Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case Development began operations in December 2024. When property is sold on an Installment basis, Case recognizes installment Income for financial reporting purposes in the

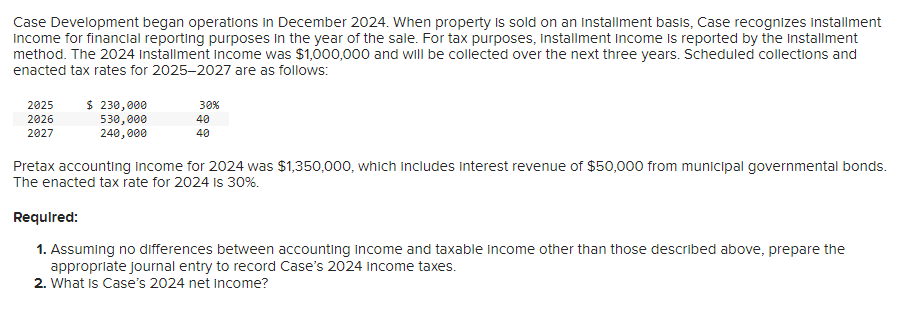

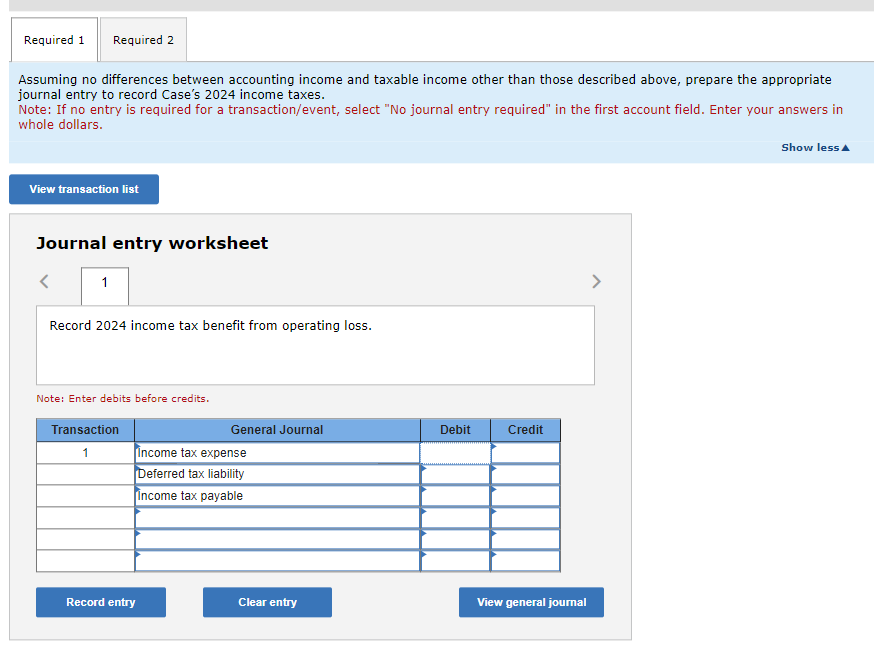

Case Development began operations in December 2024. When property is sold on an Installment basis, Case recognizes installment Income for financial reporting purposes in the year of the sale. For tax purposes, Installment Income is reported by the installment method. The 2024 Installment Income was $1,000,000 and will be collected over the next three years. Scheduled collections and enacted tax rates for 2025-2027 are as follows: Pretax accounting income for 2024 was $1,350,000, which includes interest revenue of $50,000 from municipal governmental bonds. The enacted tax rate for 2024 is 30%. Requlred: 1. Assuming no differences between accounting income and taxable income other than those described above, prepare the approprlate journal entry to record Case's 2024 income taxes. 2. What is Case's 2024 net income? Complete this question by entering your answers in the tabs below. What is Case's 2024 net income? Note: Enter your answers in whole dollars. Assuming no differences between accounting income and taxable income other than those described above, prepare the appropriate journal entry to record Case's 2024 income taxes. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in whole dollars. Show less Journal entry worksheet Record 2024 income tax benefit from operating loss. Note: Enter debits before credits

Case Development began operations in December 2024. When property is sold on an Installment basis, Case recognizes installment Income for financial reporting purposes in the year of the sale. For tax purposes, Installment Income is reported by the installment method. The 2024 Installment Income was $1,000,000 and will be collected over the next three years. Scheduled collections and enacted tax rates for 2025-2027 are as follows: Pretax accounting income for 2024 was $1,350,000, which includes interest revenue of $50,000 from municipal governmental bonds. The enacted tax rate for 2024 is 30%. Requlred: 1. Assuming no differences between accounting income and taxable income other than those described above, prepare the approprlate journal entry to record Case's 2024 income taxes. 2. What is Case's 2024 net income? Complete this question by entering your answers in the tabs below. What is Case's 2024 net income? Note: Enter your answers in whole dollars. Assuming no differences between accounting income and taxable income other than those described above, prepare the appropriate journal entry to record Case's 2024 income taxes. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in whole dollars. Show less Journal entry worksheet Record 2024 income tax benefit from operating loss. Note: Enter debits before credits Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started