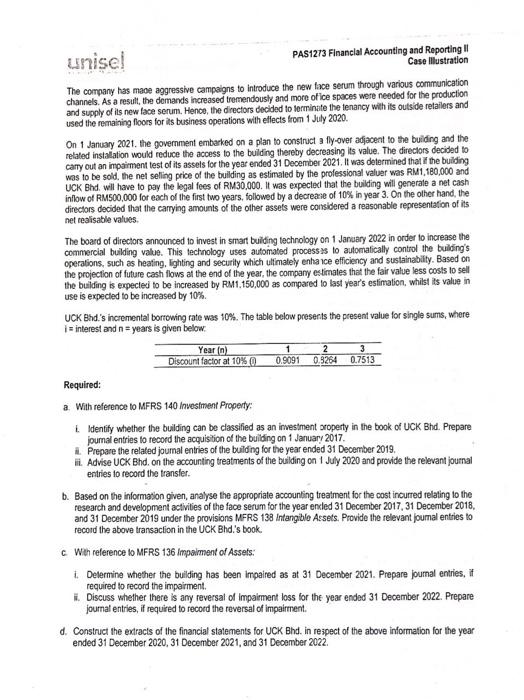

Case lllustration 2 UCK Bhd, is a multinational company locakd in Kuala Lumpur. The company produces a wide range of cosmetic and skin care products to be distrituled all around Malaysia. UCX Bhd. also has been undertaking research and development activties for several new costnelic and skin care products to meet the demand of customers who desire beauty and a healthy lifestye. UCK Bhd. clases is accounts on 31 Decerber each year. On 1 January 2017, UCK Bhd. purchased a four-slorey bulding for RM2,800,000. To acquire the buiding, UCK Bhd. incured a legal fee of RM10,000 and was eligitle for a trade discount of PM30,000. The buiding is expected to have a remaining usetul lie of 10 years with nc residual value. One flor of the building was used for the research and development activities of cosmetic and skin care products while the other loors were rented out to outside retalers. None of the portions can be sold separataly. UCK Bhd adopted the fair value model in measuring its imestment property and it is the policy of the company to depreciate its property, plant, and equipment on a straght - fine basis over the uselul life. On the same day, UCK Bhd. has undertaken research activites on the first floor of the bulding to develop a new face serum to treat typerpigmentation problens. The activities imolved in this phase were aimed to discover a new formula for the new face serum. The company spent RMe00,000 on the activities to obtain new knowledge about the new face serum, RM100,000 on the search for posside product alternatives, and RM50,000 on the search for formulation and design of the new face senum. On 1 January 2018, the researchers managed to find the corred combination of natural humectant ingredients io formulate the face serum. As such, UCK 3th. stanted the first development phase and incurred RM50,000 for the pilot samples to be tested on volunteers. However, during he year ended 31 December 2018 , the directors decidad that the development cost incurred at this phase could not provide convincing evidence that the economic benefits of the new face senum would flow to the conpany. Futher improvement was needed before the face sarum could be accepted by the market. At the end of the same year, UCK Bhd. employed an independent valuer who hoids a recognized and relevant protessional qualification to assess the fair value of the buiding. According to the professional valuer, the fair value of the building at the end of the year was RMS,500,000. UCK Bhd. conthued the next development phase on 1 January 2019. The following additional costs were incurred during the development phase which was completed on 31 December 2019 : The directors agreed that these costs hava been furlled and met all the recognition and capitalisalion criteria. The economic life of the development expendilures was qualfed to be capitalzad with the amortization period of 4 years on yearly basis. The directors were alto corfident with the sucoess of the new face serum and thus, the commerciallsation of the face serum began on 1 January 2020. The new face serum was launched into the market and is expected to derive a future econorric beneft for the next 3 years. UCK Bhd. then applied and successfully defended a patent to protect the base formulation of the new face sarum on 15 January 2020 . The cost of the patent was RM25,000 and has an estimated useful Ife of 5 years. 4misel PAS12/3 Financlal Accounting and Reporting II Case llustration The company has maoe aggressive campaigns to introduce the new tace serum through various communication channels. As a result, the demands increased tremendoushy and more of ice spoces were needed for the production and supply of its new face serum. Hence, the drectors decidad to lorminite the tenancy with its outside retailers and used the remaining floors for its business operations with effects from 1 July 2020. On 1 January 2021. the government embarked on a plan to consinuct a fly-over adjacent to the buiding and the retaled instalation would reduce the access to the bulding thereby decreasing its value. The directors decided to camy out an impsiment test of its assels for the year ended 31 December 2021. It was determined that If the buiding was to be sold, the net seling price of the building as estimaled by the professional veluar was RM1,180,000 and UCK Bhd. will have to pay the legal fees of RM30,000. It was expected that the building will generate a net cash inilow of RM 500,000 for each of the first two years, followed by a decrease of 10% in year 3 . On the other hand, the directors decided that the carying amounts of the other assets were considered a reasonable representation of its net realisable values. The board of directors announced io invest in smart buiding techrology on 1 Jaruary 2022 in order to increase the commercial building value. This technology uses automated process as to aulomatically control the builing's operations, such as heating, Ighting and security which ulimately enta ice efficiency and sustainability. Based on the projection of future cash flows at the end of the year, the company estimates that the fair value less cosis to sell the buiding is expected to be increased by RM1,150,000 as compared to last year's estimation, whilst its value in use is expecled to be increased by 10%. UCK Bnd.'s incremental borrowing rate was 10%. The table below preserts the present value for single sums, where i= interest and n= years is given below: Required: a. With reference to MFRS 140 investment Property: 1. Identify whether the building can be classified as an inwestment oroperty in the book of UCK Bhd. Prepare journal entries to record the acquistion of the bulding on 1 January 2017. i. Prepare the related joumal entrias of the building for the year ended 31 December 2019 , i. Advise UCK Bhd. on the accounting treatments of the bulding on 1 July 2020 and provide the relevant journal entries to record the transler. b. Based on the informaton given, analyse the appropriate accounling treatment for the cost irourred relating to the research and development activities of the face serum for the year ensled 31 December 2017, 31 December 2018, and 31 December 2019 under the provisions MFRS 138 intangible Assets. Provide the relevant poumal enties to record the above transaction in the UCK Bhd's book, c. Wheh relerence io MFRS 136 impoiment of Assets: 1. Delermine whether the bulling has been impaired as at 31 December 2021. Prepare joumal entries, if required to record the impaiment. 7. Discuss shether there is any reversal of impaiment loss for the year ended 31 December 2022. Prepare joumal entries, if required to record the reversal of impairment. d. Construct the extracts of the financial statements for UCK Bhd. in reipect of the above information for the year ended 31 December 2020, 31 December 2021, and 31 December 2022