Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case Overview Trading volume in currencies can exceed $ 1 B per day. One type of currency trade is known as a spot currency transaction

Case Overview

Trading volume in currencies can exceed $B per day. One type of currency trade is known as a spot currency transaction where an investor buys one currency using another currency on the spot".

To illustrate a spot transaction, consider a US company seeking to buy Japanese yen using US dollars. If each dollar was worth yen, then one hundred US dollars would buy yen at that moment in time.

Now consider the reverse transaction. If the exchange rate from yen back to US dollars was the yen would buy US dollars. The difference between the original $ investment and the final $ is the transaction cost.

Every so often the spot prices of currency are such that free money can be made. In these cases, a dollar can be invested in a set of currency transactions that returns more than a dollar at the end. In such a case the prices will quickly adjust to address this idiosyncrasy. However, if such an opportunity does arise, then it makes sense to move quickly to take advantage of it

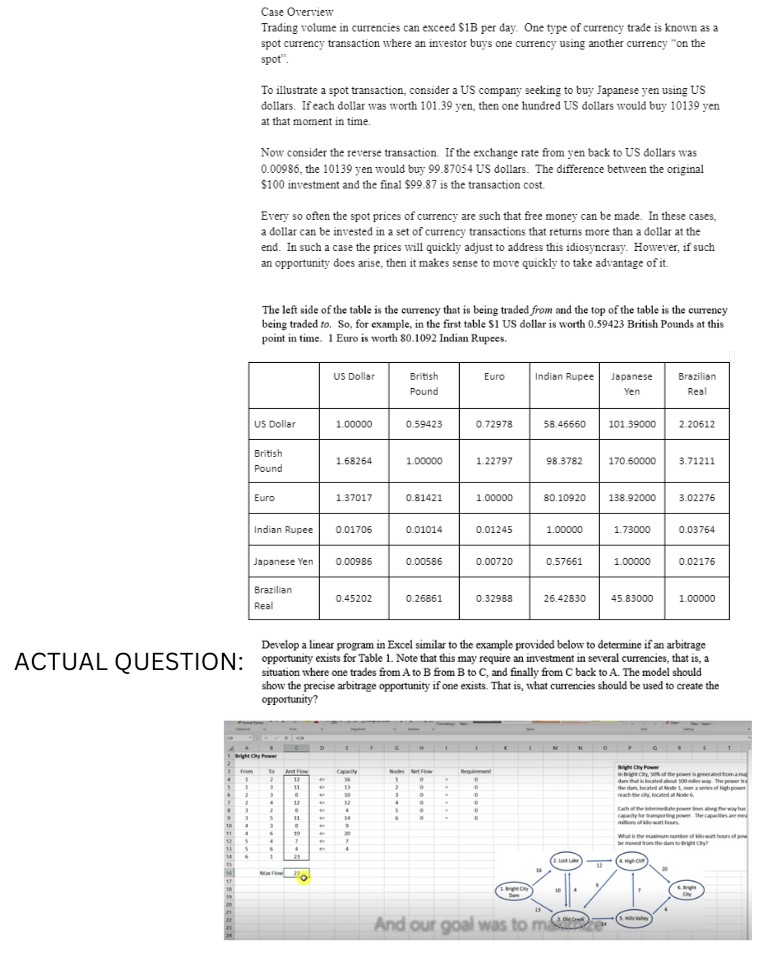

The left side of the table is the currency that is being traded from and the top of the table is the currency being traded to So for example, in the first table $ US dollar is worth British Pounds at this point in time. Euro is worth Indian Rupees.

ACTUAL QUESTION:

tableUS Dollar,tableBritishPoundEuro,Indian Rupee,tableJapaneseYentableBrazilianRealUS Dollar,tableBritishPoundEuroIndian Rupee,Japanese Yen,tableBrazillanReal

Develop a linear program in Excel similar to the example provided below to determine if an arbitrage opportunity exists for Table Note that this may require an investment in several currencies, that is a situation where one trades from to from to and finally from back to The model should show the precise arbitrage opportunity if one exists. That is what currencies should be used to create the opportunity?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started