Case - FASB Accounting Standards Codification

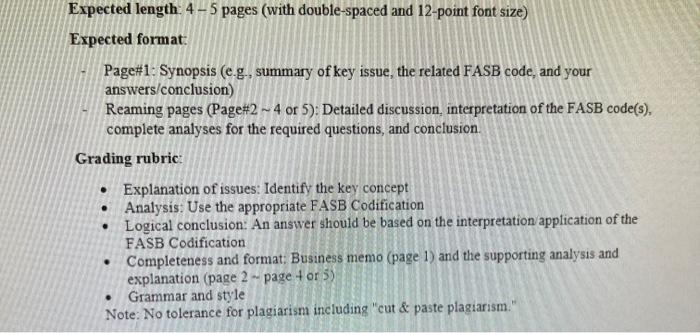

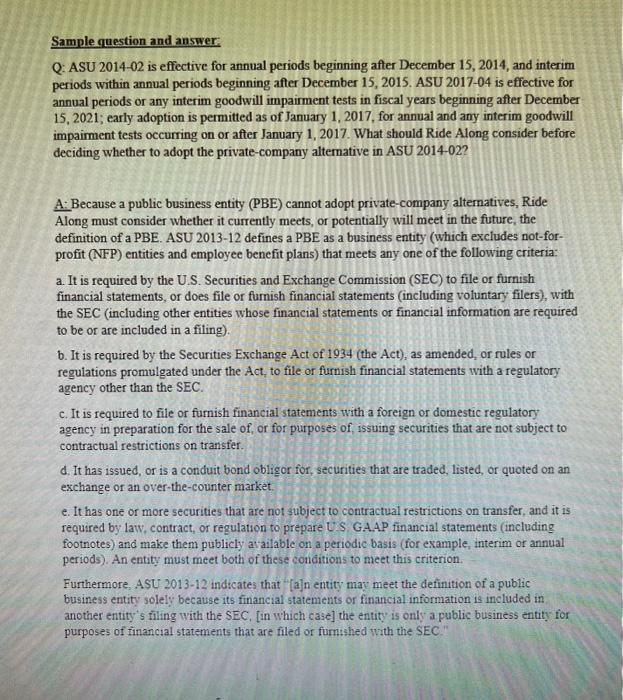

Expected length: 45 pages (with double-spaced and 12-point font size) Expected format: - Page\# 1: Synopsis (e.g., summary of key issue, the related FASB code, and your answers/conclusion) - Reaming pages (Page\#2 4 or 5): Detailed discussion, interpretation of the FASB code(s), complete analyses for the required questions, and conclusion. Grading rubric: - Explanation of issues: Identify the key concept - Analysis: Use the appropriate FASB Codification - Logical conclusion: An answer should be based on the interpretation application of the FASB Codification - Completeness and format: Business memo (page 1) and the supporting analysis and explanation (page 2 - page + or 5 ) - Grammar and style Note: No tolerance for plagiarism including "cut \& paste plagiarism." Sample question and answer: Q: ASU 2014-02 is effective for annual periods beginning after December 15, 2014, and interim periods within annual periods beginning after December 15, 2015. ASU 2017-04 is effective for annual periods or any interim goodwill impairment tests in fiscal years beginning after December 15, 2021; early adoption is permitted as of January 1,2017, for annual and any interim goodwill impairment tests occurring on or after January 1, 2017. What should Ride Along consider before deciding whether to adopt the private-company alternative in ASU 2014-02? A: Because a public business entity (PBE) cannot adopt private-company altematives, Ride Along must consider whether it currently meets, or potentially will meet in the future, the definition of a PBE. ASU 2013-12 defines a PBE as a business entity (which excludes not-forprofit (NFP) entities and employee benefit plans) that meets any one of the following criteria: a. It is required by the U.S. Securities and Exchange Commission (SEC) to file or furnish financial statements, or does file or furnish financial statements (including voluntary filers), with the SEC (including other entities whose financial statements or financial information are required to be or are included in a filing). b. It is required by the Securities Exchange Act of 1934 (the Act), as amended, or rules or regulations promulgated under the Act, to file or furmish financial statements with a regulatory agency other than the SEC. c. It is required to file or furnish financial statements with a foreign or domestic regulatory agency in preparation for the sale of, or for purposes of, issuing securities that are not subject to contractual restrictions on transfer. d. It has issued, or is a conduit bond obligor for, securities that are traded, listed, or quoted on an exchange or an over-the-counter market. e. It has one or more securities that are not subject to contractual restrictions on transfer, and it is required by law, contract, or regulation to prepare U S G.A.AP financial statements (including footnotes) and make them publicly available on a periodic basis (for example, interim or annual periods). An entity must meet both of these conditions to meet this criterion. Furthermore, ASL 2013-12 indicates that " [a]n entity may meet the definition of a public business entity solely because its financial statements or financial information is included in another entity's filing with the SEC, [in which case] the entity is only a public business entity for purposes of financial statements that are filed or furntshed with the SEC. This case analysis aims to discuss the key issue related to the FASB Accounting Standards Codification, the related FASB code, and the conclusion reached through a thorough analysis. The primary issue revolves around the identification and interpretation of the relevant FASB code(s) for a particular accounting scenario. The analysis is grounded in a thorough review of the FASB Accounting Standards Codification, with an emphasis on its proper application. The conclusion is based on the logical interpretation and application of the FASB Codification to resolve the case's accounting issue