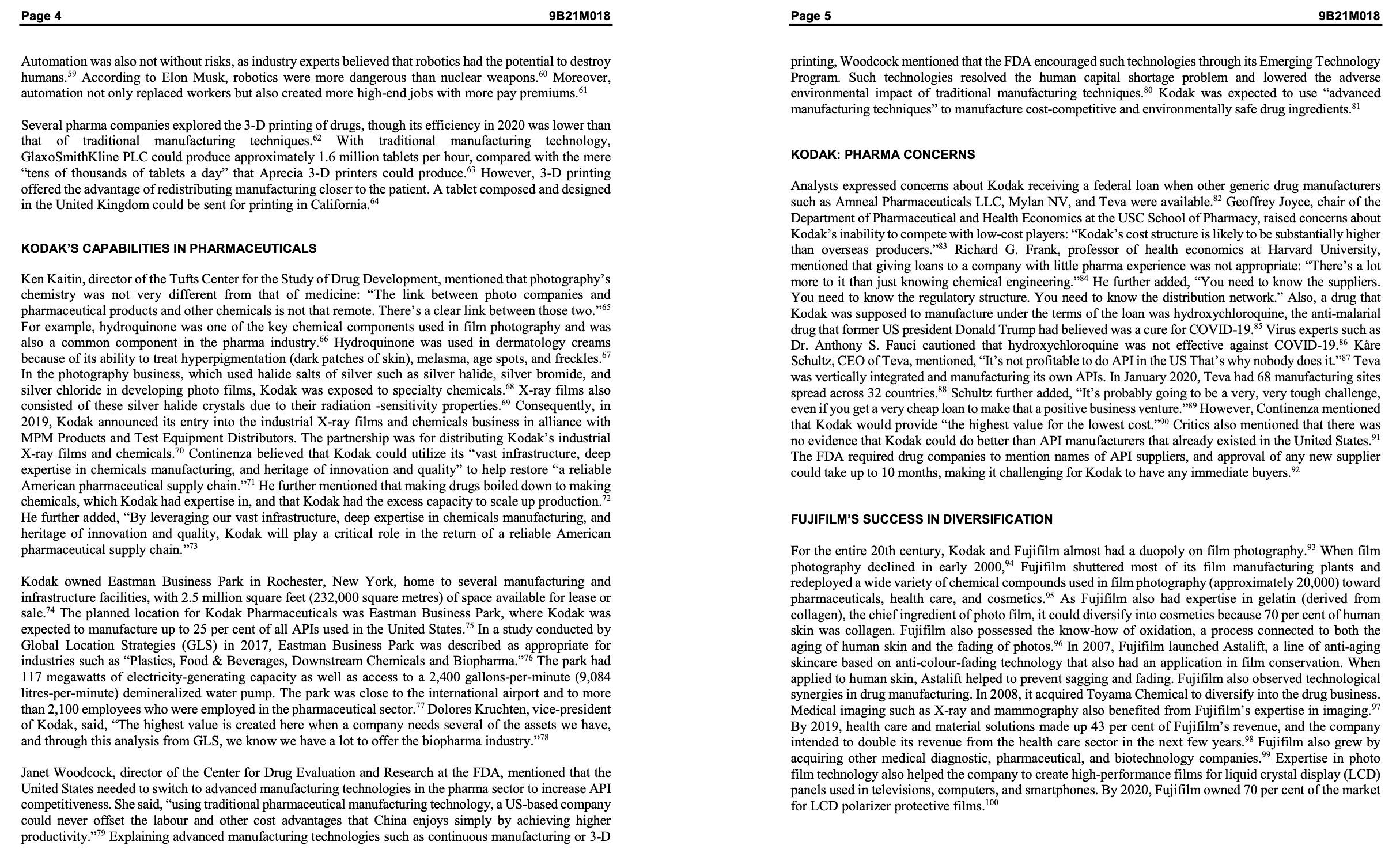

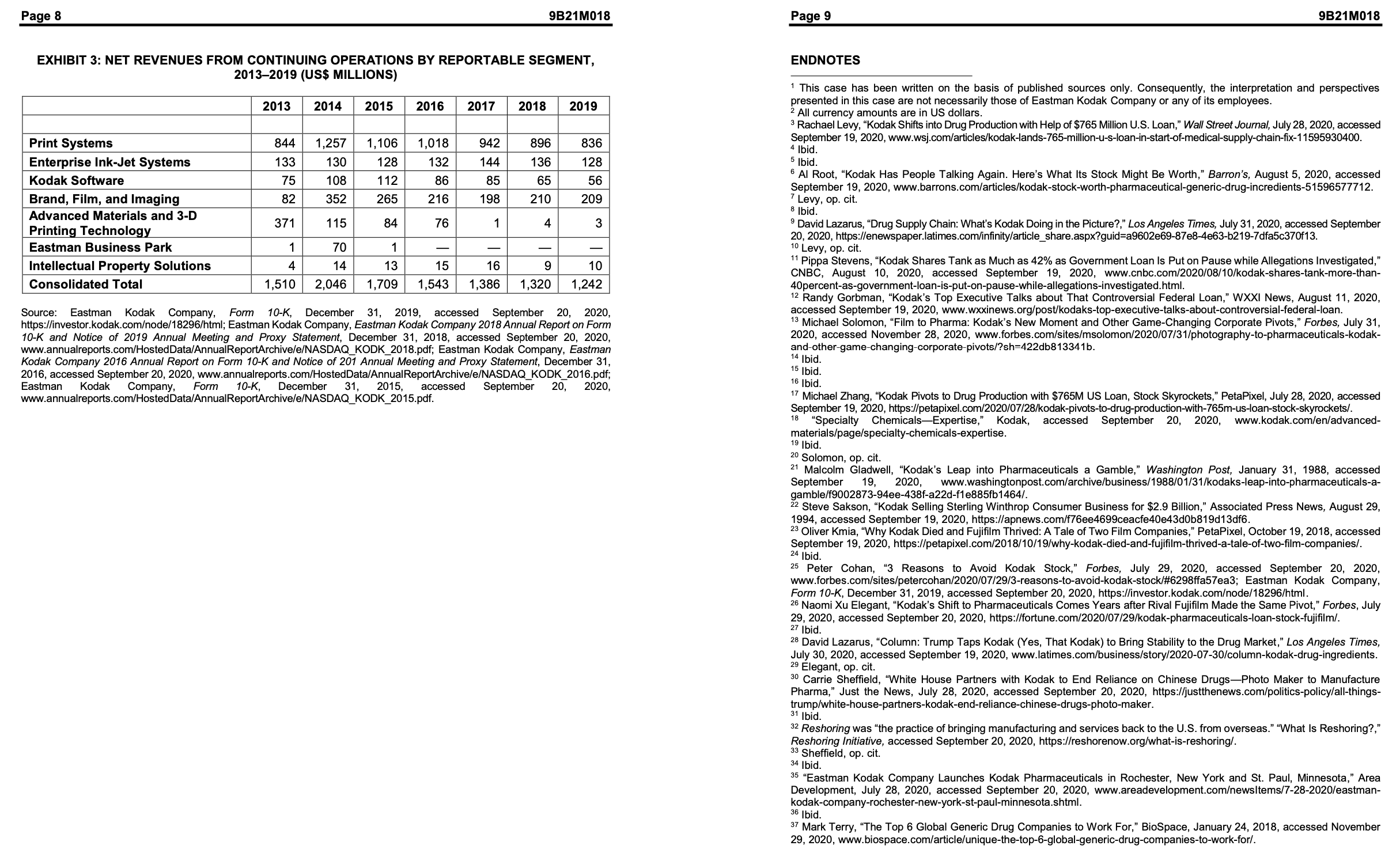

EASTMAN KODAK COMPANY: REVIVING THROUGH DIVERSIFICATION Arpita Agnihotri and Saurabh Bhattacharya wrote this case solely to provide material for class discussion. The authors do not intend to illustrate either effective or ineffective handling of a managerial situation. The authors may have disguised certain names and other identifying information to protect confidentiality. This publication may not be transmitted, photocopied, digitized, or otherwise reproduced in any form or by any means without the permission of the copyright holder. Reproduction of this material is not covered under authorization by any reproduction rights organization. To order copies or request permission to reproduce materials, contact Ivey Publishing, Ivey Business School, Western University, London, Ontario, Canada, N6G ON1; (t) 519.661.3208; (e) cases@ivey.ca; www.iveycases.com. Our goal is to publish materials of the highest quality; submit any errata to publishcases@ivey.ca. Copyright 2021, Ivey Business School Foundation Version: 2021-02-12 On July 28, 2020, Eastman Kodak Company (Kodak), the legendary camera maker, was granted a loan of US$765 million from the US International Development Finance Corporation (DFC). The loan to Kodak was for the company's manufacturing of generic drug ingredients, often called active pharmaceutical ingredients (APIs), which could increase the generic drug self-sufficiency of the United States during the COVID-19 pandemic.4 After news of the loan, Kodak's market value increased from $115 million to $347 million, with a per-share price rise from $2 to $60.6 Commenting on the relatedness between photography and drug manufacturing, Jim Continenza, Kodak's chairman and chief executive officer (CEO), said that the company had experience making chemical and advanced materials and that its infrastructure was in a position for quickly establishing the pharmaceutical business. Given Kodak's lack of expertise in pharmaceuticals, experts were not in favour of the company receiving a federal loan. Experts also believed that drug manufacturing in the United States was unsustainable in the long run, owing to the high cost of production, which in turn led to increased drug prices. Continenza, on the contrary, intended to make pharma ingredient production contribute 30 to 40 per cent of Kodak's business in the future. 