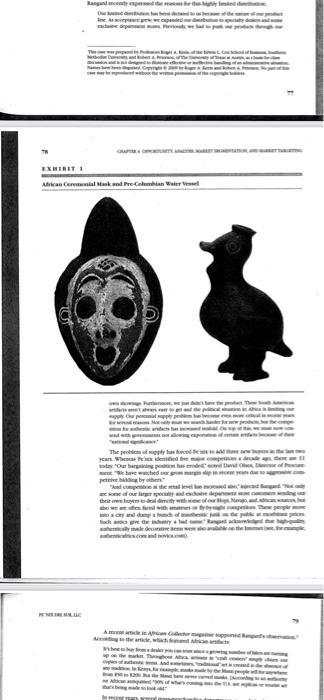

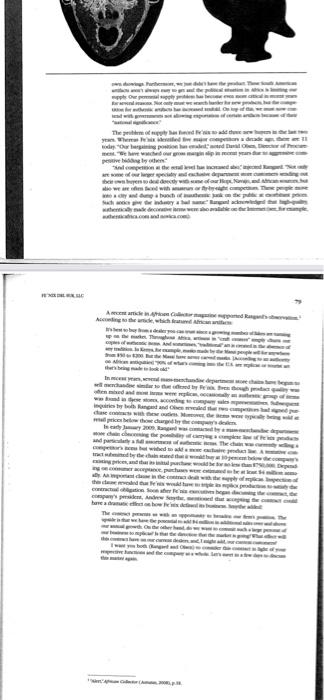

CASE Fenix del Sur, LLC eart - soline There - - - - - - aa Comprar w ag de dreww com che, EXHIBIT Athanaalai Maalaimalariar let T. Wom | African Ceremonial Mask and PreColeman Wales 5 them als ' arata -- Aalaya ca.com r. The pattatu thendra Wewed i - compete www mam care Thoma www. www - www a prathiar at nilai n radar and the mm pan , , Fe'nix del Sur, LLC Fe'nix del Sur, LLC is a limited liability company that sources and sells a wide variety of South American and African artifacts. It is also a major source of southwestern Indian--especially Hopi and Navajo-authentic jewelry and pottery. Although the firm's headquarters is located in Phoenix, Arizona, there are currently branch offices in Los Angeles, Miami, and Boston Fe'nix del Sur (Fe'nix) originated as a trading post operation near Tucson, Arizona, in the early 1900s. Through a series of judicious decisions, the company established itself as one of the more reputable dealers in authentic southwestern jewelry and pottery. Over the years, Fenix gradually expanded its product line to include pre Columbian artifacts from Peru and Venezuela (see Exhibit 1 on page 78) and tribal and burial artifacts from Africa. Through its careful verification of the authenticity of these South American and African artifacts, Fe'nix developed a national reputation as one of the most respected sources of these types of artifacts. In 2001, Fe'nix further expanded its product line to include items that were repli- cas of authentic artifacts. For example, African fertility gods and masks were made by craftspeople who took great pains to produce these items so that only the truly knowledgeable buyer-a collector-would know that they were replicas. Fe'nix now has native craftspeople in Central America, South America, Africa, and the southwest- ern United States who provide these items. Replicas account for only a small portion of total Fenix sales, the company agreed to enter this business only at the prodding of the firm's clients, who desired an expanded line. The replicas have found most favor among gift buyers and individuals looking for decorative items. The company's gross sales are about $25 million and have increased at a relatively constant rate of 20 percent per year over the last decade. Myron Rangard, the firm's national sales manager, attributed the sales increase to the popularity of the com pany's product line and to the expanded distribution of South American and African artifacts: For some reason, our South American and certainly our African artifacts have been gain ing greater acceptance. Two of our department store customers featured examples of our African line in their Christmas catalogs last year I personally think consumer tastes are changing from the modern and abstract to the more concrete, like our products. Fe'nix distributes its products exclusively through specialty dealers (including selected interior designers and decorators), firm-sponsored showings, and a few exclusive department stores. Often, the company is the sole supplier to its clients. Rangard recently expressed the reasons for this highly limited distribution: Our limited distribution has been dictated to us because of the nature of our product line. As acceptance grew, we expanded our distribution to specialty dealers and some exclusive department stores. Previously, we had to push our products through our 78 CHAPTERA OPPORTUNITY ANALYSES, MARKET SEGMENTATION, AND MARKET TARGETING EXHIBIT 1 African Ceremonial Mask and Pre-Columbian Water Vessel own showings. Furthermore, we just didn't have the product. These South American artifacts aren't always casy to get and the political situation in Africa is limiting our supply. Our perennial supply problem has become even more critical in recent years for several reasons. Not only must we search harder for new products, but the compo tition for authentic artifacts has increased tenfold. On top of this, we must now con- tend with governments not allowing exportation of certain artifacts because of their national significance The problem of supply has forced Fenix to add three new buyers in the last two years. Whereas Fe'nix kentitled five major competitors a decade ago, there are 11 today. "Our bargaining position has croded, noted David Olsen, Director of Procure- ment. We have watched our gross margin slip in recent years due to aggressive com- petitive bidding by others." "And competition at the retail level has increased also," injected Rangard. "Not only are some of our larger specialty and exclusive department store customers sending out their own buyers to deal directly with some of our Hopi, Navajo, and African sources, but also we are often faced with amateurs or fly by night competitors. These people move into a city and dump a bunch of inauthentic junk on the public at cxorbitant prices Such antics give the industry a bad name. Rangard acknowledged that high-quality authentically made decorative items were also available on the Internet (sce, for example, authenticafrica.com and novica.com), FE NEX DEL SUR, LLC 79 A recent article in African Collector magazine supported Rangard's observation! According to the article, which featured African artifacts: It's best to buy from a dealer you can trust since a growing