Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CASE Pansy Jewelry Limited (PJL) is a company listed on the Main Board in Hong Kong and is principally engaged in the manufacture and

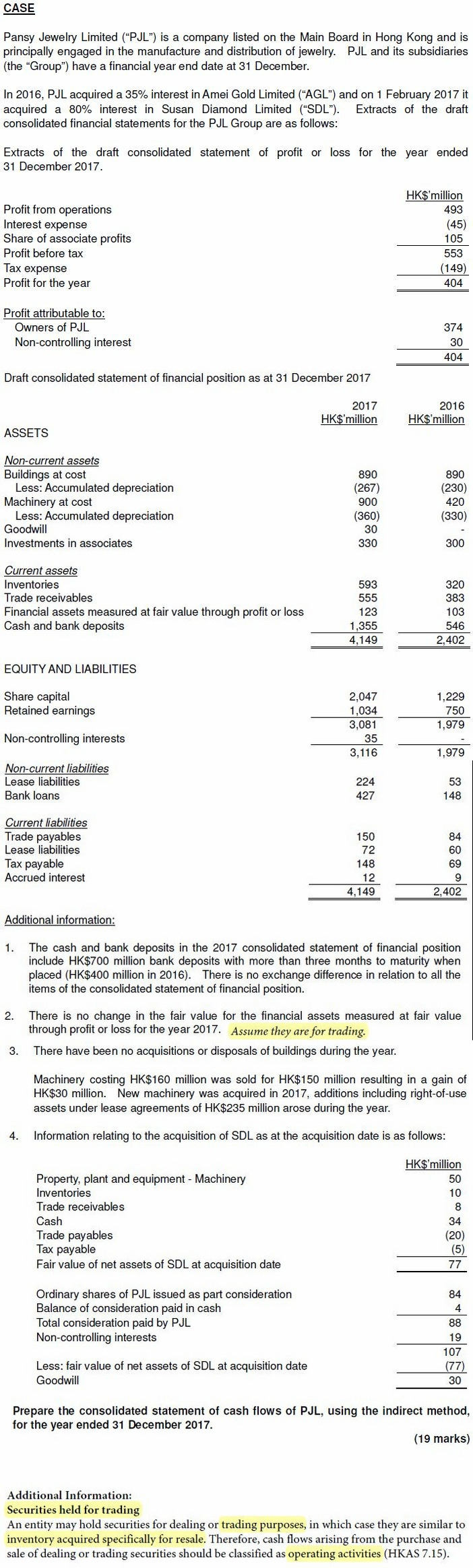

CASE Pansy Jewelry Limited ("PJL") is a company listed on the Main Board in Hong Kong and is principally engaged in the manufacture and distribution of jewelry. PJL and its subsidiaries (the "Group") have a financial year end date at 31 December. In 2016, PJL acquired a 35% interest in Amei Gold Limited ("AGL") and on 1 February 2017 it acquired a 80% interest in Susan Diamond Limited ("SDL"). Extracts of the draft consolidated financial statements for the PJL Group are as follows: Extracts of the draft consolidated statement of profit or loss for the year ended 31 December 2017. Profit from operations Interest expense Share of associate profits Profit before tax Tax expense Profit for the year Profit attributable to: Owners of PJL Non-controlling interest Draft consolidated statement of financial position as at 31 December 2017 HK$'million 493 (45) 105 553 (149) 404 374 30 404 2017 HK$'million 2016 HK$'million ASSETS Non-current assets Buildings at cost Less: Accumulated depreciation Machinery at cost Less: Accumulated depreciation Goodwill Investments in associates 890 890 (267) (230) 900 420 (360) (330) 30 330 300 Current assets Inventories 593 320 Trade receivables 555 383 Financial assets measured at fair value through profit or loss 123 103 Cash and bank deposits 1,355 546 4.149 2,402 EQUITY AND LIABILITIES Share capital 2,047 1,229 Retained earnings 1,034 750 3,081 1,979 Non-controlling interests 35 3,116 1,979 Non-current liabilities Lease liabilities 224 53 Bank loans 427 148 Current liabilities Trade payables Lease liabilities Tax payable Accrued interest Additional information: 150 84 72 60 148 69 12 9 4,149 2,402 1. The cash and bank deposits in the 2017 consolidated statement of financial position include HK$700 million bank deposits with more than three months to maturity when placed (HK$400 million in 2016). There is no exchange difference in relation to all the items of the consolidated statement of financial position. 2. There is no change in the fair value for the financial assets measured at fair value through profit or loss for the year 2017. Assume they are for trading. 3. There have been no acquisitions or disposals of buildings during the year. Machinery costing HK$160 million was sold for HK$150 million resulting in a gain of HK$30 million. New machinery was acquired in 2017, additions including right-of-use assets under lease agreements of HK$235 million arose during the year. 4. Information relating to the acquisition of SDL as at the acquisition date is as follows: Property, plant and equipment - Machinery Inventories Trade receivables Cash HK$'million 50 10 8 Trade payables Tax payable Fair value of net assets of SDL at acquisition date Ordinary shares of PJL issued as part consideration Balance of consideration paid in cash Total consideration paid by PJL Non-controlling interests Less: fair value of net assets of SDL at acquisition date Goodwill 34 (20) (5) 77 3@ 2b8 84 4 88 19 107 (77) 30 Prepare the consolidated statement of cash flows of PJL, using the indirect method, for the year ended 31 December 2017. (19 marks) Additional Information: Securities held for trading An entity may hold securities for dealing or trading purposes, in which case they are similar to inventory acquired specifically for resale. Therefore, cash flows arising from the purchase and sale of dealing or trading securities should be classified as operating activities (HKAS 7.15).

Step by Step Solution

★★★★★

3.35 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

To prepare the consolidated statement of cash flows of PJL we need to start with the profit for the year and adjust it for changes in working capital ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started