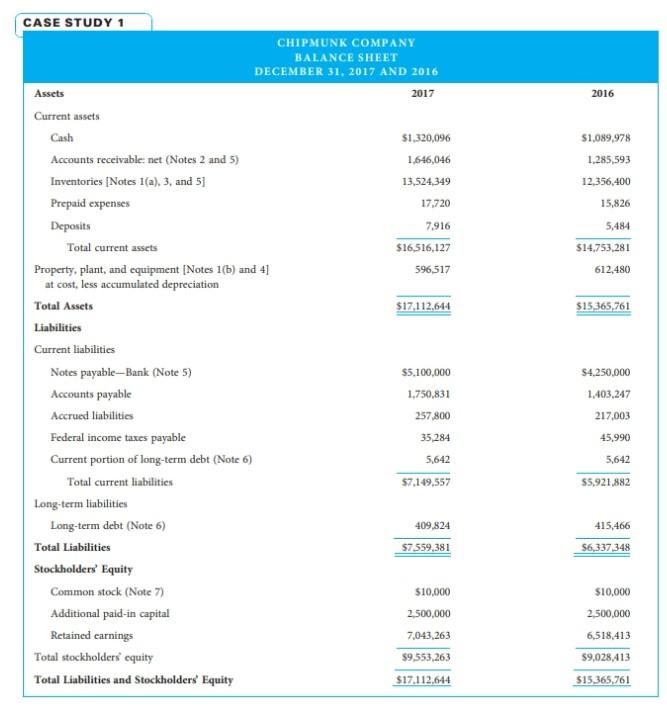

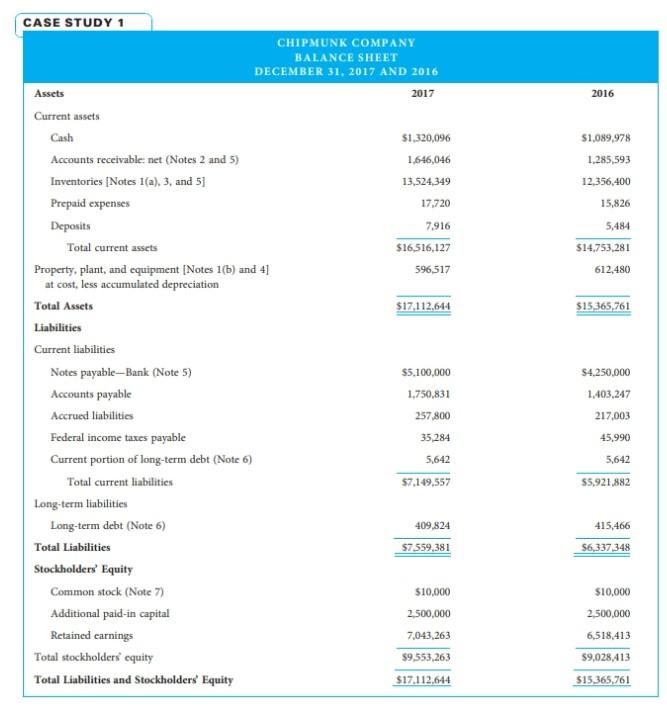

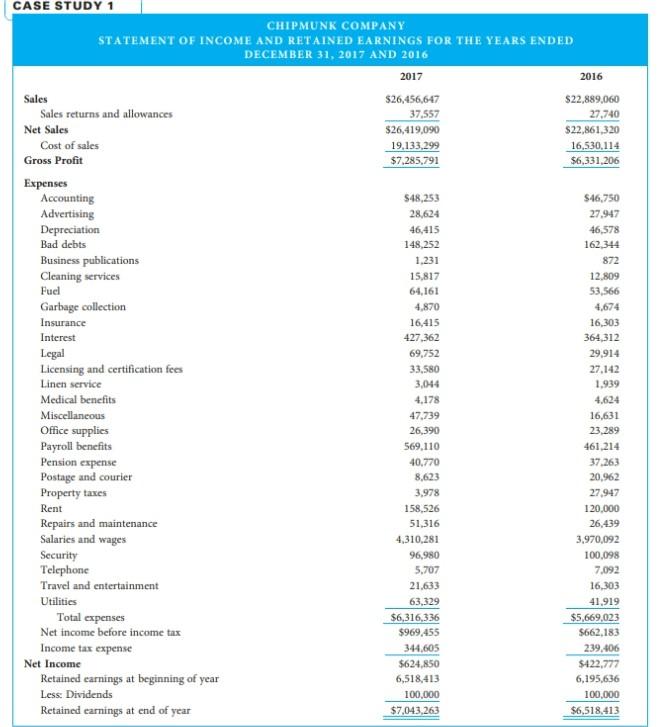

Case Study 1 You are a fraud investigator who has been hired to detect financial statement fraud for the Chipmunk Company. You have been provided with the financial statements on the following pages and are now beginning your analysis of those financial statements. Please note: the balance in inventories on January 1, 2016 was $11,427,937.

