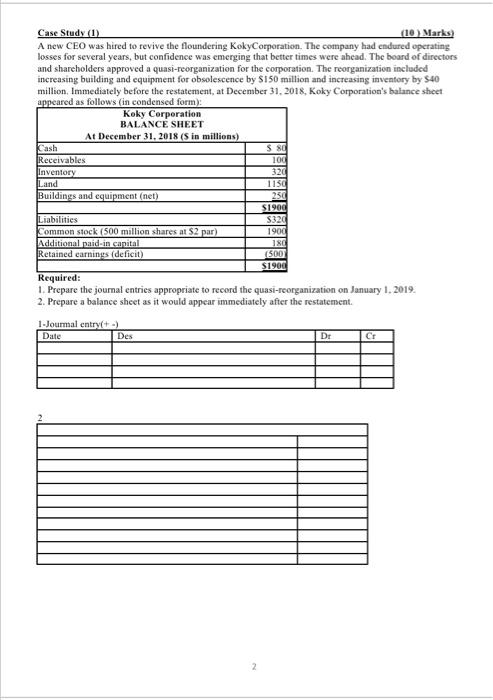

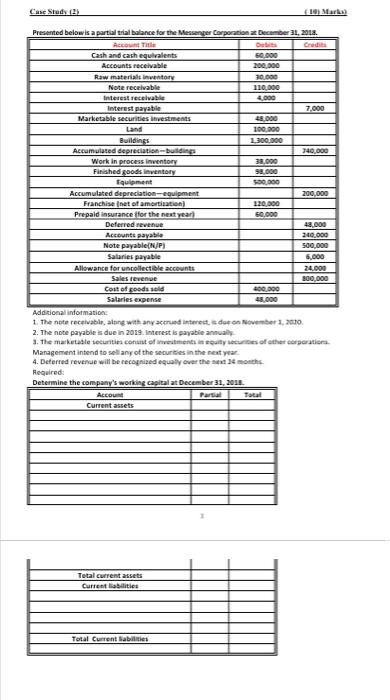

Case Study (1) (10) Marks) A new CEO was hired to revive the floundering KokyCorporation. The company had endured operating losses for several years, but confidence was emerging that better times were ahead. The board of directors and shareholders approved a quasi-reorganization for the corporation. The reorganization included increasing building and equipment for obsolescence by $150 million and increasing inventory by S40 million. Immediately before the restatement, at December 31, 2018, Koky Corporation's balance sheet appeared as follows (in condensed form) Koky Corporation BALANCE SHEET At December 31, 2018 (S in millions) Cash S8 Receivables 100 Inventory 320 Land 1150 Buildings and equipment (net) 250 $1900 Liabilities $320 Common stock (50 million shares at $2 par) 1900 Additional paid-in capital 180 Retained earnings (deficit) (500 $1900 Required: 1. Prepare the journal entries appropriate to record the quasi-reorganization on January 1, 2019. 2. Prepare a balance sheet as it would appear immediately after the restatement. 1.Jourmal entry(+ -) Date Des Dr CE Case Study Presented below is a partial trial balance for the Messenger Corporation December 31, 2018 Acco De Cash and cash equivalents 60.000 Accounts receivable 200.000 Raw materia inventory 30.000 Note receivable 110.000 Interest receivable 4.000 Interest payable 7.000 Marketable securities investments 48.000 Land 100.000 Buildings 1.300.000 Accumulated depreciation building 740.000 Work in process inventory 38.000 Finished goods inventory 98.000 Equipment 990.000 Accumulated depreciation-coupment 200.000 Franchisenet of amortisation 120.000 Prepaid insurance for the next year) 60,000 Deferred mene 18.000 Accounts payable 240.000 Note payable N/P 500,000 Salaries payable 5,000 Allowance for uncollectible accounts 24,000 Sales revenue 800,000 Cost of goods sold 400.000 Salaries expense 48.000 Additional information 1. The not receivable, along with any accrued interesador on November 1, 2010 2. The note payable is due in 2019. Interest is payable anual 3. The marketable securities content is outside of the corporation Management intend to sell any of the securities in the next year 4. Deferred revenue will be recognized equally over the months Required: Determine the company's working capital at December 31, 2015 Account Parsel Total Current assets Total current assets Current abilities Total Current Babies