Question: Case Report: Total marks possible - (75 marks) After reading the case, this is your task: The president of Bombardier Aerospace, Pierre Beaudoin, has asked

Case Report: Total marks possible - (75 marks) After reading the case, this is your task: The president of Bombardier Aerospace, Pierre Beaudoin, has asked that your team provides a strategic assessment of the Bombardier Aerospace (BA) and the strategic validity of launching the C-Series in the very near future. QUESTIONS:

1. How would you describe the firm's current business-level strategy?

Support your answer with evidence from the case that is linked to course material. (5 marks)

2. Analyze the external business environment of the industry.

A) Analyze and discuss the general or external environment using the PESTLE framework. (10 marks)

B) Use Porter's Five Forces to analyze this industry. Be clear on "who or what" constitutes each force and the relative strength of each force. Substantiate your analysis and assess the attractiveness of the industry overall. (10 marks)

C) Based on your external analysis, what are the key opportunities and threats in the external environment facing competitors in the industry? (10 marks)

3. Provide an internal analysis of the company.

A) What is the strategic position of Bombardier Aerospace and how is the company performing (at the time of the case)? (10 marks)

B) Using the VRIO framework, compl.ete an analysis of 3 key resources or capabilities of the company (including the competitive outcome for each). Provide an explanation for why you think these are important for the company. (10 marks)

C) What are the company's biggest weaknesses and challenges? Explain your rationale. (10 marks)

4. Mr. Pierre Beaudoin must make a decision on how to proceed with his business. Should Bombardier Aerospace go ahead with the C-Series initiative? Make a critical assessment and outline 3 possible alternatives/options and rationale for each. (10 marks)

