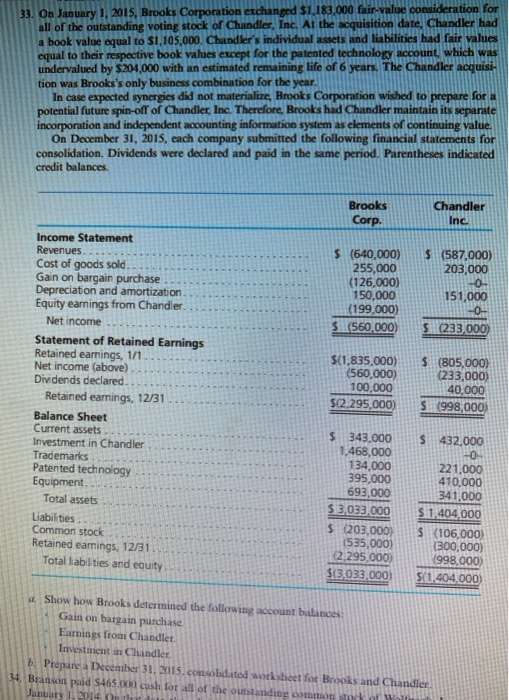

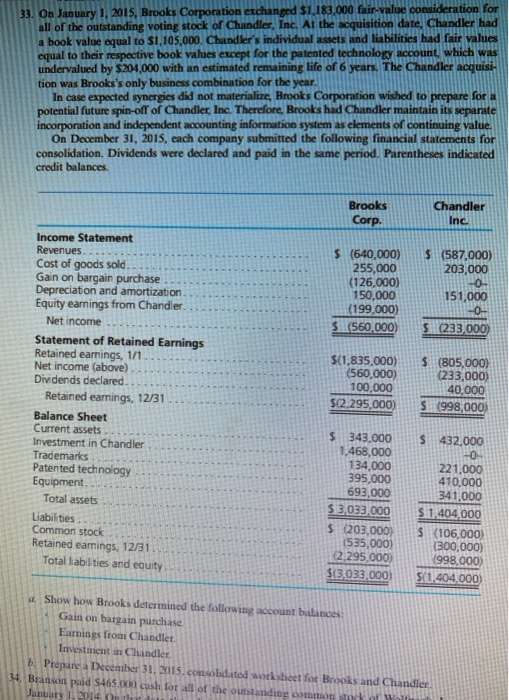

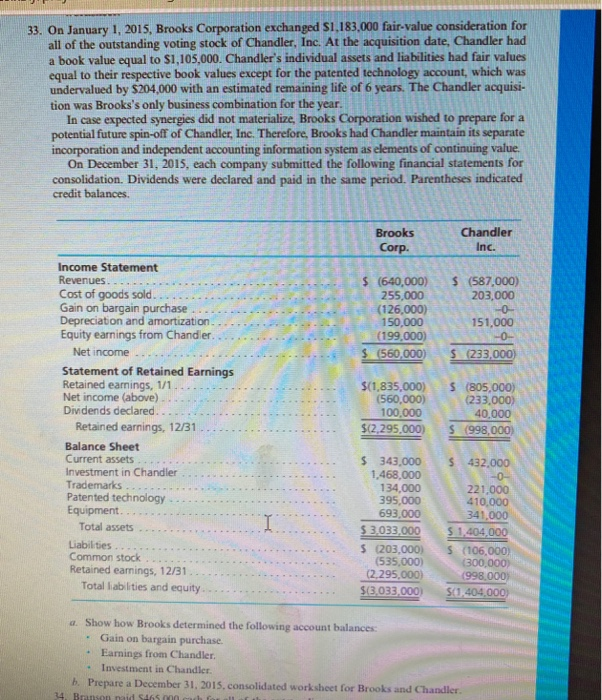

33. On January 1, 2015, Brooks Corporation exchanged $1,183,000 fair-value consideration for all of the outstanding voting stock of Chandler, Inc. At the acquisition date, Chandler had a book value equal to $1,105,000. Chandler's individual assets and liabilities had fair values equal to their respective book values except for the patented technology account, which was undervalued by $204,000 with an estimated remaining life of 6 years. The Chandler acquisi- tion was Brooks's only business combination for the year. In case expected synergies did not materialize, Brooks Corporation wished to prepare for a potential future spin-off of Chandler, Inc. Therefore, Brooks had Chandler maintain its separate incorporation and independent accounting information system as elements of continuing value. On December 31, 2015, each company submitted the following financial statements for consolidation. Dividends were declared and paid in the same period. Parentheses indicated credit balances Chandler Brooks Corp. Inc $ (640,000) 255,000 (126,000) 150,000 (199,000) $ (560,000 $ (587,000) 203,000 -O- 151,000 -0- $ (233.000 Income Statement Revenues Cost of goods sold Gain on bargain purchase Depreciation and amortization Equity earnings from Chandler Net income Statement of Retained Earnings Retained earnings, 1/1 Net income (above) Dividends declared Retained earnings, 12/31 Balance Sheet Current assets Investment in Chandler Trademarks Patented technology Equipment Total assets Liabilities Common stock Retained earnings, 12/31 Total abilities and equity $(1,835,000) (560,000) 100,000 $(2.295,000) $ (805,000) (233,000) 40,000 S (998,000 $ 343,000 1,468,000 134,000 395,000 693,000 $ 3,033,000 $ 1203,000 (535,000) (2.295.000) $13.033.000 S 432.000 -0- 221.000 410,000 341,000 51,404,000 $ (106,000) (B300,000) 1998,000 $(1.404,000 4. Show how Brooks determined the following account balances Gain on bargain purchase Earnings from Chandler. Investment in Chindler b. Prepare a December 31, 2015.consolidated worksheet for Brooks and