Answered step by step

Verified Expert Solution

Question

1 Approved Answer

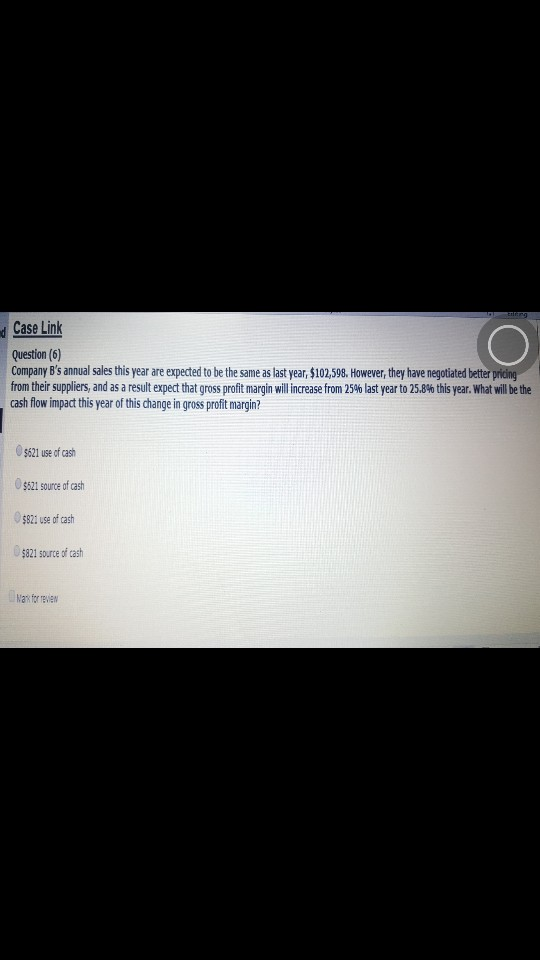

Case Link Question (6) Company B's annual sales this year are expected to be the same as last year, $102,598. However,they have negotiated better rom