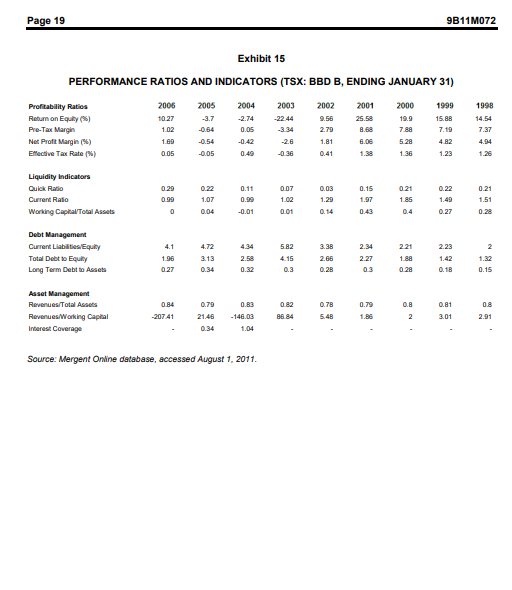

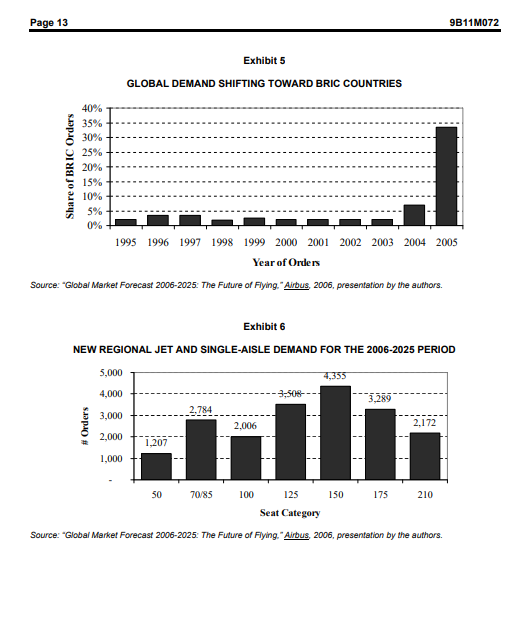

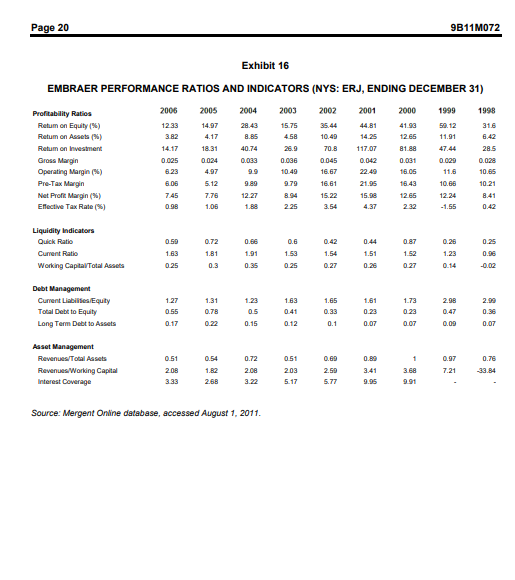

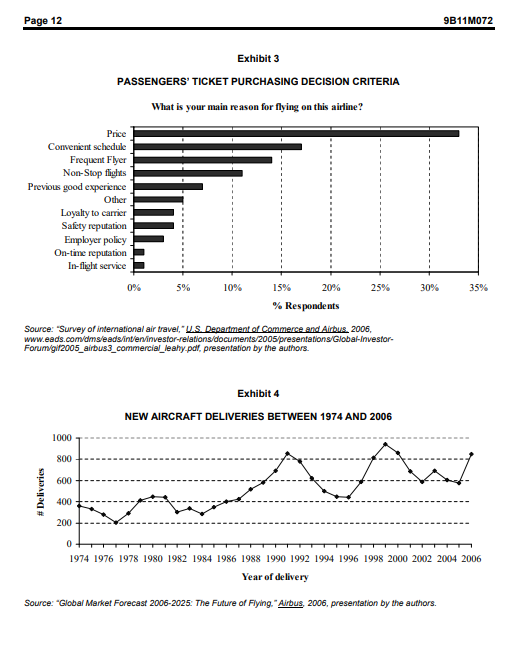

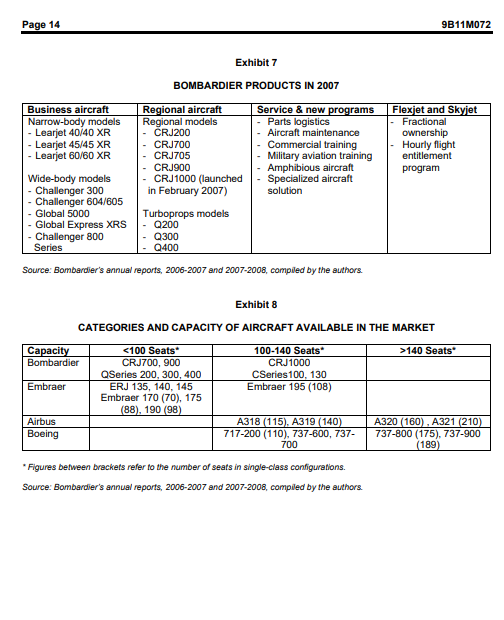

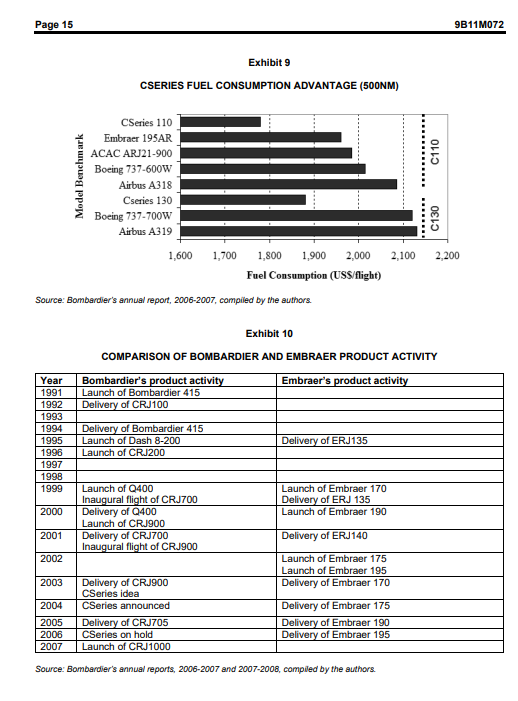

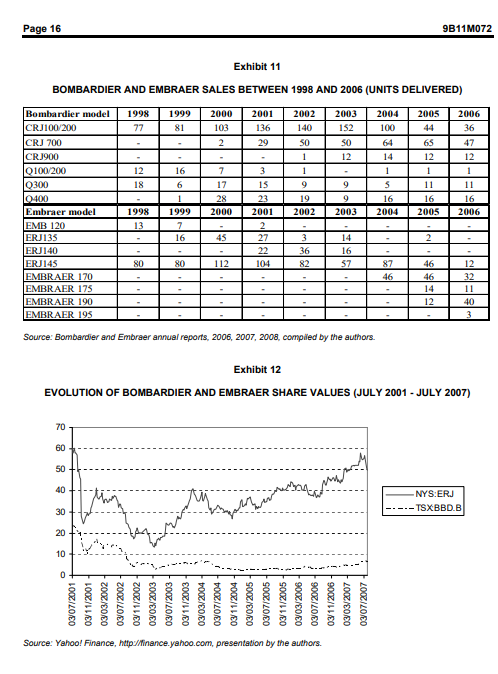

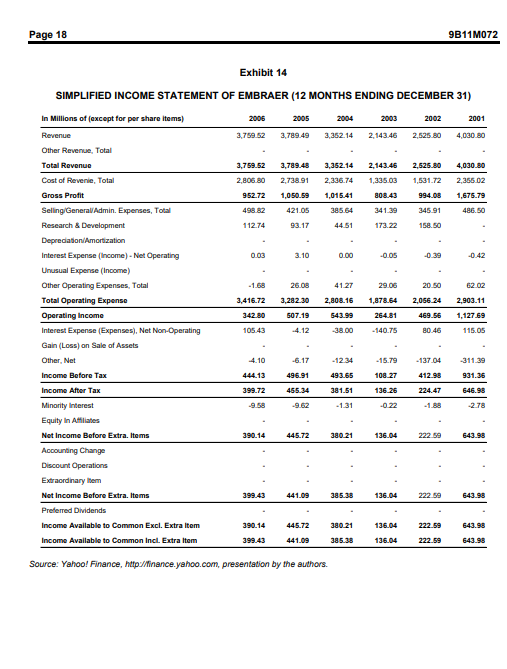

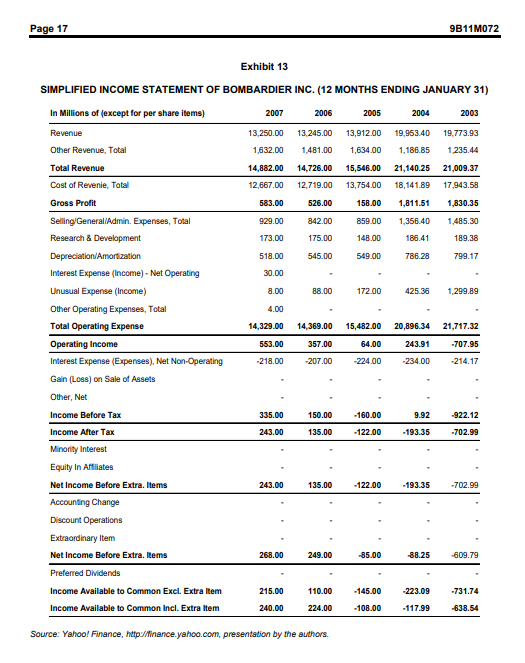

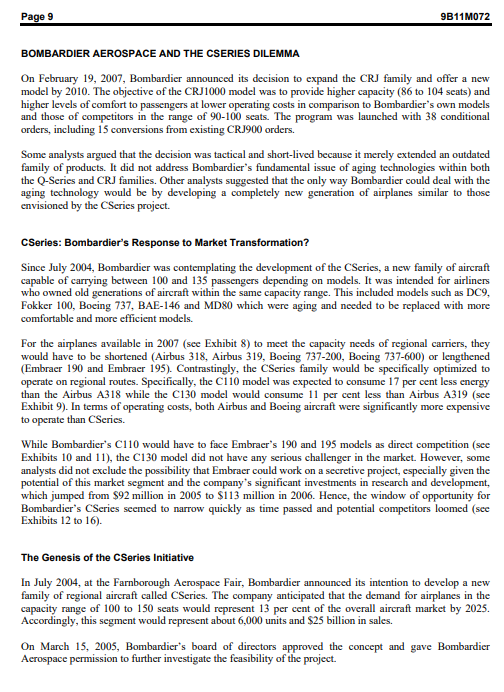

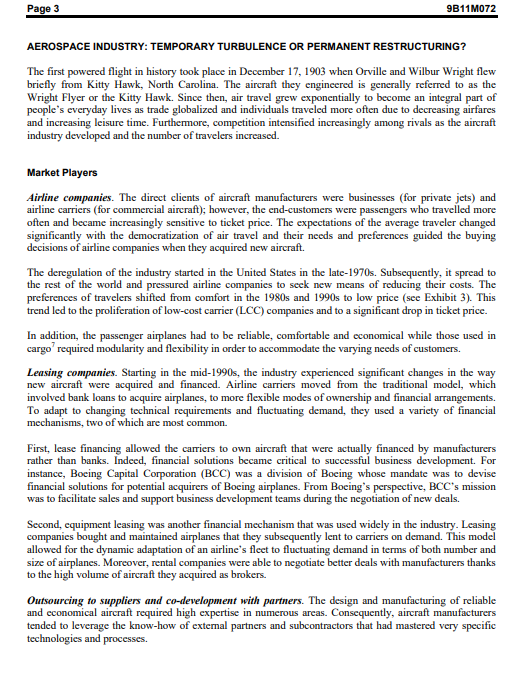

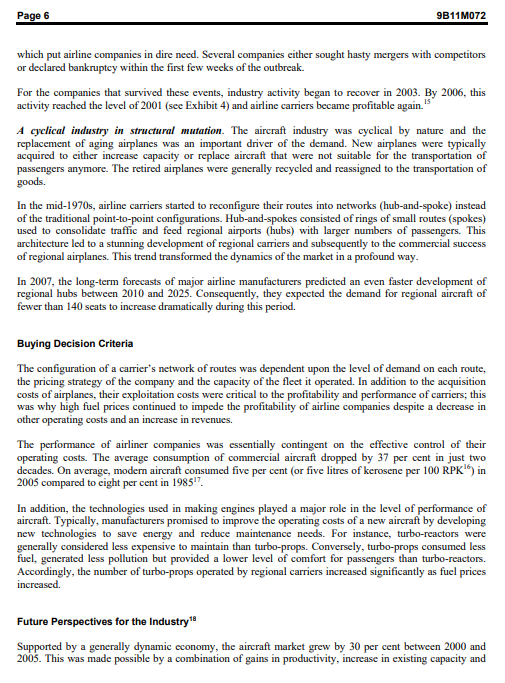

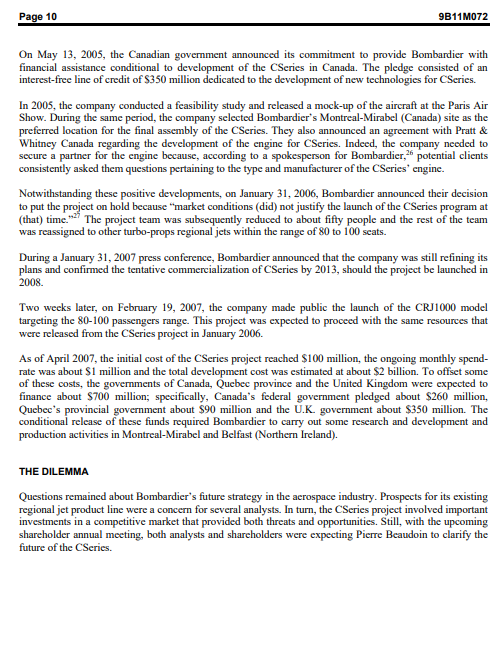

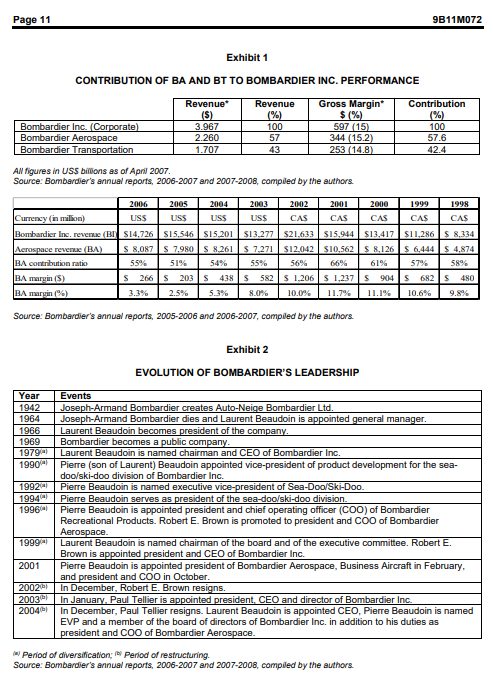

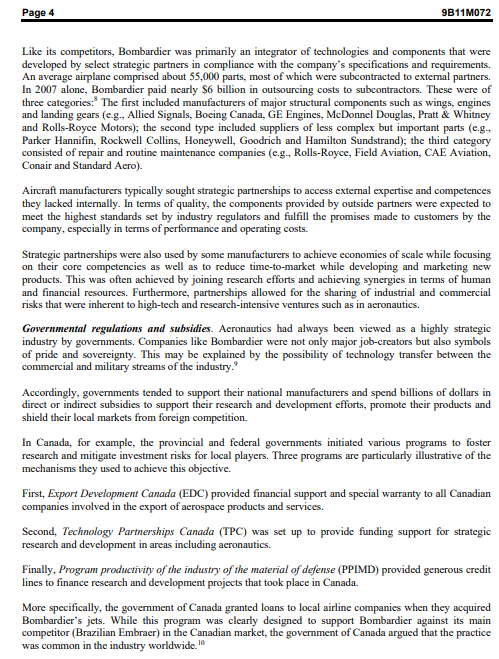

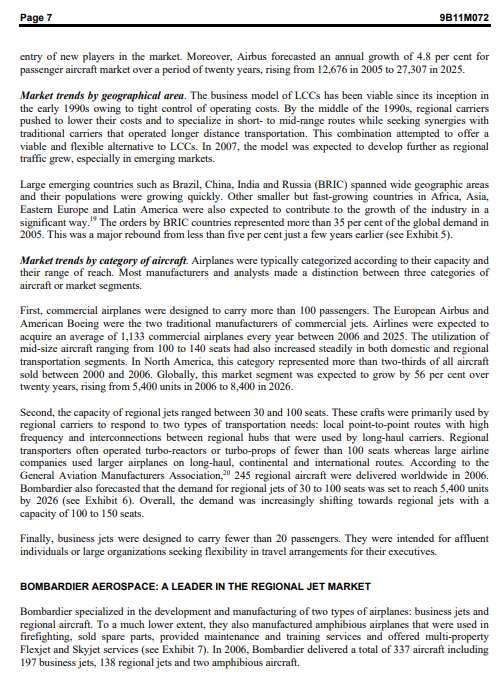

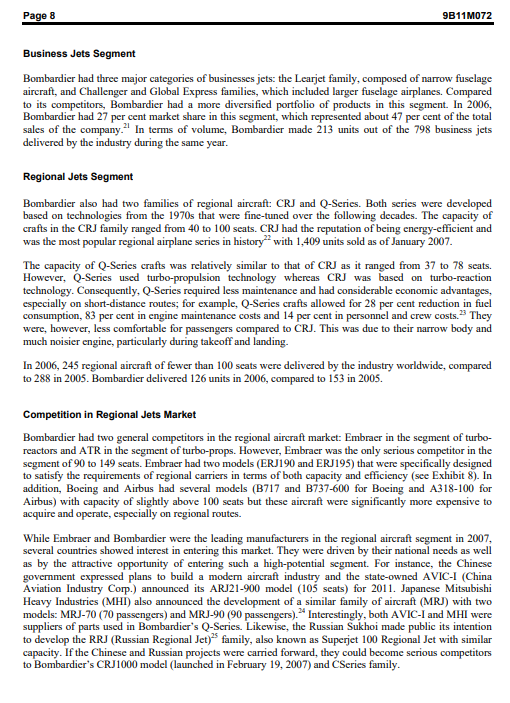

IVEy Publishing 9B11M072 BOMBARDIER AEROSPACE: THE CSERIES DILEMMA All Taleb and Louis Hebert wrote this case solely to provide material for class discussion. The authors do not intend to illustrate either effective or ineffective handling of a managerial situation. The authors may have disguised certain names and other identifying information to protect confidentiality. This publication may not be transmitted, photocopied, digitized or otherwise reproduced in any form or by any means without the permission of the copyright holder. Reproduction of this material is not covered under authorization by any reproduction rights organization. To order copies or request permission to reproduce materials, contact Ivey Publishing, Ivey Business School, Westem University, London, Ontario, Canada, NG ON1; (1) 519.661.3208; (e) cases@ivey.ca; www.iveycases.com. Copyright @2011. Richard Ivey School of Business Foundation Version: 2016-03-29 "Bombardier Aerospace announced today the name of its new commercial aircraft family and revealed the aircraft's distinctive black and white livery. The CSeries, for competitive, continental and connector, would target airlines operating aircraft in the lower end of the 100- to 150-passenger market, a large segment that is not well served by any aircraft in production today." Bombardier press release, July 19, 2004 "On March 15, 2005, Bombardier's board of directors granted Bombardier Aerospace authority to offer the new CSeries family of aircraft to customers. The authority to offer is an important step in the process that could lead to the aircraft program launch. Prior to launch, Bombardier will continue to seek firm commitments from potential customers and suppliers." Bombardier press release, May 13, 2005 "Bombardier announced today that present market conditions do not justify the launch of the CSeries program at this time. The corporation will now reorient CSeries project efforts, team and resources to regional jet and turboprop aircraft opportunities to address regional airlines' future needs in the 80- to 100- seat aircraft market." Bombardier press release, January 31, 2006 In March 2005, the board of directors of Bombardier Inc. authorized its Aeronautics division, Bombardier Aerospace, to offer a new generation of aircraft named CSeries to its clients. The company postponed the actual launch of the project several times, prompting investors and analysts to question what the long-term strategy of the company was. As the date of the company's annual meeting was imminent (scheduled for May 29, 2007) investors and industry analysts were expecting Pierre Beaudoin, president of Bombardier Acrospace, to clarify the company's plans for CSeries during this meeting.Page 19 9811M072 Exhibit 15 PERFORMANCE RATIOS AND INDICATORS (TSX: BBD B, ENDING JANUARY 31) Profitability Ratios 2005 2005 2004 2003 2007 2001 2000 1909 1998 Return on Equity (s) 10 27 -3.7 -2.74 -22 44 25.58 12.9 15.BE 14.5 Pre-Tax Margin 1 02 0184 0105 -3.34 2.70 7. 10 7.37 Not Profit Margin (5%) 1.60 0.54 -0.42 -26 1.81 5 28 4.82 4.04 Effective Tax Rate (*) 0.40 0.41 1.38 1.23 Liquidity Indicators Quick Ratio 0.20 0.22 0.11 0 07 0.03 0. 1 0.21 0.22 0.21 Current Ratio 1.07 1.02 1.20 1.07 1.85 1.49 1.51 Working Capital Total Assets -0.01 143 0.23 Debt Management Current Liabilities Equity 4.1 4.72 4.24 5.82 1.38 2.34 2.21 2.23 2 Total Debt to Equity 1.08 3.12 2.58 4.15 2.68 2.27 1.88 1.42 1.32 Long Term Debt to Assets 0.34 0.32 0.3 0.28 0. 18 0.15 Asset Management Revenues Total Assets D.B4 0.83 0 82 0.78 Revenues/Working Capital -207.41 21.48 -146.03 98 24 3.01 2.0 Interest Coverage 01.34 1.04 Source: Mergent Online database, accessed August 1, 2011.Page 13 9811M072 Exhibit 5 GLOBAL DEMAND SHIFTING TOWARD BRIC COUNTRIES 40% 35% 30% 25% Share of BRIC Orders 20% 15% 10% 5% 0% 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 Year of Orders Source: "Global Market Forecast 2006-2025: The Future of Flying. "Airbus, 2006, presentation by the authors. Exhibit 6 NEW REGIONAL JET AND SINGLE-AISLE DEMAND FOR THE 2006-2025 PERIOD 5,000 4,353 4,000 3:508-- J.289 2.784 3,000 2.006 2.172 # Orders 2,000 1,207 1,000 50 70/85 100 125 150 175 210 Seat Category Source: "Global Market Forecast 2006-2025: The Future of Flying. " Airbus, 2006, presentation by the authors.Page 20 9811M072 Exhibit 16 EMBRAER PERFORMANCE RATIOS AND INDICATORS (NYS: ERJ, ENDING DECEMBER 31) 2006 2004 2004 2003 2002 2001 2000 1909 1998 Profitability Ratios Retum on Equity (%) 12.33 14 07 28.43 15.75 35144 44.81 41.09 20. 12 31.6 Fatum on Assets (#) 3.82 4.17 8.85 4.58 10740 14.25 12 65 11.91 8.42 Actum on Investment 1417 18.31 40.74 26.9 117.07 81 88 17.44 2815 Gross Margin 0.025 0.024 01033 0.036 0 045 0.042 0.031 0 020 0.028 Operating Margin [) 8.23 4.97 10 49 18.B7 22.40 1805 11.8 10.85 Pre-Tax Margin 8 08 5.12 0.79 16.61 21.05 18 43 10.68 10.21 Not Profit Margin (#) 7.45 7.76 12.27 15.22 12 65 12.24 8.41 Effective Tax Rate 1.08 3.54 4.37 .1.55 142 Liquidity Indicators Quick Ratio 0.86 0.6 0.42 0.44 0.28 0.25 Current Ratio 1.83 1.81 1.01 1.53 1.54 1.51 1.52 1.23 Working Capital Total Assets 0.25 0.35 0.27 0.28 D.27 1 14 Debt Management Current Liabilities Equity 1.27 1.31 1.23 1.83 1.85 1.81 1.73 2.08 2.09 Total Debt to Equity 0 55 0.78 041 1.33 0 23 0.4 0.38 Long Term Debt to Assets 0 17 0.22 0.15 0.12 0.1 0.07 0 07 0.09 0107 Asset Management Revenues Total Assets 0.51 0.54 0.72 051 0.60 LITE Foevenues Working Capital 2 08 1.82 203 3.41 7.21 -33184 Interest Coverage 3.33 3.27 5.17 5.77 Source: Mergent Online database, accessed August 1, 2011.Page 12 9811M072 Exhibit 3 PASSENGERS' TICKET PURCHASING DECISION CRITERIA What is your main reason for flying on this airline? Price Convenient schedule Frequent Flyer Non-Stop flights Previous good experience Other Loyalty to carrier Safety reputation Employer policy On-time reputation In-flight service 0% 5% 10% 15% 20% 25% 30% 35% % Respondents Source: "Survey of international air travel, "IS. Department of Commerce and Airbus. 