number of fakes are turning up on the market. Throughout Africa, artisans in "craft centers simply churn out copies of authentic items, and sometimes, traditional art is created in the absence of any tradition. In Kenya, for example, masks made by the Masal people sell for anywhere from $50 to $200. But the Masal have never carved masks. According to an authority on African antiquities) "90% of what's coming into the U.S. are replicas or tourist att that's being made to look old." In recent years, several mass-merchandise department store chains have begun to sell merchandise similar to that offered by Fe'nix. Even though product quality was often mixed and most items were replicas, occasionally an authentic group of items was found in these stores, according to company sales representatives. Subsequent inquiries by both Rangard and Olsen revealed that two competitors had signed pur chase contracts with these outlets. Moreover, the items were typically being sold at retail prices below those charged by the company's dealers. In carly January 2009, Rangard was contacted by a mass-merchandise department store chain concerning the possibility of carrying a complete line of Fenix products and particularly a full assortment of authentic items. The chain was currently selling a competitor's items but wished to add a more exclusive product line. A tentative con- tract submitted by the chain stated that it would buy at 10 percent below the company's existing prices, and that its initial purchase would be for no less than $750,000. Depend ing on consumer acceptance, purchases were estimated to be at least $1 million annu ally. An important clause in the contract dealt with the supply of replicas. Inspection of this clause revealed that Fe'nix would have to triple its replica production to satisfy the contractual obligation. Soon after Fenix executives began discussing the contract, the company's president, Andrew Smythe, mentioned that accepting the contract could have a dramatic effect on how Fe'nix defined its business. Smythe added The contract presents us with an opportunity to broaden our firm's position. The upside is that we have the potential to add 54 million in additional sales over and above our annual growth. On the other hand, do we want to commit such a large percent of our business to replicas? Is that the direction that the market is going? What efect will this contract have on our current dealers, and, I might add, our current customers! I want you both (Rangard and Olsen) to consider this contract in light of your respective functions and the company as a whole. Let's meet in a few days to discuss this matter again. Alert African Collector (Autumn, 2008).p.18. Fe'nix del Sur, LLC Fe'nix del Sur, LLC is a limited liability company that sources and sells a wide variety of South American and African artifacts. It is also a major source of southwestern Indian--especially Hopi and Navajo-authentic jewelry and pottery. Although the firm's headquarters is located in Phoenix, Arizona, there are currently branch offices in Los Angeles, Miami, and Boston. Fe'nix del Su (Fe'nix) originated as a trading post operation near Tucson, Arizona, in the early 1900s. Through a series of judicious decisions, the company established itself as one of the more reputable dealers in authentic southwestern jewelry and pottery. Over the years, Fenix gradually expanded its product line to include pre- Columbian artifacts from Peru and Venezuela (see Exhibit 1 on page 78) and tribal and burial artifacts from Africa. Through its careful verification of the authenticity of these South American and African artifacts, Fe'nix developed a national reputation as one of the most respected sources of these types of artifacts. In 2001, Fe'nix further expanded its product line to include items that were repli- cas of authentic artifacts, For example, African fertility gods and masks were made by craftspeople who took great pains to produce these items so that only the truly knowledgeable buyer--a collector--would know that they were replicas. Fe'nix now has native craftspeople in Central America, South America, Africa, and the southwest- ern United States who provide these items. Replicas account for only a small portion of total Fe'nix sales; the company agreed to enter this business only at the prodding of the firm's clients, who desired an expanded line. The replicas have found most favor among gift buyers and individuals looking for decorative items. The company's gross sales are about $25 million and have increased at a relatively constant rate of 20 percent per year over the last decade. Myron Rangard, the firm's national sales manager, attributed the sales increase to the popularity of the com- pany's product line and to the expanded distribution of South American and African artifacts: - Rakan Alhuwal....docx RMPs Questions.docx InstallL.DBPackag. S V ARAW For some reason, our South American and certainly our African artifacts have been gain- ing greater acceptance. Two of our department store customers featured examples of our African line in their Christmas catalogs last year. I personally think consumer tastes are changing from the modern and abstract to the more concrete, like our products. Fe'nix distributes its products exclusively through specialty dealers (including selected interior