Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case Stades Astt Pctce and Performance Reviw 2019 Wd INSER NCE PAGE LACUT DESKIN MAILINGS REVIEW VEW Case Study Six You are an audit senior

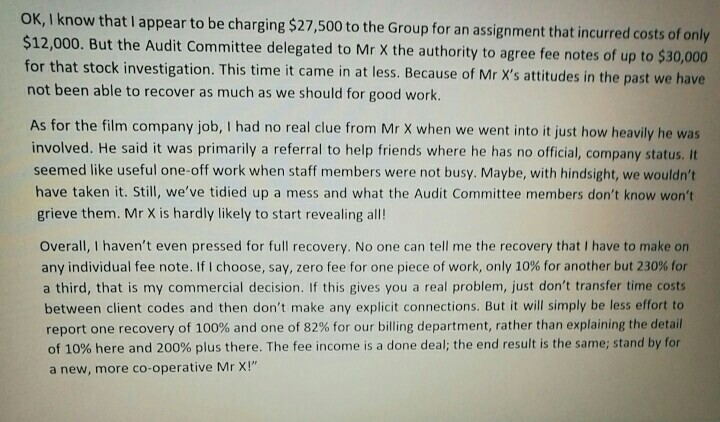

Case Stades Astt Pctce and Performance Reviw 2019 Wd INSER NCE PAGE LACUT DESKIN MAILINGS REVIEW VEW Case Study Six You are an audit senior manager for a manufacturing client where your firm's working relationships with the Group's long-standing Finance Director, Mr X, are notoriously 'difficult Too often, he seems to equate 'compromise' with 'weakness' so that he makes few concessions to his position without protracted negotiations, whether on can become disconcerting, not just because they seem unnecessarily time-consuming but the outcomes timetables, interpretation of Standards or fees. This can seem unreasonable too. For example, when, at the last audit, your firm had resolutely insisted on a more conservative valuation of long-term contracts, Mr X had dropped several unsubtle hints that the engagement should be put out early to tender. Frustratingly, to the client's Audit Committee, Mr X's approach seems characterised not as, 'difficult' but as, 'principled'. Some weeks ago, Mr Y, the engagement partner, asked you to 'sort out' the accountancy and financial statements of a small private company that had been set up a few years ago to make artistic films. This company had been persistently loss making and its one film, which had taken significantly longer to release than expected, had flopped at the box-office. During the leisurely production process, significant sums seemed to have been spent on hotels and restaurants. The shareholders and directors of the company are a young film director and the young actress who Word starred in the film. They are 'resting' and have told you that the company too is now dormant and will be just enough funds to cover the costs of this and of residual bills. Apart from a few wound up. There are small grants, the majority of the finance had been by way of loans that will not now be repaid. You were very surprised to discover that the source of all these loans had been Mr X. He had also given personal guarantees that all trade creditors will be paid. As requested by Mr Y, you have worked closely with a colleague in your firm's tax department to progress the efficient submission to IRAS of tax computations for the film company. Alongside this, some advice was given personally to Mr X on the idiosyncrasies of tax and film finance. Apparently, he had previously always dealt with his own tax affairs. At the start of the assignment two separate charge codes, Accountancy and Tax were set up for the film company. Time costs for the work, at your firm's normal rates, have amounted to $20,000 for dealing with the Accountancy and $4,000 for the Tax. Mr Y has now sent you instructions relating to monthly billings. These include: A fee note of $2,000 to be issued to the film company with $2,000 of accountancy time costs written off against it. The Accountancy code is then to be closed. The residual $18,000 is to be transferred to a 'Special Work' client account of the Group. This already has in it the time costs of $12,000 for an investigation into a stock discrepancy carried out earlier in the year. The partner tells you that the $4,000 of tax time will also be transferred across. ENGUSHSNTED ss The raising of two further fee notes, one for $27,500 addressed to the Group and one for $500 to be sent to Mr X personally at his home address. In all cases the fee notes' descriptions are to be limited to "agreed professional fees" You have asked Mr Y in person to confirm these arrangements. Clearly very amused, Mr Y explained that Mr X had funded the film company over the years on the persuasion of the young actress, who was revealed to be his niece. Mr X now accepts his investment was seriously flawed and that the loans will never be re-paid. Case Studies Aodit Prctice and Performance Review 2019 Word DESIGN PAGE LAYOUT RETERENCES MAILINGS REVIEW VIEW He is keen, to the extent legally possible tax advantages available. Moreover, the situation is, for him, one of considerable potential embarrassment. He wants the maximum discretion. He is now very grateful to the firm for the work done to minimize further his personal expenditure while gaining any and, after some instructions. Mr X accepts one further note of fee will be necessary for completing the tax work. This will go to the film company and, as with all the other residual creditors, Mr X will ensure personally that it is remarkably swift negotiation, has approved the three billings represented by Mr Y's paid. Mr Y commented that the total billing of $30,000 against incurred costs of $36,000, at 83%, was not as good a recovery as he would have hoped, or might even have negotiated. Yet, this has been his favorite assignment of the year. He added: I could probably have gone for much higher margins. But I think that it will prove better in the long-term not to have been greedy. Of course, I know Mr X's gratitude won't linger forever. Even so, I think he may be just that bit more co-operative and less aggressive in future. When he reflects that we haven't taken advantage of him and thinks carefully about what we now know, I sense that we will be able to count on his loyalty right through to his retirement! And given how much the old fool has lost on his star-wannabe niece, he'll need to go on working for a good few years yet! W When you now ask Mr Y about the ethics of transferring the time costs between clients that have no formal relationship and the apparent subsidy to Mr X personally, he replies: OK, I know that I appear to be charging $27,500 to the Group for an assignment that incurred costs of only $12,000. But the Audit Committee delegated to Mr X the authority to agree fee notes of up to $30,000 for that stock investigation. This time it came in at less. Because of Mr X's attitudes in the past we have not been able to recover as much as we should for good work. As for the film company job, I had no real clue from Mr X when we went into it just how heavily he was involved. He said it was a referral to help friends where he has no primarily official, company status. It seemed like useful one-off work when staff members were not busy. Maybe, with hindsight, wouldn't we have taken it. Still, we've tidied up a mess and what the Audit Committee members don't know won't grieve them. Mr X is hardly likely to start revealing all! Overall, I haven't even pressed for full recovery. No one can tell me the recovery that I have to make on any individual fee note. If I choose, say, zero fee for one piece of work, only 10 % for another but 230 % for C a real problem, just don't transfer time costs third, that is my commercial decision. If this gives you between client codes and then don't make any explicit connections. But it will simply be less effort to report one recovery of 100 % and one of 82% for our billing department, rather than explaining the detail of 10% here and 200 % plus there. The fee income is a done deal; the end result is the same; stand by for a co-operative Mr X!" a new, more Analysis of Scenario: What are the readily-identifiable ethical issues for your decision

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started