2006, www.eads. com/ums/eads/inferinvestor-relations/documents/2005/presentations/Global-Investor- Forum/g//2005_airbus3_commercial_leahy-pol, presentation by the authors. Exhibit 4 NEW AIRCRAFT DELIVERIES BETWEEN 1974 AND 2006 1000 800 -= = = 600 # Deliveries 400 - 200 1974 1976 1978 1980 1982 1984 1986 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 Year of delivery Source: "Global Market Forecast 2006-2025: The Future of Flying. "Airbus, 2006, presentation by the authors.Page 14 9811M072 Exhibit 7 BOMBARDIER PRODUCTS IN 2007 Business aircraft Regional aircraft Service & new programs |Flexjet and Skyjet Narrow-body models Regional models Parts logistics Fractional - Learjet 40/40 XR CRJ200 Aircraft maintenance ownership Learjet 45/45 XR CRJ700 Commercial training Hourly flight Learjet 60/60 XR CRJ705 Military aviation training entitlement CRJ900 Amphibious aircraft program Wide-body models - CRJ1000 (launched Specialized aircraft Challenger 300 in February 2007) solution - Challenger 604/605 - Global 5000 Turboprops models - Global Express XRS Q200 Challenger 800 Q300 Series Q400 Source: Bombardier's annual reports, 2006-2007 and 2007-2008, compiled by the authors. Exhibit 8 CATEGORIES AND CAPACITY OF AIRCRAFT AVAILABLE IN THE MARKET Capacity 140 Seats* Bombardier CRJ700, 900 CRJ1000 QSeries 200, 300, 400 CSeries100, 130 Embraer ERJ 135, 140, 145 Embraer 195 (108) Embraer 170 (70), 175 (88), 190 (98) Airbus A318 (115), A319 (140) A320 (160) , A321 (210) Boeing 717-200 (110), 737-600, 737- 737-800 (175), 737-900 700 (189) "Figures between brackets refer to the number of seats in single-class configurations. Source: Bombardier's annual reports, 2006-2007 and 2007-2008, compiled by the authors.Page 15 9811M072 Exhibit 9 CSERIES FUEL CONSUMPTION ADVANTAGE (500NM) CSeries 110 Embraer 195AR ACAC ARJ21-900 C110 Boeing 737-600W Model Benchmark Airbus A318 Cseries 130 Boeing 737-700W C130 Airbus A319 1,600 1,700 1,800 1,900 2,000 2,100 2,200 Fuel Consumption (USS/flight) Source: Bombardier's annual report, 2006-2007, compiled by the authors. Exhibit 10 COMPARISON OF BOMBARDIER AND EMBRAER PRODUCT ACTIVITY Year Bombardier's product activity Embraer's product activity 1991 Launch of Bombardier 415 1992 Delivery of CRJ100 1993 1994 Delivery of Bombardier 415 1995 Launch of Dash 8-200 Delivery of ERJ135 1996 Launch of CRJ200 1997 1998 1999 Launch of Q400 Launch of Embraer 170 Inaugural flight of CRJ700 Delivery of ERJ 135 2000 Delivery of Q400 Launch of Embraer 190 Launch of CRJ900 2001 Delivery of CRJ700 Delivery of ERJ140 Inaugural flight of CR.J900 2002 Launch of Embraer 175 Launch of Embraer 195 2003 Delivery of CRJ900 Delivery of Embraer 170 CSeries idea 2004 CSeries announced Delivery of Embraer 175 2005 Delivery of CRJ705 Delivery of Embraer 190 2006 CSeries on hold Delivery of Embraer 195 2007 Launch of CRJ1000 Source: Bombardier's annual reports, 2006-2007 and 2007-2008, compiled by the authors.Page 16 9811M072 Exhibit 11 BOMBARDIER AND EMBRAER SALES BETWEEN 1998 AND 2006 (UNITS DELIVERED) Bombardier model 1998 1999 2000 2001 2002 2003 2004 2005 2006 CRJ100/200 77 81 103 136 140 152 100 44 36 CRJ 700 2 20 50 64 65 47 CRJ900 14 12 12 Q100 200 1 0300 11 0400 16 Embraer model 2006 EMB 120 13 ERJ135 ERJ140 ERJ145 80 12 EMBRAER 170 EMBRAER 175 EMBRAER 190 EMBRAER 195 Exhibit 12 EVOLUTION OF BOMBARDIER AND EMBRAER SHARE VALUES (JULY 2001 - JULY 2007) 70 50 40 NYS:ERJ 30 1SXBBD.B 20 10 03/07/2001 03/03/20 02 03/11/2001 03/07/2002 0311/2002 0303/2003 0307/2003 03/11/2004 0303/2104 0307/2004 0303/2005 0307/2005 0311/2003 0303/2006 0307/2006 03/11/2005 0307/2007 0/03/2007 03/11/2006 Source: Yahoo! Finance, http /finance.yahoo.com, presentation by the authors.Page 18 9811M072 Exhibit 14 SIMPLIFIED INCOME STATEMENT OF EMBRAER (12 MONTHS ENDING DECEMBER 31) In Millions of [except for por share items) 2006 2005 2004 2001 20 02 2001 Revenue 3,759.62 3,789.49 3,352.14 2,143.46 2,626 80 4,030.80 Other Revenue, Total Total Rovenus 1,759 52 3,789.48 3,362.14 2,143.45 2,626 80 Cost of Reverie, Total 2,806.80 2,728.91 2,336.74 1,631.72 2,356 02 Gross Profit 952.72 1,050.59 1,015.41 808.43 994 05 1,676.79 Selling General Admin. Expenses, Total 498 82 421 05 38 5.64 241.39 345.91 480.60 Research & Development 112.74 93.17 44.61 173.22 158.60 Depredation Amortization Interest Expense (Income) - Net Operating 2.10 0 05 0.39 -0.47 Unusual Expense (Income) Other Operating Expenses, Total 26 08 41.27 29 05 Total Operating Expense 3,416.72 3,282.30 2,808.16 1,878.64 2,056 24 2,903.11 Operating Income 142.80 507-18 164 81 469 5 1,127 69 Interest Expense (Expenses), Net Non-Operating 105.43 -4.12 38.00 -140.76 10.46 115.05 Gain (Loss)on Sale of Assets Other, Net 4.10 -12 34 -16.79 -137_04 311.39 Income Before Tax 444.13 496.91 493.65 108.27 412 95 Income After Tax 465.34 381.51 136 26 224.47 646.98 Minority Interest -9.62 -1.31 027 -185 2 78 Equity In Affiliates Not Income Before Extra. Items 390.14 445.72 380 21 136 04 222 59 Accounting Change Discount Operations Extraordinary Rtem Net Income Before Extra. Items 441.09 IT'S BE 136.04 222 59 643.98 Preferred Dividends Income Available to Common Excl Extra Item 390.14 445.72 380 21 16.04 222 59 643.08 Income Available to Common Incl. Extra Item 441.09 38 5.38 135.04 222 59 643.98 Source: Yahoo! Finance, http /finance. yahoo.com, presentation by the authors.Page 17 9811M072 Exhibit 13 SIMPLIFIED INCOME STATEMENT OF BOMBARDIER INC. (12 MONTHS ENDING JANUARY 31) In Millions of (except for per share items) 2007 2006 2005 2004 2003 Revenue 13,250.00 13,245.00 13,912.00 19,953.40 19.773.93 Other Revenue, Total 1,632.00 1,481.00 1,634.00 1,186.85 1 235.44 Total Revenue 14,862.00 14.726.00 15,546.00 21,140.25 21,009.37 Cost of Revenie, Total 12,667.00 12,719.00 13,754.00 18,141.89 17 943.58 Gross Profit 583.00 526.00 158.00 1,81 1.51 1,830.35 Selling General/Admin. Expenses, Total 929.00 842.00 859.00 1,356.40 1,485.30 Research & Development 173.00 175.00 148.00 186.41 189.38 Depreciation/Amortization 518.00 545.00 549.00 786.28 Interest Expense (Income) - Net Operating 30.00 Unusual Expense (Income) 8.00 88.00 172.00 425.38 Other Operating Expenses, Total 4.00 Total Operating Expense 14,329.00 14.360.0 0 15.482.00 20.896.34 21,717.32 Operating Income 553.00 357.00 B4 00 243.91 707.85 Interest Expense (Expenses), Net Non-Operating 218.00 207.00 -224.00 234.00 214.17 Gain (Loss) on Sale of Assets Other, Net Income Before Tax 335.00 150.00 160.00 192 922.12 Income Alter Tax 243.00 135.00 -122.00 -193.35 -702.09 Minority Interest Equity In Affiliates Net Income Before Extra. Items 243.00 135.00 -122.00 -193.35 -702.99 Accounting Change Discount Operations Extraordinary Item Net Income Before Extra. Items 268.00 249.00 85.00 88.25 Preferred Dividends Income Available to Common Exel. Extra Item 215.00 110.00 -145.00 223.09 -731.74 Income Available to Common Incl. Extra Item 240.00 224.00 -108.00 -117.98 638.54 Source: Yahoo! Finance, http //finance.yahoo.com, presentation by the