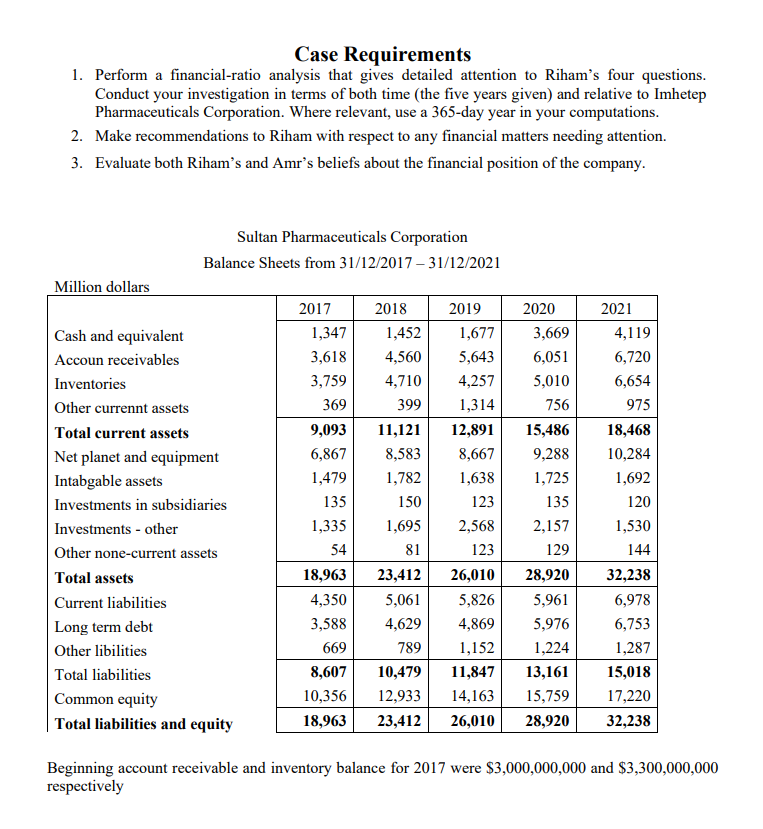

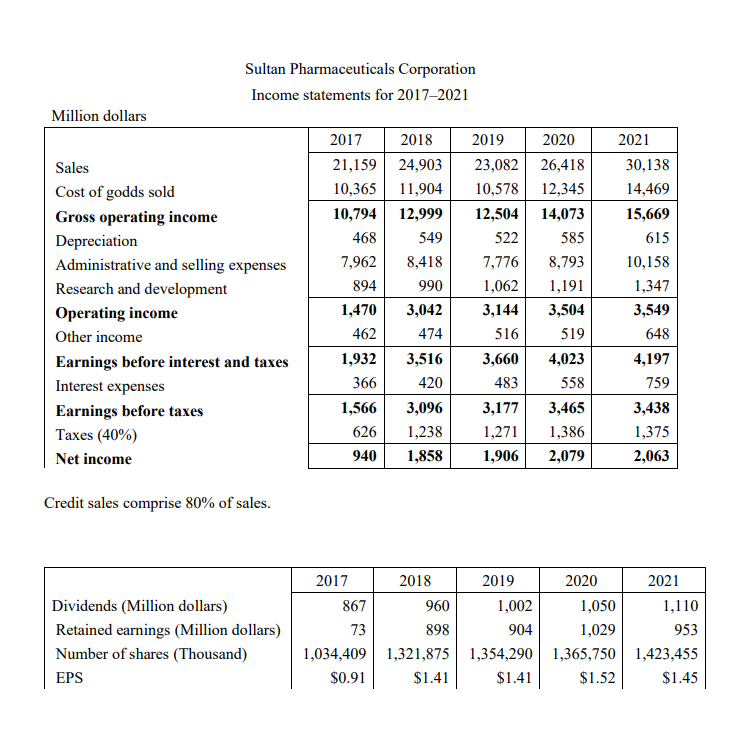

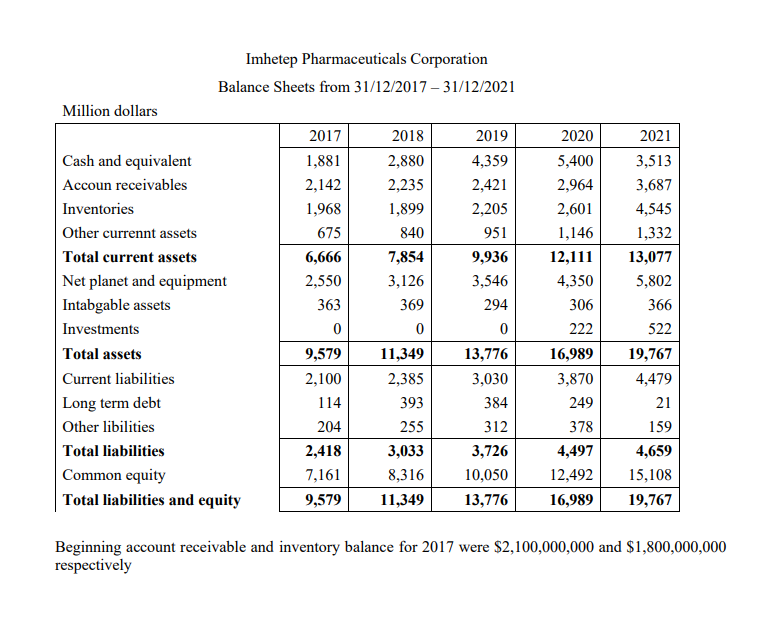

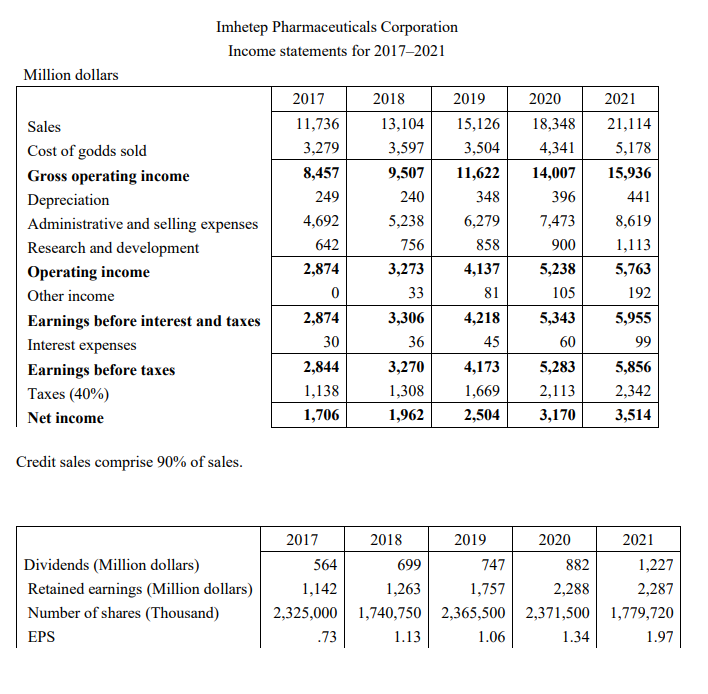

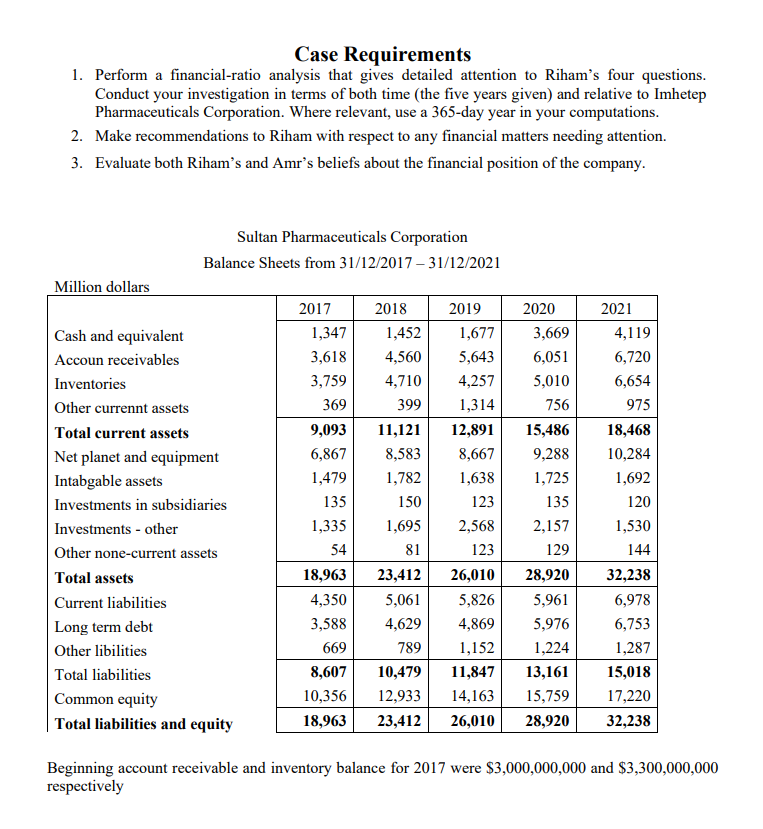

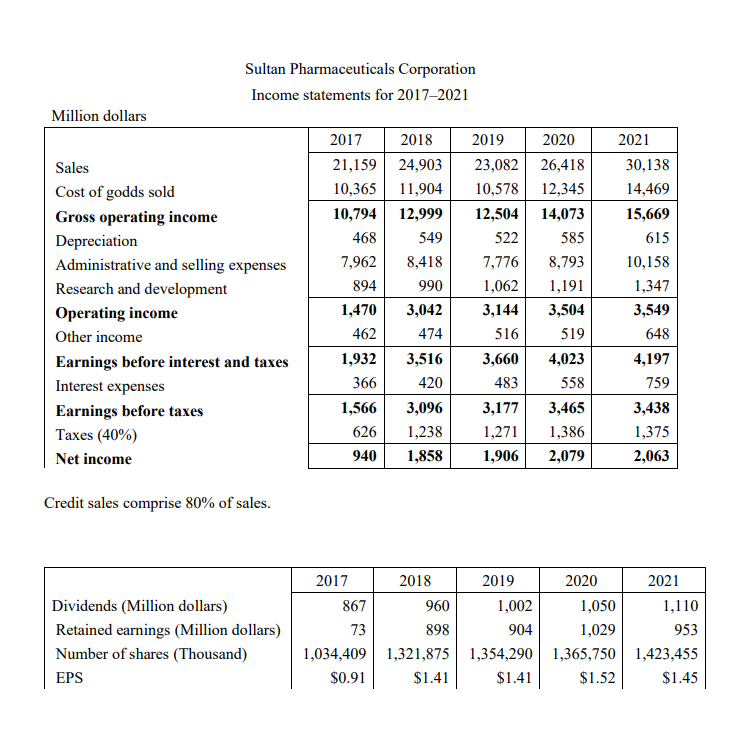

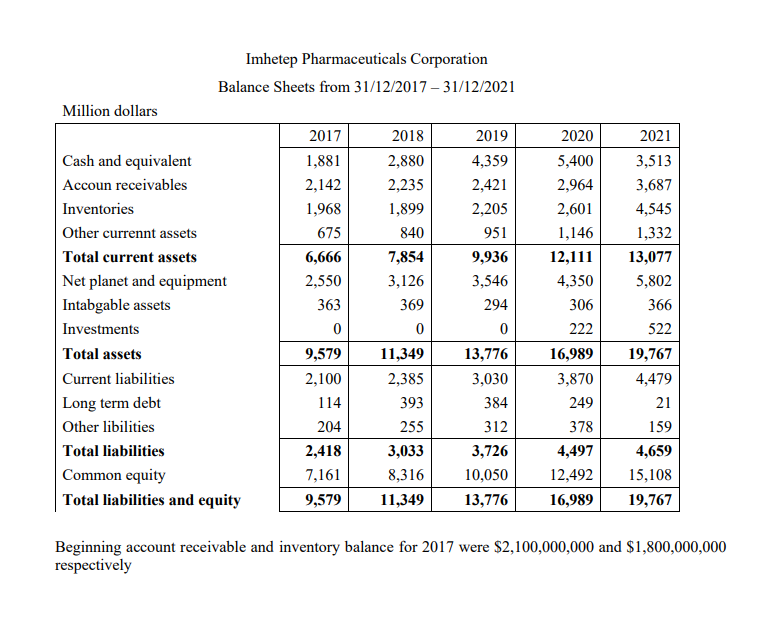

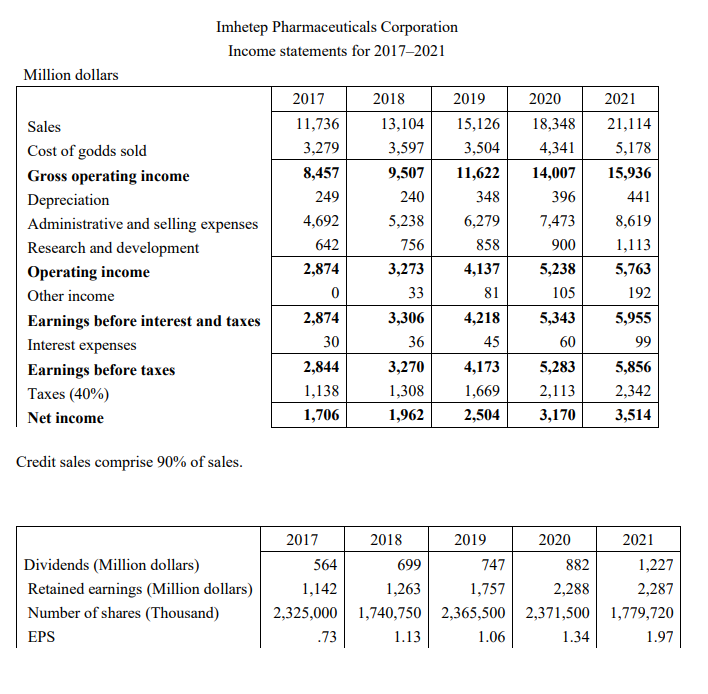

Case Requirements 1. Perform a financial-ratio analysis that gives detailed attention to Riham's four questions. Conduct your investigation in terms of both time (the five years given) and relative to Imhetep Pharmaceuticals Corporation. Where relevant, use a 365-day year in your computations. 2. Make recommendations to Riham with respect to any financial matters needing attention. 3. Evaluate both Riham's and Amr's beliefs about the financial position of the company. Sultan Pharmaceuticals Corporation Balance Sheets from 31/12/2017 - 31/12/2021 Million dollars 2017 2018 2019 2020 2021 Cash and equivalent 1,347 1,452 1,677 3,669 4,119 Accoun receivables 3,618 4,560 5,643 6,051 6,720 Inventories 3,759 4,710 4,257 5,010 6,654 Other currennt assets 369 399 1,314 756 975 Total current assets 9,093 11,121 12,891 15,486 18,468 6,867 8,583 8,667 9,288 10,284 Net planet and equipment Intabgable assets 1,479 1,782 1,638 1,725 1,692 Investments in subsidiaries 135 150 123 135 120 1,335 1,695 2,568 2,157 1,530 Investments - other Other none-current assets 54 81 123 129 144 Total assets 18,963 23,412 26,010 28,920 32,238 Current liabilities 4,350 5,061 5,826 5,961 6,978 Long term debt 3,588 4,629 4,869 