Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case question the answer cannot be too simple,5page words Please use GAAPor other accounting rules Case 15-2 Burying the Hatchet that automakers use in the

Case question

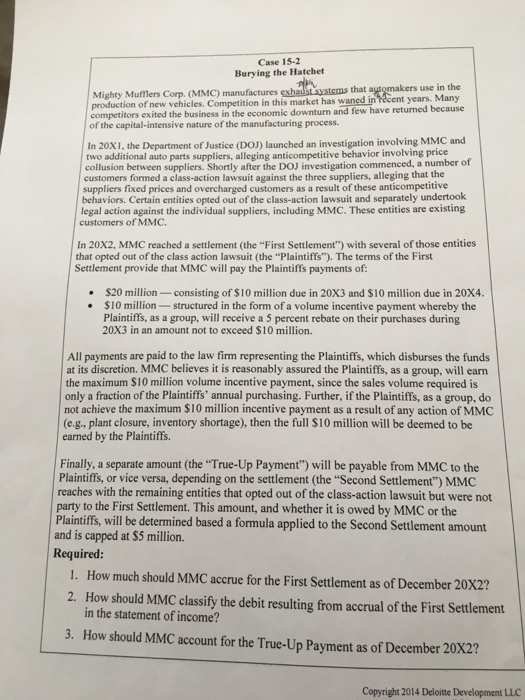

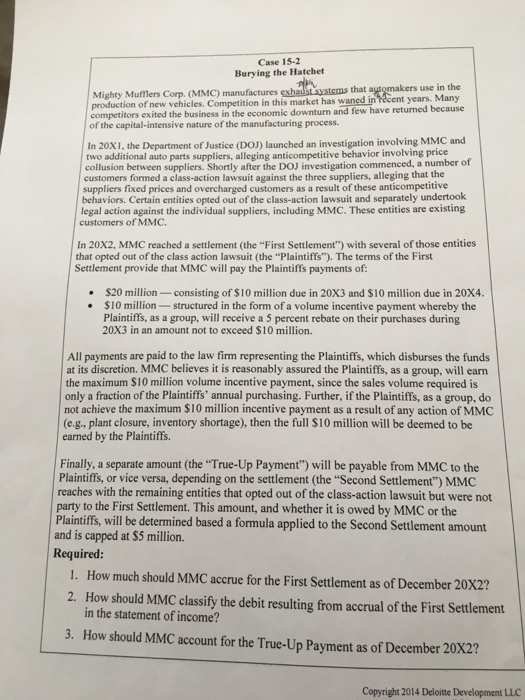

Case 15-2 Burying the Hatchet that automakers use in the Mighty Muflers Corp. (MMC) manufactures market has waned in recent years. Many production of new vehicles. Competition in this market has waned in Tecent years. competitors exited the business in the economic downturn and few have returned because of the capital-intensive nature of the manufacturing process In 20X1, the Department of Justice (DOJ) launched an investigation involving MMC and two additional auto parts suppliers, alleging anticompetitive behavior involving price collusion between suppliers. Shortly after the DOJ investigation commenced, a number of customers formed a class-action lawsuit against the three suppliers, alleging that the suppliers fixed prices and overcharged customers as a result of these anticompetitive behaviors. Certain entities opted out of the class-action lawsuit and separately undertook legal action against the individual suppliers, including MMC. These entities are existing customers of MMC. In 20X2, MMC reached a settlement (the "First Settlement") with several of those entities that opted out of the class action lawsuit (the "Plaintiffs") The terms of the First Settlement provide that MMC will pay the Plaintiffs payments of $20 million-consisting of $10 million due in 20X3 and $10 million due in 20X4. $10 million structured in the form of a volume incentive payment whereby the Plaintiffs, as a group, will receive a 5 percent rebate on their purchases during 20X3 in an amount not to exceed $10 million. All payments are paid to the law firm representing the Plaintiffs, which disburses the funds at its discretion. MMC believes it is reasonably assured the Plaintiffs, as a group, will earn the maximum $10 million volume incentive payment, since the sales volume required is only a fraction of the Plaintiffs' annual purchasing. Further, if the Plaintiffs, as a group, do not achieve the maximum $10 million incentive payment as a result of any action of MMC (e.g., plant closure, inventory shortage), then the full S10 million will be deemed to be earned by the Plaintiffs. Finally, a separate amount (the "True-Up Payment") will be payable from MMC to the Plaintiffs, or vice versa, depending on the settlement (the "Second Settlement") MMC reaches with the remaining entities that opted out of the class-action lawsuit but were not party to the First Settlement. This amount, and whether it is owed by MMC or the Plaintiffs, will be determined based a formula applied to the Second Settlement amount and is capped at $5 million. Required: . How much should MMC accrue for the First Settlement as of December 20X2? 2. How should MMC classify the debit resulting from accrual of the First Settlement in the statement of income? 3. How should MMC account for the True-Up Payment as of December 20X2? Copyright 2014 Deloitte Development LLC the answer cannot be too simple,5page words

Please use GAAPor other accounting rules

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started