authors.Page 5 9811M072 Nevertheless, whenever a government intervened to support its national aircraft industry, foreign governments and competitors reacted vigorously and engaged in legal battles to prevent or delay them. They generally referred to the World Trade Organization's (WTO) trade framework and anti-dumping policies that were ratified by their countries. In particular, the WTO arbitrated several litigations between Canada and Brazil in relation to fair competition between Bombardier and Embraer. In August 2000, WTO authorized Canada to apply countermeasures of up to $2.1 billion in response to the government of Brazil's subsidies to Embraer through its PROEX program. However, Canada lost a battle to Brazil in December 2002 when the WTO granted Brazil the right to impose countermeasures of up to $385 million (instead of the $5.2 billion initially claimed by Brazil) against Canada. This conflict originated from a financing offer - with particularly low interest rates - made by the government of Canada to Air Wisconsin in return for the acquisition of Bombardier's aircraft. It is important to note, however, that the WTO ruling allowed Brazil to increase its tariffs on Canadian exports temporarily but did not prevent the transaction between Bombardier and Air Wisconsin from materializing Another means by which governments intervened in the industry was through environmental regulations. As global warming debates intensified, several governments established laws and introduced incentives to mitigate the negative effects of air transportation on the environment. " For instance, the European Union (EU) ruled the application of its Emissions Trading Scheme (ETS) to air transportation beginning 2011. This trend resulted in a race for the development and acquisition of more environment-friendly aircraft, in increased demand for fuel-efficient jets and in early withdrawals of airplanes with high fuel consumption. Accordingly, the new generations of airplanes were expected to be more energy-efficient and reduce noise pollution for the residential areas neighboring airports. Evolution of Aircraft Market The industry experienced major transformations as a result of several cyclical and random events, all of which had structuring and long-term effects on the dynamics of the industry as a whole. Short-lived events but lasting effects. Overall, the market for commercial aircraft followed a growth trend since the 1970s in terms of both turnover and volume of sales. However, the period between 2001 and 2003 was particularly difficult for the industry as a whole for a variety of reasons. Firstly, before 2001, the industry saw the emergence of a new category of carriers - generally referred to as LCC - initially in the United States and then globally. They were a natural response to the increasing sensitivity of travelers to pricing (see Exhibit 3). Oil crises also destabilized the industry in the 1970s and 1990s but their economic effects were quickly mitigated by airline carriers and manufacturers alike. Secondly, between 2001 and 2003, the industry was confronted with a major crisis as a result of several unforeseeable events that occurred during a short period of time. The attacks on the World Trade Center in September 2001 had a devastating effect on many companies due to the immediate collapse of demand. Many carriers had to cancel or defer their orders to manufacturers. Finally, as soon as the industry began to foresee its recovery from the effects of these events, an endemic disease appeared in Hong Kong and spread to the rest of the world. Between November 2002 and July 2003, the severe acute respiratory syndrome (SARS) affected 8,096 people and caused 774 deaths." The impact on most airline companies was as quick as it was critical. A large number of flights were cancelled,Page 2 9811M072 AEROSPACE: A CORE BUSINESS OF BOMBARDIER Bombardier Inc., the parent company of Bombardier Aerospace, was headquartered in Montreal, Canada since its inception by Joseph-Armand Bombardier in 1942. As its original name - Auto-Neige Bombardier Lid.' - implied, the company specialized initially in developing and trading snowmobiles in its home province of Quebec. In May 2007, Bombardier's activities were structured into two relatively independent divisions: Bombardier Aerospace (BA) which was the global leader in business and regional aircraft manufacturing and Bombardier Transportation (BT) which was also a world leader in rail equipment. The strategic objective of Bombardier had always been to make both divisions global leaders in their respective markets. While BA was already the leading manufacturer of regional aircraft in 2001, Bombardier acquired the German DaimlerChrysler Rail Systems GimbH (ADtranz) and thus turned BT into the largest manufacturer of integrated rail equipment in the world.* However, Bombardier Inc. faced difficulties in late 2001, largely due to the crisis in the airline industry that followed the September 11 attacks on the World Trade Center. This led the company to rationalize its operations, lay off employees and divest its recreational line of business including snowmobile and jetski products. The sale of this division to a group of investors, which included members of the Bombardier family, helped reduce the debt of the company in 2003. Subsequent to this restructuring, the performance of Bombardier Inc. had improved over time. In April 2007, the company's overall revenues reached $4 billion on a quarterly basis and its gross margin was about 15 per cent. BA's contribution represented 57 per cent of revenues ($2.26 billion) and 57.6 per cent of the gross margin ($344 million) (see Exhibit 1). From an organizational perspective, each of the divisions had its own president - Pierre Beaudoin for the acrospace division and Andre Navarri for the transportation division. The structure of the group was highly decentralized in order to provide the divisions with a level of autonomy that was in line with their accountability in terms of growth and profitability.