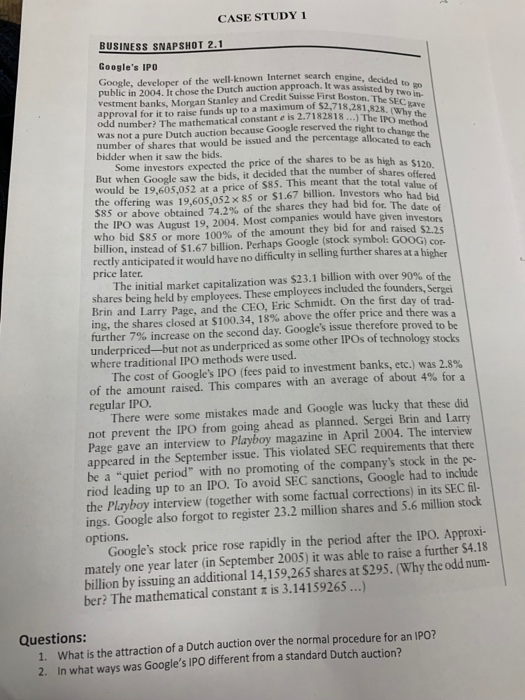

CASE STUDY 1 BUSINESS SNAPSHOT 2.1 Google's IPO Google, developer of the well-known Internet search engine, decided to go public in 2004. It chose the Dutch auction approach. It was assisted by two in- vestment banks, Morgan Stanley and Credit Suisse First Boston. The SEC gave approval for it to raise funds up to a maximum of $2,718,281,828. (Why the odd number? The mathematical constant e is 2.7182818...) The IPO method was not a pure Dutch auction because Google reserved the right to change the number of shares that would be issued and the percetage allocated to each bidder when it saw the bids Some investors expected the price of the shares to be as high as $120. But when Google saw the bids, it decided that the mumber of shares offered would be 19,605,052 at a price of $85. This meant that the total value of the offering was 19,605,052 x 85 or $1.67 billion. Investors who had bid $85 or above obtained 74.2 % of the shares they had bid for. The date of the IPO was August 19, 2004. Most companies would have given investors who bid $85 or more 100% of the amount they bid for and raised $ 25 billion, instead of $1.67 billion. Perhaps Google (stock symbol: GOOG) cor- rectly anticipated it would have no difficulty in selling further shares at a higher price later The initial market capitalization was $23.1 billion with over 90% of the shares being held by employees. These employees included the founders, Sergei Brin and Larry Page, and the CEO, Eric Schmidt. On the first day of trad- ing, the shares closed at $100.34, 18 % above the offer price and there was a further 7% increase on the second day. Google's issue therefore proved to be underpriced-but not as underpriced as some other IPOS of technology stocks where traditional IPO methods were used. The cost of Google's IPO (fees paid to investment banks, etc.) was 2.8% of the amount raised. This compares with an average of about 4 % for a regular IPO. There were some mistakes made and Google was lucky that these did not prevent the IPO from going ahead as planned. Sergei Brin and Larry Page gave an interview to Playboy magazine in April 2004. The interview appeared in the September issue. This violated SEC requirements that there be a "quiet period" with no riod leading up to an IPO. To avoid SEC sanctions, Google had to include promoting of the company's stock in the pe- the Playboy interview (together with some factual corrections) in its SEC fil- ings. Google also forgot to register 23.2 million shares and 5.6 million stock options. Google's stock price rose rapidly in the period after the IPO. Approxi- mately one year later (in September 2005) it was able to raise a further $4.18 billion by issuing an additional 14,159,265 shares at $295. (Why the odd num- ber? The mathematical constant is 3.14159265 ...) Questions: 1. What is the attraction of a Dutch auction over the normal procedure for an IPO? 2. In what ways was Google's IPO different from a standard Dutch auction