designers and decorators), firm-sponsored showings, and a few exclusive department stores. Often, the company is the sole supplier to its clients. Rangard recently expressed the reasons for this highly limited distribution: Our limited distribution has been dictated to us because of the nature of our product line. As acceptance grew, we expanded our distribution to specialty dealers and some exclusive department stores. Previously, we had to push our products through our This case was prepared by Professors Roger A. Kerin, of the Edwin L. Cox School of Business, Southern Methodist University, and Robert A. Peterson, of The University of Texas at Austin, as a basis for class discussion and is not designed to illustrate effective or incffective handling of an administrative situation Names have been disguined. Copyright 2009 by Roger A. Kerin and Robert A. Peterson. No part of this case may be reproduced without the written permission of the copyright holders, 77 own showings. Furthermore, we just didn't have the product. These South American artifacts aren't always easy to get and the political situation in Africa is limiting our supply. Our perennial supply problem has become even more critical in recent years for several reasons. Not only must we search harder for new products, but the compe. tition for authentic artifacts has increased tenfold. On top of this, we must now con- tend with governments not allowing exportation of certain artifacts because of their "national significance." The problem of supply has forced Fe'nix to add three new buyers in the last two years. Whereas Fe'nix identified five major competitors a decade ago, there are 11 today. "Our bargaining position has eroded," noted David Olsen, Director of Procure- ment. "We have watched our gross margin slip in recent years due to aggressive com- petitive bidding by others." "And competition at the retail level has increased also," injected Rangard. "Not only are some of our larger specialty and exclusive department store customers sending out their own buyers to deal directly with some of our Hopi, Navajo, and African sources, but also we are often faced with amateurs or fly-by-night competitors. These people move into a city and dump a bunch of inauthentic junk on the public at exorbitant prices. Such antics give the industry a bad name." Rangard acknowledged that high-quality, authentically made decorative items were also available on the Internet (sce, for example, authenticafrica.com and novica.com) LLC 79 A recent article in African Collector magazine supported Rangard's observation. According to the article, which featured African artifacts: It's best to buy from a dealer you can trust since a growing number of fakes are turning up on the market. Throughout Africa, artisans in "craft centers" simply churn out copies of authentic items. And sometimes, "traditional art is created in the absence of any tradition. In Kenya, for example, masks made by the Masai people sell for anywhere from $50 to $200. But the Masai have never carved masks. (According to an authority on African antiquities) "90% of what's coming into the U.S. are replicas or tourist art that's being made to look old." In recent years, several mass- merchandise department store chains have begun to sell merchandise similar to that offered by Fe'nix. Even though product quality was often mixed and most items were replicas, occasionally an authentic group of items was found in these stores, according to company sales representatives. Subsequent inquiries by both Rangard and Olsen revealed that two competitors had signed pur- chase contracts with these outlets. Moreover, the items were typically being sold at retail prices below those charged by the company's dealers. In early January 2009, Rangard was contacted by a mass-merchandise department store chain concerning the possibility of carrying a complete line of Fe'nix products and particularly a full assortment of authentic items. The chain was currently selling a competitor's items but wished to add a more exclusive product line. A tentative con- tract submitted by the chain stated that it would buy at 10 percent below the company's existing prices, and that its initial purchase would be for no less than $750,000. Depend- ing on consumer acceptance, purchases were estimated to be at least $4 million annu- ally. An important clause in the contract dealt with the supply of replicas. Inspection of this clause revealed that Fe'nix would have to triple its replica production to satisfy the contractual obligation. Soon after Fe'nix executives began discussing the contract, the company's president, Andrew Smythe, mentioned that accepting the contract could have a dramatic effect on how Fe'nix defined its business. Smythe added: The contract presents us with an opportunity to broaden our firm's position. The upside is that we have the potential to add $4 million in additional sales over and above our annual growth. On the other hand, do we want to commit such a large percent of our business to replicas? Is that the direction that the market is going? What effect will this contract have on our current dealers, and, I might add, our current customers? I want you both (Rangard and Olsen) to consider this contract in light of your respective functions and the company as a whole. Let's meet