5,976 6,753 Other libilities 669 789 1,152 1,224 1,287 Total liabilities 8,607 10,479 11,847 13,161 15,018 10,356 12,933 14,163 15,759 17,220 Common equity Total liabilities and equity 18,963 23,412 26,010 28,920 32,238 Beginning account receivable and inventory balance for 2017 were $3,000,000,000 and $3,300,000,000 respectively Sultan Pharmaceuticals Corporation Income statements for 2017-2021 Million dollars 2017 2018 2019 2020 2021 Sales 23,082 26,418 30,138 21,159 24,903 10,365 11,904 10,578 12,345 14,469 10,794 12,999 12,504 14,073 15,669 468 549 522 585 615 Cost of godds sold Gross operating income Depreciation Administrative and selling expenses Research and development Operating income 7,962 8,418 7,776 8,793 10,158 894 990 1,062 1,191 1,347 1,470 3,042 3,144 3,504 3,549 Other income 462 474 516 519 648 1,932 3,516 3,660 4,023 4,197 366 420 483 558 759 Earnings before interest and taxes Interest expenses Earnings before taxes Taxes (40%) 1,566 3,096 3,177 3,465 3,438 626 1,238 1,271 1,386 1,375 Net income 940 1,858 1,906 2,079 2,063 Credit sales comprise 80% of sales. 2017 2018 2019 2020 2021 Dividends (Million dollars) Retained earnings (Million dollars) Number of shares (Thousand) 867 960 1,002 1,050 1,110 73 898 904 1,029 953 1,034,409 1,321,875 1,354,290 1,365,750 1,423,455 $0.91 $1.41 $1.41 $1.52 $1.45 EPS Imhetep Pharmaceuticals Corporation Balance Sheets from 31/12/2017 - 31/12/2021 Million dollars 2017 2018 2019 2020 2021 Cash and equivalent 1,881 2,880 4,359 5,400 3,513 Accoun receivables 2,142 2,235 2,421 2,964 3,687 Inventories 1,968 1,899 2,205 2,601 4,545 Other current assets 675 840 951 1,146 1,332 Total current assets 6,666 7,854 9,936 12,111 13,077 2,550 3,126 3,546 4,350 5,802 Net planet and equipment Intabgable assets 363 369 294 306 366 Investments 0 0 0 222 522 Total assets 9,579 11,349 13,776 16,989 19,767 Current liabilities 2,100 2,385 3,030 3,870 4,479 Long term debt 114 393 384 249 21 Other libilities 204 255 312 378 159 Total liabilities 2,418 3,033 3,726 4,497 4,659 7,161 8,316 10,050 12,492 15,108 Common equity Total liabilities and equity 9,579 11,349 13,776 16,989 19,767 Beginning account receivable and inventory balance for 2017 were $2,100,000,000 and $1,800,000,000 respectively Imhetep Pharmaceuticals Corporation Income statements for 2017-2021 Million dollars 2017 2018 2019 2020 2021 Sales 11,736 13,104 15,126 18,348 21,114 3,279 3,597 3,504 4,341 5,178 8,457 9,507 11,622 14,007 15,936 249 240 348 396 441 Cost of godds sold Gross operating income Depreciation Administrative and selling expenses Research and development Operating income Other income 4,692 5,238 6,279 7,473 8,619 642 756 858 900 1,113 2,874 3,273 4,137 5,238 5,763 0 33 81 105 192 Earnings before interest and taxes 2,874 3,306 4,218 5,343 5,955 Interest expenses 30 36 45 60 99 2,844 3,270 4,173 5,283 5,856 Earnings before taxes Taxes (40%) 1,138 1,308 1,669 2,113 2,342 Net income 1,706 1,962 2,504 3,170 3,514 Credit sales comprise 90% of sales. 2017 2018 2019 2020 2021 564 699 747 882 1,227 Dividends (Million dollars) Retained earnings (Million dollars) Number of shares (Thousand) EPS 1,142 1,263 1,757 2,288 2,287 2,325,000 1,740,750 2,365,500 2,371,500 1,779,720 .73 1.13 1.06 1.34 1.97 Case Requirements 1. Perform a financial-ratio analysis that gives detailed attention to Riham's four questions. Conduct your investigation in terms of both time (the five years given) and relative to Imhetep Pharmaceuticals Corporation. Where relevant, use a 365-day year in your computations. 2. Make recommendations to Riham with respect to any financial matters needing attention. 3. Evaluate both Riham's and Amr's beliefs about the financial position of the company. Sultan Pharmaceuticals Corporation Balance Sheets from 31/12/2017 - 31/12/2021 Million dollars 2017 2018 2019 2020 2021 Cash and equivalent 1,347 1,452 1,677 3,669 4,119 Accoun receivables 3,618 4,560 5,643 6,051 6,720 Inventories 3,759 4,710 4,257 5,010 6,654 Other currennt assets 369 399 1,314 756 975 Total current assets 9,093 11,121 12,891 15,486 18,468 6,867 8,583 8,667 9,288 10,284 Net planet and equipment Intabgable assets 1,479 1,782 1,638 1,725 1,692 Investments in subsidiaries 135 150 123 135 120 1,335 1,695 2,568 2,157 1,530 Investments - other Other none-current assets 54 81 123 129 144 Total assets 18,963 23,412 26,010 28,920 32,238 Current liabilities 4,350 5,061 5,826 5,961 6,978 Long term debt 3,588 4,629 4,869 5,976 6,753 Other libilities 669 789 1,152 1,224 1,287 Total liabilities 8,607 10,479 11,847 13,161 15,018 10,356 12,933 14,163 15,759 17,220 Common equity Total liabilities and equity 18,963 23,412 26,010 28,920 32,238 Beginning account receivable and inventory balance for 2017 were $3,000,000,000 and $3,300,000,000 respectively Sultan Pharmaceuticals Corporation Income statements for 2017-2021 Million dollars 2017 2018 2019 2020 2021 Sales 23,082 26,418 30,138 21,159 24,903 10,365 11,904 10,578 12,345 14,469 10,794 12,999 12,504 14,073 15,669 468 549 522 585 615 Cost of godds sold Gross operating income Depreciation Administrative and selling expenses Research and development Operating income 7,962 8,418 7,776 8,793 10,158 894 990 1,062 1,191 1,347 1,470 3,042 3,144 3,504 3,549 Other income 462 474 516 519 648 1,932 3,516 3,660 4,023 4,197 366 420 483 558 759 Earnings before interest and taxes Interest expenses Earnings before taxes Taxes (40%) 1,566 3,096 3,177 3,465 3,438 626 1,238 1,271 1,386 1,375 Net income 940 1,858 1,906 2,079 2,063 Credit sales comprise 80% of sales. 2017 2018 2019 2020 2021 Dividends (Million dollars) Retained earnings (Million dollars) Number of shares (Thousand) 867 960 1,002 1,050 1,110 73 898 904 1,029 953 1,034,409 1,321,875 1,354,290 1,365,750 1,423,455 $0.91 $1.41 $1.41 $1.52 $1.45 EPS Imhetep Pharmaceuticals Corporation Balance Sheets from 31/12/2017 - 31/12/2021 Million dollars 2017 2018 2019 2020 2021 Cash and equivalent 1,881 2,880 4,359 5,400 3,513 Accoun receivables 2,142 2,235 2,421 2,964 3,687 Inventories 1,968 1,899 2,205 2,601 4,545 Other current assets 675 840 951 1,146 1,332 Total current assets 6,666 7,854 9,936 12,111 13,077 2,550 3,126 3,546 4,350 5,802 Net planet and equipment Intabgable assets 363 369 294 306 366 Investments 0 0 0 222 522 Total assets 9,579 11,349 13,776 16,989 19,767 Current liabilities 2,100 2,385 3,030 3,870 4,479 Long term debt 114 393 384 249 21 Other libilities 204 255 312 378 159 Total liabilities 2,418 3,033 3,726 4,497 4,659 7,161 8,316 10,050 12,492 15,108 Common equity Total liabilities and equity 9,579 11,349 13,776 16,989 19,767 Beginning account receivable and inventory balance for 2017 were $2,100,000,000 and $1,800,000,000 respectively Imhetep Pharmaceuticals Corporation Income statements for 2017-2021 Million dollars 2017 2018 2019 2020 2021 Sales 11,736 13,104 15,126 18,348 21,114 3,279 3,597 3,504 4,341 5,178 8,457 9,507 11,622 14,007 15,936 249 240 348 396 441 Cost of godds sold Gross operating income Depreciation Administrative and selling expenses Research and development Operating income Other income 4,692 5,238 6,279 7,473 8,619 642 756 858 900 1,113 2,874 3,273 4,137 5,238 5,763 0 33 81 105 192 Earnings before interest and taxes 2,874 3,306 4,218 5,343 5,955 Interest expenses 30 36 45 60 99 2,844 3,270 4,173 5,283 5,856 Earnings before taxes Taxes (40%) 1,138 1,308 1,669 2,113 2,342 Net income 1,706 1,962 2,504 3,170 3,514 Credit sales comprise 90% of sales. 2017 2018 2019 2020 2021 564 699 747 882 1,227 Dividends (Million dollars) Retained earnings (Million dollars) Number of shares (Thousand) EPS 1,142 1,263 1,757 2,288 2,287 2,325,000 1,740,750 2,365,500 2,371,500 1,779,720 .73 1.13 1.06 1.34 1.97