Chandler 14. Branson paid $465.000 cash for all of the outstanding common sok January 1, 2014 33. On January 1, 2015, Brooks Corporation exchanged S1,183,000 fair-value consideration for all of the outstanding voting stock of Chandler, Inc. At the acquisition date, Chandler had a book value equal to $1,105,000. Chandler's individual assets and liabilities had fair values equal to their respective book values except for the patented technology account, which was undervalued by $204,000 with an estimated remaining life of 6 years. The Chandler acquisi- tion was Brooks's only business combination for the year. In case expected synergies did not materialize, Brooks Corporation wished to prepare for a potential future spin-off of Chandler, Inc. Therefore, Brooks had Chandler maintain its separate incorporation and independent accounting information system as elements of continuing value. On December 31, 2015, each company submitted the following financial statements for consolidation. Dividends were declared and paid in the same period. Parentheses indicated credit balances. Brooks Corp. Chandler Inc. $ (640,000) 255,000 (126,000) 150,000 (199,000) $ (560,000) $(587,000) 203,000 - 151,000 -0 5 233,000 Income Statement Revenues Cost of goods sold Gain on bargain purchase Depreciation and amortization Equity earnings from Chandler. Net income Statement of Retained Earnings Retained earnings, 1/1 Net income (above) Dividends declared. Retained earnings, 12/31 Balance Sheet Current assets Investment in Chandler Trademarks Patented technology Equipment Total assets Liabilities. Common stock Retained earnings, 12/31 Total liabilities and equity $(1,835,000) (560,000) 100,000 $12,295.000) 5 (805,000) (233,000) 40.000 S (998,000 I $ 343.000 1,468,000 134,000 395,000 693,000 $ 3,033,000 5 (203.000) (535.000) (2.295,000) $(3,033,000 $ 432.000 -0 221,000 410.000 341,000 $ 1,404,000 5 (106,000 (300,000 1998,000 $(1,404,000 a. Show how Brooks determined the following account balances Gain on bargain purchase Earnings from Chandler, Investment in Chandler b. Prepare a December 31, 2015, consolidated worksheet for Brooks and Chandler, 34 Brunson naid S465