in a few days to discuss this matter again. CASE Fenix del Sur, LLC eart - soline There - - - - - - aa Comprar w ag de dreww com che, EXHIBIT Athanaalai Maalaimalariar let T. Wom | African Ceremonial Mask and PreColeman Wales 5 them als ' arata -- Aalaya ca.com r. The pattatu thendra Wewed i - compete www mam care Thoma www. www - www a prathiar at nilai n radar and the mm pan , , Fe'nix del Sur, LLC Fe'nix del Sur, LLC is a limited liability company that sources and sells a wide variety of South American and African artifacts. It is also a major source of southwestern Indian--especially Hopi and Navajo-authentic jewelry and pottery. Although the firm's headquarters is located in Phoenix, Arizona, there are currently branch offices in Los Angeles, Miami, and Boston Fe'nix del Sur (Fe'nix) originated as a trading post operation near Tucson, Arizona, in the early 1900s. Through a series of judicious decisions, the company established itself as one of the more reputable dealers in authentic southwestern jewelry and pottery. Over the years, Fenix gradually expanded its product line to include pre Columbian artifacts from Peru and Venezuela (see Exhibit 1 on page 78) and tribal and burial artifacts from Africa. Through its careful verification of the authenticity of these South American and African artifacts, Fe'nix developed a national reputation as one of the most respected sources of these types of artifacts. In 2001, Fe'nix further expanded its product line to include items that were repli- cas of authentic artifacts. For example, African fertility gods and masks were made by craftspeople who took great pains to produce these items so that only the truly knowledgeable buyer-a collector-would know that they were replicas. Fe'nix now has native craftspeople in Central America, South America, Africa, and the southwest- ern United States who provide these items. Replicas account for only a small portion of total Fenix sales, the company agreed to enter this business only at the prodding of the firm's clients, who desired an expanded line. The replicas have found most favor among gift buyers and individuals looking for decorative items. The company's gross sales are about $25 million and have increased at a relatively constant rate of 20 percent per year over the last decade. Myron Rangard, the firm's national sales manager, attributed the sales increase to the popularity of the com pany's product line and to the expanded distribution of South American and African artifacts: For some reason, our South American and certainly our African artifacts have been gain ing greater acceptance. Two of our department store customers featured examples of our African line in their Christmas catalogs last year I personally think consumer tastes are changing from the modern and abstract to the more concrete, like our products. Fe'nix distributes its products exclusively through specialty dealers (including selected interior designers and decorators), firm-sponsored showings, and a few exclusive department stores. Often, the company is the sole supplier to its clients. Rangard recently expressed the reasons for this highly limited distribution: Our limited distribution has been dictated to us because of the nature of our product line. As acceptance grew, we expanded our distribution to specialty dealers and some exclusive department stores. Previously, we had to push our products through our 78 CHAPTERA OPPORTUNITY ANALYSES, MARKET SEGMENTATION, AND MARKET TARGETING EXHIBIT 1 African Ceremonial Mask and Pre-Columbian Water Vessel own showings. Furthermore, we just didn't have the product. These South American artifacts aren't always casy to get and the political situation in Africa is limiting our supply. Our perennial supply problem has become even more critical in recent years for several reasons. Not only must we search harder for new products, but the compo tition for authentic artifacts has increased tenfold. On top of this, we must now con- tend with governments not allowing exportation of certain artifacts because of their national significance The problem of supply has forced Fenix to add three new buyers in the last two years. Whereas Fe'nix kentitled five major competitors a decade ago, there are 11 today. "Our bargaining position has croded, noted David Olsen, Director of Procure- ment. We have watched our gross margin slip in recent years due to aggressive com- petitive bidding by others." "And competition at the retail level has increased also," injected Rangard. "Not only are some of our larger specialty and exclusive department store customers sending out their own buyers to deal directly with some of our Hopi, Navajo, and African sources, but also we are often faced with amateurs or fly by night competitors. These people move into a city and dump a bunch of inauthentic junk on the public at cxorbitant prices Such antics give the industry a bad name. Rangard acknowledged that high-quality authentically made decorative items were also available on the Internet (sce, for example, authenticafrica.com and novica.com), FE NEX DEL SUR, LLC 79 A recent article in African Collector magazine supported Rangard's observation! According to the article, which featured African artifacts: It's best to buy from a dealer you can trust since a growing number of fakes are turning up on the