* The head office was involved only in providing shared services such as strategic planning, human resources management, organizational development, public relations, finance and budgeting and legal affairs to the two divisions. In addition to their divisional responsibilities, the two divisional presidents became executive vice- presidents (EVPs) of Bombardier Inc. in December 2004 and consequently formed the *office of the president' along with corporate president and chief executive officer (CEO), Laurent Beaudoin. Industry analysts interpreted the nomination of Pierre Beaudoin as EVP of Bombardier Inc. as anticipatory of his future appointment to the head of the company as a replacement of his soon-to-retire father, Laurent Beaudoin. Bombardier had essentially been a family-run business since its inception. The Bombardier and Beaudoin families had been leading the company for 58 years, thus providing leadership stability and strategic coherence during the company's successful diversification era between 1975 and 1999. Following this period, the company has been less stable as it changed leadership regularly (see Exhibit 2). Industry analysts suggested that frequent changes in leadership led the company to blurred vision and strategic uncertainty. This may explain why Bombardier had lagged behind its competition in the regional aircraft market since then.Page 9 9811M072 BOMBARDIER AEROSPACE AND THE CSERIES DILEMMA On February 19, 2007, Bombardier announced its decision to expand the CRJ family and offer a new model by 2010. The objective of the CRJ1000 model was to provide higher capacity (86 to 104 seats) and higher levels of comfort to passengers at lower operating costs in comparison to Bombardier's own models and those of competitors in the range of 90-100 seats. The program was launched with 38 conditional orders, including 15 conversions from existing CRJ900 orders. Some analysts argued that the decision was tactical and short-lived because it merely extended an outdated family of products. It did not address Bombardier's fundamental issue of aging technologies within both the Q-Series and CRJ families. Other analysts suggested that the only way Bombardier could deal with the aging technology would be by developing a completely new generation of airplanes similar to those envisioned by the CSeries project. CSeries: Bombardier's Response to Market Transformation? Since July 2004, Bombardier was contemplating the development of the CSeries, a new family of aircraft capable of carrying between 100 and 135 passengers depending on models. It was intended for airliners who owned old generations of aircraft within the same capacity range. This included models such as DC9, Fokker 100, Boeing 737, BAE-146 and MD80 which were aging and needed to be replaced with more comfortable and more efficient models. For the airplanes available in 2007 (see Exhibit 8) to meet the capacity needs of regional carriers, they would have to be shortened (Airbus 318, Airbus 319, Boeing 737-200, Boeing 737-600) or lengthened (Embraer 190 and Embraer 195). Contrastingly, the CSeries family would be specifically optimized to operate on regional routes. Specifically, the C1 10 model was expected to consume 17 per cent less energy than the Airbus A318 while the C130 model would consume 11 per cent less than Airbus A319 (see Exhibit 9). In terms of operating costs, both Airbus and Bocing aircraft were significantly more expensive to operate than CSeries. While Bombardier's C110 would have to face Embraer's 190 and 195 models as direct competition (see Exhibits 10 and 11), the C130 model did not have any serious challenger in the market. However, some analysts did not exclude the possibility that Embraer could work on a secretive project, especially given the potential of this market segment and the company's significant investments in research and development, which jumped from $92 million in 2005 to $113 million in 2006. Hence, the window of opportunity for Bombardier's CSeries seemed to narrow quickly as time passed and potential competitors loomed (see Exhibits 12 to 16). The Genesis of the CSeries Initiative In July 2004, at the Farnborough Acrospace Fair, Bombardier announced its intention to develop a new family of regional aircraft called CSeries. The company anticipated that the demand for airplanes in the capacity range of 100 to 150 seats would represent 13 per cent of the overall aircraft market by 2025. Accordingly, this segment would represent about 6,000 units and $25 billion in sales. On March 15, 2005, Bombardier's board of directors approved the concept and gave Bombardier Acrospace permission to further investigate the feasibility of the project.Page 3 9811M072 AEROSPACE INDUSTRY: TEMPORARY TURBULENCE OR PERMANENT RESTRUCTURING? The first powered flight in history took place in December 17, 1903 when Orville and Wilbur Wright flew briefly from Kitty Hawk, North Carolina. The aircraft they engineered is generally referred to as the Wright Flyer or the Kitty Hawk. Since then, air travel grew exponentially to become an integral part of people's everyday lives as trade globalized and individuals traveled more often due to decreasing airfares and increasing leisure time. Furthermore, competition intensified increasingly among rivals as the aircraft industry developed and the number of travelers increased. Market Players Airline companies. The direct clients of aircraft manufacturers were businesses (for private jets) and airline carriers (for commercial aircraft); however, the end-customers were passengers who travelled more often and became increasingly sensitive to ticket price. The expectations of the average traveler changed significantly with the democratization of air travel and their needs and preferences guided the buying decisions of airline companies when they acquired new aircraft. The deregulation of the industry started in the United States in the late-1970s. Subsequently, it spread to the rest of the world and pressured airline companies to seek new means of reducing their costs. The preferences of travelers shifted from comfort in the 1980s and 1990s to low price (see Exhibit 3). This trend led to the proliferation of low-cost carrier (LCC) companies and to a significant drop in ticket price. In addition, the passenger airplanes had to be reliable, comfortable and economical while those used in cargo' required modularity and flexibility in order to accommodate the varying needs of customers. Leasing companies. Starting in the mid-1990s, the industry experienced significant changes in the way new aircraft were acquired and financed. Airline carriers moved from the traditional model, which involved bank loans to acquire airplanes, to more flexible modes of ownership and financial arrangements. To adapt to changing technical requirements and fluctuating demand, they used a variety of financial mechanisms, two of which are most common. First, lease financing allowed the carriers to own aircraft that were actually financed by manufacturers rather than banks. Indeed, financial solutions became critical to successful business development. For instance, Boeing Capital Corporation (BCC) was a division of Boeing whose mandate was to devise financial solutions for potential acquirers of Boeing airplanes. From Boeing's perspective, BCC's mission was to facilitate sales and support business development teams during the negotiation of new deals. Second, equipment leasing was another financial mechanism that was used widely in the industry. Leasing companies bought and maintained airplanes that they subsequently lent to carriers on demand. This model allowed for