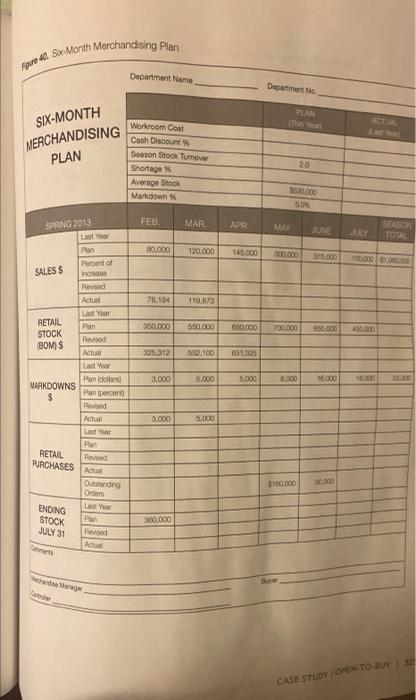

CASE STUDY 1 OPEN-TO-BUY It is the beginning of the third week in April. Mr. Johnston, the handbag buyer for a women's specialty store in California, studies the position of this department as he approaches the second quarter of the Spring season. Before Mr. Johnston analyzes the actual results of the season-to-date performances, he examines the classification reports for the department to ascertain if the composi- tion of his stock is in balance with the sales records. He finds that the leather handbag category-in which the price lines are highest-has fewer unit sales, which result in a high dollar inventory. The "fashion" fabrication of the season-sisal and straw, combined with new styling-has caused an out-of-proportion increase in unit sales of this group when compared to the sales of previous years. This trend has surpassed even Mr. Johnston's originally high expectations of this fashion. Additionally, the weather, which has turned unusually warm for this time of year, has been a catalyst to this vigorous selling in the Spring-Summer look. On the six-month merchandise plan, the season-to-date figures for the department are shown in Figure 40. reprodo. Six Month Merchandising Plan Department Name Department PLAN SIX-MONTH MERCHANDISING PLAN Workroom Cost Cash Discount Season Stock Tumor Shortage Average Stock Markdown 150.00 50 FEB MAR APR SPRING 2013 La MA JUNE LY SERSON TOTAL 50.000 120,000 Pront of SALES $ 78,104 119,073 RETAIL Revised Actu Last Year Plan Red Actual Last Year 350,000 550.000 050.000 700.000 650.000 250.000 STOCK BOMS 325,312 562.100 651325 3.000 5.000 5.000 30.000 0.000 Pano NARKDOWNS $ Panipecond Poved Adual Last Year Par Red 3.000 5.000 RETAIL PURCHASES Outstanding Orders $160.000 ENDING STOCK JULY 31 Pan 200.000 CASE STUDY IDEN.TO BUY . As Mr. Johnston examines these figures, he considers the following facts: The February and March sales are almost on target for the plan, but the post-Easter sales sagged. (Mr. Johnston estimates that there will be a 10% decrease in sales from the plan during the first quarter because the sales before Easter were slightly off and have been decreasing since that time.) A 5% increase is required over planned sales for the second quarter to achieve, if not surpass, the total seasonal planning goals in relation to sales, markdowns, and turnover. Unless immediate action is taken, the lowered actual sales to date will result in a higher than planned May 1 inventory figure. . Both the dollar amount in the inventory and the outstanding orders in the straw category are entirely too low to generate possible sales increases because the demand for this merchandise has exploded. (This requires instant correction.) The sales at the beginning of the third week for the month are $60,000, and the inventory figure is $795,000. To accomplish the second-quarter objectives (i.e., to attain the originally planned figures regarding sales, markdowns, and turnover), what actions must Mr. Johnston take? What are the alternatives, if any? What adjustments do you recommend? Justify your suggestions mathematically. CASE STUDY 1 OPEN-TO-BUY It is the beginning of the third week in April. Mr. Johnston, the handbag buyer for a women's specialty store in California, studies the position of this department as he approaches the second quarter of the Spring season. Before Mr. Johnston analyzes the actual results of the season-to-date performances, he examines the classification reports for the department to ascertain if the composi- tion of his stock is in balance with the sales records. He finds that the leather handbag category-in which the price lines are highest-has fewer unit sales, which result in a high dollar inventory. The "fashion" fabrication of the season-sisal and straw, combined with new styling-has caused an out-of-proportion increase in unit sales of this group when compared to the sales of previous years. This trend has surpassed even Mr. Johnston's originally high expectations of this fashion. Additionally, the weather, which has turned unusually warm for this time of year, has been a catalyst to this vigorous selling in the Spring-Summer look. On the six-month merchandise plan, the season-to-date figures for the department are shown in Figure 40. reprodo. Six Month Merchandising Plan Department Name Department PLAN SIX-MONTH MERCHANDISING PLAN Workroom Cost Cash Discount Season Stock Tumor Shortage Average Stock Markdown 150.00 50 FEB MAR APR SPRING 2013 La MA JUNE LY SERSON TOTAL 50.000 120,000 Pront of SALES $ 78,104 119,073 RETAIL Revised Actu Last Year Plan Red Actual Last Year 350,000 550.000 050.000 700.000 650.000 250.000 STOCK BOMS 325,312 562.100 651325 3.000 5.000 5.000 30.000 0.000 Pano NARKDOWNS $ Panipecond Poved Adual Last Year Par Red 3.000 5.000 RETAIL PURCHASES Outstanding Orders $160.000 ENDING STOCK JULY 31 Pan 200.000 CASE STUDY IDEN.TO BUY . As Mr. Johnston examines these figures, he considers the following facts: The February and March sales are almost on target for the plan, but the post-Easter sales sagged. (Mr. Johnston estimates that there will be a 10% decrease in sales from the plan during the first quarter because the sales before Easter were slightly off and have been decreasing since that time.) A 5% increase is required over planned sales for the second quarter to achieve, if not surpass, the total seasonal planning goals in relation to sales, markdowns, and turnover. Unless immediate action is taken, the lowered actual sales to date will result in a higher than planned May 1 inventory figure. . Both the dollar amount in the inventory and the outstanding orders in the straw category are entirely too low to generate possible sales increases because the demand for this merchandise has exploded. (This requires instant correction.) The sales at the beginning of the third week for the month are $60,000, and the inventory figure is $795,000. To accomplish the second-quarter objectives (i.e., to attain the originally planned figures regarding sales, markdowns, and turnover), what actions must Mr. Johnston take? What are the alternatives, if any? What adjustments do you recommend? Justify your suggestions mathematically