market. Throughout Africa, artisans in "craft centers simply churn out copies of authentic items, and sometimes, traditional art is created in the absence of any tradition. In Kenya, for example, masks made by the Masal people sell for anywhere from $50 to $200. But the Masal have never carved masks. According to an authority on African antiquities) "90% of what's coming into the U.S. are replicas or tourist att that's being made to look old." In recent years, several mass-merchandise department store chains have begun to sell merchandise similar to that offered by Fe'nix. Even though product quality was often mixed and most items were replicas, occasionally an authentic group of items was found in these stores, according to company sales representatives. Subsequent inquiries by both Rangard and Olsen revealed that two competitors had signed pur chase contracts with these outlets. Moreover, the items were typically being sold at retail prices below those charged by the company's dealers. In carly January 2009, Rangard was contacted by a mass-merchandise department store chain concerning the possibility of carrying a complete line of Fenix products and particularly a full assortment of authentic items. The chain was currently selling a competitor's items but wished to add a more exclusive product line. A tentative con- tract submitted by the chain stated that it would buy at 10 percent below the company's existing prices, and that its initial purchase would be for no less than $750,000. Depend ing on consumer acceptance, purchases were estimated to be at least $1 million annu ally. An important clause in the contract dealt with the supply of replicas. Inspection of this clause revealed that Fe'nix would have to triple its replica production to satisfy the contractual obligation. Soon after Fenix executives began discussing the contract, the company's president, Andrew Smythe, mentioned that accepting the contract could have a dramatic effect on how Fe'nix defined its business. Smythe added The contract presents us with an opportunity to broaden our firm's position. The upside is that we have the potential to add 54 million in additional sales over and above our annual growth. On the other hand, do we want to commit such a large percent of our business to replicas? Is that the direction that the market is going? What efect will this contract have on our current dealers, and, I might add, our current customers! I want you both (Rangard and Olsen) to consider this contract in light of your respective functions and the company as a whole. Let's meet in a few days to discuss this matter again. Alert African Collector (Autumn, 2008).p.18. Fe'nix del Sur, LLC Fe'nix del Sur, LLC is a limited liability company that sources and sells a wide variety of South American and African artifacts. It is also a major source of southwestern Indian--especially Hopi and Navajo-authentic jewelry and pottery. Although the firm's headquarters is located in Phoenix, Arizona, there are currently branch offices in Los Angeles, Miami, and Boston. Fe'nix del Su (Fe'nix) originated as a trading post operation near Tucson, Arizona, in the early 1900s. Through a series of judicious decisions, the company established itself as one of the more reputable dealers in authentic southwestern jewelry and pottery. Over the years, Fenix gradually expanded its product line to include pre- Columbian artifacts from Peru and Venezuela (see Exhibit 1 on page 78) and tribal and burial artifacts from Africa. Through its careful verification of the authenticity of these South American and African artifacts, Fe'nix developed a national reputation as one of the most respected sources of these types of artifacts. In 2001, Fe'nix further expanded its product line to include items that were repli- cas of authentic artifacts, For example, African fertility gods and masks were made by craftspeople who took great pains to produce these items so that only the truly knowledgeable buyer--a collector--would know that they were replicas. Fe'nix now has native craftspeople in Central America, South America, Africa, and the southwest- ern United States who provide these items. Replicas account for only a small portion of total Fe'nix sales; the company agreed to enter this business only at the prodding of the firm's clients, who desired an expanded line. The replicas have found most favor among gift buyers and individuals looking for decorative items. The company's gross sales are about $25 million and have increased at a relatively constant rate of 20 percent per year over the last decade. Myron Rangard, the firm's national sales manager, attributed the sales increase to the popularity of the com- pany's product line and to the expanded distribution of South American and African artifacts: - Rakan Alhuwal....docx RMPs Questions.docx InstallL.DBPackag. S V ARAW For some reason, our South American and certainly our African artifacts have been gain- ing greater acceptance. Two of our department store customers featured examples of our African line in their Christmas catalogs last year. I personally think consumer tastes are changing from the modern and abstract to the more concrete, like our products. Fe'nix distributes its products exclusively through specialty dealers (including selected interior designers and decorators), firm-sponsored