the dynamic adaptation of an airline's fleet to fluctuating demand in terms of both number and size of airplanes. Moreover, rental companies were able to negotiate better deals with manufacturers thanks to the high volume of aircraft they acquired as brokers. Outsourcing to suppliers and co-development with partners. The design and manufacturing of reliable and economical aircraft required high expertise in numerous areas. Consequently, aircraft manufacturers tended to leverage the know-how of external partners and subcontractors that had mastered very specific technologies and processes.Page 6 9811M072 which put airline companies in dire need. Several companies either sought hasty mergers with competitors or declared bankruptcy within the first few weeks of the outbreak. For the companies that survived these events, industry activity began to recover in 2003. By 2006, this activity reached the level of 2001 (see Exhibit 4) and airline carriers became profitable again." A cyclical industry in structural mutation. The aircraft industry was cyclical by nature and the replacement of aging airplanes was an important driver of the demand. New airplanes were typically acquired to either increase capacity or replace aircraft that were not suitable for the transportation of passengers anymore. The retired airplanes were generally recycled and reassigned to the transportation of goods. In the mid-1970s, airline carriers started to reconfigure their routes into networks (hub-and-spoke) instead of the traditional point-to-point configurations. Hub-and-spokes consisted of rings of small routes (spokes) used to consolidate traffic and feed regional airports (hubs) with larger numbers of passengers. This architecture led to a stunning development of regional carriers and subsequently to the commercial success of regional airplanes. This trend transformed the dynamics of the market in a profound way. In 2007, the long-term forecasts of major airline manufacturers predicted an even faster development of regional hubs between 2010 and 2025. Consequently, they expected the demand for regional aircraft of fewer than 140 seats to increase dramatically during this period. Buying Decision Criteria The configuration of a carrier's network of routes was dependent upon the level of demand on each route, the pricing strategy of the company and the capacity of the fleet it operated. In addition to the acquisition costs of airplanes, their exploitation costs were critical to the profitability and performance of carriers; this was why high fuel prices continued to impede the profitability of airline companies despite a decrease in other operating costs and an increase in revenues. The performance of airliner companies was essentially contingent on the effective control of their operating costs. The average consumption of commercial aircraft dropped by 37 per cent in just two decades. On average, modern aircraft consumed five per cent (or five litres of kerosene per 100 RPK ) in 2005 compared to eight per cent in 198517. In addition, the technologies used in making engines played a major role in the level of performance of aircraft. Typically, manufacturers promised to improve the operating costs of a new aircraft by developing new technologies to save energy and reduce maintenance needs. For instance, turbo-reactors were generally considered less expensive to maintain than turbo-props. Conversely, turbo-props consumed less fuel, generated less pollution but provided a lower level of comfort for passengers than turbo-reactors. Accordingly, the number of turbo-props operated by regional carriers increased significantly as fuel prices increased. Future Perspectives for the Industry" Supported by a generally dynamic economy, the aircraft market grew by 30 per cent between 2000 and 2005. This was made possible by a combination of gains in productivity, increase in existing capacity andPage 10 9811M072 On May 13, 2005, the Canadian government announced its commitment to provide Bombardier with financial assistance conditional to development of the CSeries in Canada. The pledge consisted of an interest-free line of credit of $350 million dedicated to the development of new technologies for CSeries. In 2005, the company conducted a feasibility study and released a mock-up of the aircraft at the Paris Air Show. During the same period, the company selected Bombardier's Montreal-Mirabel (Canada) site as the preferred location for the final assembly of the CSeries. They also announced an agreement with Pratt & Whitney Canada regarding the development of the engine for CSeries. Indeed, the company needed to secure a partner for the engine because, according to a spokesperson for Bombardier," potential clients consistently asked them questions pertaining to the type and manufacturer of the CSeries' engine Notwithstanding these positive developments, on January 31, 2006, Bombardier announced their decision to put the project on hold because "market conditions (did) not justify the launch of the CSeries program at (that) time.""The project team was subsequently reduced to about fifty people and the rest of the team was reassigned to other turbo-props regional jets within the range of 80 to 100 seats. During a January 31, 2007 press conference, Bombardier announced that the company was still refining its plans and confirmed the tentative commercialization of CSeries by 2013, should the project be launched in 2008. Two weeks later, on February 19, 2007, the company made public the launch of the CRJ1000 model targeting the 80-100 passengers range. This project was expected to proceed with the same resources that were released from the CSeries project in January 2006. As of April 2007, the initial cost of the CSeries project reached $100 million, the ongoing monthly spend- rate was about $1 million and the total development cost was estimated at about $2 billion. To offset some of these costs, the governments of Canada, Quebec province and the United Kingdom were expected to finance about $700 million; specifically, Canada's federal government pledged about $260 million, Quebec's provincial government about $90 million and the U.K. government about $350 million. The conditional release of these funds required Bombardier to carry out some research and development and production activities in Montreal-Mirabel and Belfast (Northern Ireland). THE DILEMMA Questions remained about Bombardier's future strategy in the acrospace industry. Prospects for its existing regional jet product line were a concern for several analysts. In turn, the CSeries project involved important investments in a competitive market that provided both threats and opportunities. Still, with the upcoming shareholder annual meeting, both analysts and shareholders were expecting Pierre Beaudoin to clarify the future of the CSeries.Page 11 9811M072 Exhibit 1 CONTRIBUTION OF BA AND BT TO BOMBARDIER INC. PERFORMANCE Revenue Revenue Gross Margin* Contribution $ (%) Bombardier Inc. (Corporate 3.967 100 597 (15] 100 Bombardier Aerospace 2.260 57 344 (15.2) 57.6 Bombardier Transportation 1.707 13 253 (14.8) 42.4 AN Figures in USS billions as of April 2007. Source: Bombardier's annual reports, 2006-2007 and 2007-2008, compiled by the authors. 