Questions

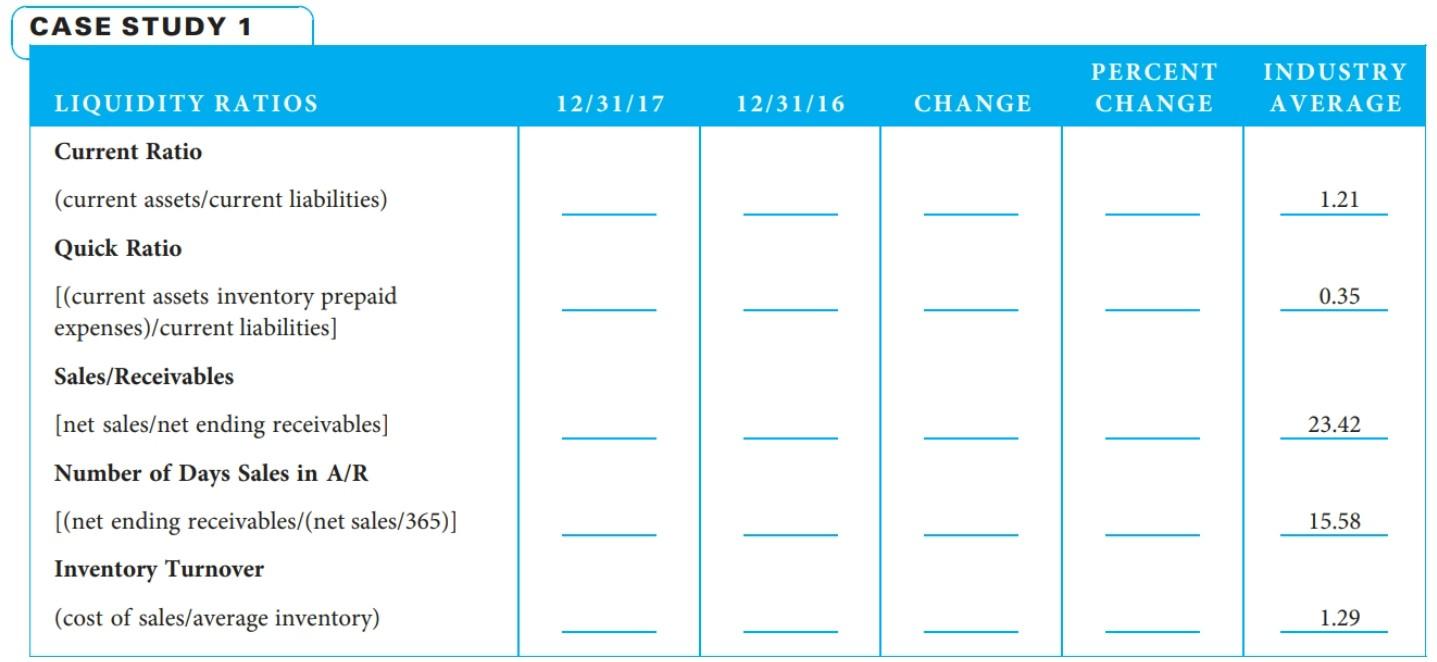

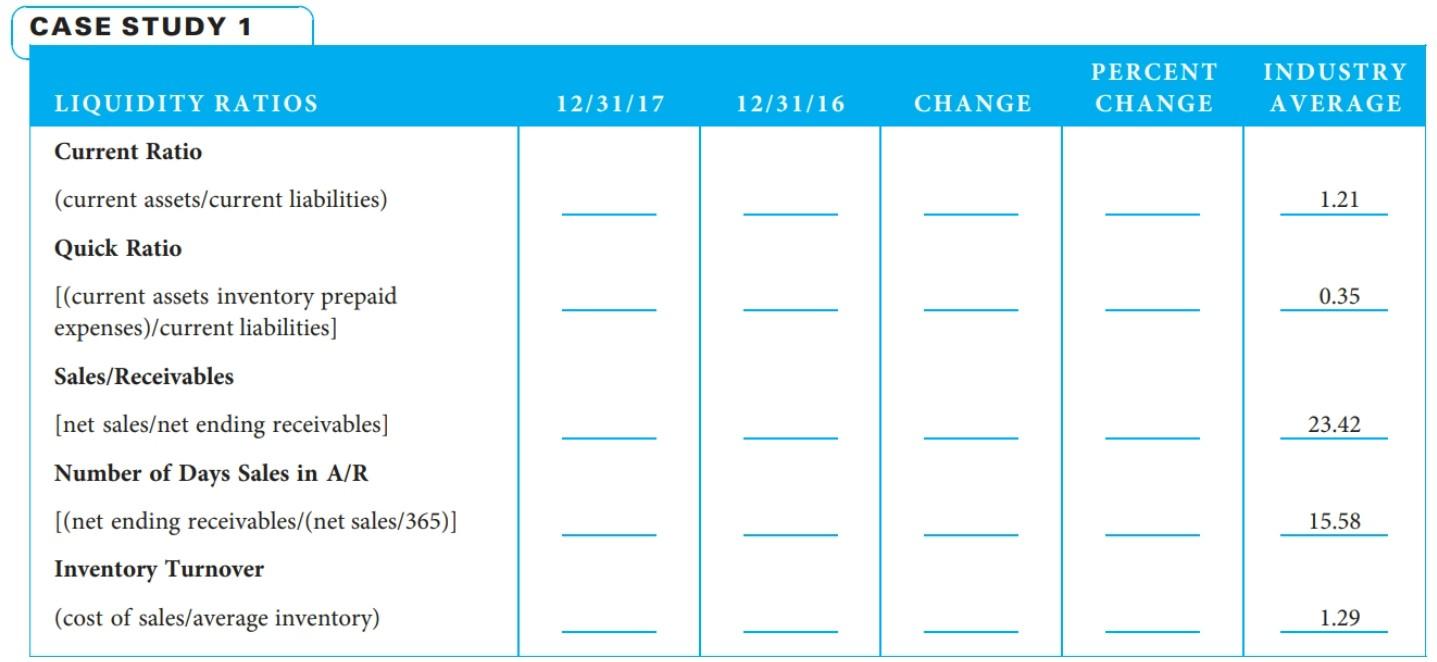

1. Calculate the 2017 and 2016 liquidity ratios identified using the ratio analysis table below. Also calculate the change and the percentage change for the ratios and complete the table. (Formulas are given to shorten the time spent on the assignment.)

2. Analyze the Chipmunk Companys ratios for both years and compare the figures with the given industry ratios. Based on the ratios identified, where do you think fraud may have occurred?