0 By August 10, 2020, the loan was on hold because of accusations of insider trading. Media reports stated that if an investigation from the US Securities and Exchange Commission about insider trading was unfavourable and DFC did not sanction the loan, "Kodak's reputation could be damaged and its existing business could be adversely affected." Should Kodak diversify into the pharma industry? Would Continenza be able to establish a mark in the US pharma industry? What challenges was Kodak likely to face, and how could such challenges be resolved? 10 BACKGROUND 13 Kodak was founded in 1888 by George Eastman.3 The company remained the market leader in the film photography segment for almost a century. By the 1970s, Kodak controlled 85 per cent of the camera market and 90 per cent of the US film market. Kodak's revenue from film photography peaked in 1996 at $16 billion.4 Although Kodak invented the first digital camera in 1975, it ignored the digital camera's revolutionary potential, and by 2012, Kodak went bankrupt.5 A year after bankruptcy, Kodak emerged as a printing and imaging company after giving up the photography business. 6 In the same year, the company also began licensing its brand name to third-party manufacturers such as JK Imaging Ltd.7 By 2013, Kodak diversified into the specialty chemicals business, where it offered both custom and general chemical manufacturing. Its specialty chemical portfolio of products included functional and infrared dyes,

Step by Step Solution

3.37 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

1 Critically analyze whether Kodak should diversify into the pharmaceutical industry Will Kodak be able to deliver performance in the generic drug industry Why or why not Kodaks decision to diversify ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started