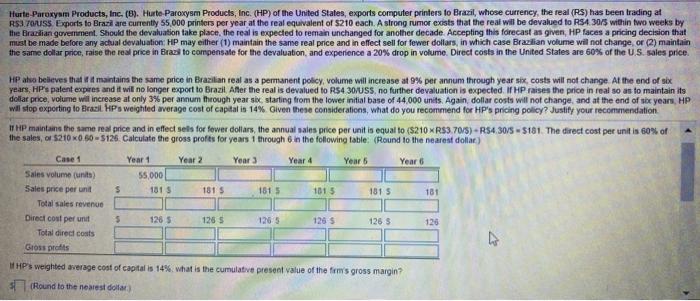

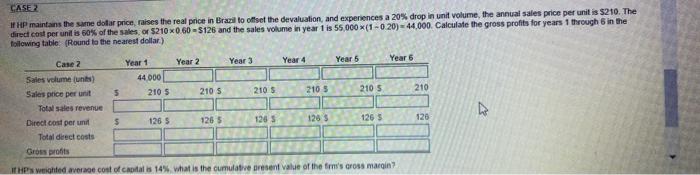

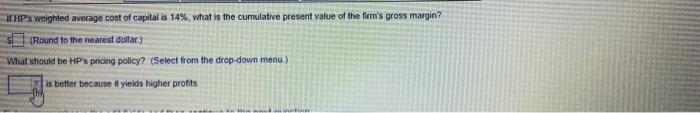

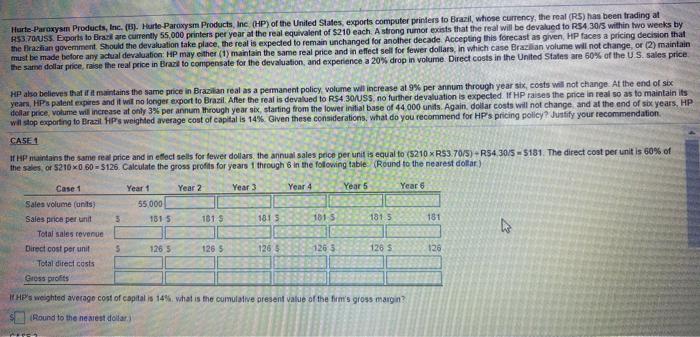

CASE I HP maintains the same dollar price raises the real price in Brazil to offset the devaluation, and experiences a 20% drop in unit volume, the annual sales price per unit is $210. The direct cost per unit is 60% of the sales of $210x0.60 - $126 and the sales volume in year 1 is 55,000 X (1-020) = 44,000 Calculate the gross profits for years through in the following table (Round to the nearest dollar) Year 2 Year 3 Year 4 Year 5 Year 5 Year 1 44000 210 5 5 210 5 210 $ 210 210 5 210 5 Case 2 Sales volume units) Sales price per unit Total sales revenue Direct cost per und Total direct costs Gross profits $ 126 5 126 5 129 1285 1265 126 Highted average cost of all is 14% what is the cumulative resent Value of the fri's Gross margin HPs weighted average cost of capital is 14%, what is the cumulative present value of the firm's gross margin? $(Round to the nearest dollar) What should be MP's pricing policy? (Select from the drop-down menu) is better because yields higher profits Hurte Paroxysm Products, Inc. (135. Hurte Paroxysm Products, Inc. (HP) of the United States, exports computer printers to Brazil, whose currency, the real (RS) has been trading at R53.70USS Exports to Brasil are currently 55.000 printers per year at the real equivalent of $210 each. A strong rumor exists that the real will be devalued to R54 30/3 within two weeks by the Brazilian government should the devaluation take place, the real is expected to remain unchanged for another decade. Accepting this forecast as given, HP faces a pricing decision that must be made before any actual devaluation HP may either (1) maintain the same real price and in effect sell for fewer dollars, in which case Brazilian volume will not change, or (2) maintain the same dollar price, raise the real price in Brazil to compensate for the devaluation, and experience a 20% drop in volume Direct costs in the United States are 60% of the US. sales price HP also believes that it maintains the same price in Brazilian real as a permanent policy, volume will increase at 9% per annum through year six costs will not change. At the end of six years, HPs patent expures and it will no longer export to Brazil After the real is devalued to R54 30/USS, no further devaluation is expected. If HP raises the price in real so as to maintain its dollar price, volume will increase at only 3% per annum through year six, starting from the lower initial base of 44.000 units. Again, dollar costs will not change and at the end of six years, HP will stop exporting to Brazil HP's weighted average cost of capital is 14%. Given these considerations, what do you recommend for HP's pricing policy? Justify your recommendation CA561 #HP maintains the same real price and in effect sells for fewer dollars, the annual sales price per unit is equal to (S210 XR53 70/3) - R$4.3075 - $181. The direct cost per unit is 60% of the sale or 52100 60 = $126. Calculate the gross profits for years through 8 in the following table (Round to the nearest dollar) Case 1 Yeart Year 2 Year 3 Year 4 Year 5 Year 6 Sales volume (units) 55 000 Sales prica per unit 3 1815 1815 1813 1815 1815 181 Total sales revenue Direct cost per unit 5 126 5 126 5 1263 1263 1263 126 Total direct costs Gross profits HP's weighted average cost of capitalis 14% what is the cumulative present value of the firm's gross margin? N Round to the nearest dollar AL