Question

CASE DESCRIPTION The purpose of this case is to explore the financial challenges faced by college students and to underscore the need for students to

CASE DESCRIPTION

The purpose of this case is to explore the financial challenges faced by college students and to underscore the need for students to make sound financial decisions while in school and after graduation. This case is best suited for discussion in a Personal Finance class. However, there are components that lend themselves to the Introductory Finance class as well. The case can be discussed in 2 class periods and will require 3-4 hours of outside preparation by students. Upon completion of the case, students will be able to prepare and analyze Personal Financial Statements and assess ones net worth. They will be able to explain the importance of establishing credit, using it wisely and strategies for improving ones credit score. Students will also be able to apply time value of money concepts to calculate loan payments and make retirement projections.

CASE SYNOPSIS

Michelle Jones is a recent graduate of Johnson C. Smith University (JCSU). She received a BS in Business Administration with a concentration in Finance. She successfully completed an internship with Branch Banking and Trust (BB&T) while at JCSU and joined the bank full-time after graduation as a Credit Analyst. Michelle was supported financially by her parents while in college. Now she is on her own and must face the challenges of being an adult. Michelle felt nave about managing her finances so she reached out to one of her Finance Professors at JCSU for advice. This is where the fun begins.

MICHELLES FINANCES

Michelle Jones was fortunate to have parents who could pay her college expenses and provide her with periodic spending money. The spending money was never enough, however. There was always that one new outfit that she just had to have. She had a meal plan, but the food in the cafeteria was not satisfactory. She frequently joined her friends for meals off campus. No problem. She had a credit card. Mr. Jones often talked to Michelle about managing her money. There were two things that her father said that made a lasting impression. All college students should establish and maintain a cash emergency fund and they should establish credit. Michelle took this advice to heart. She opened up a savings account at BB&T for her emergency fund. In order to establish her credit history, Michelle applied for and received a MasterCard. She was not overly concerned with the finance charge and method of calculation because she planned to pay her balance in full each month. Her primary concern was the avoidance of an annual fee. Further, she preferred a card that offered a long grace period. The grace period is the number of days from the statement date that Proceedings of the International Academy for Case Studies Volume 22, Number 1 5 the card holder has to pay the balance in full and avoid a finance charge. Paying off the balance prior to the end of the grace period allows the card holder to utilize the float (i.e. earn interest on monies until payment is made). Michelle opened accounts at Belk, a regional department store, and her favorite retailer, Victorias Secret. Michelle heard that it was advisable to open different types of credit in order to improve ones credit score. She routinely checked her credit file using annualcreditreport.com. She knew that checking ones bank and charge card statements regularly is a primary safeguard against identity theft. Michelle was also advised to check her credit file at each of the three credit bureaus periodically to ensure that there were no errors or unauthorized transactions. Errors should be reported to the credit bureau in writing immediately. Each credit bureau generates its own credit score. More recently, the credit bureaus jointly created the VantageScore. VantageScore 3.0 ranges from 300 to 850. Most lenders, however, rely on ones FICO score, www.myfico.com, when making credit decisions and/or determining the interest rate to be charged. FICO scores range from 300 to 850. A FICO score of 800 or above is considered excellent. A good score ranges from 700 799. A fair score is 650 699. A score below 650 is considered poor. One of Michelles goals is to improve her credit score. She did some research to identify the determinants of ones FICO score. Michelle learned that a FICO score is computed based on the following components and weights (Weston, 2012): Types of credit maintained 10% History of timely payments 35% Amount owed relative to credit limits 30% Length of credit history 15% New credit 10% The most weight is given to ones history of making timely payments. Accordingly, the earlier a student establishes credit and makes payments on a timely basis, the higher his/her FICO score will be. Michelle also learned that it is best to maintain a balance of less than 30% of ones credit limit. This computation is made for each credit and in total. Note that ones income or net worth is not factored into ones credit score. Also, note that applying to open several different accounts in a relatively short period of time will adversely affect ones credit score. This will not occur if the applicant is merely shopping for the same type of credit (i.e., a mortgage) at different lenders.

