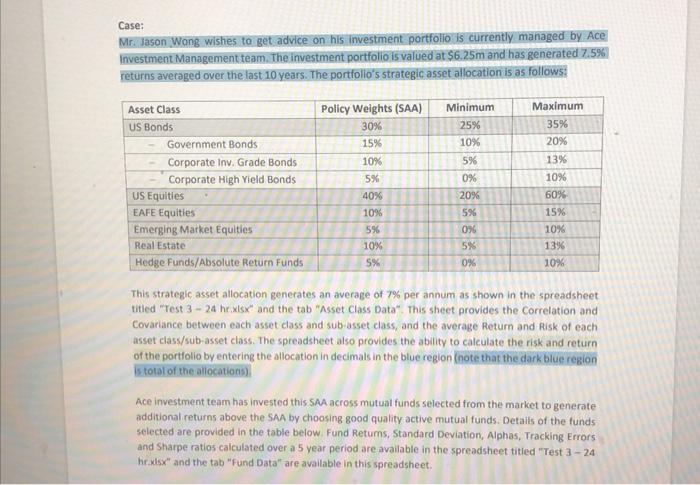

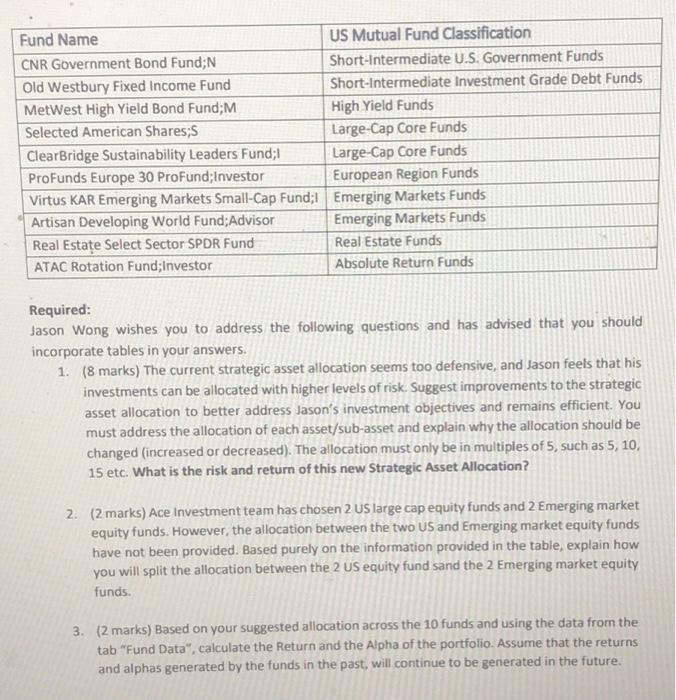

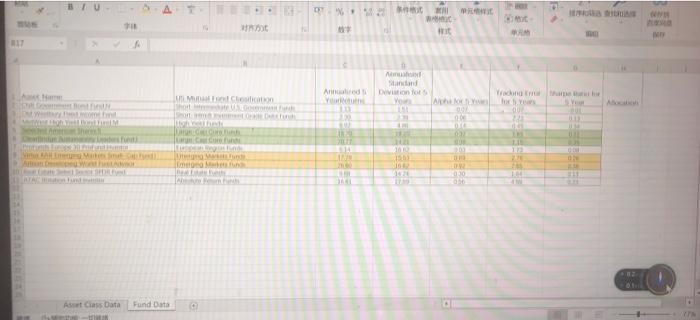

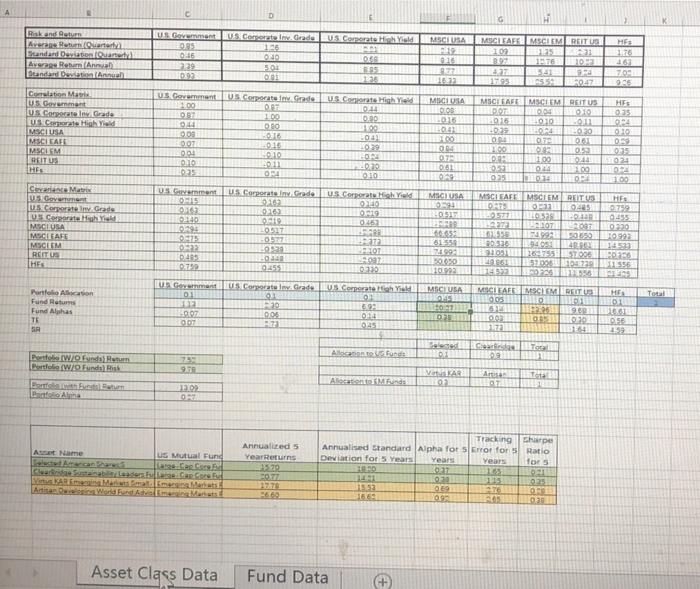

Case: Mr. Jason Wong wishes to get advice on his investment portfolio is currently managed by Ace Investment Management team. The investment portfolio is valued at $6.25m and has generated 7.5% returns averaged over the last 10 years. The portfolio's strategic asset allocation is as follows: This strategic asset allocation generates an average of 7% per annum as shown in the spreadsheet titied "Test 324hrxsx" and the tab "Asset Class Data". This sheet provides the Correlation and Covariance between each asset class and sub-asset class, and the average Return and Risk of each asset class/sub-asset class. The spreadsheet also provides the ability to calculate the risk and return of the portfolio by entering the allocation in decimals in the blue region (note that the dark blue region is total of the allocations) Ace investment team has invested this SAA across mutual funds selected from the market to generate additional returns above the SAA by choosing good quality active mutual funds. Details of the funds selected are provided in the table below. Fund Returns, Standard Deviation, Alphas, Tracking Errors and Sharpe ratios calculated over a 5 year period are available in the spreadsheet titied "Test 324 hroxlsx" and the tab "Fund Data" are available in this spreadsheet. Required: Jason Wong wishes you to address the following questions and has advised that you should incorporate tables in your answers. 1. (8 marks) The current strategic asset allocation seems too defensive, and Jason feels that his investments can be allocated with higher levels of risk. Suggest improvements to the strategic asset allocation to better address Jason's investment objectives and remains efficient. You must address the allocation of each asset/sub-asset and explain why the allocation should be changed (increased or decreased). The allocation must only be in multiples of 5 , such as 5,10 , 15 etc. What is the risk and return of this new Strategic Asset Allocation? 2. (2 marks) Ace Investment team has chosen 2 US large cap equity funds and 2 Emerging market equity funds. However, the allocation between the two US and Emerging market equity funds have not been provided. Based purely on the information provided in the table, explain how you will split the allocation between the 2 US equity fund sand the 2 Emerging market equity funds. 