Case Ms. Napa: Use Ms. Napa financial statements for analysis.

Ms. Napa Napasri, a 28-year-old senior sales officer, is enjoying her career. This year she got married to Mr. Ross Geller-a 32 year old American entrepreneur. Ms. Napa moved into Mr. Rosss house to live together and she helps with the living expenses. She let her friend rent her condominium to earn some rental income. Ms. Napa still has her car loan and condominium loan. Mr. Rosss business is still in the initiation stage. Because of these financial challenges and the cultural difference, the couple decided not to register for a marriage certificate and delay having their first child. Financial statements for Ms. Napa and Mr. Ross are analyzed separately. Beginning a grown-up life, Ms. Napa would like to know her financial status and pay more attention to her personal financial planning.

Financial statements for Miss Napa are provided.

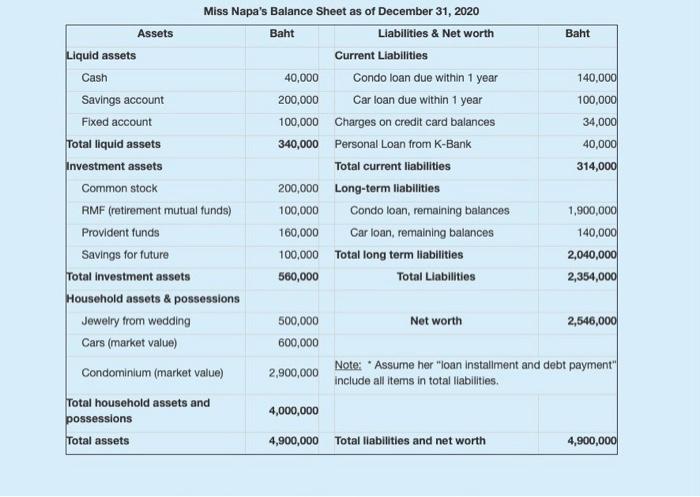

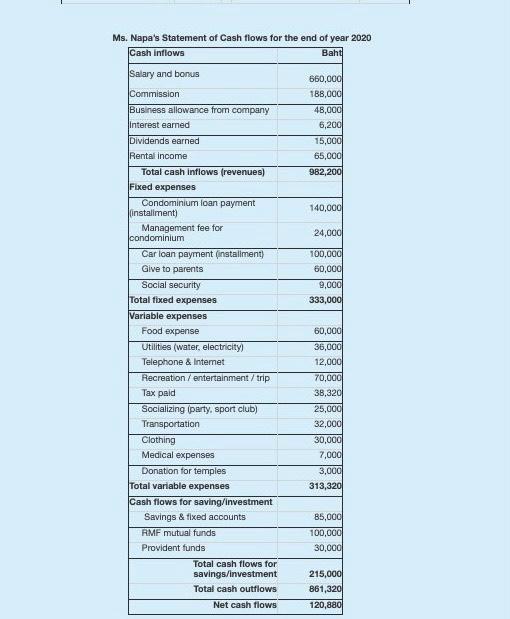

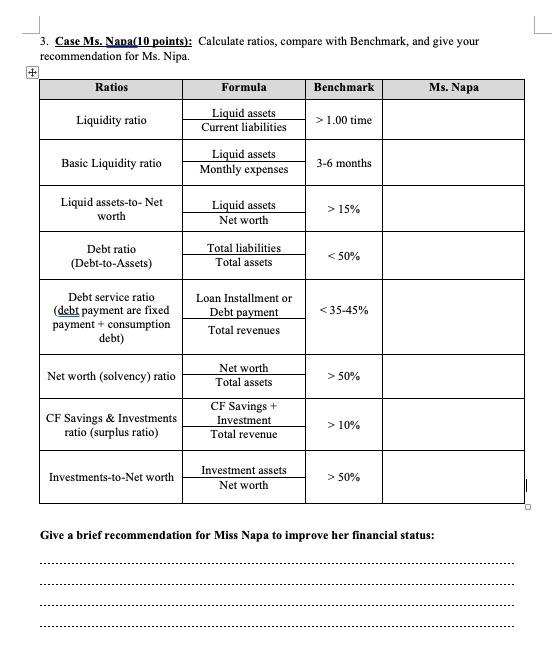

Baht Miss Napa's Balance Sheet as of December 31, 2020 Assets Baht Liabilities & Net worth Liquid assets Current Liabilities Cash 40,000 Condo loan due within 1 year 140,000 Savings account 200,000 Car loan due within 1 year 100,000 Fixed account 100,000 Charges on credit card balances 34,000 Total liquid assets 340,000 Personal Loan from K-Bank 40,000 Investment assets Total current liabilities 314,000 Common stock 200,000 Long-term liabilities RMF (retirement mutual funds) 100,000 Condo loan, remaining balances 1,900,000 Provident funds 160,000 Car loan, remaining balances 140,000 Savings for future 100,000 Total long term liabilities 2,040,000 Total investment assets 560,000 Total Liabilities 2,354,000 Household assets & possessions Jewelry from wedding 500,000 Net worth 2,546,000 Cars (market value) 600,000 Condominium (market value) Note: * Assume her "loan installment and debt payment 2,900,000 include all items in total liabilities. Total household assets and possessions 4,000,000 Total assets 4,900,000 Total liabilities and net worth 4,900,000 Ms. Napa's Statement of Cash flows for the end of year 2020 Cash inflows Baht Salary and bonus 660,000 Commission 188,000 Business allowance from company 48,000 Interest earned 6,200 Dividends earned 15,000 Rental income 65,000 Total cash inflows (revenues) 982,200 Fixed expenses Condominium loan payment 140,000 instaliment) Management fee for 24,000 condominium Car loan payment installment) 100,000 Give to parents 60,000 Social security 9,000 Total fixed expenses 333,000 Variable expenses Food expense 60,000 Utilities (water, electricity) 36,000 Telephone & Internet 12,000 Recreation /entertainment/trip 70,000 Tax paid 38,320 Socializing (party, sport club) 25,000 Transportation 32,000 Clothing 30,000 Medical expenses 7,000 Donation for temples 3,000 Total variable expenses 313,320 Cash flows for saving/investment Savings & fixed accounts 85,000 RMF mutual funds 100,000 Provident funds 30,000 Total cash flows for savings/investment 215,000 Total cash outflows 861,320 Net cash flows 120,880 3. Case Ms. Napa(10 points): Calculate ratios, compare with Benchmark, and give your recommendation for Ms. Nipa. Ratios