TIME TO BE AN ADULT

Michelle remained in Charlotte after graduation. She currently works as a Credit Analyst at BB&T. She decided to live with her parents in order to save money. One year after graduation, Michelles mom said, It is time for you to move out of my house. She turned to her dad. Surely, he wouldnt make her move. Michelle was crushed when her dad stated that it was time for her to go. Michelle drives a Honda Accord. The Joneses purchased the car used. It now has a current value of $9,992 per Kelly Blue Book. Hondas are noted for great gas mileage, reliability and relatively low repair costs. Michelle enjoyed driving the Honda while a student. Now, she believes it is time for a new car. My Honda does not convey the image that I would like to project. Michelle has accumulated $5,000 in personal savings. Her checking account balance is currently $1,500. Additional assets consist of her car, value of clothing ($2,000), jewelry ($2,500), Proceedings of the International Academy for Case Studies Volume 22, Number 1 6 electronics ($2,200), furniture ($1,200) and the balance in her 401(k). She has utilized her credit cards to make purchases of clothing, jewelry and household possessions. It is her intent to pay her credit card balance in full each month. Unfortunately, she has not done so. Currently, she has credit card debt of $2,687. The monthly minimum payment is $35. The annual finance charge is 18%.

TAKING CONTROL?

Michelle agreed to obtain her own auto coverage and cell phone plan since she now has a real job. The days of living off her parents are over! She really does want to become more selfsufficient. Michelle ventured into a BMW dealership one rainy Saturday afternoon. She had no intention of buying a car that day. She was greeted by an enthusiastic salesperson. A few hours later, she drove off the lot in a brand new red BMW 3 series. Michelle was very proud of her new car and her newfound negotiation skills. With some counsel from her brother, Trevor, and after several back and forth offers and threats to leave, Michelle negotiated a purchase price of $39,100 with a trade-in allowance of $8,300. BMW was offering incentive financing on the car she selected. She financed her purchase at 0.9% for 60 months. Clearly, establishing a favorable credit history early paid off. Michelle obtained a quote from three auto insurers. She learned that she could have maintained a liability only policy on the Honda, but must maintain full coverage on the new car since it is financed. Liability protects others in the event that there is an accident and Michelle is deemed to be at fault. Collision provides for reimbursement in the event her car is damaged in an accident and she is at fault. Comprehensive provides coverage against theft, fire, hail, etc. Michelle must decide on an appropriate deductible. The deductible is the out-of-pocket expense that Michelle will incur if there is an accident and there are damages to her car and she is at fault. A higher deductible of $250, $500, $1,000 or more results in a lower premium, but increases the amount of financial risk assumed by the insured. Michelle has been diligent about contributing 3% of her salary to the 401(k) plan offered by BB&T. BB&T matches the first 6% of employee contributions. The current balance in her 401(k) is $3,128. Her current allocation is 80% stable value fund and 20% money market fund. She has not researched the investment options available in her 401(k), but says, I cant afford to lose my money. Michelle has chosen the two most conservative options from a menu of investment choices. Michelle expects to receive a tax refund of approximately $600. She has been using a tax preparation service to prepare her Federal and state tax returns. Of course, she incurs a fee for this service. Michelle should be able to complete her own tax return because her return is fairly straightforward (i.e., she doesnt itemize deductions). Her friend suggested that she use the IRS free-file program. There is no charge for the Federal return and the charge for the state return is nominal. Michelles friend also suggested that she increase the number of her withholding allowances in order to reduce the amount of taxes withheld each paycheck. This would reduce her refund check, but it would increase her take-home pay throughout the year. This is accomplished by completing and submitting a W-9 form to ones employer.