3. ( 2 marks) Based on your suggested allocation across the 10 funds and using the data from the tab "Fund Data", calculate the Return and the Alpha of the portfolio. Assume that the returns and alphas generated by the funds in the past, will continue to be generated in the future. Asset Class Data Fund Data Case: Mr. Jason Wong wishes to get advice on his investment portfolio is currently managed by Ace Investment Management team. The investment portfolio is valued at $6.25m and has generated 7.5% returns averaged over the last 10 years. The portfolio's strategic asset allocation is as follows: This strategic asset allocation generates an average of 7% per annum as shown in the spreadsheet titied "Test 324hrxsx" and the tab "Asset Class Data". This sheet provides the Correlation and Covariance between each asset class and sub-asset class, and the average Return and Risk of each asset class/sub-asset class. The spreadsheet also provides the ability to calculate the risk and return of the portfolio by entering the allocation in decimals in the blue region (note that the dark blue region is total of the allocations) Ace investment team has invested this SAA across mutual funds selected from the market to generate additional returns above the SAA by choosing good quality active mutual funds. Details of the funds selected are provided in the table below. Fund Returns, Standard Deviation, Alphas, Tracking Errors and Sharpe ratios calculated over a 5 year period are available in the spreadsheet titied "Test 324 hroxlsx" and the tab "Fund Data" are available in this spreadsheet. Required: Jason Wong wishes you to address the following questions and has advised that you should incorporate tables in your answers. 1. (8 marks) The current strategic asset allocation seems too defensive, and Jason feels that his investments can be allocated with higher levels of risk. Suggest improvements to the strategic asset allocation to better address Jason's investment objectives and remains efficient. You must address the allocation of each asset/sub-asset and explain why the allocation should be changed (increased or decreased). The allocation must only be in multiples of 5 , such as 5,10 , 15 etc. What is the risk and return of this new Strategic Asset Allocation? 2. (2 marks) Ace Investment team has chosen 2 US large cap equity funds and 2 Emerging market equity funds. However, the allocation between the two US and Emerging market equity funds have not been provided. Based purely on the information provided in the table, explain how you will split the allocation between the 2 US equity fund sand the 2 Emerging market equity funds. 3. ( 2 marks) Based on your suggested allocation across the 10 funds and using the data from the tab "Fund Data", calculate the Return and the Alpha of the portfolio. Assume that the returns and alphas generated by the funds in the past, will continue to be generated in the future. Asset Class Data Fund Data