Benchmark Ms. Napa Liquidity ratio > 1.00 time Formula Liquid assets Current liabilities Liquid assets Monthly expenses Basic Liquidity ratio 3-6 months Liquid assets-to-Net worth Liquid assets Net worth > 15% Debt ratio (Debt-to-Assets) Total liabilities Total assets 50% Net worth Total assets CF Savings + Investment Total revenue CF Savings & Investments ratio (surplus ratio) > 10% Investments-to-Net worth Investment assets Net worth > 50% Give a brief recommendation for Miss Napa to improve her financial status: Baht Miss Napa's Balance Sheet as of December 31, 2020 Assets Baht Liabilities & Net worth Liquid assets Current Liabilities Cash 40,000 Condo loan due within 1 year 140,000 Savings account 200,000 Car loan due within 1 year 100,000 Fixed account 100,000 Charges on credit card balances 34,000 Total liquid assets 340,000 Personal Loan from K-Bank 40,000 Investment assets Total current liabilities 314,000 Common stock 200,000 Long-term liabilities RMF (retirement mutual funds) 100,000 Condo loan, remaining balances 1,900,000 Provident funds 160,000 Car loan, remaining balances 140,000 Savings for future 100,000 Total long term liabilities 2,040,000 Total investment assets 560,000 Total Liabilities 2,354,000 Household assets & possessions Jewelry from wedding 500,000 Net worth 2,546,000 Cars (market value) 600,000 Condominium (market value) Note: * Assume her "loan installment and debt payment 2,900,000 include all items in total liabilities. Total household assets and possessions 4,000,000 Total assets 4,900,000 Total liabilities and net worth 4,900,000 Ms. Napa's Statement of Cash flows for the end of year 2020 Cash inflows Baht Salary and bonus 660,000 Commission 188,000 Business allowance from company 48,000 Interest earned 6,200 Dividends earned 15,000 Rental income 65,000 Total cash inflows (revenues) 982,200 Fixed expenses Condominium loan payment 140,000 instaliment) Management fee for 24,000 condominium Car loan payment installment) 100,000 Give to parents 60,000 Social security 9,000 Total fixed expenses 333,000 Variable expenses Food expense 60,000 Utilities (water, electricity) 36,000 Telephone & Internet 12,000 Recreation /entertainment/trip 70,000 Tax paid 38,320 Socializing (party, sport club) 25,000 Transportation 32,000 Clothing 30,000 Medical expenses 7,000 Donation for temples 3,000 Total variable expenses 313,320 Cash flows for saving/investment Savings & fixed accounts 85,000 RMF mutual funds 100,000 Provident funds 30,000 Total cash flows for savings/investment 215,000 Total cash outflows 861,320 Net cash flows 120,880 3. Case Ms. Napa(10 points): Calculate ratios, compare with Benchmark, and give your recommendation for Ms. Nipa. Ratios Benchmark Ms. Napa Liquidity ratio > 1.00 time Formula Liquid assets Current liabilities Liquid assets Monthly expenses Basic Liquidity ratio 3-6 months Liquid assets-to-Net worth Liquid assets Net worth > 15% Debt ratio (Debt-to-Assets) Total liabilities Total assets 50% Net worth Total assets CF Savings + Investment Total revenue CF Savings & Investments ratio (surplus ratio) > 10% Investments-to-Net worth Investment assets Net worth > 50% Give a brief recommendation for Miss Napa to improve her financial status