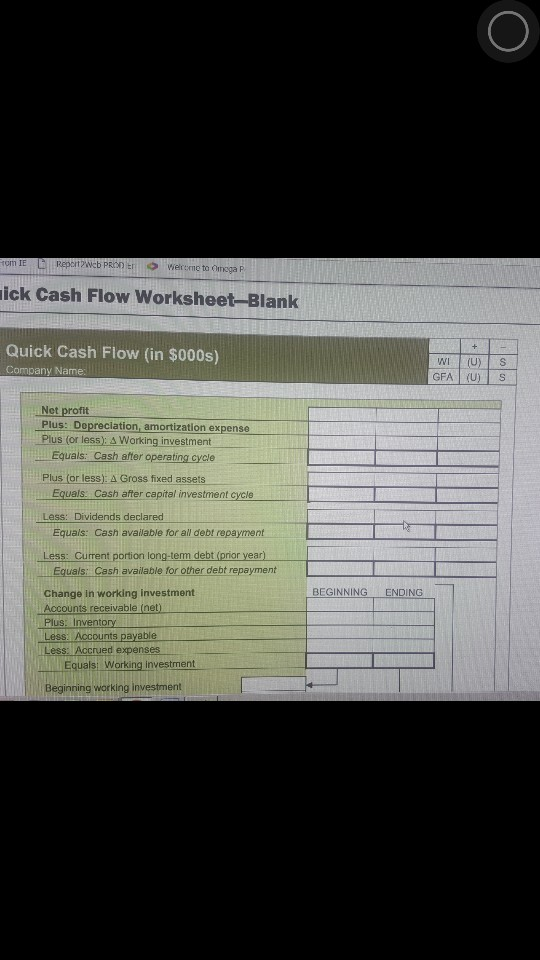

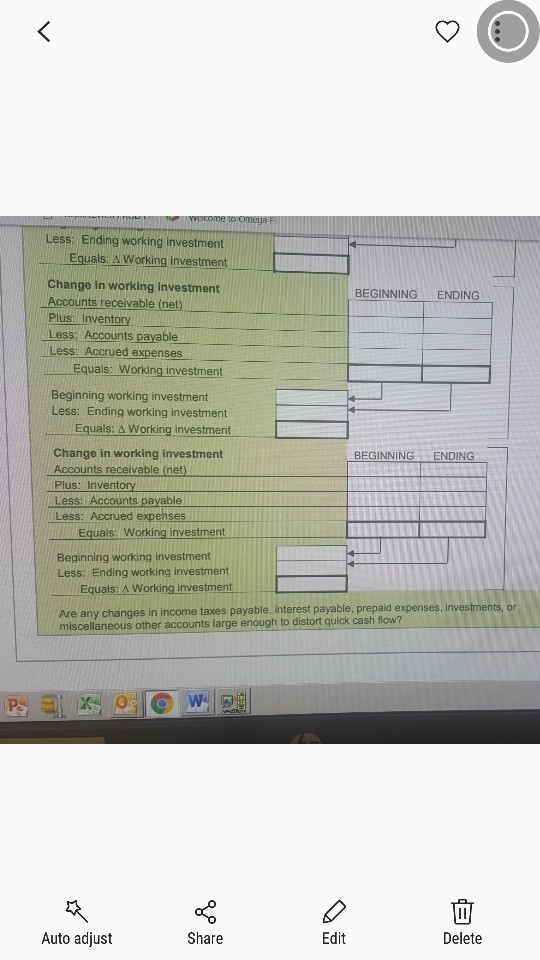

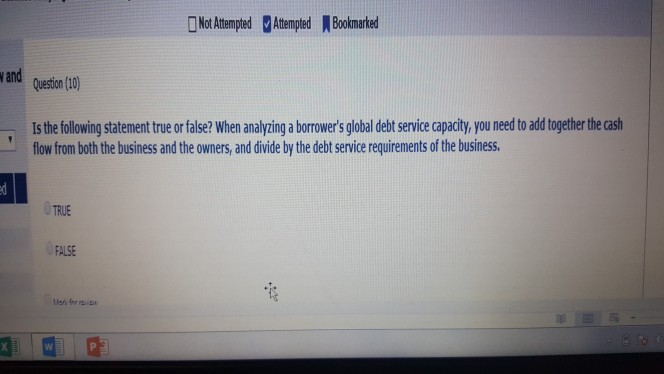

Case Link Question (6) Company B's annual sales this year are expected to be the same as last year, $102,598. However,they have negotiated better rom their suppliers and as a result expect that gross profit margin will increase from 25% ast year to 25.8% this year what will be the cash flow impact this year of this change in gross profit margin? $621 use of cash $521 source of cash $922 use of ash $821 source of cash Wa fer review ick Cash Flow Worksheet-Blank Quick Cash Flow (in $000s) Company Name GFA Plus: Depreciation, amortization expense Plus (or less: 4 Working investment Equals: Cash atter operating cycle Plus for less): A Gross fixed assets Equals Cash after capital investment cycle Less: Dividends declared Equals: Cash available for all debt repayment Less: Cument portion long-term debt (prior year) Equals: Cesh available for other debt repayment Change in working investment Accounts receivable (net Plus: Invento ENDING Less: Accrued expenses Equalsi Working investment Beginning working investment Less: Ending working investment Equals: A Working Investment Change in working investment Accounts receivable (net) BEGINNING ENDING Plus: Inventory Less: Accounts payable Less: Accrued expenses Equals: Working investment Beginning working investment Less: Ending working investment Equals: Working investment Change in working investment Accounts receivable (net Plus: Irivent Less: Accounts Less: Accrued expehses BEGINNING ENDING Equals: Working invest Beginning working investment Less: Ending working investment Equals: A Working investment Are any changes in income taxes payable, interest payable, prepaid expenses, investments, or miscellaneous other accounts large enough to distort quick cash flow? Auto adjust Share Edit Delete Not Attempted Attempted Bookmarked and Question (10) Is the following statement true orfalse? When analyzing a borrower's global debt service capacty, you need to add together the cash flow from both the business and the owners, and divide by the debt service requirements of the business TRUE FALSE

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started