showings, and a few exclusive department stores. Often, the company is the sole supplier to its clients. Rangard recently expressed the reasons for this highly limited distribution: Our limited distribution has been dictated to us because of the nature of our product line. As acceptance grew, we expanded our distribution to specialty dealers and some exclusive department stores. Previously, we had to push our products through our This case was prepared by Professors Roger A. Kerin, of the Edwin L. Cox School of Business, Southern Methodist University, and Robert A. Peterson, of The University of Texas at Austin, as a basis for class discussion and is not designed to illustrate effective or incffective handling of an administrative situation Names have been disguined. Copyright 2009 by Roger A. Kerin and Robert A. Peterson. No part of this case may be reproduced without the written permission of the copyright holders, 77 own showings. Furthermore, we just didn't have the product. These South American artifacts aren't always easy to get and the political situation in Africa is limiting our supply. Our perennial supply problem has become even more critical in recent years for several reasons. Not only must we search harder for new products, but the compe. tition for authentic artifacts has increased tenfold. On top of this, we must now con- tend with governments not allowing exportation of certain artifacts because of their "national significance." The problem of supply has forced Fe'nix to add three new buyers in the last two years. Whereas Fe'nix identified five major competitors a decade ago, there are 11 today. "Our bargaining position has eroded," noted David Olsen, Director of Procure- ment. "We have watched our gross margin slip in recent years due to aggressive com- petitive bidding by others." "And competition at the retail level has increased also," injected Rangard. "Not only are some of our larger specialty and exclusive department store customers sending out their own buyers to deal directly with some of our Hopi, Navajo, and African sources, but also we are often faced with amateurs or fly-by-night competitors. These people move into a city and dump a bunch of inauthentic junk on the public at exorbitant prices. Such antics give the industry a bad name." Rangard acknowledged that high-quality, authentically made decorative items were also available on the Internet (sce, for example, authenticafrica.com and novica.com) LLC 79 A recent article in African Collector magazine supported Rangard's observation. According to the article, which featured African artifacts: It's best to buy from a dealer you can trust since a growing number of fakes are turning up on the market. Throughout Africa, artisans in "craft centers" simply churn out copies of authentic items. And sometimes, "traditional art is created in the absence of any tradition. In Kenya, for example, masks made by the Masai people sell for anywhere from $50 to $200. But the Masai have never carved masks. (According to an authority on African antiquities) "90% of what's coming into the U.S. are replicas or tourist art that's being made to look old." In recent years, several mass- merchandise department store chains have begun to sell merchandise similar to that offered by Fe'nix. Even though product quality was often mixed and most items were replicas, occasionally an authentic group of items was found in these stores, according to company sales representatives. Subsequent inquiries by both Rangard and Olsen revealed that two competitors had signed pur- chase contracts with these outlets. Moreover, the items were typically being sold at retail prices below those charged by the company's dealers. In early January 2009, Rangard was contacted by a mass-merchandise department store chain concerning the possibility of carrying a complete line of Fe'nix products and particularly a full assortment of authentic items. The chain was currently selling a competitor's items but wished to add a more exclusive product line. A tentative con- tract submitted by the chain stated that it would buy at 10 percent below the company's existing prices, and that its initial purchase would be for no less than $750,000. Depend- ing on consumer acceptance, purchases were estimated to be at least $4 million annu- ally. An important clause in the contract dealt with the supply of replicas. Inspection of this clause revealed that Fe'nix would have to triple its replica production to satisfy the contractual obligation. Soon after Fe'nix executives began discussing the contract, the company's president, Andrew Smythe, mentioned that accepting the contract could have a dramatic effect on how Fe'nix defined its business. Smythe added: The contract presents us with an opportunity to broaden our firm's position. The upside is that we have the potential to add $4 million in additional sales over and above our annual growth. On the other hand, do we want to commit such a large percent of our business to replicas? Is that the direction that the market is going? What effect will this contract have on our current dealers, and, I might add, our current customers? I want you both (Rangard and Olsen) to consider this contract in light of your respective functions and the company as a whole. Let's meet in a few days to discuss this matter again