THE CHALLENGE AHEAD

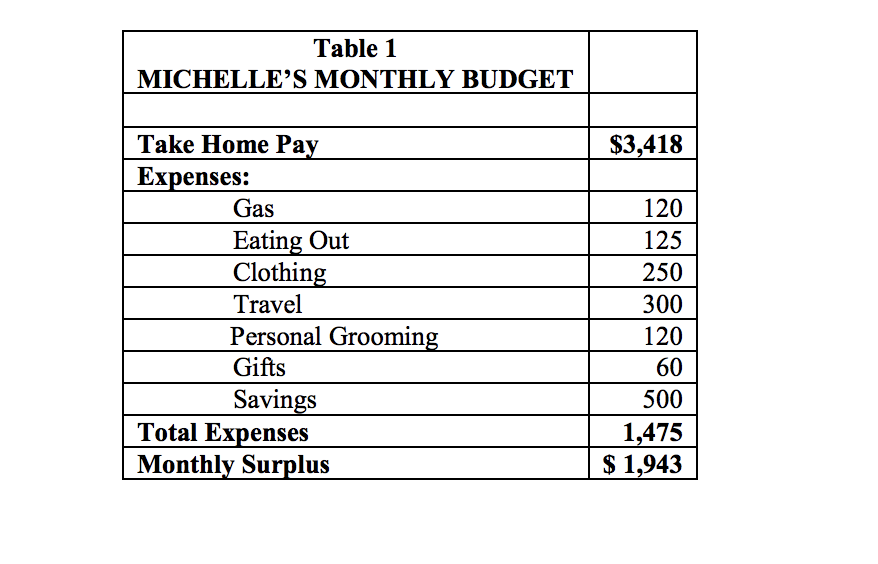

Michelle felt ill-prepared and overwhelmed to take charge of her finances. A personal finance class was not offered at JCSU when she attended. She believed that assistance from a professional financial planner was required. Michelle remembered that one of her professors had practiced for years as a Financial Planner. She emailed Dr. Thomas to request a meeting. Dr. Thomas informed her that he had retired as a Financial Planner. Further, it would be difficult to refer her to a professional planner because she really didnt have sufficient assets at this stage of her life to justify paying a fee. Dr. Thomas agreed to meet with Michelle. He stated that he would be willing to assess her current financial situation and provide recommendations. There would be no charge for this meeting. During their meeting, Michelle was asked, What are your goals? She offered the following: to be wealthy, to own a home, to marry and have two children, to obtain an MBA, to move up the corporate ladder, and to be financially independent at age 60. Dr. Thomas suggested that Michelle formulate short, intermediate and long-term goals. Short-term goals should include those things Michelle wants to accomplish within the next twelve months. Intermediate term goals are those to be accomplished between one and five years. Longterm goals are those with a target date for accomplishment more than five years away. Dr. Thomas also commented on the quality of Michelles goal statements. They lack a timeframe and arent measureable. Effective goal statements are: SMART specific, measureable, attainable, realistic, and have a timeframe for accomplishment. Dr. Thomas was pleasantly surprised to learn that Michelle had prepared a monthly budget. Dr. Thomas asked Michelle how she formulated her budget. She said, I estimated the amounts based on what I thought I was spending. She provided the budget shown in Table 1. Dr. Thomas asked if she compared her actual expenses to her monthly budget. Michelle answered, No. Dr. Thomas suggested that she maintain a record of her spending for the next six months using a manual spending log or an online service such as mint.com. Mint makes it easy to track spending and generate Personal Financial Statements. It is a free service. Once Michelles budget is revised, he implored her to compare actual expenses to budgeted amounts on a monthly basis. This will allow her to identify favorable and unfavorable variances. Spending less than budgeted or receiving more income than budgeted is a favorable variance. Conversely, spending more than budgeted or receiving less income than budgeted is an unfavorable variance. Table 1 MICHELLES MONTHLY BUDGET Take Home Pay $3,418 Expenses: Gas 120 Eating Out 125 Clothing 250 Travel 300 Personal Grooming 120 Gifts 60 Savings 500 Total Expenses 1,475 Monthly Surplus $ 1,943 Proceedings of the International Academy for Case Studies Volume 22, Number 1 8 What should I do to manage my finances more effectively? Michelle asked. Dr. Thomas responded, There are no magic answers. This is going to take time and a great deal of discipline on your part. Lets get started! Dr. Thomas advised Michelle to prepare a Personal Balance Sheet (Walker & Walker, 2013). This statement will show the value of the things she owns (assets) and the amount of debt that she currently has (liabilities). Assets are valued at fair market value (what one would receive for the items if they are sold in an arms-length transaction) as of the Balance Sheet date. The purchase price of the items is immaterial. Ones net worth can then be computed by subtracting total liabilities from total assets. It is not uncommon for college students and recent graduates to have a negative net worth. This is largely driven by student loan balances. Michelle was also instructed to maintain a spending log and revise her budget (Kapoor, Dlablay, Hughes & Hart, 2013). Michelles head was spinning. This sounded like a lot of work on her part. Nonetheless, she left Dr. Thomas office determined to complete her homework assignments and to become much more astute at managing her finances.

In 50-100 Words Explain the following questions be precise as possible

1. What evidence is there that Michelle lacks contentment?

2. In what ways is Michelle exhibiting ambivalence toward her finances?

3. What financial idols does Michelle have in her life?

4. What goals does Michelle have and will she be able to obtain them with her current habits?

Table 1 MICHELLE'S MONTHLY BUDGET $3,418 Take Home Pay Expenses: Gas Eating Out Clothing Travel Personal Grooming Gifts Savings Total Expenses Monthly Surplus 120 125 250 300 120 60 500 1,475 $ 1,943 Table 1 MICHELLE'S MONTHLY BUDGET $3,418 Take Home Pay Expenses: Gas Eating Out Clothing Travel Personal Grooming Gifts Savings Total Expenses Monthly Surplus 120 125 250 300 120 60 500 1,475 $ 1,943Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started