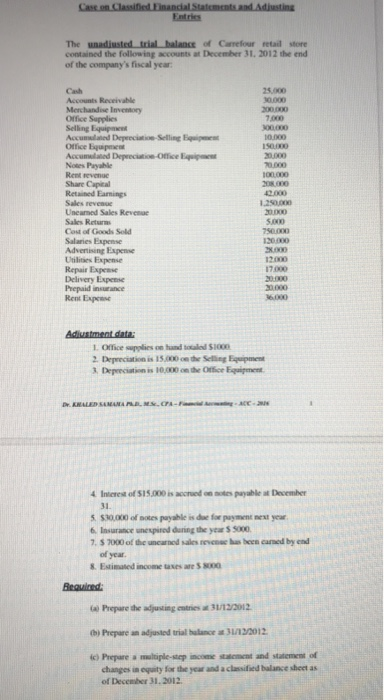

Case on Classified Financial Statements and Adjusting The wadiusted trial balance of Carrefour retail store contained the following accounts at December 31, 2012 the end of the company's fiscal year 25.000 30.000 200.000 Cach Accounts Receivable Merchandise Inventory Office Supplies Selling Equipment Accumulated Depreciatio-Selling Equipment Office Accumulated Depreciative-Office Equipment Notes Payable Rent revenge Share Capital Retailed Earnings Sales reve Uneamed Sales Revenue Sales Retur Cost of Goods Sold Salaries Expense Advertising Expense Utilises Expense Repair Expense Delivery Expense Prepaid insurance Rent Express DO 10. 1S 20.000 70.000 100.000 BODO 42.000 1.250.000 20.000 5.000 750.000 12 12.000 17.000 Adiustment data 1. Office supplies contunded 100 2. Depreciation is 15.000 on the Selling Equipment 3. Depreciation is 10,000 on the Office Equipment Dr. KHALED SEMANALMCPAC. 4 Interest of 515.000 is accrued as payable at December 31 5 $30,000 of notes payable is due for payment next year 6. Insurance expired during the years 5000 7. $ 7000 of the uncanned sales rescue has been camed by end of year. 8. Estimated income taxes are $ 8000 Required: Prepare the adjusting entries 31/12/2012 th) Prepare an adjusted trial balance 31/12/2012. to Prepare multiple-step income statement and statement of changes in equity for the year and a classified balance sheet as of December 31, 2012. Case on Classified Financial Statements and Adjusting The wadiusted trial balance of Carrefour retail store contained the following accounts at December 31, 2012 the end of the company's fiscal year 25.000 30.000 200.000 Cach Accounts Receivable Merchandise Inventory Office Supplies Selling Equipment Accumulated Depreciatio-Selling Equipment Office Accumulated Depreciative-Office Equipment Notes Payable Rent revenge Share Capital Retailed Earnings Sales reve Uneamed Sales Revenue Sales Retur Cost of Goods Sold Salaries Expense Advertising Expense Utilises Expense Repair Expense Delivery Expense Prepaid insurance Rent Express DO 10. 1S 20.000 70.000 100.000 BODO 42.000 1.250.000 20.000 5.000 750.000 12 12.000 17.000 Adiustment data 1. Office supplies contunded 100 2. Depreciation is 15.000 on the Selling Equipment 3. Depreciation is 10,000 on the Office Equipment Dr. KHALED SEMANALMCPAC. 4 Interest of 515.000 is accrued as payable at December 31 5 $30,000 of notes payable is due for payment next year 6. Insurance expired during the years 5000 7. $ 7000 of the uncanned sales rescue has been camed by end of year. 8. Estimated income taxes are $ 8000 Required: Prepare the adjusting entries 31/12/2012 th) Prepare an adjusted trial balance 31/12/2012. to Prepare multiple-step income statement and statement of changes in equity for the year and a classified balance sheet as of December 31, 2012