2006 2005 2004 2003 20 02 20 01 2000 1999 1998 Currency (in million) USS LISS US LISS CA CAS CA CAS Bombardier Inc. revenue BT $14,726 $15.546 $15.201 $13.277 $21.633 $15.944 $13,417 $1 1,286 $ 8.134 Acrospace revenue( BA) $ 8.087 $ 7.980 $ 8.261 $ 7.271 $12.042 $10,562 $ 8, 126 $ 6,444 $ 4.874 BA continbution ratio 51% 54%% 5696 61% 579 5895 BA margin (3) S 206 S S 438 S 582 $ 1,206 $ 1,237 904 682 JA margin (26) 3.3% 2.5% 5.3% 8.0%% 11.7% 11.1% 10.6% 9.8% Source: Bombardier's annual reports, 2005-2006 and 2006-2007, compiled by the authors. Exhibit 2 EVOLUTION OF BOMBARDIER'S LEADERSHIP Year Events 1942 Joseph-Armand Bombardier creates Auto-Neige Bombardier Lid. 1964 Joseph-Armand Bombardier dies and Laurent Beaudoin is appointed general manager. 1966 Laurent Beaudoin becomes president of the company 1969 Bombardier becomes a public company. 1979 Laurent Beaudoin is named chairman and CEO of Bombardier Inc. 1990 Pierre (son of Laurent) Beaudoin appointed vice-president of product development for the sea- doo/ski-doo division of Bombardier Inc. 19920 Pierre Beaudoin is named executive vice-president of Sea-Doo Ski-Doo. 19940 Pierre Beaudoin serves as president of the sea-doo/ski-doo division. 19960) Pierre Beaudoin is appointed president and chief operating officer (COO) of Bombardier Recreational Products. Robert E. Brown is promoted to president and COO of Bombardier Aerospace. 1999( Laurent Beaudoin is named chairman of the board and of the executive committee. Robert E. Brown is appointed president and CEO of Bombardier Inc. 2001 Pierre Beaudoin is appointed president of Bombardier Aerospace, Business Aircraft in February, and president and COO in October. 2002 1 In December, Robert E. Brown resigns 20030) In January, Paul Tellier is appointed president, CEO and director of Bombardier Inc. 20041 In December, Paul Tellier resigns. Laurent Beaudoin is appointed CEO, Pierre Beaudoin is named EVP and a member of the board of directors of Bombardier Inc. in addition to his duties as president and COO of Bombardier Aerospace "Period of diversification; It Period of restructuring. Source: Bombardier's annual reports, 2006-2007 and 2007-2008, compiled by the authors.Page 4 9811M072 Like its competitors, Bombardier was primarily an integrator of technologies and components that were developed by select strategic partners in compliance with the company's specifications and requirements. An average airplane comprised about 55,000 parts, most of which were subcontracted to external partners. In 2007 alone, Bombardier paid nearly $6 billion in outsourcing costs to subcontractors. These were of three categories:" The first included manufacturers of major structural components such as wings, engines and landing gears (c.g., Allied Signals, Bocing Canada, GE Engines, McDonnel Douglas, Pratt & Whitney and Rolls-Royce Motors); the second type included suppliers of less complex but important parts (c.g., Parker Hannifin, Rockwell Collins, Honeywell, Goodrich and Hamilton Sundstrand); the third category consisted of repair and routine maintenance companies (e.g., Rolls-Royce, Field Aviation, CAE Aviation, Conair and Standard Acro)- Aircraft manufacturers typically sought strategic partnerships to access external expertise and competences they lacked internally. In terms of quality, the components provided by outside partners were expected to meet the highest standards set by industry regulators and fulfill the promises made to customers by the company, especially in terms of performance and operating costs. Strategic partnerships were also used by some manufacturers to achieve economies of scale while focusing on their core competencies as well as to reduce time-to-market while developing and marketing new products. This was often achieved by joining research efforts and achieving synergies in terms of human and financial resources. Furthermore, partnerships allowed for the sharing of industrial and commercial risks that were inherent to high-tech and research-intensive ventures such as in acronautics. Governmental regulations and subsidies. Aeronautics had always been viewed as a highly strategic industry by governments. Companies like Bombardier were not only major job-creators but also symbols of pride and sovereignty. This may be explained by the possibility of technology transfer between the commercial and military streams of the industry." Accordingly, governments tended to support their national manufacturers and spend billions of dollars in direct or indirect subsidies to support their research and development efforts, promote their products and shield their local markets from foreign competition. In Canada, for example, the provincial and federal governments initiated various programs to foster research and mitigate investment risks for local players. Three programs are particularly illustrative of the mechanisms they used to achieve this objective. First, Export Development Canada (EDC) provided financial support and special warranty to all Canadian companies involved in the export of aerospace products and services. Second, Technology Partnerships Canada (TPC) was set up to provide funding support for strategic research and development in areas including acronautics. Finally, Program productivity of the industry of the material of defense (PPIMD) provided generous credit lines to finance research and development projects that took place in Canada. More specifically, the government of Canada granted loans to local airline companies when they acquired Bombardier's jets. While this program was clearly designed to support Bombardier against its main competitor (Brazilian Embraer) in the Canadian market, the government of Canada argued that the practice was common in the industry worldwide. 