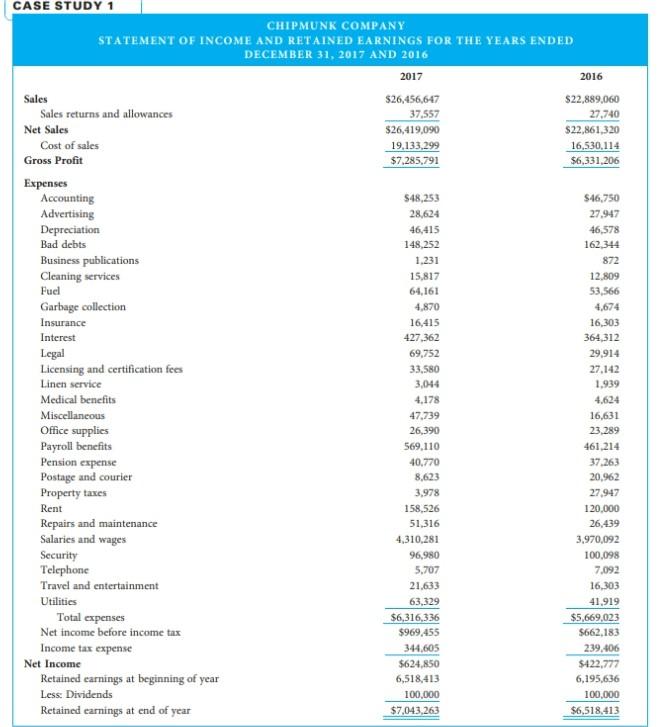

CASE STUDY 1 CHIPMUNK COMPANY 13.AL.ANCE SHEET DECEMBER 31, 2017 AND 2016 Assets 2017 2016 Current assets Cash Accounts receivable: net (Notes 2 and 5) Inventories [Notes 1(a), 3, and 5] Prepaid expenses Deposits Total current assets Property, plant, and equipment [Notes 1(b) and 4] \begin{tabular}{rr} $1,320,096 & $1,089,978 \\ 1,646,046 & 1,285,593 \\ 13,524,349 & 12,356,400 \\ 17,720 & 15,826 \\ 7,916 & $14,753,2815,484 \\ \hline$16,516,127 & 612,480 \end{tabular} at cost, less accumulated depreciation Total Assets $17.112.644 $15,365,761 Liabilities Current liabilities Notes payable-Bank (Note 5) Accounts payable Accrued liabilities Federal income taxes payable Current portion of long-term debt (Note 6) Total current liabtlities \begin{tabular}{rr} $5,100,000 & $4,250,000 \\ 1,750,831 & 1,403,247 \\ 257,800 & 217,003 \\ 35,284 & 45,990 \\ 5,642 & 5,642 \\ \hline 57,149,557 & 55,921,882 \end{tabular} Long-term liabilities Long-term debt (Note 6) Total Liabilities 409,82457,559,381 Stockholders' Equity Common stock (Note 7) Additional paid-in capital Retained earnings Total stockholders' equity Total Liabilities and Stockholders' Equity CASE STUDY 1 CHIPMUNK COMPANY STATEMENT OF INCOME AND RETAINED EARNINGS FOR THE YEARS ENDED DECEMBER 31,2017 AND 2016 2017 2016 Sales Sales returns and allowances Net Sales Expenses Accounting Advertising Depreciation Bad debts Business publications Cleaning services Fuel Garbage collection Insurance Interest Legal Licensing and certification fees Linen service Medical benefits Miscellaneous Office supplies Payroll benefits Pension expense Postage and courier Property taxes Rent Repairs and maintenance Salaries and wages Security Telephone Travel and entertainment Utilities Total expenses Net income before income tax Income tax expense Net Income Retained earnings at beginning of year Less: Dividends Retained earnings at end of year \begin{tabular}{rr} $48,253 & $46,750 \\ 28,624 & 27,947 \\ 46,415 & 46,578 \\ 148,252 & 162,344 \\ 1,231 & 872 \\ 15,817 & 12,809 \\ 64,161 & 53,566 \\ 4,870 & 4,674 \\ 16,415 & 16,303 \\ 427,362 & 364,312 \\ 69,752 & 29,914 \\ 33,580 & 27,142 \\ 3,044 & 1,939 \\ 4,178 & 4,624 \\ 47,739 & 16,631 \\ 26,390 & 23,289 \\ 569,110 & 461,214 \\ 40,770 & 37,263 \\ 8,623 & 20,962 \\ 3,978 & 27,947 \\ 158,526 & 120,000 \\ 51,316 & 26,439 \\ 4,310,281 & 3,970,092 \\ \hline 96,980 & 100,098 \\ \hline 5,707 & 7,092 \\ \hline 21,633 & 16,303 \\ 63,329 & 41,919 \\ \hline$6,316,336 & $5,669,023 \\ \hline$969,455 & $662,183 \\ 344,605 & 239,406 \\ \hline$624,850 & $422,777 \\ 6,518,413 & 6,195,636 \\ 100,000 & 100,000 \\ \hline$7,043,263 \\ \hline \hline \end{tabular} CASE STUDY 1