Answered step by step

Verified Expert Solution

Question

1 Approved Answer

case for accounting please help Read the following case and, in your own words, explain whether Furance Company is a variable interest entity (VIE). If

case for accounting please help

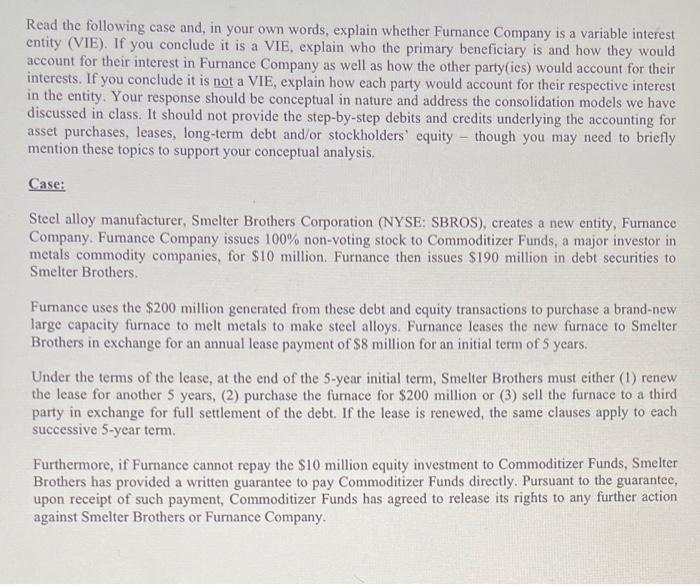

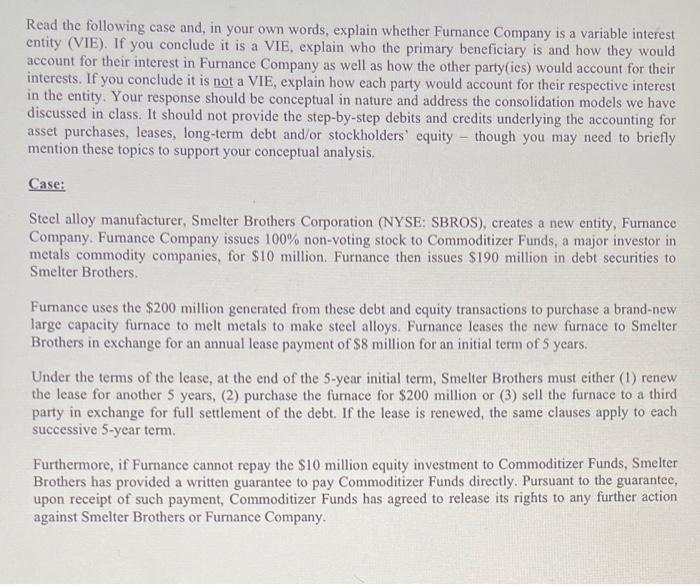

Read the following case and, in your own words, explain whether Furance Company is a variable interest entity (VIE). If you conclude it is a VIE, explain who the primary beneficiary is and how they would account for their interest in Furnance Company as well as how the other party(ies) would account for their interests. If you conclude it is not a VIE, explain how each party would account for their respective interest in the entity. Your response should be conceptual in nature and address the consolidation models we have discussed in class. It should not provide the step-by-step debits and credits underlying the accounting for asset purchases, leases, long-term debt and/or stockholders' equity - though you may need to briefly mention these topics to support your conceptual analysis. Case: Steel alloy manufacturer, Smelter Brothers Corporation (NYSE: SBROS), creates a new entity, Furnance Company. Fumance Company issues 100% non-voting stock to Commoditizer Funds, a major investor in metals commodity companies, for $10 million. Furnance then issues $190 million in debt securities to Smelter Brothers Furnance uses the $200 million generated from these debt and equity transactions to purchase a brand-new large capacity furnace to melt metals to make steel alloys. Furnance leases the new furnace to Smelter Brothers in exchange for an annual lease payment of $8 million for an initial term of 5 years, Under the terms of the lease, at the end of the 5-year initial term, Smelter Brothers must either (1) renew the lease for another 5 years, (2) purchase the furnace for $200 million or (3) sell the furnace to a third party in exchange for full settlement of the debt. If the lease is renewed, the same clauses apply to each successive 5-year term. Furthermore, if Furnance cannot repay the $10 million equity investment to Commoditizer Funds, Smelter Brothers has provided a written guarantee to pay Commoditizer Funds directly. Pursuant to the guarantee, upon receipt of such payment, Commoditizer Funds has agreed to release its rights to any further action against Smelter Brothers or Furnance Company. Read the following case and, in your own words, explain whether Furance Company is a variable interest entity (VIE). If you conclude it is a VIE, explain who the primary beneficiary is and how they would account for their interest in Furnance Company as well as how the other party(ies) would account for their interests. If you conclude it is not a VIE, explain how each party would account for their respective interest in the entity. Your response should be conceptual in nature and address the consolidation models we have discussed in class. It should not provide the step-by-step debits and credits underlying the accounting for asset purchases, leases, long-term debt and/or stockholders' equity - though you may need to briefly mention these topics to support your conceptual analysis. Case: Steel alloy manufacturer, Smelter Brothers Corporation (NYSE: SBROS), creates a new entity, Furnance Company. Fumance Company issues 100% non-voting stock to Commoditizer Funds, a major investor in metals commodity companies, for $10 million. Furnance then issues $190 million in debt securities to Smelter Brothers Furnance uses the $200 million generated from these debt and equity transactions to purchase a brand-new large capacity furnace to melt metals to make steel alloys. Furnance leases the new furnace to Smelter Brothers in exchange for an annual lease payment of $8 million for an initial term of 5 years, Under the terms of the lease, at the end of the 5-year initial term, Smelter Brothers must either (1) renew the lease for another 5 years, (2) purchase the furnace for $200 million or (3) sell the furnace to a third party in exchange for full settlement of the debt. If the lease is renewed, the same clauses apply to each successive 5-year term. Furthermore, if Furnance cannot repay the $10 million equity investment to Commoditizer Funds, Smelter Brothers has provided a written guarantee to pay Commoditizer Funds directly. Pursuant to the guarantee, upon receipt of such payment, Commoditizer Funds has agreed to release its rights to any further action against Smelter Brothers or Furnance Company

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started