0Page 7 9811M072 entry of new players in the market. Moreover, Airbus forecasted an annual growth of 4.8 per cent for passenger aircraft market over a period of twenty years, rising from 12,676 in 2005 to 27,307 in 2025. Market trends by geographical area. The business model of LCCs has been viable since its inception in the early 1990s owing to tight control of operating costs. By the middle of the 1990s, regional carriers pushed to lower their costs and to specialize in short- to mid-range routes while seeking synergies with traditional carriers that operated longer distance transportation. This combination attempted to offer a viable and flexible alternative to LCCs. In 2007, the model was expected to develop further as regional traffic grew, especially in emerging markets. Large emerging countries such as Brazil, China, India and Russia (BRIC) spanned wide geographic areas and their populations were growing quickly. Other smaller but fast-growing countries in Africa, Asia, Eastern Europe and Latin America were also expected to contribute to the growth of the industry in a significant way."The orders by BRIC countries represented more than 35 per cent of the global demand in 2005. This was a major rebound from less than five per cent just a few years earlier (see Exhibit 5). Market trends by category of aircraft. Airplanes were typically categorized according to their capacity and their range of reach. Most manufacturers and analysts made a distinction between three categories of aircraft or market segments. First, commercial airplanes were designed to carry more than 100 passengers. The European Airbus and American Boeing were the two traditional manufacturers of commercial jets. Airlines were expected to acquire an average of 1,133 commercial airplanes every year between 2006 and 2025. The utilization of mid-size aircraft ranging from 100 to 140 seats had also increased steadily in both domestic and regional transportation segments. In North America, this category represented more than two-thirds of all aircraft sold between 2000 and 2006. Globally, this market segment was expected to grow by 56 per cent over twenty years, rising from 5,400 units in 2006 to 8,400 in 2026. Second, the capacity of regional jets ranged between 30 and 100 seats. These crafts were primarily used by regional carriers to respond to two types of transportation needs: local point-to-point routes with high frequency and interconnections between regional hubs that were used by long-haul carriers. Regional transporters often operated turbo-reactors or turbo-props of fewer than 100 seats whereas large airline companies used larger airplanes on long-haul, continental and international routes. According to the General Aviation Manufacturers Association," 245 regional aircraft were delivered worldwide in 2006. Bombardier also forecasted that the demand for regional jets of 30 to 100 seats was set to reach 5,400 units by 2026 (see Exhibit 6). Overall, the demand was increasingly shifting towards regional jets with a capacity of 100 to 150 seats. Finally, business jets were designed to carry fewer than 20 passengers. They were intended for affluent individuals or large organizations seeking flexibility in travel arrangements for their executives. BOMBARDIER AEROSPACE: A LEADER IN THE REGIONAL JET MARKET Bombardier specialized in the development and manufacturing of two types of airplanes: business jets and regional aircraft. To a much lower extent, they also manufactured amphibious airplanes that were used in firefighting, sold spare parts, provided maintenance and training services and offered multi-property Flexjet and Skyjet services (see Exhibit 7). In 2006, Bombardier delivered a total of 337 aircraft including 197 business jets, 138 regional jets and two amphibious aircraft.Page 8 9811M072 Business Jets Segment Bombardier had three major categories of businesses jets: the Learjet family, composed of narrow fuselage aircraft, and Challenger and Global Express families, which included larger fuselage airplanes. Compared to its competitors, Bombardier had a more diversified portfolio of products in this segment. In 2006, Bombardier had 27 per cent market share in this segment, which represented about 47 per cent of the total sales of the company." In terms of volume, Bombardier made 213 units out of the 798 business jets delivered by the industry during the same year. Regional Jets Segment Bombardier also had two families of regional aircraft: CRJ and Q-Series. Both series were developed based on technologies from the 1970s that were fine-tuned over the following decades. The capacity of crafts in the CRJ family ranged from 40 to 100 seats. CRJ had the reputation of being energy-efficient and was the most popular regional airplane series in history" with 1,409 units sold as of January 2007. The capacity of Q-Series crafts was relatively similar to that of CRJ as it ranged from 37 to 78 seats. However, Q-Series used turbo-propulsion technology whereas CRJ was based on turbo-reaction technology. Consequently, Q-Series required less maintenance and had considerable economic advantages, especially on short-distance routes; for example, Q-Series crafts allowed for 28 per cent reduction in fuel consumption, 83 per cent in engine maintenance costs and 14 per cent in personnel and crew costs." They were, however, less comfortable for passengers compared to CRJ. This was due to their narrow body and much noisier engine, particularly during takeoff and landing. In 2006, 245 regional aircraft of fewer than 100 seats were delivered by the industry worldwide, compared to 288 in 2005. Bombardier delivered 126 units in 2006, compared to 153 in 2005. Competition in Regional Jets Market Bombardier had two general competitors in the regional aircraft market: Embraer in the segment of turbo- reactors and ATR in the segment of turbo-props. However, Embraer was the only serious competitor in the segment of 90 to 149 seats. Embraer had two models (ERJ190 and ERJ195) that were specifically designed to satisfy the requirements of regional carriers in terms of both capacity and efficiency (see Exhibit 8). In addition, Boeing and Airbus had several models (B717 and B737-600 for Bocing and A318-100 for Airbus) with capacity of slightly above 100 seats but these aircraft were significantly more expensive to acquire and operate, especially on regional routes. While Embraer and Bombardier were the leading manufacturers in the regional aircraft segment in 2007, several countries showed interest in entering this market. They were driven by their national needs as well as by the attractive opportunity of entering such a high-potential segment. For instance, the Chinese government expressed plans to build a modern aircraft industry and the state-owned AVIC-I (China Aviation Industry Corp.) announced its ARJ21-900 model (105 seats) for 2011. Japanese Mitsubishi Heavy Industries (MHI) also announced the development of a similar family of aircraft (MRJ) with two models: MRJ-70 (70 passengers) and MRJ-90 (90 passengers). "Interestingly, both AVIC-I and MHI were suppliers of parts used in Bombardier's Q-Series. Likewise, the Russian Sukhoi made public its intention to develop the RRJ (Russian Regional Jet)" family, also known as Superjet 100 Regional Jet with similar capacity. If the Chinese and Russian projects were carried forward, they could become serious competitors to Bombardier's CRJ1000 model (launched in February 19, 2007) and CSeries family

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts