Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case Scenario about financial planning, accounting and analysis Answer Part A & B below as they are related together with discussion NOTE: You can deduct

Case Scenario about financial planning, accounting and analysis

Answer Part A & B below as they are related together with discussion

NOTE: You can deduct 2 questions from my account for both parts, if its not possible ill email the staff and ask for 2 questions deduction to the expert's credits

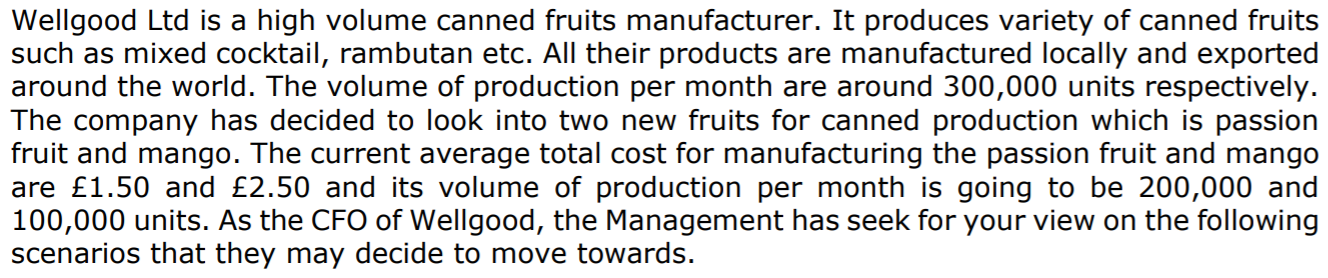

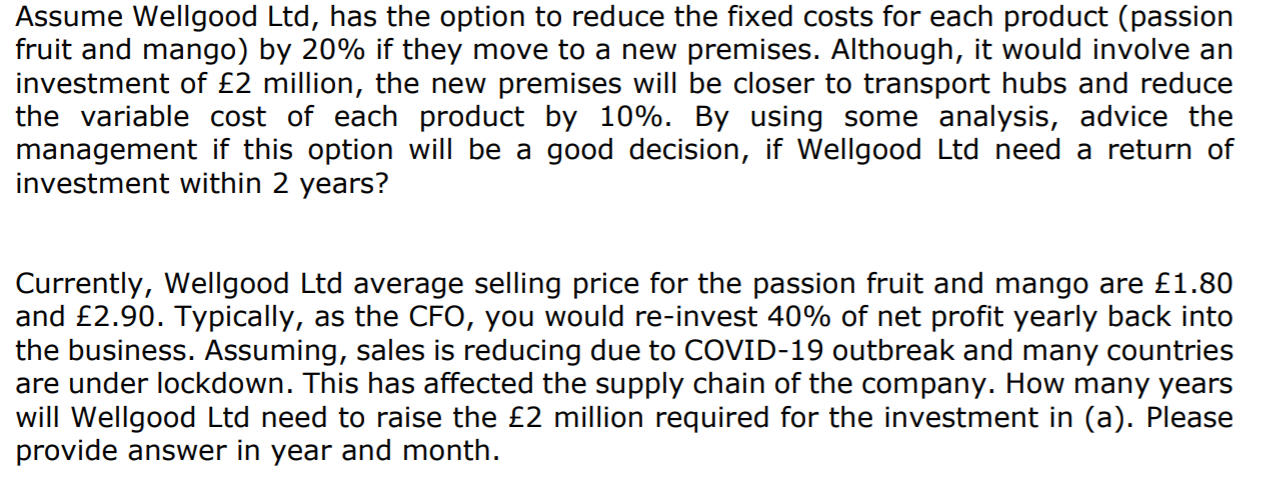

Wellgood Ltd is a high volume canned fruits manufacturer. It produces variety of canned fruits such as mixed cocktail, rambutan etc. All their products are manufactured locally and exported around the world. The volume of production per month are around 300,000 units respectively. The company has decided to look into two new fruits for canned production which is passion fruit and mango. The current average total cost for manufacturing the passion fruit and mango are 1.50 and 2.50 and its volume of production per month is going to be 200,000 and 100,000 units. As the CFO of Wellgood, the Management has seek for your view on the following scenarios that they may decide to move towards. Assume Wellgood Ltd, has the option to reduce the fixed costs for each product (passion fruit and mango) by 20% they move to a new premises. Although, it would involve an investment of 2 million, the new premises will be closer to transport hubs and reduce the variable cost of each product by 10%. By using some analysis, advice the management if this option will be a good decision, if Wellgood Ltd need a return of investment within 2 years? Currently, Wellgood Ltd average selling price for the passion fruit and mango are 1.80 and 2.90. Typically, as the CFO, you would re-invest 40% of net profit yearly back into the business. Assuming, sales is reducing due to COVID-19 outbreak and many countries are under lockdown. This has affected the supply chain of the company. How many years will Wellgood Ltd need to raise the 2 million required for the investment in (a). Please provide answer in year and month. Wellgood Ltd is a high volume canned fruits manufacturer. It produces variety of canned fruits such as mixed cocktail, rambutan etc. All their products are manufactured locally and exported around the world. The volume of production per month are around 300,000 units respectively. The company has decided to look into two new fruits for canned production which is passion fruit and mango. The current average total cost for manufacturing the passion fruit and mango are 1.50 and 2.50 and its volume of production per month is going to be 200,000 and 100,000 units. As the CFO of Wellgood, the Management has seek for your view on the following scenarios that they may decide to move towards. Assume Wellgood Ltd, has the option to reduce the fixed costs for each product (passion fruit and mango) by 20% they move to a new premises. Although, it would involve an investment of 2 million, the new premises will be closer to transport hubs and reduce the variable cost of each product by 10%. By using some analysis, advice the management if this option will be a good decision, if Wellgood Ltd need a return of investment within 2 years? Currently, Wellgood Ltd average selling price for the passion fruit and mango are 1.80 and 2.90. Typically, as the CFO, you would re-invest 40% of net profit yearly back into the business. Assuming, sales is reducing due to COVID-19 outbreak and many countries are under lockdown. This has affected the supply chain of the company. How many years will Wellgood Ltd need to raise the 2 million required for the investment in (a). Please provide answer in year and monthStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started