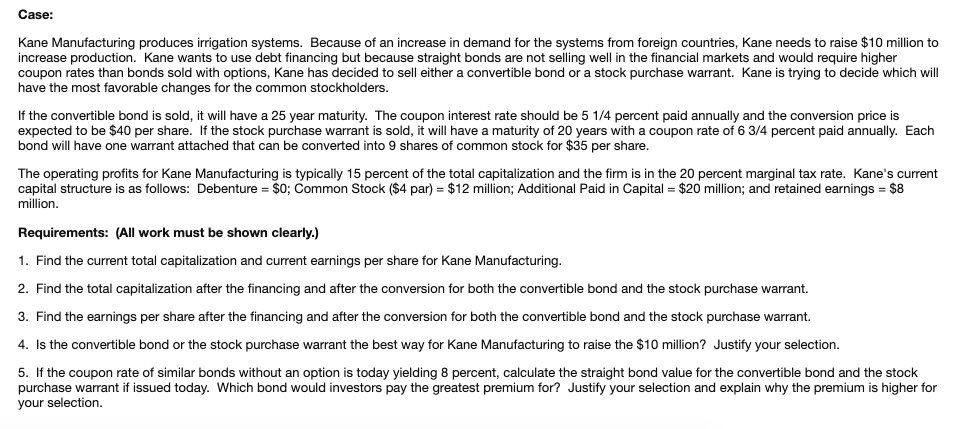

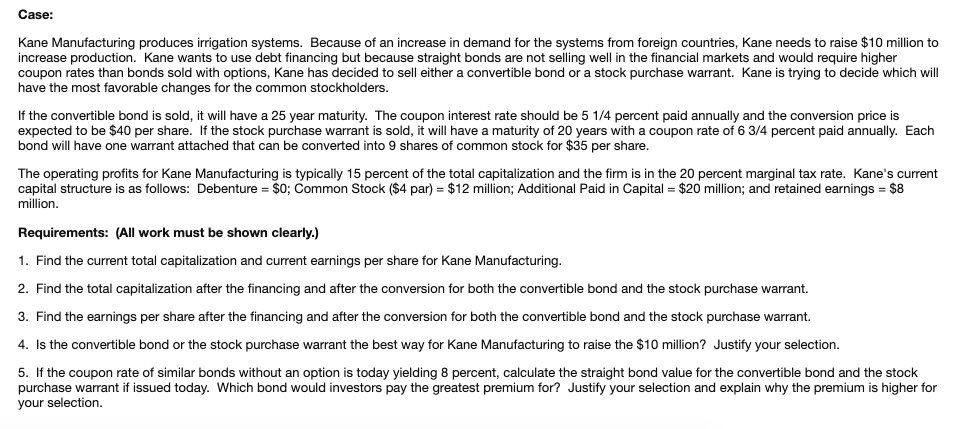

Case: Kane Manufacturing produces irrigation systems. Because of an increase in demand for the systems from foreign countries, Kane needs to raise $10 million to increase production. Kane wants to use debt financing but because straight bonds are not selling well in the financial markets and would require higher coupon rates than bonds sold with options, Kane has decided to sell either a convertible bond or a stock purchase warrant. Kane is trying to decide which will have the most favorable changes for the common stockholders. If the convertible bond is sold, it will have a 25 year maturity. The coupon interest rate should be 5 1/4 percent paid annually and the conversion price is expected to be $40 per share. If the stock purchase warrant is sold, it will have a maturity of 20 years with a coupon rate of 6 3/4 percent paid annually. Each bond will have one warrant attached that can be converted into 9 shares of common stock for $35 per share. The operating profits for Kane Manufacturing is typically 15 percent of the total capitalization and the firm is in the 20 percent marginal tax rate. Kane's current capital structure is as follows: Debenture = $0; Common Stock ($4 par) = $12 million; Additional Paid in Capital = $20 million; and retained earnings = $8 million. Requirements: (All work must be shown clearly.) 1. Find the current total capitalization and current earnings per share for Kane Manufacturing. 2. Find the total capitalization after the financing and after the conversion for both the convertible bond and the stock purchase warrant. 3. Find the earnings per share after the financing and after the conversion for both the convertible bond and the stock purchase warrant. 4. Is the convertible bond or the stock purchase warrant the best way for Kane Manufacturing to raise the $10 million? Justify your selection. 5. If the coupon rate of similar bonds without an option is today yielding 8 percent, calculate the straight bond value for the convertible bond and the stock purchase warrant if issued today. Which bond would investors pay the greatest premium for? Justify your selection and explain why the premium is higher for your selection. Case: Kane Manufacturing produces irrigation systems. Because of an increase in demand for the systems from foreign countries, Kane needs to raise $10 million to increase production. Kane wants to use debt financing but because straight bonds are not selling well in the financial markets and would require higher coupon rates than bonds sold with options, Kane has decided to sell either a convertible bond or a stock purchase warrant. Kane is trying to decide which will have the most favorable changes for the common stockholders. If the convertible bond is sold, it will have a 25 year maturity. The coupon interest rate should be 5 1/4 percent paid annually and the conversion price is expected to be $40 per share. If the stock purchase warrant is sold, it will have a maturity of 20 years with a coupon rate of 6 3/4 percent paid annually. Each bond will have one warrant attached that can be converted into 9 shares of common stock for $35 per share. The operating profits for Kane Manufacturing is typically 15 percent of the total capitalization and the firm is in the 20 percent marginal tax rate. Kane's current capital structure is as follows: Debenture = $0; Common Stock ($4 par) = $12 million; Additional Paid in Capital = $20 million; and retained earnings = $8 million. Requirements: (All work must be shown clearly.) 1. Find the current total capitalization and current earnings per share for Kane Manufacturing. 2. Find the total capitalization after the financing and after the conversion for both the convertible bond and the stock purchase warrant. 3. Find the earnings per share after the financing and after the conversion for both the convertible bond and the stock purchase warrant. 4. Is the convertible bond or the stock purchase warrant the best way for Kane Manufacturing to raise the $10 million? Justify your selection. 5. If the coupon rate of similar bonds without an option is today yielding 8 percent, calculate the straight bond value for the convertible bond and the stock purchase warrant if issued today. Which bond would investors pay the greatest premium for? Justify your selection and explain why the premium is higher for your selection